Hong Kong Value Stocks Q2 2024 – Part 2 June 19, 2024

Recently, we have witnessed a surge of momentum, fuelled by a series of tailwinds that have transformed the investment landscape in Hong Kong. The recent robust performance of the Hong Kong stock market can be attributed to several factors, including the resurgence of the Chinese economy, heightened backing from Chinese economic policies, and the comparatively lower valuation of Hong Kong stocks.

In line with the Hong Kong market’s potential resurgence, we are happy to announce that POEMS will be hosting a special lucky draw! Learn more about this special event from our page here! Don’t miss out on this opportunity to win while participating in the Hong Kong market’s potential upswing!

At the time of writing, the Hang Seng Index has increased about 10% year-to-date to 18,300 points. Despite this jump, we believe there is still room for growth.

In this article, we will be providing insights on several sectors and highlighting some companies that we believe are undervalued compared to their sectors’ index. If you would like the full list of value stocks, you may read our previous article here.

Industrial Sector

The industrial sector is a crucial part of the economy, consisting of three main components: manufacturing, construction, and infrastructure.

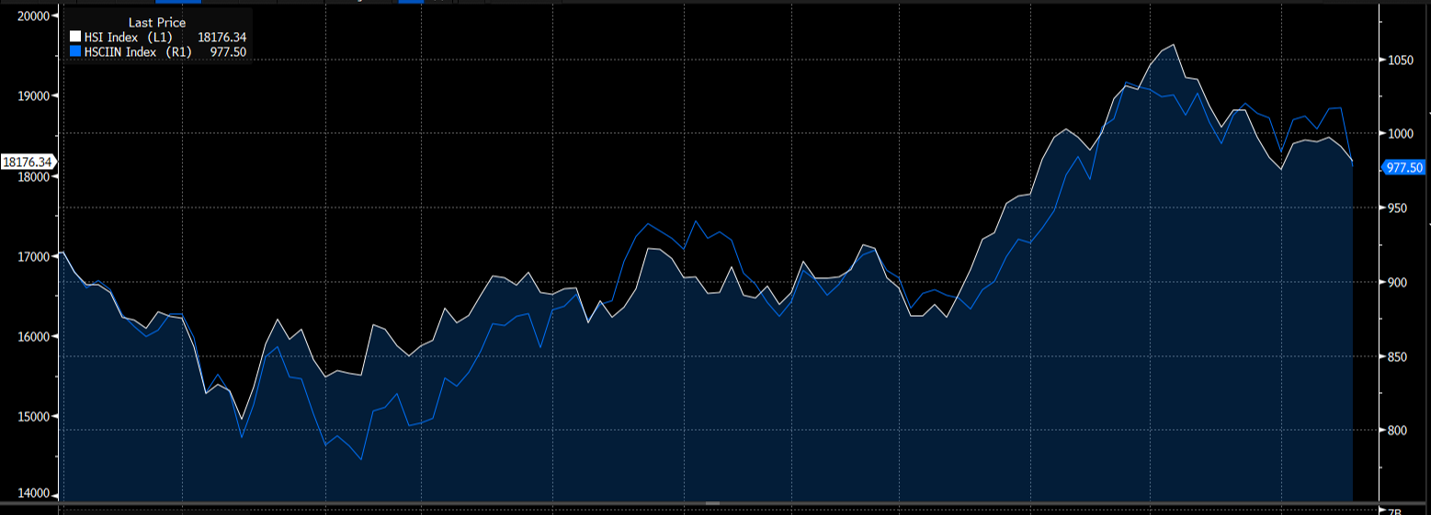

The Hang Seng Composite Industry Index – Industrials (HSCIIN) tracks the performance of industrial companies listed on the Hong Kong Stock Exchange (HKEX). The index includes 46 companies, providing a comprehensive overview of the industrial sector within the Hong Kong market.

| HSI | HSCIIN | |

| P/E ratio | 9.62 | 11.44 | P/B ratio | 1.07 | 0.84 | EPS | 1,910.18 | 88.90 |

Source: Bloomberg as at 11 June 2024

Figure 1: Normalised data of HSI and HSCIIN

Figure 1: Normalised data of HSI and HSCIIN

In Figure 1 above, the white line represents the Hang Seng Index (HSI), while the blue line represents the Hang Seng Composite Industry Index – Industrials (HSCIIN). As observed, the HSI year-to-date (YTD) closing was at 18,176.34, while the HSCIIN was at 977.50.

Notably, the HSCIIN has been closely tracking the HSI and has recently outperformed it. The total return YTD for the HSI was 8.37%, whereas for the HSCIIN, it was 7.71%. This shows that the HSCIIN is slightly underperform than HSI by 0.66%, driven by both capital gains and dividends.

Consequently, the companies listed within the HSCIIN present a potentially attractive investment opportunity for investors.

China Communications Construction Co Ltd (1800.HK) and China Railway Construction Corp Ltd (1186.HK) both provide extensive transportation infrastructure construction services.

China Communications focuses on constructing ports, waterways, highways, bridges, and other infrastructure, along with real estate development.

Meanwhile, China Railway Construction specializes in building railways, highways, urban tracks, and similar infrastructure, while also engaging in real estate development and materials trading services.

| China Communications Construction Co Ltd (1800.HK) | China Railway Construction Co Ltd (1186.HK) | |

| Consensus Rating | (8B/1H/0S) | (10B/1H/0S) | Consensus Target Price | HKD 6.22 | HKD 6.87 |

Source: Bloomberg as at 11 June 2024

China Communications Construction Co Ltd (1800.HK) is navigating a mixed financial landscape with both challenges and opportunities. The company’s estimated earnings per share (EPS) growth for the next three years stands at 7.8%, trailing behind the peer average of 12.1%. Its free cash flow (FCF) yield is significantly negative at -48.1%, compared to -30.8% for its competitors.

Despite these hurdles, the company has an optimistic analyst consensus price target of HKD 6.22, which is 30.7% above its current price. Notably, revenues from transportation infrastructure have surged 36% year-on-year, now accounting for 87% of total revenue. Additionally, the company’s cash conversion cycle of -78 days indicates that the business is in a favourable position to easily meet its financial obligations. Despite this, Fitch has given giving a negative credit outlook for the company.

China Railway Construction Corp Ltd (1186.HK) is trading at a low price-to-earnings (P/E) ratio of 2.5x estimated forward earnings, well below the 3.8x average of its peers. The stock offers a substantial dividend yield of 6.8%, significantly outperforming the peer average of 4.9%. Despite these positive aspects, the stock is valued at a 43% discount compared to its historical and peer valuations.

Projected sales growth for the next three years is 3.4%, which is lower than the historical average of 9.3% and the peer average of 7.5%. Analyst consensus sets the stock’s price target 24.6% above its current level. Financially, the company is robust, with a significant cash balance of CNY 150.82 billion, representing 26% of its enterprise value.

Consumer Discretionary

The consumer discretionary sector encompasses industries and businesses that produce goods and services considered non-essential but desirable, typically purchased when consumers have disposable income.

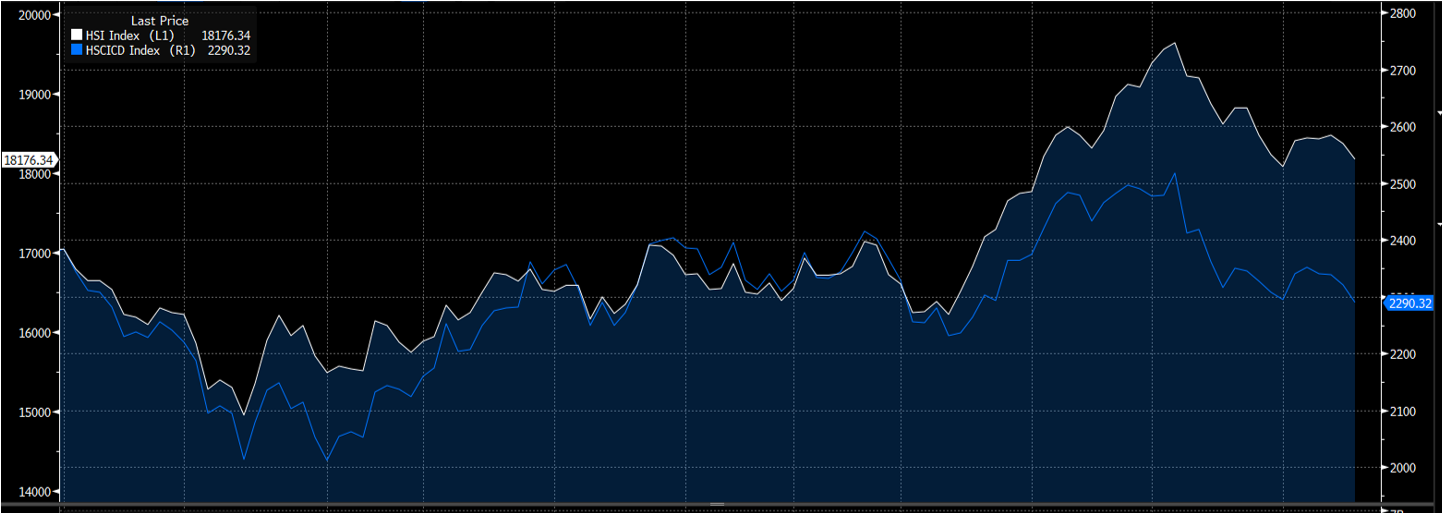

Unlike consumer staples, which are necessities, demand for consumer discretionary products is more susceptible to economic fluctuations. The Hang Seng Composite Industry Index – Consumer Discretionary (HSCICD Index) tracks the performance of consumer discretionary companies listed on the Hong Kong Stock Exchange (HKEX), which comprises of 99 companies.

| HSI | HSCICD | |

| P/E ratio | 9.62 | 19.64 | P/B ratio | 1.07 | 2.10 | EPS | 1,910.18 | 118.22 |

Source: Bloomberg as at 11 June 2024

Figure 2: Normalised data of HSI and HSCICD

Figure 2: Normalised data of HSI and HSCICD

In Figure 2 above, the white line represents the Hang Seng Index (HSI), while the blue line represents the Hang Seng Composite Industry Index – Consumer Discretionary (HSCICD). As of year-to-date, the HSI closed at 18,176.34, while the HSCICD stood at 2,290.32.

Initially moving closely with the HSI, the HSCICD began to underperform from mid-April onwards. The total return YTD for the HSI was 8.37%, compared to – 2.74% for the HSCICD, reflecting a – 11.11% underperformance. This significant underperformance may be attributed to substantial declines in stock prices within the HSCICD.

Consequently, the companies within the HSCICD may currently present less attractive investment opportunities.

Chow Tai Fook Jewellery Group Ltd (1929.HK) is a leading retailer of fine jewellery, offering a wide range of products across its retail stores in various Asian countries.

Haidilao International Holding Ltd (6862.HK) is renowned for its Chinese hotpot cuisine, providing a dining experience with an array of hotpot options, soup bases, dipping sauces, and prepared dishes.

Geely Automobile Holdings Ltd (0175.HK) is a key player in the automotive sector, specializing in the manufacture and sale of passenger vehicles, with a focus on delivering innovative and high-quality automobiles to global markets.

| Chow Tai Fook Jewellery Group Ltd (1929.HK) | Haidilao International Holding Ltd (6862.HK) | Geely Automobile Holdings Ltd (0175.HK) | |

| Consensus Rating | (27B/3H/2S) | (36B/8H/1S) | (36B/1H/0S) | Consensus Target Price | HKD 14.18 | HKD 20.98 | HKD 13.40 |

Source: Bloomberg as at 11 June 2024

In the current market landscape, Chow Tai Fook Jewellery Group Ltd (1929.HK) is experiencing a downturn in its P/E ratio, currently standing at 11.2x estimated forward EPS, a significant drop from its 2-year historical average of 15.8x.

Despite this, the company presents an attractive dividend yield of 5.3%, surpassing its 2-year historical average of 3.8%. However, its YTD total return remains negative at -13.4%, in contrast to the 10.7% performance of the Hang Seng Index (HSI). With the stock trading at a 16% discount relative to its historical and peer valuations, there is notable attention on its performance.

