Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors September 30, 2025

Summary

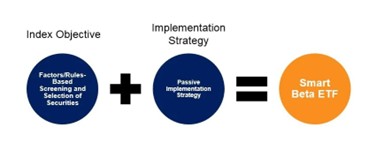

Factor-based (often called smart-beta) ETFs use transparent, rule-based indexes to tilt exposure toward specific investment attributes (factors) such as value, quality, momentum, dividend yield, growth, or low volatility.

They offer a middle ground between purely passive market-cap indexing and fully active management, adapting ETF mechanisms with a systematic, repeatable focus or priority aimed at improving risk-adjusted returns or reducing volatility.

Examples include dividend or quality ETFs in Singapore (e.g., high-yield Singapore ETFs such as Phillip Sing Income ETF (OVQ)) and US factor ETFs like iShares MSCI USA Momentum Factor ETF (MTUM) and VanEck MSCI International Value ETF (VLUE).

1. What is a Factor-Based ETF?

Simple Definition

A factor ETF tracks an index that explicitly selects and weights stocks according to one or more measurable characteristics or “factors” — e.g., companies with high dividend yields, superior profitability, or recent price momentum.

Why “Smart-Beta”?

The term smart-beta highlights that these ETFs use “smarter” index construction rules than simple market-cap weighting. They are still index-based (rule-driven), providing transparency and low operational subjectivity, but differ from a plain traditional index by seeking outcomes such as higher income, lower volatility, or exposure to value/growth dynamics.

2. Common Factors and What They Capture

Core Factors for Consideration

- Value: Stocks that appear cheap on metrics like price-to-earnings or price-to-book.

- Growth: Companies with strong sales/earnings growth expectations.

- Momentum: Stocks that have performed well recently (trend-following).

- Quality: Firms with stable earnings, high returns on equity, low leverage.

- Dividend / Income: Companies with higher or growing dividends.

- Low Volatility: Stocks with lower historical price swings.

- Size: Small-cap tilt.

o Favours cyclicals, financials at times.

o Favours tech and disruptive firms.

o Can capture strong performers but may reverse in mean-reverting markets.

o Typically less volatile in downturns.

oAttractive for yield seekers and income investors.

oUseful for defensive allocations.

Factor Behaviour

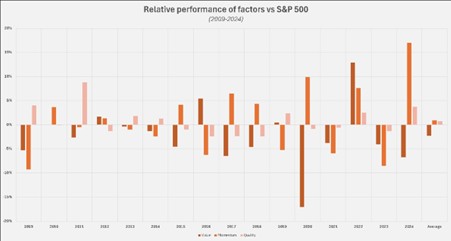

It is important to understand how each factor behaves differently across cycles.

For example, value often outperforms after a market trough or rotation, momentum performs well in trending markets, and low-volatility may protect capital in downturns.

Investors can use factor diversification by combining different factor exposures to smooth returns.

3. How Factor Indexes Are Constructed & Reviewed

Selection & Scoring

- Universe: Start with a market universe (e.g., S&P 500 or Singapore stocks).

- Scoring: Each stock receives a score based on factor metrics (e.g., yield, ROE, price momentum).

- Ranking & Cut-Off: Stocks are ranked; the top N (quantity) or top X% (percentage) are included.

- Weighting: Stocks can be equally weighted, factor-weighted, or follow a modified market-cap rule.

Rebalancing Schedule

Most factor indexes rebalance on a scheduled basis (quarterly, semi-annually). This maintains the factor tilt but creates potentially higher turnover compared to passive traditional indexes. Higher turnover can increase transaction costs and taxable events (for taxable accounts), leading to a higher expense ratio due to the operating cost of rebalancing. Thus, investors should check rebalancing frequency and expected impact of ETF expense ratios.

Example: Income / Quality Index (Singapore)

- Method: Rank by dividend yield, financial health and business quality; pick top 30 names.

- Result: A high-income, quality-tilted basket (e.g., Phillip SING Income ETF methodology).

4. Differences Between Factor Selection vs Traditional Index Selection

Traditional Market-Cap Index

- Selection: All eligible stocks included; weight proportional to market capitalization.

- Outcome: Emphasises largest companies; automatically increases weight as a stock’s price rises (momentum bias).

Factor Index

- Selection: Stocks selected by factor scores (value, dividend, quality).

- Outcome: Overweights companies with desired traits even if they are not the biggest by market cap; can intentionally underweight or exclude certain sectors.

Practical Consequence

Factor indices purposely deviate from market-cap benchmarks to pursue specific performance characteristics — this is why their returns can diverge significantly from plain indices.

5. Factor ETFs: Practical Uses and Examples

Uses in a Portfolio

- Return enhancement: E.g., value or momentum factor for potential excess returns.

- Risk management: Low-volatility or quality factors to reduce drawdowns.

- Income solutions: Dividend factor ETFs for yield-focused allocations.

- Diversification: Combining factors with market-cap exposure to potentially smooth returns across cycles.

Examples (US & Singapore)

- Momentum (US): : MTUM — momentum tilt.

- Value (US): VLUE — value tilt.

- Dividend (US):: VYM or SDY — dividend-focused indices.

- Singapore Income / Quality (SGX): Phillip SING Income ETF (OVQ) — high income + quality selection.

- Thematic overlaps: Growth/AI exposures can be achieved via growth factor ETFs or through thematic ETFs that incorporate factor rules.

Source: S&P Dow Jones Indices. As at 30 September 2024. Based on S&P 500 Index and relevant factor indices. Past performance is not indicative of future returns. You cannot invest directly in an index. Index performance does not take into account any ETF fees and costs.

Source: S&P Dow Jones Indices. As at 30 September 2024. Based on S&P 500 Index and relevant factor indices. Past performance is not indicative of future returns. You cannot invest directly in an index. Index performance does not take into account any ETF fees and costs.

6. What to Look for When Selecting Factor ETFs

Key Selection Criteria

- Clear methodology: Read the index rulebook—how are factors measured and weights assigned?

- Rebalancing frequency and turnover: Higher turnover means higher trading costs and potential tax implications.

- Historical factor behaviour: Understand cycle sensitivity (e.g., value vs. growth).

- Fees: Factor ETFs generally cost more than plain market-cap ETFs but less than fully active funds. Compare expected net-of-fee outcomes.

- Liquidity & AUM: Sufficient assets under management and trading volume reduce bid/ask spreads and tracking uncertainty.

- Overlap: Check overlap with existing holdings—factor ETFs can unintentionally concentrate similar stocks across multiple funds.

7. Key Takeaways — Factor ETFs

Key Selection Criteria

- Smart-beta blends rules and targeting: Factor ETFs offer targeted tilts while preserving index transparency and systematic discipline.

- Know the factor: Different factors perform in different environments; combine factors to diversify factor risk.

- Mind the mechanics: Rebalancing frequency, turnover, and fees materially affect outcomes—read the methodology..

- Use factors strategically:Consider factors as building blocks — e.g., combine a core market-cap ETF with a dividend factor ETF and a quality ETF for balanced exposure.

Call to Action

Consider adding selected factor ETFs to your watchlist and reviewing how they perform to observe if any can play a role in your investment portfolio.

Some examples mentioned in this article are:

- OVQ (SGX — Singapore income/quality)

- MTUM (US — momentum)

- Mind the mechanics Rebalancing frequency, turnover, and fees materially affect outcomes—read the methodology..

- VLUE (US — value)

- VYM / SDY (US — dividend focus)

As always, align your ETF picks with your preferred investment goals and strategy. Review choices based on total portfolio exposure to avoid unintentionally becoming overexposed to one or a few counters..

Stay tuned for our next feature, where we explore different aspects of ETF categories in greater detail.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Mr Teo Huan Zi

Mr Teo Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance.

He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?