Getting Started in ESG Investing December 6, 2019

Doing good with my hard earned money

As a parent, my biggest wish is for my children to be responsible with their money. This is why I gave them 3 piggy banks; for long-term and short-term savings as well as for donations or giving.

Singapore was built on the philanthropy and kindness of Singaporean businessmen such as Lee Kong Chian, Lien Ying Chow, Khoo Teck Puat, Goh Cheng Liang. Their contributions and support in several areas shaped our society.

Figure 1: Mr. Goh Cheng Liang (Resource from AsiaOne)1

We work hard to secure a better future for our children and ourselves. Hence, we should set a good example and be responsible when handling our finances.

What is ESG Investing?

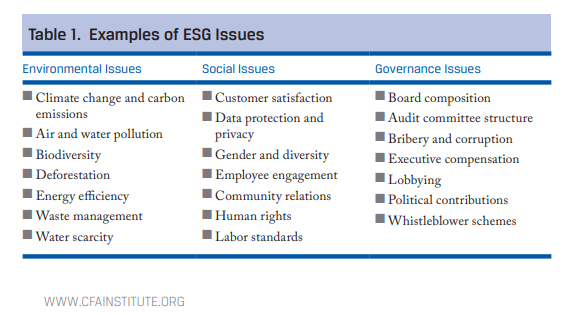

Environmental, Social and Governance (ESG) Investing involves investing in companies that support environmental protection, social justice, ethical management practices, alongside traditional fundamental factors.2

Figure 2: Resource from CFA Institute

How much money is invested in ESG?

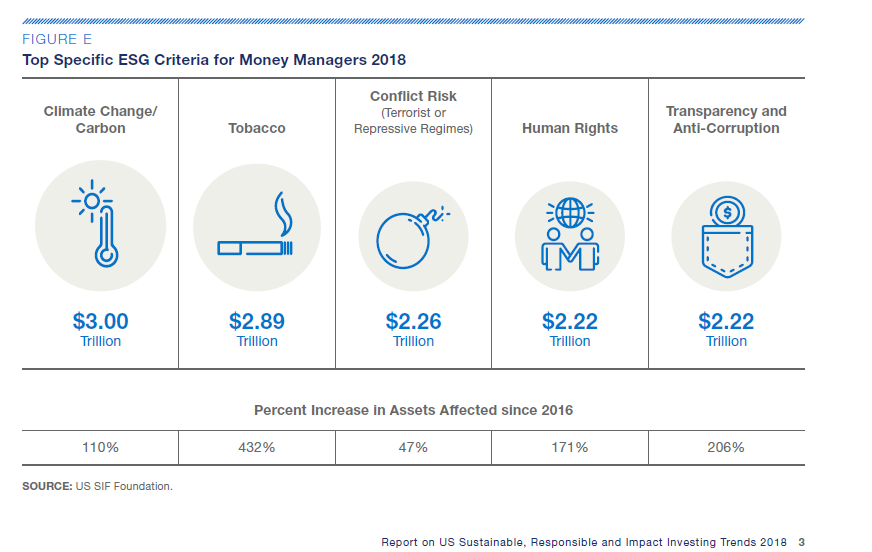

It was reported in US Sustainable, Responsible and Impact Investing Trends that $12.0 trillion in total assets under management (AUM) was allocated for the use of at least one sustainable, responsible and impact investing strategy.3 ESG-themed ETF fund assets more than doubled from $3.5 billion to $7.4 billion, and the number of funds increased 176 percent from 25 to 69.

Sustainable, Responsible and Impact Investment (SRI) mutual fund assets have increased 34 percent since 2016 from $1.72 trillion to $2.58 trillion, while the total number of SRI mutual funds has increased 50 percent from 475 to 636.4

Figure 3: Resource from US SIF Foundation

How can I start with my own personal portfolio?

1. Reflect on your values

Different investors hold different attitudes towards the value of their investments. While some consider the economic value of ESG ETFs, i.e. the opportunities and risks of its future returns, others might take moral values into consideration. Most investors seek to maximise their economic value, but some may consider if the companies they invest in have environmental protection, social justice, ethical management, e.g. a coffee or fashion business that practise fair trade and responsible production.

2. Familiarise yourself with the ESG investing methodologies

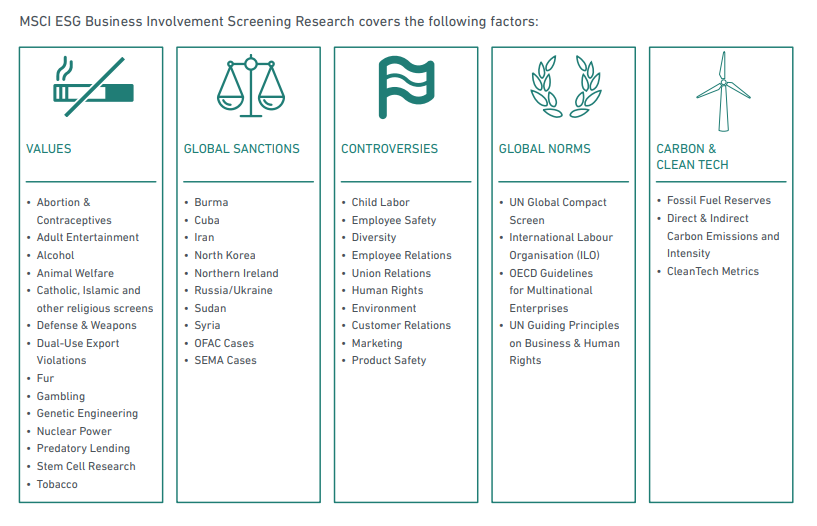

There are plenty of strategies in ESG investing; at least six methodologies are introduced by the CFA Institute. The most popular way to evaluate your investment is exclusionary screening/negative screening. You can either eliminate a certain product, service or exclude the whole company and the entire sectors based on your moral values: weapons, alcohol, tobacco, energy and etc.

Figure 4: Factors considered by MSCI Screening Research5

3. Identify the investments

a. Stocks

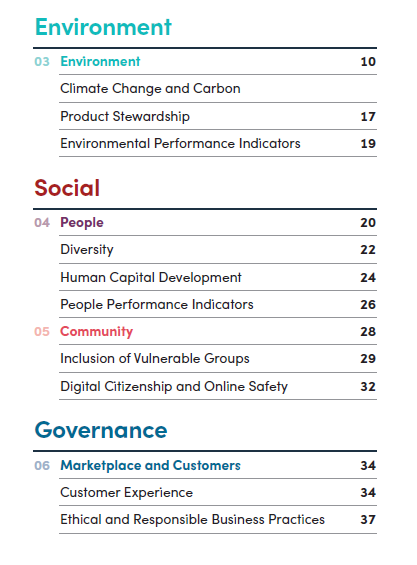

You can refer to the sustainability section of a company’s reports (strategic report, sustainability report or annual report) which allows you to evaluate their performance on ESG integration.

Figure 5: Extract from: Singtel’s 2019 Sustainability Report

b. Funds

ESG fund is an option if you are looking for hassle-free investments. You can do your part by sharing your needs and preferences with your financial institution so that its Fund Managers can produce the funds with your investment objectives in mind.

One example is the First State Dividend Advantage Fund: Click here for more information about this Fund.

c. ESG ETFs

— Use POEMS ESG ETF Screener

You can use POEMS ETF Screener by applying “ETF” filter.

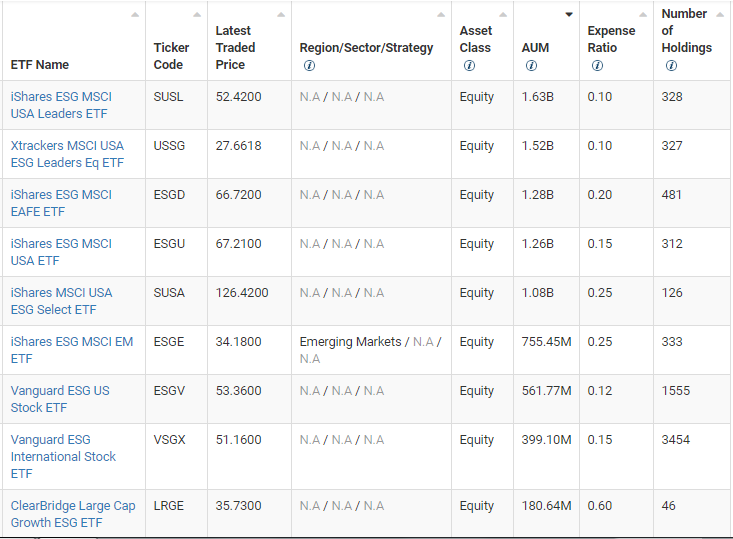

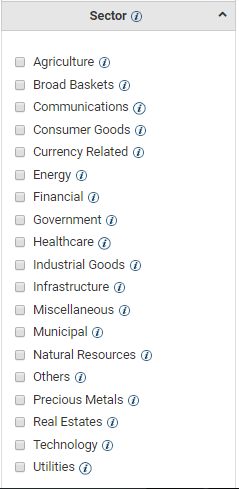

Figure 6: POEMS ETF Screener with “ESG” filter applied and showing descending order by AUM

Figure 7: POEMS ETF Screener’s Sectors Filter

You can also filter the funds according to your preferred sectors.

— Analyse ESG ETFs

According to CFA Institute’s guide Environmental, Social, and Governance Issues in Investing, A Guide for Investment Professionals, there are six methods of analysing ESG ETFs. The most popular method of evaluation is exclusionary/negative screening, which avoids securities of companies or countries on the basis of traditional moral values (e.g., products or services involving alcohol, tobacco, or gambling) and standards and norms (e.g., those pertaining to human rights and environmental protection).6

Studies has proven ESG Investing to be a good investment strategy

In the research study “ESG and financial performance: aggregated evidence from more than 2000 empirical studies”, 2100 out of more than 3700 empiric studies showed a positive relationship between Corporate Financial Performance (CFP) and ESG Investing. (Gunnar Friede, 2015)

Figure 8: Clean Energy is an example of environmental criteria in the ESG theme

The War wages on – We need your help

While ESG investing is becoming more common, encouraging responsibility and awareness of ESG standards among companies remains a challenge.

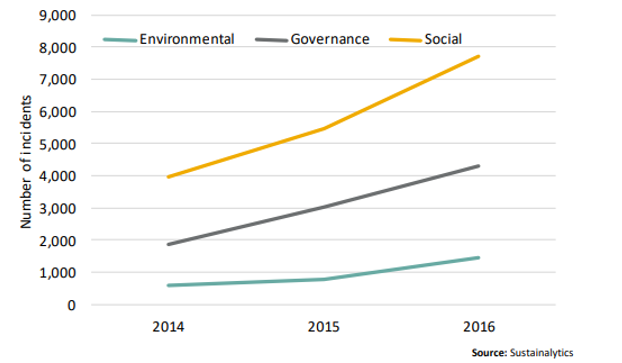

Sustainalytics, a company focusing on ESG and Corporate Governance research and ratings, reported that the number of company activities that generate undesirable social or environmental effects grew from 6,400 in 2014 to over 13,000 in 2016. These activities are dominated by Quality and Safety and Business Ethics, which together account for 30% of all incidents.7

Hence, we urge you to consider the sustainability and societal impact of your investments.

Figure 9: Incidents by year and ESG theme from Sustainalytics

Reference:

- [1] AsiaOne, n.d.

- [2] Investopedia

- [3] USSIF, 2019

- [4] USSIF, 2019

- [5] MSCI, n.d.

- [6] (CFA Institute, 2015)

- [7] (Sustainabilytics, 2017)

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Luke Lim

Managing Director

As the Managing Director of Phillip Securities Pte Ltd (PSPL), Luke oversees PSPL's daily operational businesses, strategic directions and executes management decisions for performance-driven results in consultation with the board of directors. He honed his management leadership style having been responsible for various roles in the PhillipCapital Group of companies since 2004. His experience covers research solutions, overall strategy and business development. He co-founded POEMS Venture, one of the venture capital arm of PhillipCapital which invests in companies such as start-ups with valuable guidance accumulated from years of experiences in the finance industry and running POEMS, one of the earliest FINTECH launching online trading. Luke also formed and chaired various Industry Workgroups and led discussions with regulators on issues impacting SAS members. Luke graduated from Imperial College London with a Bachelor of Electrical and Electronic of Engineering and obtained a Master's degree in Business Administration from Nanyang Technological University.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  Singapore Equities Hit New Highs in Record Nine-Month Rally

Singapore Equities Hit New Highs in Record Nine-Month Rally  OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth

OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth  Tesla Faces Delivery Challenges as EV Tax Credits Are Removed

Tesla Faces Delivery Challenges as EV Tax Credits Are Removed