Notably, revenue from its jewellery stores witnessed a promising 8.4% year-over-year (YoY) increase in the six months ending 30 Sept 2023, constituting 51% of its total revenue. Analysts remain bullish on the company’s growth prospects, reflected in their notably high target price assessments.

Haidilao International Holding Ltd (6862.HK) is currently witnessing a decline in its P/E ratio, standing at 17.1x estimated forward EPS, a notable decrease from its 2-year historical average of 27.8x. Despite this, the company boasts a higher dividend yield of 4.6%, outperforming its peers with a 1.7% valuation.

Impressively, its YTD total return stands at a remarkable 23.0%, surpassing the performance of the Hang Seng Index (HSI) at 10.7%. The company’s cash conversion cycle of -7 days indicates that the business is in a favourable position to easily meet its financial obligations. On a brighter note, analysts from Fitch have issued a positive credit outlook for the company, signalling optimism in its trajectory.

Geely Automobile Holdings Ltd (0175.HK) is anticipated to experience robust EPS growth over the next three years, estimated at 29.4%, a figure significantly surpassing the 4.4% average among its peers. Furthermore, the company has demonstrated a commendable YTD total return of 14.4%, outperforming the Hang Seng Index (HSI) at 10.8%. Sales growth is also forecasted to be strong, projected at 15.3% over the same period, notably higher than the 4.8% average for its peers.

Meanwhile, the company’s cash conversion cycle of -25 days indicates that the business is in a favourable position to easily meet its financial obligations. Additionally, concerns have been raised regarding a negative credit outlook from S&P and recent management changes, warranting attention in the market.

Consumer Staples

The consumer staples sector encompasses industries and enterprises that manufacture and distribute fundamental goods essential to consumers, irrespective of economic conditions. This sector is distinguished by its non-cyclical behaviour, sustained demand, and economic resilience, rendering it pivotal for both consumers and investors alike.

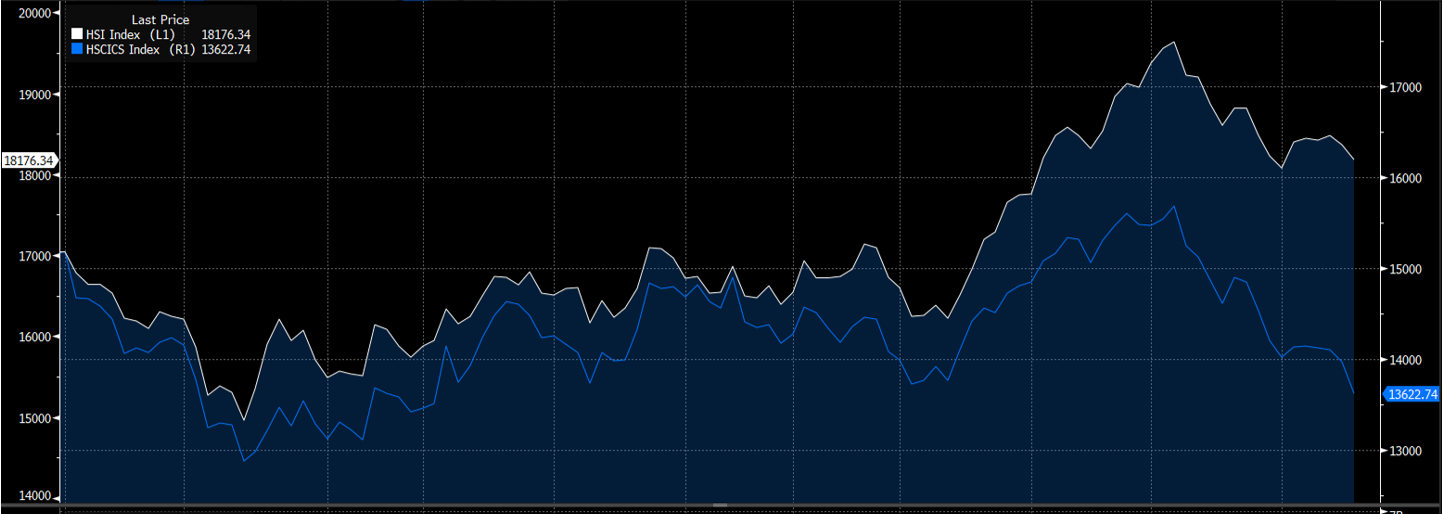

The Hang Seng Composite Industry Index – Consumer Staples (HSCICS Index) serves as a benchmark for tracking consumer discretionary companies listed on the Hong Kong Stock Exchange (HKEX), comprising a total of 31 companies within the exchange.

