How to Read a Fund Factsheet April 24, 2025

When investing in a unit trust, a fund factsheet is an important document that offers insight into its objectives, strategy, and performance.

Understanding how to read a fund factsheet is essential for evaluating investment opportunities effectively. In this article, we’ll cover the key information included in a factsheet, and why they’re important when evaluating a fund.

Introduction to Unit trusts

A unit trust is an instrument where professional fund managers pool investors’ monies together to invest in a diversified portfolio of assets. A typical unit trust consists of a variety of bonds, stocks, and other types of securities. These funds are managed by professional fund managers who research investment opportunities, monitor the fund’s performance, and make decisions based on the fund’s objectives and past performances. Some common fund objectives are long-term capital appreciation, regular income, or to track an index.

Features and benefits of Unit trusts

Here are the key benefits of investing in unit trusts:

| Benefits | Description |

| Diversification | Investing in a unit trust provides diversification, as funds typically hold a basket of different assets, including stocks, bonds, and other securities. This reduces investment risk by minimising the impact of adverse performance in any single investment. |

| Professional Management | Fund managers carry out comprehensive research and implement strategic investment decisions on behalf of investors. |

| Accessibility | Unit trusts are relatively accessible, with many requiring a low initial investment amount, making them suitable for a wide range of investors. |

| Liquidity | Most unit trusts offer daily pricing (excluding non-market days, weekends, and public holidays), allowing investors to buy and sell units easily through platforms that offer unit trusts, such as POEMS. |

What is a Factsheet?

The best way to understand a unit trust is by reading a fund factsheet, which outlines its features and benefits.

A fund factsheet is a detailed document that provides critical information about a unit trust. It helps investors understand the fund’s performance, goals, asset allocation, risk considerations, and other essential information.

How to Read a Fund Factsheet

Components of a Factsheet

Here is a list of the key components typically included in a unit trust factsheet:

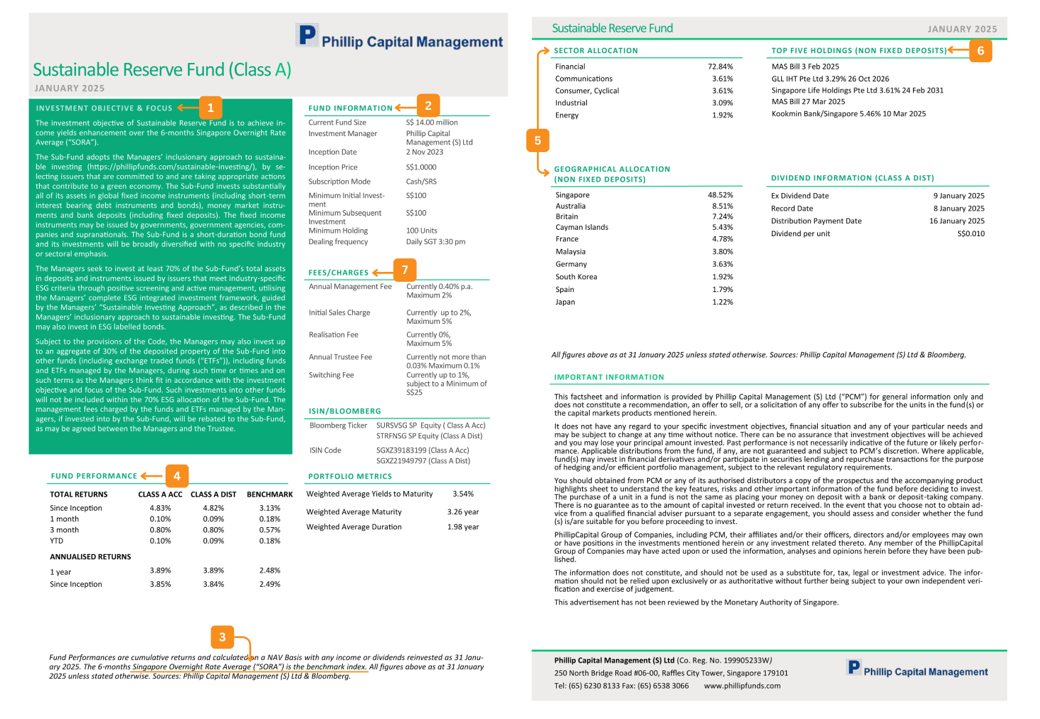

1. Investment Objective

This section outlines the fund’s primary aim, such as capital appreciation or regular income It may also describe the types of assets the fund invests in and their intended proportions.

