Europe’s Steady Hand Amid Global Storms May 21, 2025

Table of contents

- Global Trade War, Tariffs, and Volatility

- Europe’s Steady Hand

- Investing in Europe

- European Market Guide

Global Trade War, Tariffs, and Volatility

In recent weeks, the global financial landscape has been rattled by a series of disruptive events, from the implementation of protectionist tariffs to the ongoing trade tensions between the US and China. These geopolitical frictions have triggered ripple effects across economies, unsettling investor sentiment and amplifying market volatility worldwide.

Against this backdrop of uncertainty, the importance of diversification has never been more apparent. Investors today face both market risk and heightened geopolitical and policy-driven risks. In such an environment, geographical diversification plays a crucial role in preserving capital and uncovering new opportunities that may be overlooked in more turbulent markets.

Last Updated: 15 May 2025

Last Updated: 15 May 2025

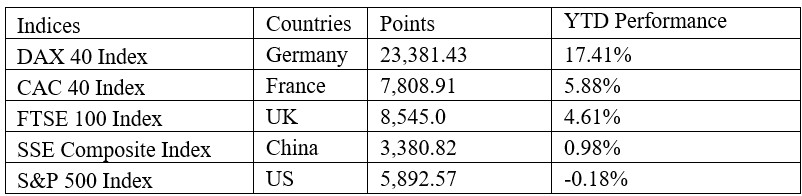

Notably, while the S&P 500 has slumped by -0.18% year-to-date (YTD), weighed down by inflationary concerns, tighter monetary policy, and tech-sector volatility, European markets have shown signs of relative resilience. Germany’s DAX 40 Index, for instance, has posted a positive return of 17.41% YTD, standing out as a rare bright spot amid broader global uncertainty. Meanwhile, France’s CAC 40 Index and the UK’s FTSE 100 Index have experienced more modest declines of 5.88% and 4.61%, respectively, faring considerably better than their US and Chinese counterparts.

Europe’s Steady Hand

This divergence is not merely a matter of performance but a reflection of fundamental differences in market structure and macroeconomic drivers. European indices typically exhibit greater exposure to sectors such as industrials, financials, and consumer staples, areas that are generally more resilient during periods of heightened volatility. Unlike the tech-heavy compositions of the US and China, these sectors are less sensitive to abrupt monetary policy shifts and speculative sentiment, providing a more stable foundation amid global uncertainty.

Source: Eurostat

Source: Eurostat

Based on Eurostat data, automotive manufacturers are likely to be the most significantly impacted by the implementation of tariffs. This sector faces the potential for notable revenue losses, supply chain disruptions, and production cutbacks. In contrast, the outlook for general industrial machinery and medicinal and pharmaceutical products is more nuanced. The impact on these sectors will largely depend on the competitiveness of US domestic manufacturing, local production capacity, and the trajectory of economic growth. If US producers are unable to meet demand cost-effectively, European exports in these areas may remain resilient despite tariff headwinds.

As investors reassess their global allocations in 2025, European equities may present an attractive low-volatility alternative, offering not only a hedge against regional concentration risk but also the potential for consistent, income-generating returns supported by structural strength and sectoral balance.

Investing in Europe

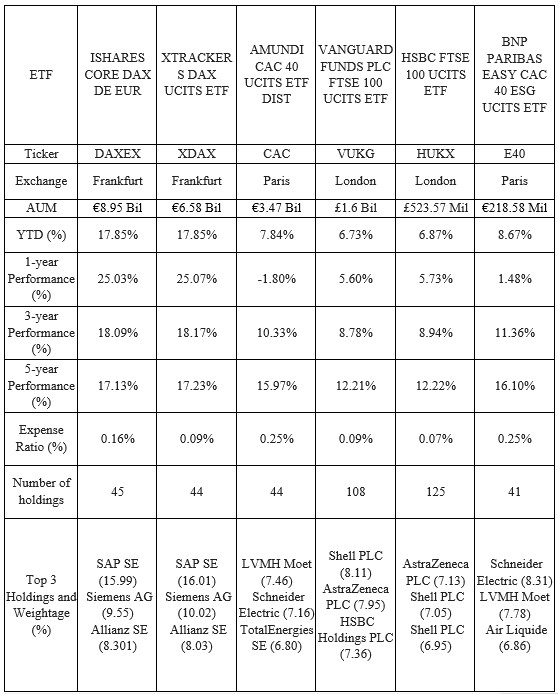

To achieve effective geographical diversification, investors may consider the “Undertakings for the Collective Investment in Transferable Securities” (UCITS) ETFs, which are widely listed across European exchanges. UCITS funds are known for their robust regulatory framework under the supervision of the European Securities and Markets Authority (ESMA), making them a popular choice among global investors seeking transparency, liquidity, and risk control. Below are several UCITS ETFs that are actively traded and offer exposure to key segments of the European market.

Source: Bloomberg Last Updated: 15 May 2025

Source: Bloomberg Last Updated: 15 May 2025

When compared with the SPDR S&P 500 ETF Trust (SPY.US), which has registered a YTD decline of -0.31%, several European ETFs have demonstrated notable resilience, underscoring the relative strength of the region’s equity markets amid a challenging global backdrop.

For investors seeking to mitigate downside risk while maintaining equity exposure, incorporating European ETFs as part of a geographically diversified portfolio can provide a stabilising effect and an alternative source of returns. This approach is especially relevant in the current environment, where regional divergences in economic fundamentals and policy response have widened, creating new opportunities for active global allocation.

European Market Guide

POEMS has expanded its global investment offering with the launch of new European markets, providing clients with broader access to the continent’s key financial hubs. In addition to existing markets, investors can now trade equities listed in the United Kingdom, Germany, France, the Netherlands, Belgium, and Portugal, directly through the POEMS platform.

| Country | Exchange | DST(Singapore Time) | Non-DST(Singapore Time) |

| London Stock Exchange | 03:00pm – 11:30pm | 04:00pm – 12:30pm | |

| Deutsche Borse Xetra | 03:00pm – 11:30pm | 04:00pm – 12:30pm | |

| Euronext Paris | 03:00pm – 11:30pm | 04:00pm – 12:30pm | |

| Euronext Amsterdam | 03:00pm – 11:30pm | 04:00pm – 12:30pm | |

| Euronext Brussels | 03:00pm – 11:30pm | 04:00pm – 12:30pm | |

| Euronext Lisbon | 03:00pm – 11:30pm | 04:00pm – 12:30pm |

Source: POEMS Last Updated: 15 May 2025

Markets will be available for trading from Monday to Friday. You may refer to the table for Daylight Saving Time (DST) and Non-Daylight-Saving Time (Non-DST) trading hours.

For more information, you may visit the POEMS website or contact our experienced trading representatives for help. Please refer to the link provided here to view the pricing information for the relevant markets.

In Case You Missed It: Previous Market Journals

As we continue to navigate an increasingly complex global landscape, our past market journals have explored key themes shaping investor behaviour and market dynamics. These pieces provide valuable context and lay the foundation for our current outlook on Europe’s resilience. Highlights include:

- “Dive into Europe: New Markets, New Gains!”

- “Navigating Leveraged ETFs: Strategies, Risks, and Opportunities”

- “Euronext Paris: The Hidden Gem of Europe”

A deep dive into the benefits of investing in Euronext Markets

Understanding the power of leveraged shares and how to use them to your advantage!

How Euronext Paris Stock Exchange once overtook the London Stock Exchange as the biggest stock market in Europe!

There is an upcoming webinar, on 27 May 2025, where we’ll dive into the latest macroeconomic trends, uncover Europe’s strongest-performing sectors, and spotlight key Euronext-listed companies that combine stability with long-term growth potential. Whether you’re looking to diversify your portfolio or capture new income opportunities, find out why Europe could be your next smart move in today’s volatile global landscape. Register here

For more information about trading on European and US markets through POEMS, visit our website or contact our Night Desk representatives at 6531 1225, available from 3 PM onwards. Don’t wait, register your account today and take the first step toward accessing these exciting markets!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Thng Xiao Xiong

Assistant Manager

Xiao Xiong is an assistant manager in the Global Markets Team specializing in UK markets. He is a graduate of the Singapore Institute of Technology with a bachelor's in Aircraft System Engineering. He has a strong interest in macroeconomics and options strategies

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile