Explore Opportunities with Free SGX Enhanced Market Depth! Stay ahead of the competition with real-time market insights October 18, 2024

Summary:

Market Depth is a powerful tool for retail stock investors, that provides real-time insights into buy and sell orders at different price levels. The Singapore Exchange (SGX) offers enhanced market depth with up to 20 levels of information, helping investors assess liquidity, optimise trade sizes, and better determine price support and resistance zones. This 4-part series of articles will explain the importance of market depth, how to use it to evaluate liquidity, analyse order sizes, and refine your trading decisions, particularly your entry and exit price levels.

Part 1: Understanding Market Depth and Its Role in Trading

What is Market Depth?

Market depth provides a detailed view of the buy and sell orders placed at each price level for a listed security, such as stocks or ETFs. It shows the quantity of these orders in real-time, helping investors understand market interest. With a full view of current bid and ask prices as well as the volume of orders at different prices, investors gain a clearer picture of how the market might move.

SGX Market Depth

The Singapore Exchange (SGX) provides an enhanced market depth feature that lets investors view up to 20 levels of buy and sell orders. This gives investors a comprehensive picture of market activity instead of just seeing the best bid and ask prices. Additionally, it shows the queue quantity of shares as well as number of orders waiting at each price level which gives investors a more complete view of market activity.

Impact on Trading Decisions

Market depth data can help investors in several ways:

- Liquidity: By observing order volumes at various price levels, investors can assess how easy it is to buy or sell a stock at their desired price.

- Order Optimisation: Investors can choose the optimal size for their orders by evaluating how much volume is available at different price points.

- Price Zones: Market depth helps investors identify key support and resistance levels, which can lead to more precise entry and exit points in both short-term and long-term strategies.

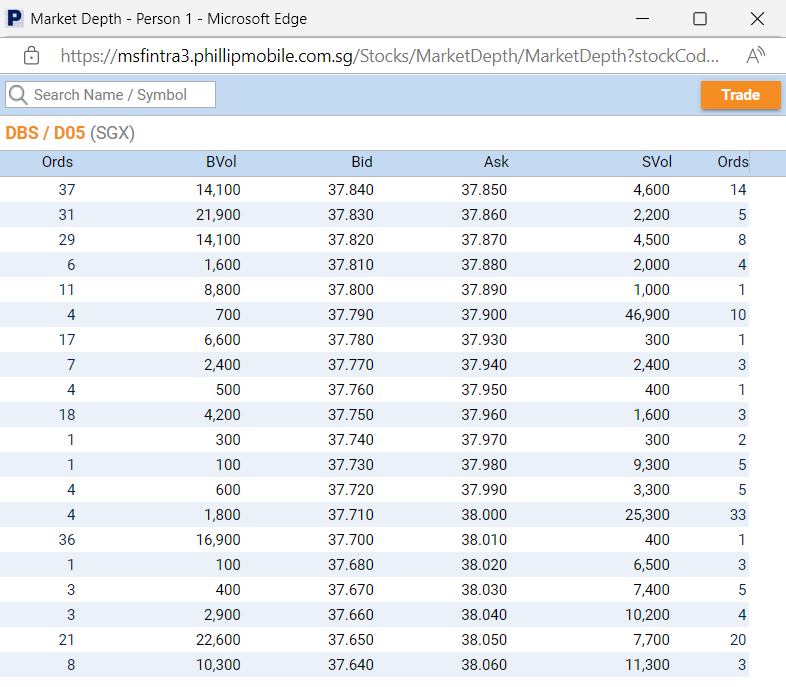

Example 1 of Market Depth on POEMS Platform – DBS (SGX: D05) 4 Oct 2024 at 1.59pm

Legend: (1) Ords: Number of orders, (2) BVol: Volume of shares queuing on buy side (Bid prices), (3) SVol: Volume of shares queuing on sell side (Ask prices)

Part 2: Evaluating Liquidity with Market Depth

What is Liquidity?

Liquidity refers to how easily a security can be bought or sold in the market without significantly affecting its price. It’s not just about the volume of orders at the best bid and ask prices but also the availability of buy and sell orders at various price levels. A highly liquid stock has many orders placed at close price levels, allowing trades to occur with minimal price movement or slippage.

Using SGX Market Depth to Measure Liquidity

With SGX’s market depth feature, which provides up to 20 levels of buy and sell orders, investors can assess liquidity in a detailed manner. If stock has large volumes of orders spread across multiple price levels, the security is likely highly liquid, meaning your trades can be executed without significant price changes.

- High Liquidity: Stocks with high liquidity have a “thick” order books, meaning there are many buy and sell orders stacked close together.

- Low Liquidity: A “thin” order book, with fewer orders at each price level, indicates lower liquidity and may lead to more volatile price movements.

Why Liquidity Matters

Liquidity is especially critical when trading large volumes. In a thin market, large trades can cause price slippage where the execution price differs from the unexpected price. Using Market Depth helps traders time their trades better, which helps to minimise market impact and optimise execution.

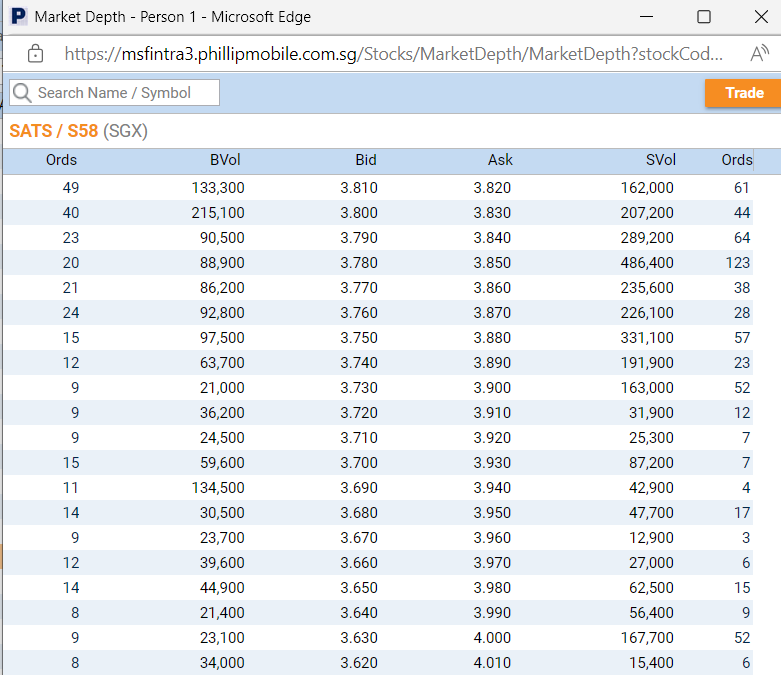

Example 2 of Market Depth on POEMS Platform – SATS (SGX: S58) 4 Oct 2024 at 2.04pm

Based on example 2, the queue volume of ask is much higher than bid. Liquidity for buyers is higher than sellers in this case. This means that a buyer can execute trades in larger quantities without causing the price to rise drastically.

Part 3: Optimising Trade Size Using Market Depth

Breaking Down Order Size Based on Volume

One key advantage of using SGX Market Depth is the ability to see volumes at various price levels. For large orders, knowing how much volume exists at different prices can helps investors split their orders into more manageable parts to avoid influencing the price.

How Market Depth Helps with Trade Size

- Order Queue Sizing: By seeing how many shares are available in the queue at each price level, investors can decide whether they need to split their order into smaller trades to better match the available liquidity.

- Avoiding Slippage: Executing a large orders in a market with limited liquidity (a thin order book) may result in a price impact. Monitoring Market Depth allows you to avoid executing your entire order at once and spread it across different price points.

Suppose you need to buy 10,000 shares but the Market Depth shows only 2,000 shares available at the current price. Instead of buying all 10,000 at once and potentially pushing the price higher, you might choose to buy in smaller increments at different price levels.

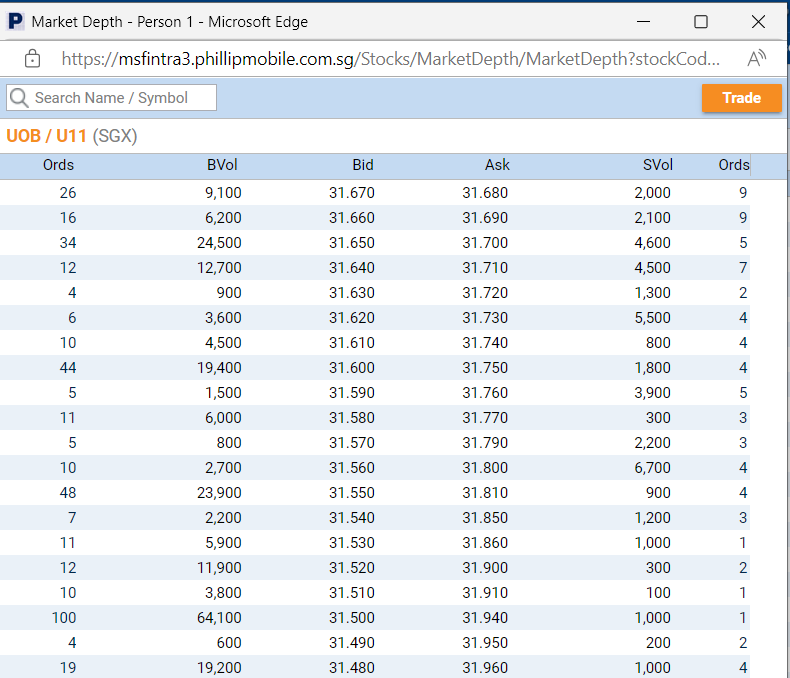

Example 3 of Market Depth on POEMS Platform – UOB ( SGX: U11) 4 Oct 2024 at 2.11pm

In Example 3, the low queue volume on the ask prices suggests that large buy orders placed at market price could quickly consume the available ask orders, causing the price to rise by hitting multiple higher ask prices (slippage). This scenario indicates that the buyer might risk overpaying by moving through the different price levels due to the lack of sufficient sell orders at a single price.

To avoid this, the buyer may choose to break down the orders into smaller parts instead of placing a large order all at once. This strategy allows the buyer to purchase shares at favourable prices without alerting sellers to the buyer’s large demand, which could lead to sellers increasing their prices. By placing smaller orders discreetly, the buyer can prevent others from reacting to the market depth data and thus optimise their purchase without causing unwanted price shifts.

Part 4: Using Market Depth for Entry and Exit Strategies

Identifying Price Support and Resistance

Market depth can reveal potential price support and resistance levels based on the concentration of buy and sell orders.

Support Levels: If there are many buy orders at a particular price, this can create a support level, preventing the price from falling further. These buy orders provide a cushion as the demand at that level may absorb selling pressure.

Resistance Levels: Similarly, a large number of sell orders at a certain price creates a resistance level, making it harder for the price to rise beyond that point as the supply outweighs demand.

Setting Entry and Exit Prices

Investors can use Market Depth in conjunction with trade summaries to identify good entry and exit points. Here’s how:

- Entry Price: If the market depth shows a significant buy order block at a lower price, this may suggest a good entry point as that support level might prevent the price from dropping further.

- Exit Price: A heavy concentration of sell orders at a certain price level may signal a resistance point. This might be an ideal exit point, as it signals a potential price drop or slowdown in upward momentum.

Evaluating Volume for Support and Resistance By tracking the volume at each price level in the market depth, investors can get a sense of how strong the support or resistance is. The thicker the volume at a particular level, the harder it is for the price to break through.

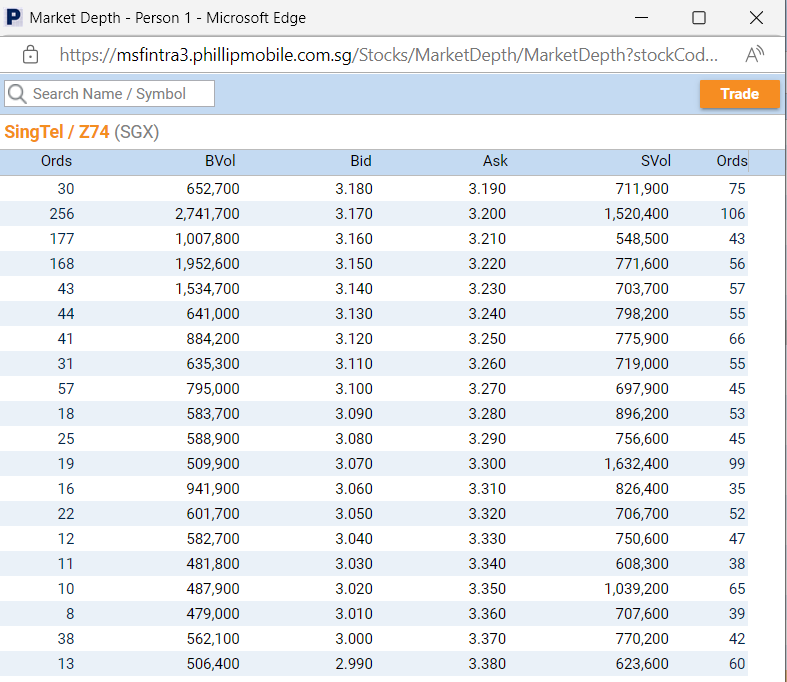

Example 4 of Market Depth on POEMS Platform – Singtel ( SGX: Z74) 4 Oct 2024 at 2.16pm

With reference to Example 4, as of 4 Oct 2024, Fri at 2.16pm, Singtel’s day high is S$3.20 and its day low is S$3.17, with the stock opening at S$3.17. Upon observing the significant buy and sell queue volumes at these price levels, we can identify S$3.17 as a potential support level and S$3.20 as a potential resistance level. The stock has traded nearly 13 million shares by 2.17 pm , indicating that while these levels show support and resistance, they may not be difficult to break given the large volume of trading activity.

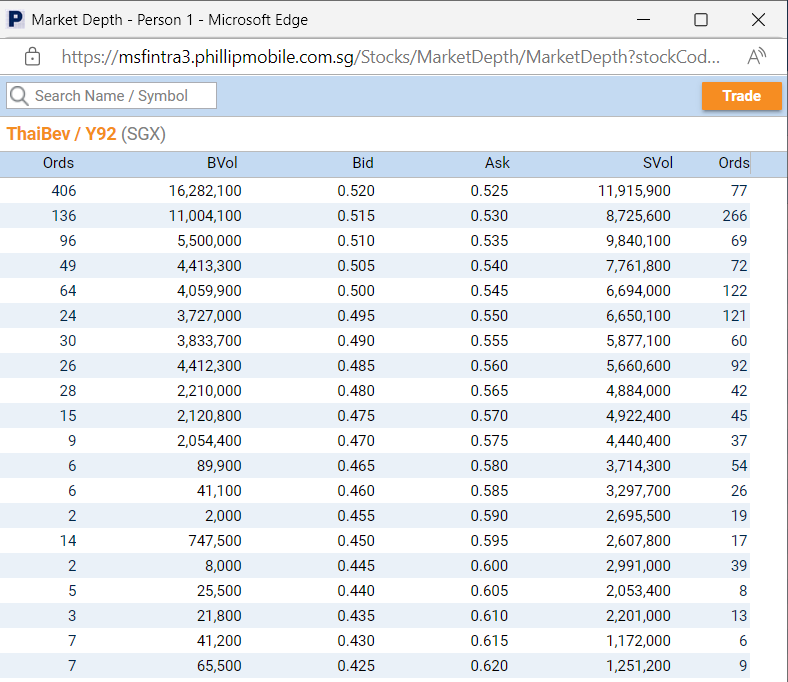

Example 5 of Market Depth on POEMS Platform – ThaiBev (Y92) 2.21pm 04/10/2024

In comparison, Thaibev has a total volume of approximately 6.7 million shares traded by 2.22 pm. The best bid and ask prices are S$0.520 and S$0.525, respectively. Here, the queue volumes are significantly higher than the transacted volume, indicating stronger support and resistance at these price levels due to lower overall trading activity compared to Singtel.

By comparing the situation between example 4 and 5, investors can better assess support and resistance levels based on trading volumes and queue sizes, helping them time their entry and exit points more effectively

Conclusion Market Depth is more than just a technical tool—it offers retail investors insights into market sentiment, liquidity, and price action. By using SGX’s enhanced Market Depth feature, investors can make informed decisions about when and how to trade, optimising their strategies for both short-term gains and long-term investments.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Huan Zi Teo

Manager, Dealing & Investor Education

PHILLIP INVESTOR CENTRE

Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance. He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

Thomson Medical Group Ltd: Mixed Performance Amid Strategic Transformation

Thomson Medical Group Ltd: Mixed Performance Amid Strategic Transformation  Airbnb Inc Upgraded to Accumulate as New US Initiatives Drive Booking Growth

Airbnb Inc Upgraded to Accumulate as New US Initiatives Drive Booking Growth  AppLovin Corp Maintains Strong Growth Trajectory Despite Market Challenges

AppLovin Corp Maintains Strong Growth Trajectory Despite Market Challenges  BRC Asia Ltd Delivers Strong Growth with Record Order Book Surge

BRC Asia Ltd Delivers Strong Growth with Record Order Book Surge