2. Fund Details

This section contains data about the fund, such as fund size, currency denomination, ISIN code, and more.

3. Benchmark Index

Indicates the index against which the fund’s performance is measured.

4. Fund Performance

This is a crucial component for investors as it shows historical returns across various periods (e.g., 1 month, 3 months, 1 year, 3 years, 5 years). Performance may be presented in tables or graphs to help investors assess consistency and trends.

5. Asset Allocation & Country allocation

This section displays the percentage distribution of investments across different asset classes and geographic regions, enabling investors to understand the fund’s diversification and potential exposure to regional risks.

6. Portfolio Holdings

The factsheet may list the top 5 or 10 holdings within the portfolio. It offers investors insight into where the fund’s money is deployed and the major drivers of its success.

Fees and charges

Expense Ratio

This is the total percentage of a fund’s assets used to cover all expenses, including management and operational costs. It is usually built into the NAV, reducing overall returns. It usually ranges from 0.5% – 2.5% per annum.

Annual Management Fee

The management fee covers the cost of operating the fund and the fund managers’ expertise in managing it. It covers the strategic allocation of assets, ongoing analysis, and decision-making processes that contribute to the fund’s performance.

Sales charge (also known as Front-end load)

Sales charges are paid to the distributor (e.g. POEMS). This is a one-time fee charged when purchasing fund units. It is usually deducted upfront from the investment amount. It usually ranges from 0% – 5%. You can enjoy 0% sales charge when you trade unit trusts on POEMS.

Trustee fee / Custodian fee

This is the fee paid to the trustee or custodian for overseeing the fund’s operations and safekeeping its assets. It usually ranges from 0.02% – 0.10% per annum and is deducted from the fund’s assets.

Redemption Fee (Back-end load)

This is a fee charged when units are sold within a specified holding period, usually ranging from 0% to 3%. The longer the investment is held, the lower the fee. You can enjoy a 0% redemption fee when you trade unit trusts on POEMS.

Switching fee

This is a fee charged when switching from one fund to another within the same fund house. It is usually deducted from the switching amount and ranges from 0% – 2%. POEMS clients enjoy 0% switching fees.

Performance fee

A performance fee is paid to the investment manager for generating returns above the benchmark. It is usually deducted from the fund’s profits and ranges from 10% – 20% of profits above the benchmark.

Conclusion

Understanding how to read a fund factsheet is crucial to making well-informed investment decisions. A factsheet breaks down complex investment information into clear, actionable insights, covering a fund’s objectives, historical performance, asset allocation, and associated costs. By analysing these key elements, you can better evaluate whether a fund aligns with your financial goals, investment horizon, and risk appetite. In today’s dynamic market environment, having the right information at your fingertips gives you a significant advantage.

Instead of relying solely on past performance or brand recognition, you are empowered to make objective, confident choices that support long-term portfolio growth. Whether you are seeking stability, income, or capital appreciation, mastering the art of reading fund factsheets ensures you invest with clarity, purpose, and a higher degree of control over your financial future.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Darius Lee

Darius Lee graduated from the National University of Singapore with a Bachelor’s of Engineering degree. Life took him on a different path and he ended up spending 8 years in the Wealth Management space. He is as obsessed with the technical aspects of investing as well as the psychology that drives investors. In his free time he enjoys reading about topics from Economics to Science Fiction.

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions  Why Idle Cash Attracts Scammers & How to Beat Them

Why Idle Cash Attracts Scammers & How to Beat Them  Should You Invest Your Supplementary Retirement Scheme (SRS) Savings?

Should You Invest Your Supplementary Retirement Scheme (SRS) Savings?  What are Index Funds and How Do They Fit Into Your Portfolio?

What are Index Funds and How Do They Fit Into Your Portfolio?