Importance of Investing in financial literacy April 22, 2025

The average person spends approximately 45 years in the workforce, accumulating wealth over time. Regardless of what the profession, education level or even social economic status is, it is essential for everyone to attain financial literacy and the skills to manage money1. Without proper financial knowledge and discipline, it is easy to fall into spending traps driven by frequent publicised sales, unlimited consumer desires and ever-changing market trends. The rise of financial technology and payment systems like Buy Now, Pay Later (BNPL) from providers such as Atome, Grab, and FavPay has further simplified spending, making it more crucial than ever for individuals to balance consumption with savings and retirement planning.

Economic Challenges and the Need for Wealth Preservation

On 4 March 2025, Donald Trump threatened to impose additional tariffs, 25% on imports, from Canada and Mexico and an additional 10% on imports from China2. This move has the potential to trigger retaliatory tariffs, increase global inflation and worst case, start a trade war, all of which would further complicate financial planning.

In Singapore, the average inflation rate over the past 30 years (1993 to 2023) has been 1.73%3. The Monetary Authority of Singapore (MAS) has forecasted a potential economic slowdown in 2025 with MAS Core Inflation expected to remain below 2%4. Additionally, interest rates on bank deposits are expected to decrease with the 3-month Singapore Overnight Rate Average (3M SORA) projected to drop from 3.3% in 2024 to around 2.5% by the end of 20255. Given these factors, the need for investment strategies to outpace inflation and preserve wealth has never been more critical.

To navigate these financial uncertainties, individuals must adopt structured financial habits that prioritise disciplined saving and smart investment choices.

The 50/30/20 Rule for Financial Stability

A commonly recommended budgeting strategy by financial institutions and banks in Singapore is the 50/30/20 rule. The rule suggests spending 50% of income on needs such as bills, rent payment, utility expenses, 30% on wants such as shopping, entertainment, vacation expenses and 20% on savings such as emergency fund, investments and long-term goals6.

Wage Growth and Inflation Considerations

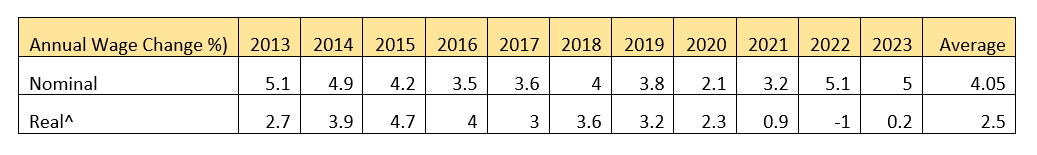

Source: Annual Wage Changes – Survey on Annual Wage Changes, Manpower Research & Statistics Department, MOM

Source: Annual Wage Changes – Survey on Annual Wage Changes, Manpower Research & Statistics Department, MOM

The table shown above is taken from the Ministry of Manpower Singapore; it highlights the annual wage change % from 2013 to 2023 in both nominal and Real. The Real rate takes in to account of the Consumer Price Index (CPI) a proxy for inflation of the respective years. It can be observed that between 2020 to 2023, the real annual wage change is below the 10-year average of 2.5% with 2022 experiencing a -1% real wage change despite a nominal wage increase of 5.1%7. This underscores the importance of investing to counteract inflation’s erosive impact on purchasing power.

The Power of Compounding in Wealth Accumulation

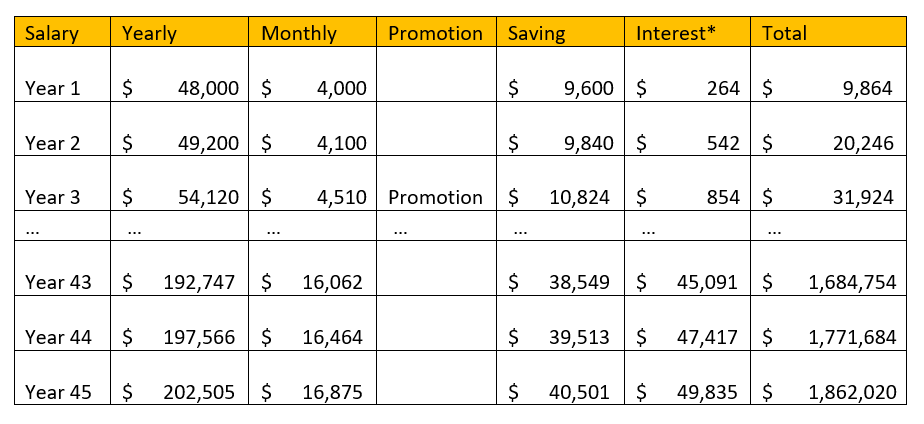

Consider an individual earning an average starting salary of S$4,000, with yearly wage increment of 2.5%, a promotion every three years resulting in a 10% salary increase every 3 years (for 15 years) and a career spanning 45 years. and assuming he saves 20% of his salary annually and earns a ~2.75% rate of return (equivalent to the 30-year Singapore government bond yield and commonly used as a benchmark risk free rate)8, this would be his accumulated savings:

| Total Deposit | Total Interest | Total Savings |

| $ 1,075,251 | $ 786,769 | $ 1,862,020 |

* Assuming that yearly savings are invested at the start of the year

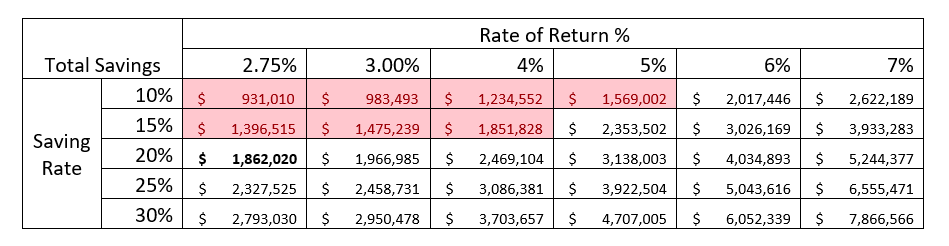

Impact of Savings Rate and Investment Returns on Wealth Accumulation

Financial outcomes vary based on saving rates and returns, which differ based on different individual needs, spending habits and financial instruments. Considering the above-mentioned scenario as the base case, how will varying saving rates and rate of return affect the total savings?

With reference to the table, even with lower saving rates of 10-15%, it can still result in savings higher than our base scenario when paired with a 5-7% rate of return. Notice how for every % rate of return increase, the end value increases exponentially? This emphasises the power of compounding over time and highlights the importance of asset allocation.

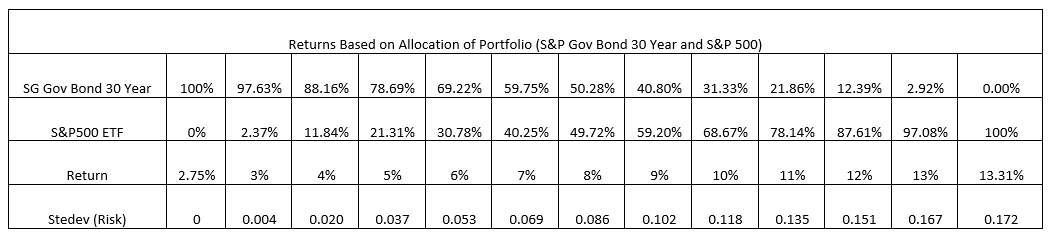

Risk vs. Return: A Balanced Investment Approach

In finance, there is a common saying of “No Risk, No Return” which applies to investing. A 2.75% rate of return assumes investments solely in 30 Year SG Government Bond, which are among the “safest” assets. However, higher returns can be achieved through incorporating other financial instruments such as stocks and Equity Traded Funds (ETFs) for a diversified portfolio.

For instance, the S&P500 delivered an average annual return of 13.31% between 2013 to 20239. ETFs such as VOO and SPX offer cost-effective exposure to the S&P 500 without requiring substantial capital or incurring high fees. Though past performance does not guarantee future results, the S&P 500’s track record and the ETF’s constant rebalancing make it a compelling investment option10. The above table demonstrates how an individual can optimise their returns while managing risk based on their portfolio allocation to a S&P500 ETF and 30 Year SG Government bond.

Aligning Investments with Risk Tolerance and Objectives

There is no one-size-fits-all approach to how much risk an investor should take for higher returns, as it depends on factors such as investment horizon (the estimated duration of the investment), investment objectives (capital appreciation, generating income, preserving wealth, etc.), and the ability to withstand market volatility.

Based on historical S&P500 performance, there were periods of economic downturn such as 2000 – 2009 when total return was -6%11. However, over a longer time horizon, 94 years, the S&P500 averaged an annual return of 9%. This illustrates that time in the market tends to be more rewarding than attempting to time market fluctuations. Market cycles of booms and recessions are inevitable, and investors should build strategies that account for these fluctuations rather than reacting emotionally to short-term volatility.

Lastly, the ability to endure market fluctuations is crucial. Even seasoned investors may struggle with emotional biases, such as selling assets prematurely in a downturn or taking excessive profits during early market upswings. Observations of investor behaviour have revealed a common pattern of premature profit taking in bull markets and panic selling during bear markets. A well-structured allocation strategy rewards patience and long-term discipline over reactionary decision-making.

In conclusion, with potential trade wars and economic uncertainties affecting inflation and interest rates, strategic financial planning is more important than ever. A well-structured approach including disciplined savings, balanced asset allocation, and a focus on long-term growth, can help individuals safeguard their wealth and achieve financial independence. By tailoring their investment strategies based on risk parameters, objectives and personal profile, investors can optimise their savings and confidently navigate the ever-changing financial landscape.

Appendix

- [1] https://www.forbes.com/sites/truetamplin/2023/09/21/financial-literacy–meaning-components-benefits–strategies/

- [2] https://www.bbc.com/news/articles/c89ye749nxvo

- [3] https://smartwealth.sg/average-inflation-rate-singapore/

- [4] https://www.mas.gov.sg/news/monetary-policy-statements/2025/mas-monetary-policy-statement-24jan25

- [5] https://dollarbackmortgage.com/blog/when-will-mortgage-rates-go-down-singapore/#:~:text=Following%20this%20policy%20shift%2C%20analysts,by%20the%20end%20of%202025

- [6] https://www.sc.com/sg/stories/financial-tips/why-savvy-singaporeans-are-using-the-50-30-20-rule-for-budgeting/

- [7] https://stats.mom.gov.sg/Pages/Income-Summary-Table.aspx

- [8] https://tradingeconomics.com/singapore/30-year-bond-yield

- [9] https://www.investing.com/indices/us-spx-500-historical-data

- [10] https://www.investopedia.com/terms/s/sp500.asp

- [11] https://www.forbes.com/councils/forbesfinancecouncil/2023/08/04/the-ups-and-downs-of-the-sp-500/

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Hei Tung Sam

Assistant Manager

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?