Wells Fargo Reports Mixed Q4 Results as Severance Costs Weigh on Performance January 29, 2026

Company Overview and Market Position

Wells Fargo & Company operates as one of the largest financial services institutions in the US, providing banking, investment, mortgage, and consumer finance services. The company serves millions of customers through its extensive branch network and digital platforms, maintaining a strong market position in retail banking, commercial lending, and wealth management services.

Strong Earnings Growth Offset by One-Time Expenses

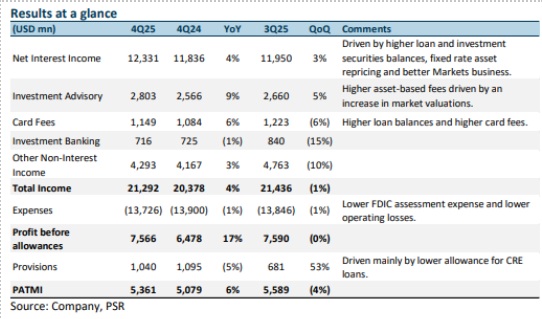

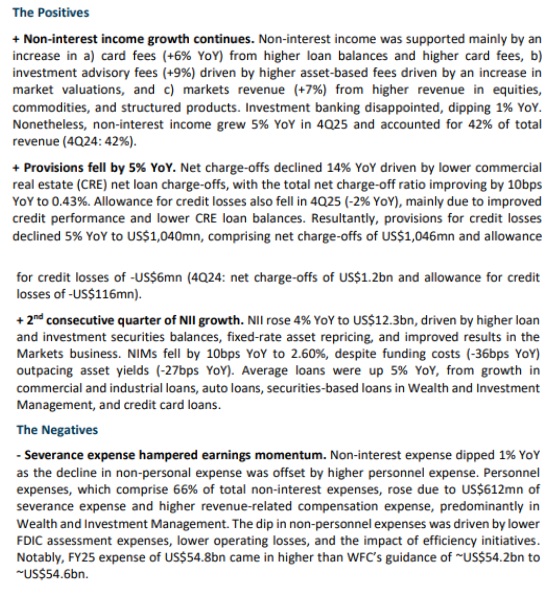

The company delivered solid fourth-quarter 2025 results with earnings growing 6% year-over-year to US$5.4 billion, though full-year earnings came in slightly below analyst expectations at 96% of forecasted levels. The bank’s performance was supported by net interest income growth from loan expansion, higher non-interest income, and reduced provision expenses. Shareholders benefited from a 13% dividend increase to US$0.45 per share and US$5 billion in common stock repurchases, representing a 25% year-over-year increase.

Revenue Diversification Drives Performance

Wells Fargo & Company’s revenue growth was bolstered by a 4% year-over-year increase in net interest income, while non-interest income expansion came primarily from investment advisory and brokerage services, along with card fee income. Credit provisions declined 5% year-over-year, providing additional earnings support. However, a significant severance expense of US$612 million hampered the pace of earnings acceleration during the quarter.

Forward Guidance and Investment Outlook

The company’s management has provided guidance for fiscal year 2026, projecting net interest income of approximately US$50 billion, representing 5% year-over-year growth, while expenses are expected to reach around US$55.7 billion, up 2% from the previous year. The Phillip Securities Research team maintains an ACCUMULATE recommendation with a raised target price of US$98, up from the previous US$95 target. This valuation assumes a 1.73x price-to-book ratio and 15.8% return on equity estimate.

The research team expects the eventual lifting of Wells Fargo’s asset cap will enable deposit growth, lending expansion, and increased investment in markets and trading activities, which will strengthen the bank’s competitive position. However, potential headwinds include macroeconomic factors that could impact non-interest income growth, particularly in investment banking and trading, while potentially leading to higher provision expenses.

Frequently Asked Questions

Q: What was Wells Fargo’s fourth-quarter 2025 earnings performance?

A: Wells Fargo reported fourth-quarter 2025 earnings of US$5.4 billion, representing 6% year-over-year growth, though full-year earnings came in at 96% of analyst forecasts.

Q: What factors supported Wells Fargo’s earnings growth?

A: Earnings were supported by net interest income growth from loan expansion, higher non-interest income from investment advisory and brokerage services and card fees, and a 5% year-over-year decline in credit provisions.

Q: What expense impacted Wells Fargo’s earnings acceleration?

A: A severance expense of US$612 million hampered the bank’s earnings acceleration during the quarter.

Q: What is Phillip Securities Research recommendation and target price for Wells Fargo?

A: The Research house maintains an ACCUMULATE recommendation with a raised target price of US$98, up from the previous target of US$95.

Q: What are Wells Fargo’s guidance projections for fiscal year 2026?

A: Management projects net interest income of approximately US$50 billion (5% year-over-year growth) and expenses of around US$55.7 billion (2% year-over-year increase) for fiscal year 2026.

Q: How did Wells Fargo reward shareholders during the quarter?

A: The bank increased its dividend by 13% year-over-year to US$0.45 per share and conducted US$5 billion in common stock repurchases, up 25% from the previous year.

Q: What are the key growth opportunities for Wells Fargo?

A: The expected lifting of the bank’s asset cap will allow for deposit growth, lending expansion, and increased investment in markets and trading activities, strengthening its competitive position.

Q: What potential headwinds does Wells Fargo face?

A: Macroeconomic factors could impact non-interest income growth, particularly in investment banking and trading activities, and may lead to higher provision expenses.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Glenn Thum

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.