ETF Market Review: February Outlook Signals Strong Performance February 9, 2026

Current Market Trends Analysis

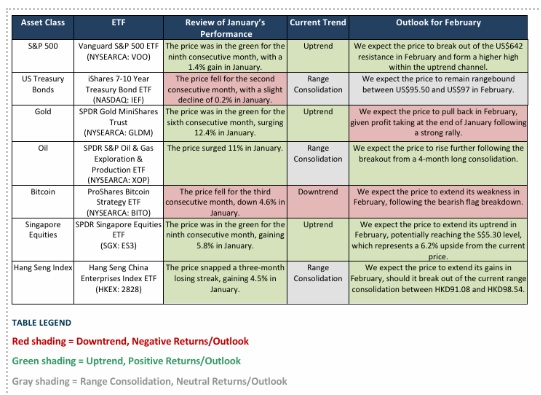

The technical landscape across major asset classes reveals distinct patterns heading into February. The S&P 500, Gold, and Singapore Equities are currently maintaining upward trends. Meanwhile, US Treasury Bonds, Oil, and the Hang Seng Index have entered range consolidation phases. Bitcoin stands out as the only major asset class currently experiencing a downtrend, reflecting ongoing volatility in the cryptocurrency space.

February Market Outlook

Looking ahead to February, we anticipate a bullish environment for several key asset classes. ETFs tracking the S&P 500 are expected to continue their upward trajectory. Oil ETFs are projected to gain momentum despite their current consolidation phase, potentially building on January’s strong performance. Singapore Equities and the Hang Seng Index are both positioned for gains, with the latter expected to break out of its current range-bound trading pattern.

However, not all asset classes are expected to maintain their positive momentum. Gold ETFs are likely to experience a pullback after their recent uptrend, while Bitcoin ETFs may continue facing headwinds given their current downward trajectory. US Treasury Bond ETFs are expected to remain in their current rangebound pattern, suggesting limited directional movement in the near term.

Frequently Asked Questions

Q: Which ETF was the top performer in January?

A: The ETF tracking Oil (XOP) was the top performer, surging 11% during January.

Q: Which asset classes declined in January?

A: Only US Treasury Bonds (IEF) and Bitcoin (BITO) posted negative returns, falling 0.2% and 4.6% respectively.

Q: What asset classes are currently in an uptrend?

A: The S&P 500, Gold, and Singapore Equities are currently maintaining upward trends. .

Q: Which markets are expected to gain in February?

A: ETFs tracking the S&P 500, Oil, Singapore Equities, and the Hang Seng Index are expected to post gains in February.

Q: What is the outlook for Gold and Bitcoin ETFs?

A: Both Gold and Bitcoin ETFs are likely to experience pullbacks in February, despite Gold’s current uptrend. .

Q: Which asset classes are in range consolidation phases?

A: US Treasury Bonds, Oil, and the Hang Seng Index are currently in range consolidation phases.

Q: What is expected for US Treasury Bond ETFs in February?

A: US Treasury Bond ETFs are likely to remain rangebound, continuing their current consolidation pattern.

Q: How did most ETFs perform overall in January?

A: Most ETFs were in the green during January, with only two major asset classes posting negative returns.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Zane Aw

Equity Research Analyst

Zane Aw is an equity research analyst focused on technical analysis, covering the Singapore, Hong Kong and United States markets. He applied a rules-based approach that incorporate trend-following techniques, price action, momentum oscillators and other indicators to anticipate key inflection points in individual stocks, sectors and broader indices. He graduated from Nanyang Technological University with a Bachelor of Accountancy (Honours).

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?  ETF Market Review: Most ETFs up in November; gold expected to extend recent gains

ETF Market Review: Most ETFs up in November; gold expected to extend recent gains