First REIT Faces Currency Headwinds Despite Stable Operations February 13, 2026

Financial Performance Overview

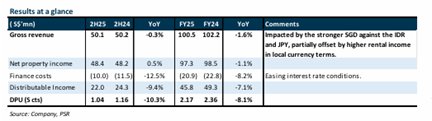

First REIT (FIRT) reported its 2H25/FY25 distribution per unit (DPU) results of 1.04 and 2.17 Singapore cents representing declines of 10.3% and 8.1% year-on-year respectively. Theese figures were in line with market expectations, accounting for 48% and 100% of FY25 forecasts. The year-on-year decline was primarily attributed to the depreciation of the Indonesian Rupiah (IDR) and Japanese Yen (JPY) against the Singapore Dollar, though this was partially mitigated by increased local-currency rental income and reduced finance costs.

Strategic Developments and Portfolio Changes

FIRT completed the divestment of its non-core Imperial Aryaduta Hotel & Country Club (IAHCC) on December 4, 2025. Following the redemption of S$33.3 million of 4.9817% subordinated securities in January 2026, FIRT eliminated all perpetual securities from its capital structure. Excluding the IAHCC divestment, portfolio valuations declined 6.2% year-on-year, primarily due to foreign exchange depreciation in IDR and JPY.

Investment Recommendation and Outlook

Phillip Securities Research maintains its ACCUMULATE rating for First REIT with a revised target price of S$0.29, down from the previous S$0.31. This adjustment reflects updated dividend discount model forecasts that account for weaker IDR and JPY currencies, as well as the IAHCC divestment impact. FY26 and FY27 DPU estimates have been reduced by 5% and 8% respectively to incorporate these factors.

Business Fundamentals and Market Position

First REIT continues to operate as a healthcare-focused real estate investment trust with assets primarily in Indonesia, Singapore, and Japan. The company continues to benefit from a base 4.5% rental escalation across its Indonesia portfolio, with three Indonesian hospitals now operating under performance-based rent structures. A strategic review regarding Siloam’s potential acquisition of FIRT’s Indonesian hospital assets remains ongoing without material updates.

Financial Strength Indicators

FIRT demonstrated stable capital management with its cost of debt declining by 50 basis points year-on-year to 4.5%. Gearing and interest coverage ratios remained healthy at 42.1% and 3.7x respectively. FIRT trades at an FY26 estimated DPU yield of 8.4% and is currently in discussions to extend and refinance S$260 million of loans maturing in 2026.

Key Takeaways

Q: What was First REIT’s DPU performance for 2H25/FY25?

A: First REIT reported 2H25/FY25 DPU of 1.04/2.17 Singapore cents, representing declines of 10.3% and 8.1% year-on-year respectively, primarily due to IDR and JPY depreciation against the SGD.

Q: What is Phillip Securities Research’s current recommendation and target price?

A: Phillip Securities Research maintains an ACCUMULATE rating with a revised target price of S$0.29, reduced from the previous S$0.31 due to weaker currency forecasts and the IAHCC divestment.

Q: What major asset divestment did First REIT complete recently?

A: First REIT completed the divestment of the non-core Imperial Aryaduta Hotel & Country Club (IAHCC) on December 4, 2025.

Q: How did different geographical segments perform in local currency terms?

A: FY25 income from Indonesia and Singapore properties rose by 5.1% and 2.0% respectively in local currency terms, while Japan remained stable.

Q: What are the key financial health indicators for First REIT?

A: The REIT maintains healthy financials with gearing at 42.1%, interest coverage ratio at 3.7x, and cost of debt at 4.5% (down 50bps year-on-year).

Q: What is the status of rental payments from MPU?

A: Rentals continue to be owed by MPU, with S$6.9 million outstanding as of December 31, 2025. S$1.5 million was received in January 2026, reducing the outstanding amount to S$5.4 million.

Q: How did portfolio valuations perform excluding the IAHCC divestment?< A: On a same-store basis, portfolio valuations declined 6.2% year-on-year, primarily due to foreign exchange headwinds, with the Indonesia portfolio rising 1.4% in local currency terms while Japan declined 0.7%.

Q: What is First REIT’s current dividend yield?

A: First REIT trades at an FY26 estimated DPU yield of 8.4%.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Darren Chan

Darren has over seven years of experience across both the buy-side and sell-side. During his tenure as a fund manager, he managed multiple funds and mandates, including dividend income, growth, customised, Singapore-focused, and regionally focused strategies. He holds a First-Class Honours degree in Banking and Finance from the University of London.