Furry Finances: Is Pet Insurance Worth It? July 30, 2024

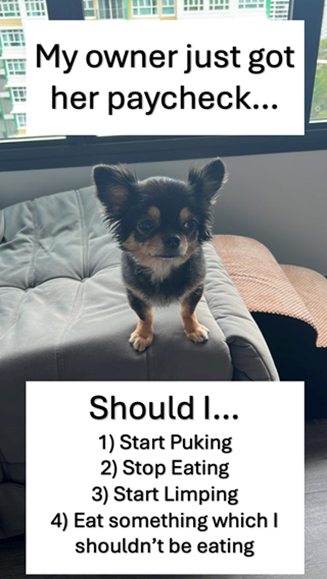

Imagine returning home to find your precious dog vomiting and listless. Panicking, you rush to the vet with your dog, only to learn it’s swallowed a toy and require emergency surgery costing thousands of dollars. Can you afford such a hefty bill? Before getting caught in that possible scenario, getting pet insurance for your dog would help you avoid such expenses.

Pet insurance in Singapore covers a range of medical expenses for domestic dogs and cats, including cancer treatment, emergency care, prescriptions, and surgery. In dire situations, it can even save a pet’s life by enabling treatments that would otherwise be unaffordable, potentially preventing the heartbreaking decision of euthanasia. However, if your pet is generally healthy, you might end up paying premiums without utilising the coverage. So, is pet insurance worth it?

Here are factors to help you decide:

Similar to humans facing medical bills without health insurance, uncovered vet bills can be financially challenging for pet owners. Considering the potential scenarios where expensive emergency care or surgery might be crucial, here are some questions to ask yourself:

Is your dog’s breed prone to costly health issues?

Certain dog breeds, such as Pugs with their brachycephalic (flat-faced) anatomy, are more prone to respiratory problems and heat intolerance, which can potentially lead to higher medical costs over time.

Does your pet lack a clear medical history or come from unknown breeding?

Pets with unclear medical histories, such as those from unknown breeding backgrounds or shelters, may have undisclosed health risks. This uncertainty could lead to unexpected medical expenses if underlying conditions develop later.

Is your pet accident-prone, leading to potential high medical bills?

High-energy dogs like Jack Russels, known for their agility and activity levels, can sometimes experience accidents or injuries. Their owners should be prepared for potential veterinary costs associated with such energetic nature.

Could your pet unintentionally harm others, leading to liability concerns?

Although dog bites or aggressive incidents are rare in Singapore, there are cases where pet dogs attack other dogs, when they run away from home or when their owner isn’t paying attention during walks.

These questions can guide you in determining whether pet insurance is necessary and what coverage types are essential. It might even be prudent to consider multiple insurance plans for broader protection.

Remember, pet insurance isn’t meant to cover small expenses. It’s about protecting against significant future bills and ensuring you’re prepared for unexpected situations.

Consider your budget carefully

While the best insurance plans might be ideal, affordability is a genuine concern for most. Avoid overextending yourself when choosing a plan. Opting for a more affordable plan initially, with the option to upgrade later, can be a practical approach. Remember, insurance premiums often increase as pets age, so buying early can lock in lower rates.

Keep in mind common insurance terms like co-insurance (your share of eligible bills) and deductible (the fixed portion you pay before insurance kicks in). Each insurer may define these differently, affecting your out-of-pocket expenses. Understanding these terms can help you make an informed decision that balances coverage and cost.

Alternative to Pet Insurance

If you’re unsure about pet insurance, there are alternatives to consider that avoid annual premiums but require careful financial planning to cover unexpected costs:

Savings account: Set aside money in a savings account specifically for vet bills. While you won’t pay an annual pet insurance premium, a major accident or illness, such as a torn ACL or cancer, could significantly deplete your savings.

Investment: Creating cash flow via dividend-paying funds can help cover monthly expenses such as supplements or grooming. Over time, the invested sum could grow in value and be used to pay vet bills. However, it’s better to seek advice on investments if you are unsure, as returns are not guaranteed.

Personal Loan/Credit Card: One option is to take out a personal loan from a bank or lending institution. Another is to pay the vet bill using a credit card. However, it’s important to note that credit cards typically have high interest rates, averaging around 27.65%, which can lead to significant interest payments over time if the balance is not paid off quickly. It’s essential to consider these factors and weigh them against the cost and benefits of pet insurance when planning for your pet’s medical expenses.

Ultimately, make a decision based on your pet’s needs and your financial situation, for your peace of mind. By planning ahead and choosing the right pet insurance policy, you can safeguard your furry companion’s health and well-being for the long term. Remember, investing in pet insurance is not just about financial protection—it’s about ensuring that your pet receives the best possible care when they need it most.

Contributor:

Elin Chee

Financial Services Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

http://bit.ly/TTPelin

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Elin Chee

Financial Services Manager

Being a firm believer that early financial planning enables one to enjoy life meaningfully, Elin joined the finance industry immediately after graduation. After a year with a reputable insurer, she realised that effective financial planning for her clients required a more robust platform and deeper personal knowledge. Consequently, she took a leap of faith to "restart" her career by joining Phillip Wealth Advisory and embarking on the CHFC program.

After three years at Phillip Wealth Advisory, Elin is pleased to have fulfilled the first phase of her goal in the finance industry by attaining her CHFC certificate and applying her knowledge using the robust platform at Phillip Wealth Advisory. She hopes to expand her client base with individuals who appreciate planning ahead with a knowledgeable and service-oriented adviser through the various stages of their lives.

Protecting More Than Just Walls: Fire Insurance vs Home Insurance

Protecting More Than Just Walls: Fire Insurance vs Home Insurance  Before the Year Ends: Key Financial Steps for a Confident 2026

Before the Year Ends: Key Financial Steps for a Confident 2026  The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions  Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting