How to Build a Diversified Global ETF Portfolio August 15, 2025

Introduction: Why Diversification Is Essential in 2025

In our June edition article (https://www.poems.com.sg/market-journal/the-complete-etf-playbook-for-singapore-investors-from-beginner-to-advanced-strategies/), we introduced a tiered investment strategy tailored for Singaporean investors, starting with foundational domestic ETFs and scaling up to include global and thematic exposures. As markets continue to navigate volatility from rate shifts, geopolitical tensions, and sectoral rotations, investors are asking: How can I ensure my portfolio is both resilient and growth-oriented?

For this article, we take the conversation further by addressing:

- How to construct a truly diversified ETF portfolio across sectors and geographies

- What diversification really means and why it matters

- Who benefits most from diversified strategies

- How to structure a global ETF allocation effectively

What Is Diversification?

Diversification is a core investment principle used to manage risk and enhance long-term returns. Instead of relying on the performance of a single stock, sector, or country, it spreads investments across a variety of assets. This reduces the impact of any single underperforming asset class on your overall portfolio.

In simple terms:

“Don’t put all your eggs in one basket.”

By allocating across different sectors (e.g. banking, technology, healthcare), asset classes (e.g. equities, bonds), and markets (e.g. Singapore, US, Asia), you lower the chances of your entire portfolio declining during a downturn in any single area.

Fig 1.1 Diversification Definition

Fig 1.1 Diversification Definition

Who Should Diversify—and Why?

While all investors can benefit from diversification, it is especially important for those who may be unknowingly overexposed to a particular risk factor. This includes:

- Investors heavily concentrated in specific sectors

E.g. portfolios consisting mainly of banking or tech stocks, which can be cyclical or sensitive to regulatory risk. - Investors with home country bias

E.g. those who allocate nearly 100% of their capital to Singapore-listed equities, which may lack exposure to global trends like AI, healthcare innovation, or emerging markets growth.

Diversification doesn’t mean abandoning local investments—it means complementing them with assets that behave differently in varying market environments.

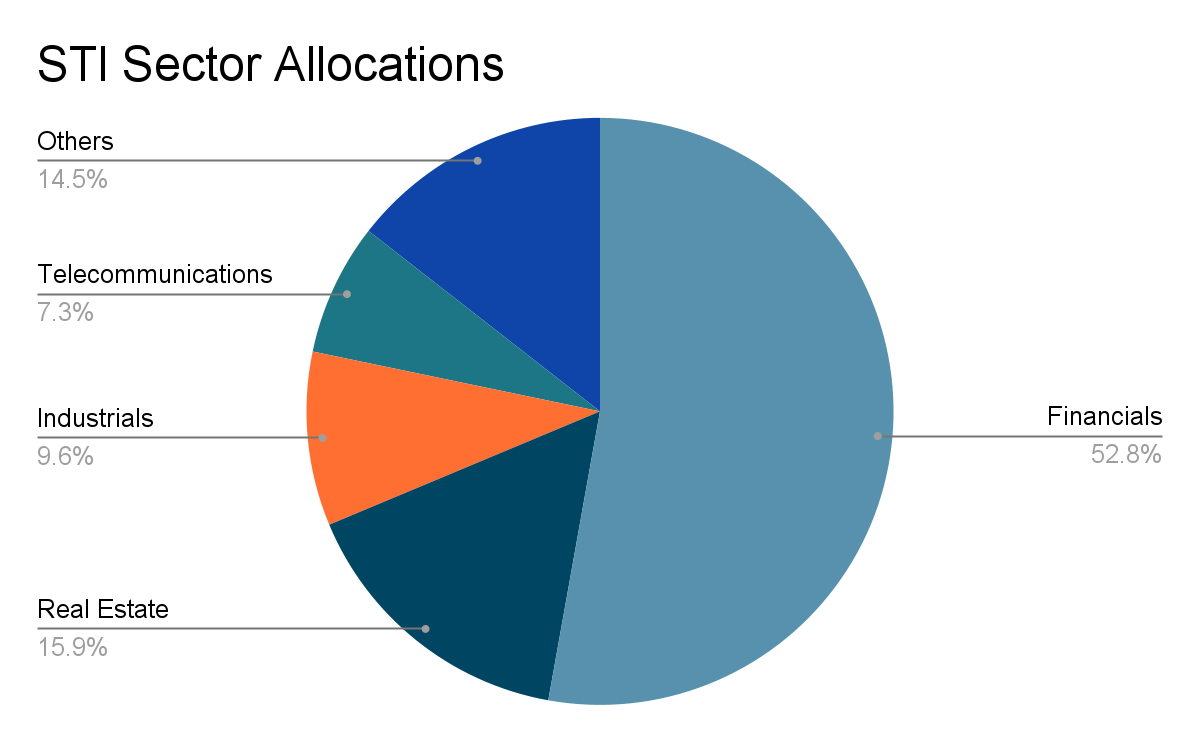

Case Study: Portfolio Concentration in the STI

Singapore’s benchmark Straits Times Index (STI) consists of 30 constituents, yet remains heavily concentrated in a few sectors—approximately 53% in financials, primarily banks. While these are blue-chip with sound fundamentals, and consistent dividend-paying stocks, the index lacks sector diversity.

Fig. 1.2 Straits Times Index Allocations

Fig. 1.2 Straits Times Index Allocations

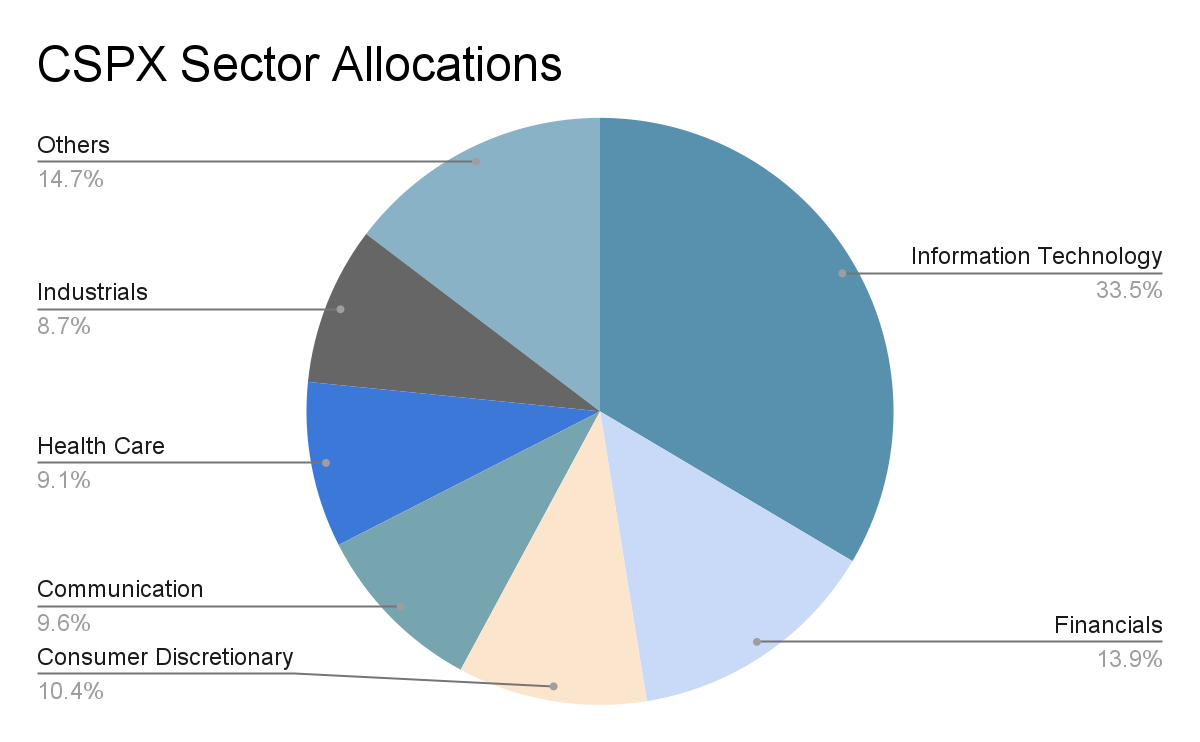

To mitigate this concentration, global ETFs such as CSPX (S&P 500) can be added. CSPX holds U.S. equities across tech, healthcare, consumer goods, and more—providing exposure to high-growth sectors not represented in Singapore.

Fig. 1.3 CSPX Sector Allocations

Fig. 1.3 CSPX Sector Allocations

Sample Diversified Portfolio Allocation

Here’s how investors might structure their portfolios to balance local strength with global opportunity:

| Region | Allocation | ETF Examples |

| Singapore Core | 50% | 40% ES3 (STI), 10% MBH (SGD Bonds) | US Diversification | 40% | CSPX (S&P 500 Index) | Thematic Growth | 10% | SOXX (Semiconductors) |

This structure allows investors to:

- Retain exposure to local blue-chip dividend payers (e.g. banks, REITs)

- Add global large-cap growth stocks (via CSPX)

- Capture thematic trends (via SOXX for AI chips)

Historically, the US market has outperformed in capital appreciation, while Singapore equities provide higher yields and lower volatility. Combining the two creates a more balanced total-return profile.

Other examples could include an ETF with exposure into emerging markets such as ASEAN or ETF with Asia Pacific (APAC) exposure.

Conclusion: Build Global Resilience from a Singapore Core

Diversification isn’t just about owning more ETFs—it’s about owning the right mix across markets, sectors, and asset classes. Whether you’re looking to stabilize income, access high-growth global themes, or reduce reliance on local sectors, diversification is the tool to future-proof your investment strategy.

A simple start for self-evaluation would be asking:

- Are you too concentrated in a single market or sector?

- Does your portfolio reflect global growth drivers like technology, healthcare, or emerging markets?

Building Your ETF Watchlist

Some ETFs mentioned in this article include:

- ES3 – Singapore’s STI Index

- MBH – Singapore Corporate Bond ETF

- CSPX – S&P 500 (Ireland-domiciled)

- SOXX – USSemiconductor ETF

As always, align your ETF picks with your time horizon, risk tolerance, and financial goals. Diversification works best when applied with clarity and consistency.

Stay tuned for our next feature, where we explore how to be more tax efficient as well as avoid common pitfalls in selecting ETFs.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Teo Huan Zi

Dealing Manager

Phillip Securities Pte Ltd

Mr Teo Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance.

He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?  ETF Market Review: Most ETFs up in November; gold expected to extend recent gains

ETF Market Review: Most ETFs up in November; gold expected to extend recent gains  Should You Invest Your Supplementary Retirement Scheme (SRS) Savings?

Should You Invest Your Supplementary Retirement Scheme (SRS) Savings?