Is the 60/40 Portfolio Still Relevant Today? July 29, 2025

The 60/40 Portfolio rose to prominence in the 1960s as institutional investors sought a straightforward way to balance both growth and income. Over the years, this mix eventually became a standard due to its simplicity and effectiveness across various market conditions.

But what exactly is a 60/40 Portfolio?

It typically refers to a Portfolio with an asset allocation mix of 60 percent equities and 40 percent bonds.

Why this combination, you may wonder? Let’s look at how its investment strategy has actually performed over the years.

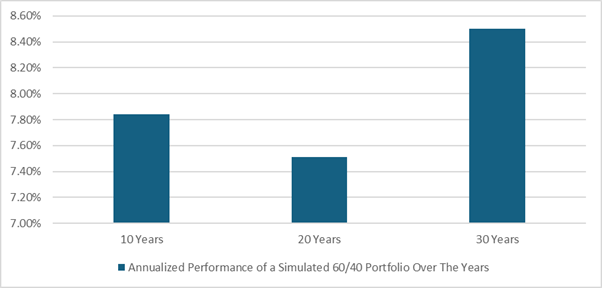

Annualised

Looking across different investment periods – 10, 20, and even 30 years, the 60/40 Portfolio has consistently delivered average annual returns of around 7 to 8 percent [1]. This demonstrates its historical effectiveness as a balanced investment strategy.. For this article, I have referenced data using proxies that closely reflect the S&P 500 and the Bloomberg US Aggregate Bond Index.

The idea behind a 60/40 Portfolio is that equities and bonds often move in opposite directions across market cycles. This diversification supports capital growth while providing a degree of capital preservation.

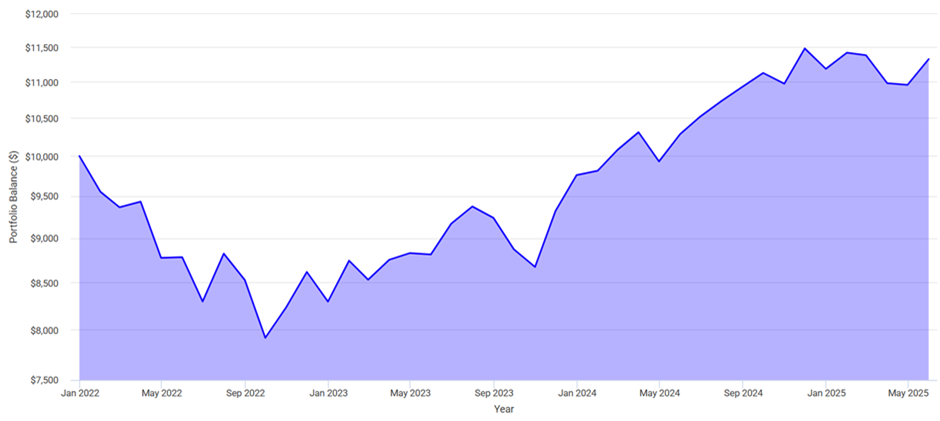

That was the case – until 2022, when a combination of surging inflation, sharp interest rate hikes, and ongoing geopolitical tensions caused both equities and bonds to decline simultaneously. As a result, the 60/40 Portfolio dropped by 23 percent from its peak in 2021 [2]. The magnitude of that pullback led many investors to panic and question whether the 60/40 model still made sense.

Has a similar situation occurred in the past?

One of the earliest and most notable periods where both equities and bonds struggled was from 1969 to 1970. During that time, US equities, as measured by the S&P 500, fell nearly 9 percent, while bond returns were also negative due to rising inflation and tightening monetary policy. Although the 60/40 approach was only beginning to gain traction then, a similarly balanced portfolio would have faced the same challenges.

Despite these setbacks, the 60/40 Portfolio eventually recovered and continued to grow over time. While fear can elicit strong emotional responses, market memory tends to be short-lived. Once markets recover, investors tend to forget just how volatile the journey was. In fact, just look at where we are today compared to 2022. As shown in the chart, after the sharp decline in 2022, the 60/40 Portfolio experienced a steady recovery. Despite periods of volatility along the way, the overall trajectory has remained positive, with Portfolio balances rising consistently through 2023 and 2024. This reinforces the importance of staying invested, as markets often rebound over time, rewarding long-term discipline and patience.

So, is the 60/40 Portfolio still reliable in today’s markets?

For most investors, the answer is yes.

History shows that while the 60/40 Portfolio may not always deliver the highest short-term returns, it has performed well over the long run. Although it may lack excitement, it remains effective , especially for those who stay invested through different market cycles. This balanced mix has provided steady returns while helping to reduce extreme volatility.

Furthermore, a 60/40 allocation gives investors an emotional anchor, which is often underestimated. In periods of volatility, investors with fully or heavily equity-based portfolios tend to feel greater stress which can lead to emotional decisions and poor timing. The inclusion of bonds in a 60/40 mix helps to smooth out the ride, build confidence, and encourage investors to stay the course instead of reacting out of fear.

Now, why did I specifically say most investors?

There will always be individuals who prefer to manage their portfolios more actively. They include professionals or highly experienced investors who may adopt different asset allocations or use more advanced strategies. With the right skill, discipline, and track record, they can navigate the markets effectively. For them, a more tailored approach might be appropriate. However, for the average investor who does not have the time, tools, or temperament to manage complex portfolios, the 60/40 model remains a reliable and time-tested framework. It brings structure, balance, and emotional resilience – Qualities that are even more valuable in today’s uncertain market environment. Most importantly, it helps investors to take the first step rather than staying on the sidelines.

So, if the 60/40 Portfolio still holds value for most investors, how can we turn that into something practical?

Remember, the beauty of the 60/40 Portfolio lies not just in its numbers, but in the structure it provides. That structure encourages better investing behaviour and long-term thinking. Here are some core principles I often share with my clients – principles that form the foundation of a strong investment plan.

Clearly define your investment objective

Ask yourself: for what are you investing? Are you building a fund to buy your first home? Planning for your child’s university education in 15 years? Or preparing for your own retirement two or three decades down the road? Clearly defining your goals gives direction to your entire investment plan.

Acknowledge your time horizon

Once your objective is clear, your time horizon naturally follows. The 60/40 Portfolio is best suited for long-term investing, where its benefits become apparent as markets recover and compounding takes effect. That said, even within the 60/40 structure, your investing strategy can be shaped based on your time horizon. For example, an individual investing for retirement in 25 years might have a different equity-to-bond mix than someone planning for a child’s education in five years. The structure remains consistent, but the strategy adapts to the timeline.

Build your Portfolio around discipline rather than prediction

No one can consistently forecast markets, but what we can control are our habits and emotions. Building a disciplined approach increases the probability of long-term success. This includes periodically rebalancing and reviewing your portfolio to ensure it still aligns with your financial objectives.

At the end of the day, investing is not about chasing perfection but building a plan you can stick to. The 60/40 Portfolio may not be flawless, but its strength lies in its simplicity, discipline, and long-term resilience. For most investors, which is all they need to begin the journey with confidence.

Contributor:

Keef Wong

Senior Financial Services Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

http://bit.ly/TTPKeefWong

References:

- [1] www.portfoliovisualizer.com For the purpose of this article, data was referenced using proxies that closely reflect the S&P 500 and the Bloomberg US Aggregate Bond Index.

- [2] www.portfoliovisualizer.comPeak December 2021 to September 2022

- [3] www.portfoliovisualizer.comSeptember 2022 to May 2025

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Keef Wong

Senior Financial Services Manager

Phillip Securities Pte Ltd

With almost two decades of experience in the Financial Services industry, Keef recognizes that the responsibilities of a practitioner extend beyond possessing professional knowledge and providing financial advice.

Keef firmly believes that a lifelong commitment to service is the core value that every practitioner must engrave within themselves because what matters most is the journey and process of growing together with the people who have entrusted their finances and future to him.

Throughout his practice, he has served over 200 families, integrating both personal and professional elements into his advisory approach. Additionally, he has conducted training sessions, seminars, and webinars, along with writing articles focused on financial education and literacy.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile