Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection February 10, 2026

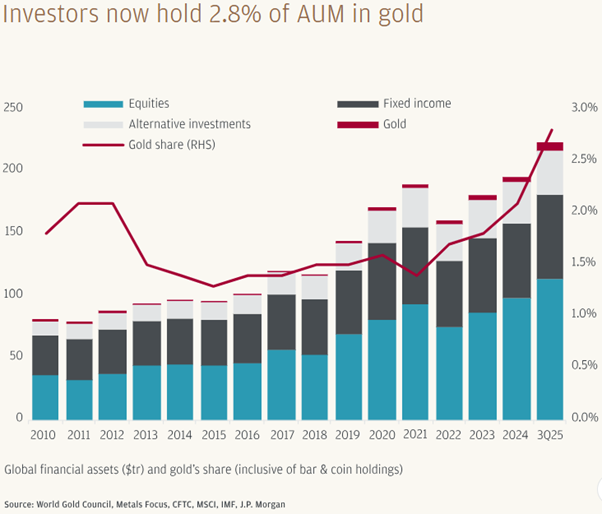

Gold has re-emerged as one of the most closely watched assets in global markets, not because of speculation, but because of what it represents in an increasingly uncertain investment landscape. As inflation risks persist, geopolitical tensions remain elevated, and confidence in fiat currencies is periodically tested, investors are once again turning to gold for stability, diversification, and protection of purchasing power.

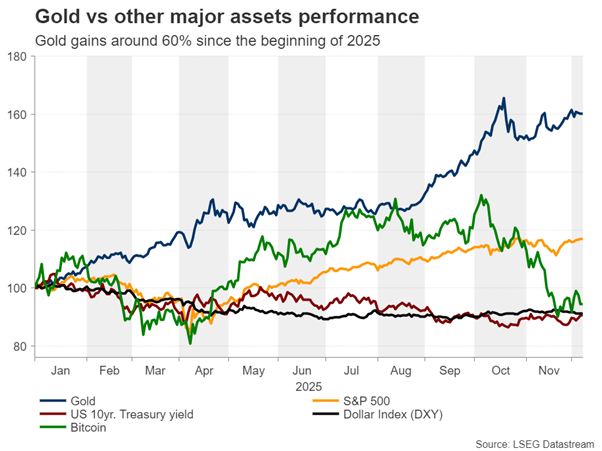

Over the past two years, gold has delivered exceptional performance, rising approximately 25.5% in 2024 and a further 60–65% in 2025, making it one of the best-performing asset classes over this period. The strong performance has drawn increasing attention from investors seeking portfolio resilience amid heightened global uncertainty.

In Singapore, retail interest in gold has surged. According to the World Gold Council (WGC) and reported by Singapore Bullion Market Association (SBMA), purchases of gold bars and coins by Singaporeans rose 37% year-over-year to 2.2 tonnes in Q2 2025 after recording 2.5 tonnes of gold investment in Q1 2025 which was the highest on the WGC’s record. This trend reflects a growing shift towards viewing gold as a portfolio asset rather than purely a form of jewellery or store of wealth.

For Singaporean retail investors, the SPDR Gold Shares ETF (SGX: USD code O87, SGD code GSD) offers a convenient way to gain exposure to physical gold without the challenges of storage, insurance, or liquidity associated with holding bullion directly.

Understanding gold’s role in portfolio construction is essential. Below, we explore two key perspectives: first, how gold ETFs can enhance diversification and stabilize a retail portfolio, and second, how gold can function as a long-term hedge against inflation, despite not generating income.

Diversification Benefits of Gold ETFs

Diversification involves spreading investments across uncorrelated assets, so that weakness in one market may be offset by strength or stability in another.

Gold has long been valued for its role as a portfolio diversifier, as it has historically moved independently of both equities and bonds. For example, during the market turmoil of 2022, global equities declined by 19.5% and bonds fell by 16%, while gold recorded a gain of approximately 3%. Portfolio analysis suggests that even a modest allocation to gold, typically 3–5%, can meaningfully reduce overall portfolio volatility.

Research by the WGC indicates that adding 5% gold to a balanced portfolio can reduce portfolio risk by a similar magnitude, while gold’s own contribution to total risk remains relatively small. Financial advisers also highlight that gold’s low correlation with traditional asset classes helps cushion portfolio drawdowns during periods of market stress.

Key diversification attributes include:

- Low Correlation: Gold prices often rise when equities or bonds sell off, due to its safe-haven appeal. This inverse or near-zero correlation has been documented over decades.

- Crisis Resilience: Gold has historically preserved value during periods of crisis. For instance, during the Global Financial Crisis (2008) and early 2020, gold rallied as broader markets panicked. Even as recently as early 2025, when tariffs and geopolitical risks spiked volatility, gold advanced steadily.

- Improved Portfolio Stability: Incorporating gold ETFs into a retail portfolio can improve risk-adjusted returns by reducing volatility without materially compromising long-term growth potential.

Moreover, Singapore’s regulatory framework further enhances accessibility to gold ETFs accessible. The SPDR Gold Shares ETF, for example, is cross-listed on SGX and trades in USD (O87) or SGD (GSD). Investors can buy as little as 1 share (board lot) via any brokerage, and the ETF is included under Singapore’s CPF Investment Scheme (subject to % limitation of investment limit of CPFIS). This allows retail investors, including those using CPF or SRS funds, to allocate a small portion of their portfolio to gold in a disciplined and accessible manner.

Reasons to consider of Gold ETFs in your portfolio

- Ease of Access: Gold ETFs trade like stocks and incur only standard brokerage fees, avoiding the premiums and logistics of physical gold.

- Regulatory Friendly:Unlike many other commodities, SPDR Gold Shares is recognised under CPF and SRS investment rules, making it a distinctive option for Singapore investors seeking regulated exposure to gold within their retirement or supplementary savings frameworks.

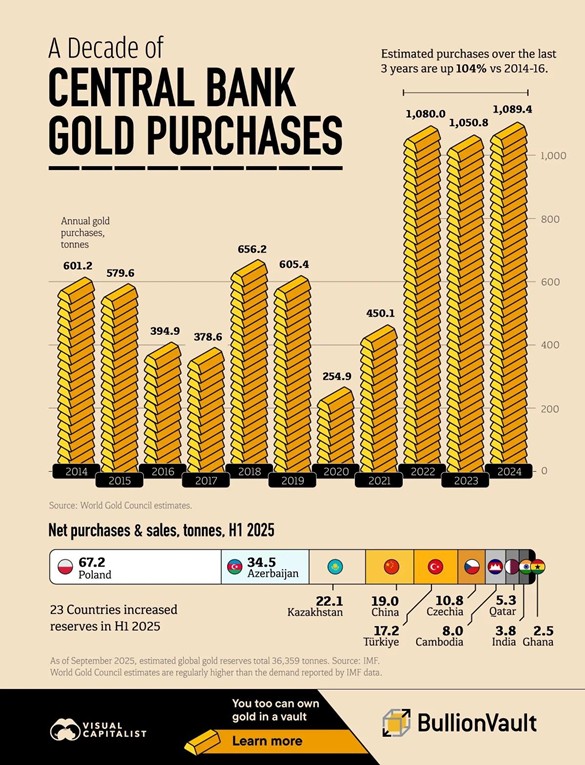

- Global Reserves Trend: Central banks, including those in China, Russia, and several emerging markets, have been steadily increasing their gold holdings in recent years. This sustained accumulation signals confidence in gold’s role as a strategic reserve asset and reinforces its relevance within diversified portfolios.

Overall, retail investors in Singapore can utilise gold ETFs to help smooth portfolio volatility. In a balanced portfolio of stocks, bonds, and perhaps property, allocating a modest portion to gold via an ETF can help reduce drawdowns during periods of market stress. The recent gold rally underscores this defensive characteristic. In 2025, SPDR Gold Shares delivered returns of approximately 64% in USD terms, significantly outperforming many other asset classes. Combined with gold’s low correlation to traditional investments, this performance highlights its potential role as a risk mitigator. For long-term retail investors, a prudent approach is to view gold as portfolio insurance against sharp equity or bond corrections, rather than as a vehicle for chasing short-term gains.

Gold ETFs as a Long-Term Hedge Against Inflation

Inflation erodes the real value of cash and fixed-income returns, which is why gold is often cited as a long-term hedge. Historically, gold’s purchasing power has held up over decades of rising prices. In times of “uncomfortably high” inflation (e.g. 1970s, or the 2008 crisis), gold rallied sharply. More recently, renewed inflation concerns have contributed to gold’s ongoing bull run. Several major institutions, including Goldman Sachs, have projected further upside, citing strong central bank demand and potential ETF inflows as key drivers. Some forecasts suggest gold prices could reach US$4,900 per ounce by 2026, with spot gold already trading at record highs above US$4,850 per ounce as at 23 January 2026.

In parallel, many central banks, including those in China, Russia, and Turkey, have significantly increased their gold reserves over the past few years, reflecting a structural shift away from paper assets. Gold’s price appreciation can be partially attributed to this sustained central bank buying, alongside a weakening US dollar and increased retail participation.

Over the long term, research indicates that gold can help preserve wealth not only against consumer price inflation, but also against currency debasement and asset-price inflation. In this sense, gold serves as a hedge when monetary expansion accelerates or when prolonged inflationary pressures undermine the real value of financial assets.

However, investors must be mindful of the trade-offs. Unlike stocks or bonds, gold pays no dividends or interest. Its return comes solely from price appreciation. Gold does not generate income or dividends like other assets. In an inflationary environment, this means holding gold (or gold ETFs) foregoes the yields one might get from, say, inflation-linked bonds or even high-dividend stocks. Moreover, gold’s price can be volatile and does not always move in lockstep with inflation in the short term.

Conclusion

Gold ETFs offer Singapore retail investors a practical way to incorporate gold into their portfolios, combining accessibility, liquidity, and regulatory alignment without the challenges of physical ownership. As global markets navigate heightened uncertainty, persistent inflation risks, and shifting monetary dynamics, gold continues to play a relevant role as a portfolio stabiliser and store of value.

While gold does not generate income and can be volatile in the short term, its long-term behaviour has demonstrated an ability to preserve purchasing power and provide diversification benefits when traditional asset classes come under pressure. For retail investors, the key lies in moderation and intent. Gold ETFs should be viewed as a strategic allocation rather than a return-seeking instrument, complementing equities, bonds, and other income-generating assets.

Used thoughtfully, instruments such as SPDR Gold Shares (SGX: O87/GSD) can enhance portfolio resilience and help investors navigate market cycles with greater balance and discipline. As with all investments, understanding the role each asset plays within a broader strategy remains essential to achieving long-term financial objectives.

Sources:

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Teo Huan Zi

Mr Teo Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance.

He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?  ETF Market Review: Most ETFs up in November; gold expected to extend recent gains

ETF Market Review: Most ETFs up in November; gold expected to extend recent gains