| HSI | HSCICS | |

| P/E ratio | 9.62 | 15.06 | P/B ratio | 1.07 | 1.71 | EPS | 1,910.18 | 927.88 |

Source: Bloomberg as at 11 June 2024

Figure 3: Normalised data of HSI and HSCICS

Figure 3: Normalised data of HSI and HSCICS

From Figure 3 above, the white line represents the Hang Seng Index (HSI), while the blue line corresponds to the Hang Seng Composite Industry Index – Consumer Staples (HSCICS). As of the latest available figures, the YTD closing for HSI stood at 18,176.34, while HSCICS closed at 13,622.74. A discernible trend emerges from the comparison, showing HSCICS moving in tandem with HSI until mid-April, after which the gap between them widens, with HSCICS now exhibiting underperformance compared to HSI.

Notably, the YTD total return for HSI was 8.37%, whereas for HSCICS, it stood at – 8.62%. This suggests that the total return for HSCICS trails behind HSI by – 16.99%, possibly attributed to significant declines in stock prices of companies comprising HSCICS.

Consequently, investors may find the listed companies within HSCICS less appealing for investment, considering their potential underperformance in the current market scenario.

WH Group Ltd (0288.HK) operates as a holding company overseeing meat processing services and chilled meat supply.

China Mengniu Dairy Co Ltd (2319.HK) focuses on manufacturing and distributing dairy products in China.

Want Want China Holdings Ltd (0151.HK) specialises in producing rice crackers, snack food, beverages, and packaging materials, along with manufacturing wheat and flour for snack food production.

| WH Group (0288.HK) | China Mengniu Diary Co Ltd (2319.HK) | Want Want China Holdings Ltd (0151.HK) | |

| Consensus Rating | (15B/1H/0S) | (35B/3H/0S) | (11B/6H/3S) | Consensus Target Price | HKD 6.66 | HKD 25.11 | HKD 5.47 |

Source: Bloomberg as at 11 June 2024

WH Group (0288.HK) is presently trading with a P/E ratio of 7.4x for estimated forward EPS, exceeding its 2-year historical average of 6.2x. Additionally, the company presents a superior dividend yield of 5.5%, outperforming its peers, which offer a yield of 3.1%. With a YTD total return of 12.9%, surpassing the 10.7% return of the Hang Seng Index (HSI), WH Group’s stock is currently trading at a notable 54% discount compared to both its historical and peer valuations.

China Mengniu Diary Co Ltd (2319.HK) currently exhibits a reduced P/E ratio of 9.4x for estimated forward EPS, notably lower than its 2-year historical average of 15.4x. Despite this, the company boasts a higher dividend yield of 3.6%, surpassing its 1.7% 2-year historical average.

However, its YTD total return stands at a negative -29.4%, contrasting sharply with the 10.7% return of the Hang Seng Index (HSI). The stock is currently trading at a substantial 42% discount compared to both its historical and peer valuations, despite witnessing a 4.9% year-on-year increase in revenues from milk, which now comprise 83% of the company’s revenue stream.

Want Want China Holdings Ltd (0151.HK) presently boasts a reduced P/E ratio of 12.4x for estimated forward EPS, falling short of its peers’ average of 16.2x. Despite this, its dividend yield stands at 3.5%, slightly lower than its historical average. Notably, the company has witnessed a noteworthy 7.1% year-on-year increase in revenues from milk, which now constitute 54% of its total revenue.

Learn more about Hong Kong Value Stocks with us! Visit our YouTube playlist here where we had special guest Mr. Louis Wong, Director of Phillip Securities Hong Kong, share with us his value stocks picks!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile