Japan’s Market in Motion: Key Events That Shaped Q1 2025 April 8, 2025

Introduction

In Q1 2025, Japan’s market navigated rising inflation, evolving monetary policies, and significant corporate developments. Core inflation surged to multi-month highs, prompting the Bank of Japan (BOJ) to raise interest rates while maintaining caution amid global uncertainties. Key corporate narratives, such as the halted merger discussions between major automakers and SoftBank’s US$6.5 billion acquisition in the semiconductor space, underscored the rapid shifts occurring within Japan’s industrial landscape.

Furthermore, Warren Buffett’s increased investments in Japanese trading houses fuelled strong rallies, reflecting enduring investor confidence. These developments, combined with a revised GDP growth outlook and a mix of stable and volatile sector performances, highlight both the challenges and opportunities ahead.

As Japan transitions into Q2, market participants must balance the potential impact of further monetary tightening with emerging growth prospects in high-performance sectors like semiconductors and technology, as well as the resilience of traditional industries.

Economic Overview

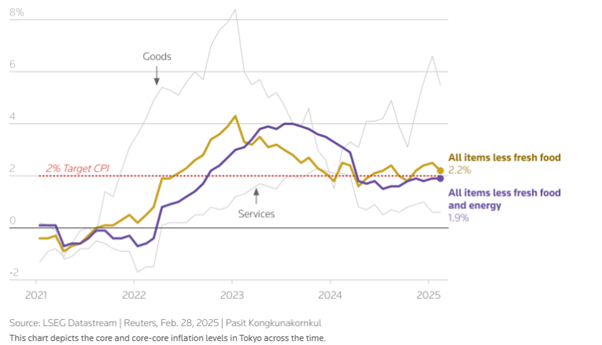

Core consumer prices in Japan’s capital rose 2.2% in February year-on-year, slowing for the first time in four months but remaining well above BOJ’s 2% target.

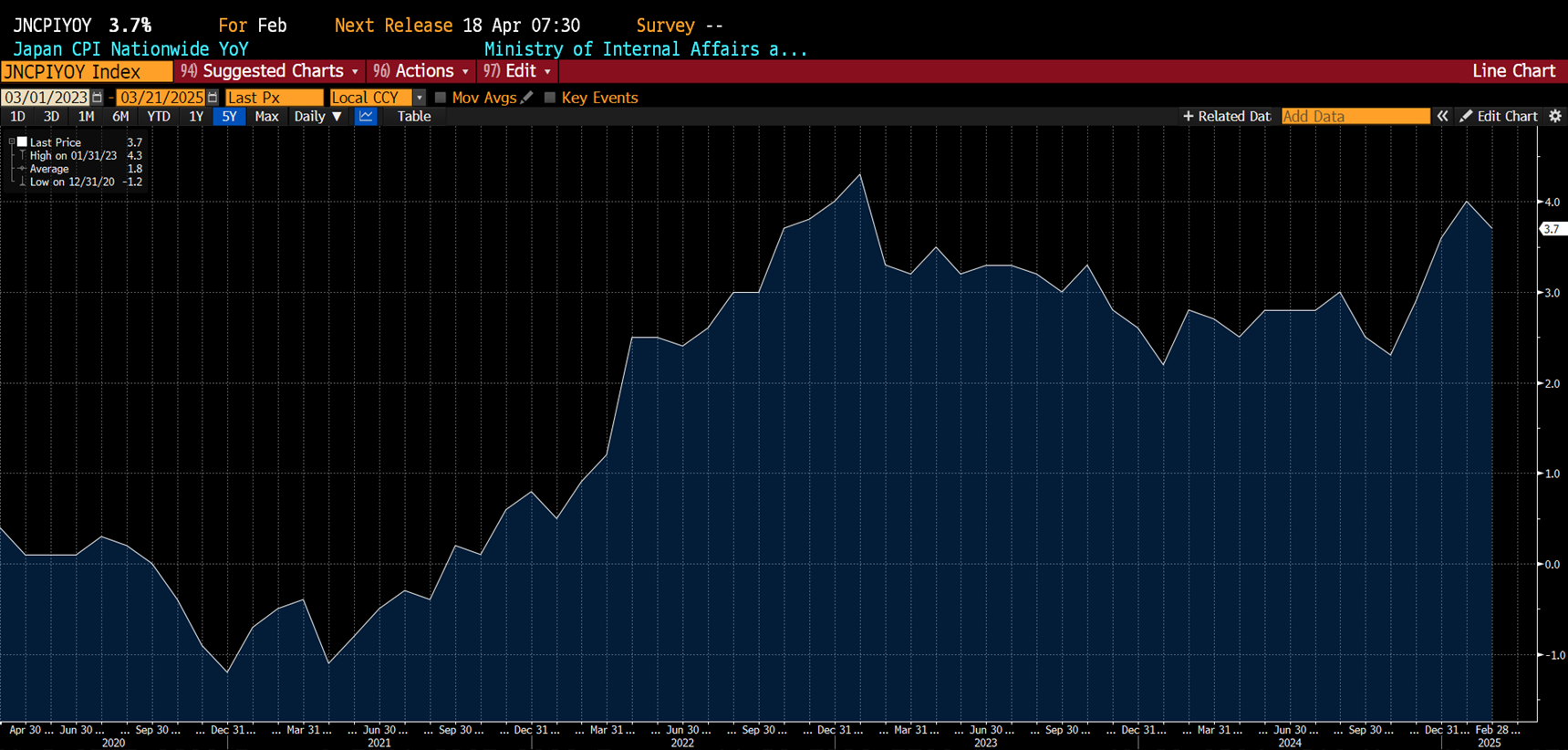

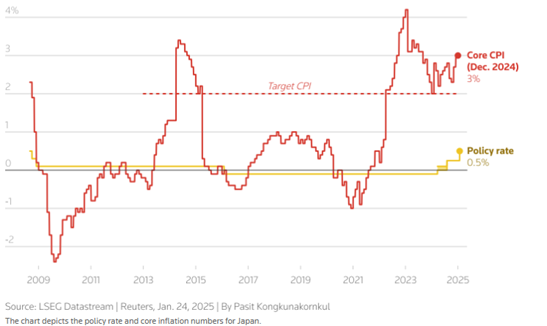

Inflation Trends: Japan’s inflation trajectory reveals a persistent challenge as core inflation surged to a 16-month high of 4% in January, marking the highest level in two years. In February, core inflation eased slightly to 3% but still outpaced market expectations, strengthening the argument for potential further interest rate hikes by the BOJ.

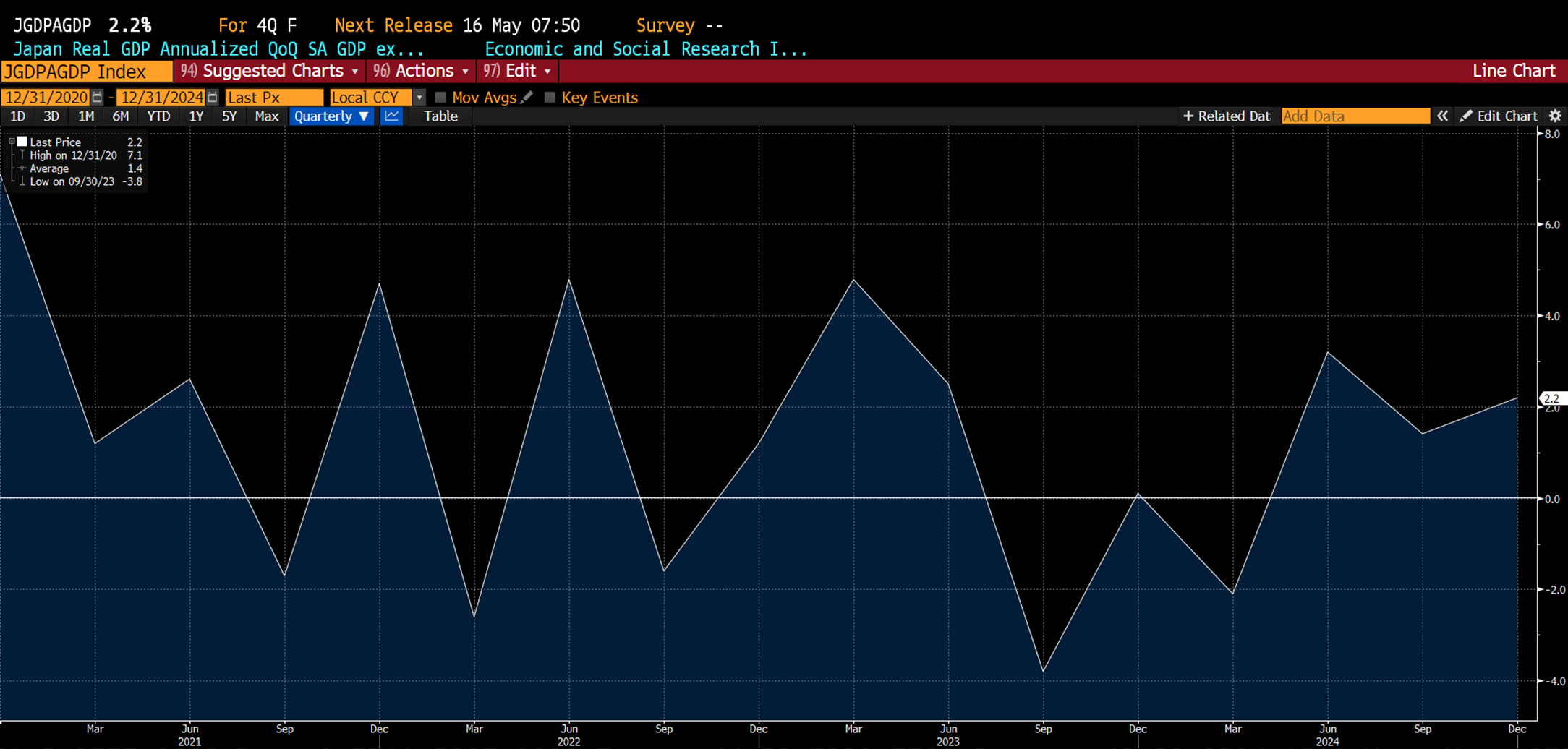

Japan also revised its Q4 2024 GDP to 2.2%, a slower pace than initially reported. On a quarter-on-quarter (QoQ) basis, GDP grew by 0.6% compared with the initial estimate of 0.7%.

Monetary Policy

Rate Hike: In January, the BOJ raised interest rates by 25 basis points to 0.5%, the highest level since 2008, signalling a shift from its long-standing ultra-loose monetary policy. The BOJ stated that the decision was an 8-1 split, with board member Toyoaki Nakamura dissenting on raising rates.

In our recent webinar with Nomura Asset Management , Mr. Atsushi Matsumoto, Senior Economist mentioned “We are looking at a GDP growth of 1% alongside 3% inflation, so this combination is what the BOJ has been aspiring to achieve for a long time and that is why the BOJ has decided to initiate its normalisation cycle and decided on 3 rate hikes. Moving forward, we are anticipating an additional rate hike and the timing may be around July 2025.”

As of 20 March 2025

Following the BOJ’s decision, the Japanese yen strengthened 0.6% to trade at155.12 against the US dollar.

Despite earlier rate hikes, the central bank opted to maintain its policy rate in March, citing uncertainty surrounding global economic conditions, including the potential impact of new US tariffs expected to be announced by President Trump on 2 April. According to Hiroki Shimazu, Chief Strategist at MCP Asset Management Japan, the BOJ may be referring to reciprocal or sector-specific tariffs that could affect Japan’s exports.

Investors who had hesitated to enter Japan’s market earlier are now watching from the sidelines as tech and industrial giants drive a market surge. With key indices outperforming global benchmarks, the window to capitalise on Japan’s economic revival may be closing fast.

Navigating the Uncertainty in Japan’s Market – Opportunities and Risks Ahead for Q2

The following analysis represents the author’s personal perspective on Japan’s market outlook for Q2, based on their interpretation of current economic trends and sector developments.

Macroeconomic Overview

A key question heading into Q2 is whether inflationary pressures will ease or remain persistent. Should inflation stay elevated, the BOJ may consider further rate hikes, which could tighten liquidity and raise borrowing costs for corporates and consumers. Conversely, if economic growth continues to weaken, the BOJ may pause its tightening cycle and maintain a more accommodative policy stance.

Stock Market Trends & Sector Outlook

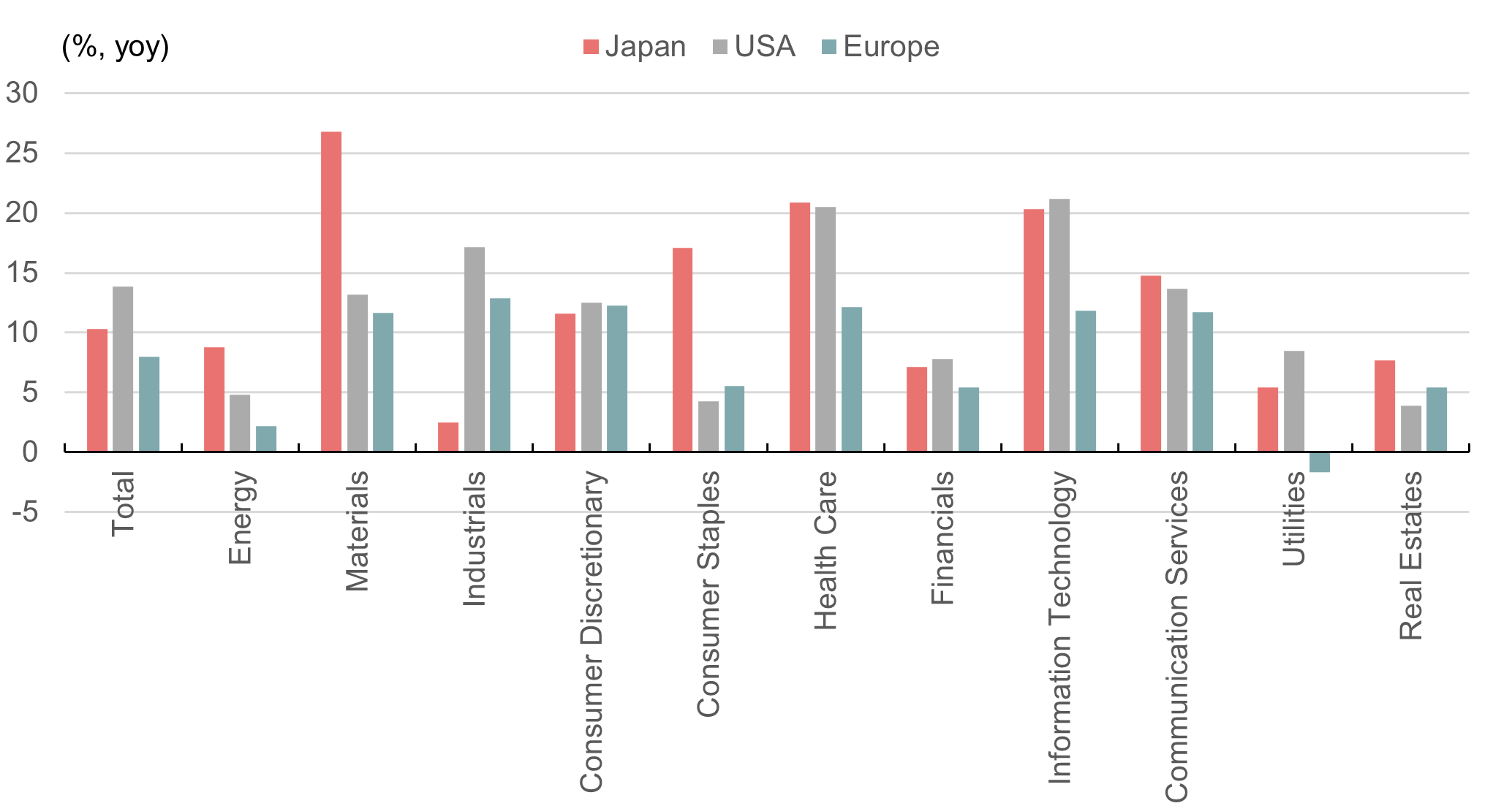

By Industry, Japan has the Highest Earnings Growth Rate in 6 of 11 Industries.

- Technology & Semiconductors: SoftBank’s (9984.JP) US$6.5 billion acquisition of chip designer Ampere in Q1 signals strong momentum in Japan’s semiconductor industry. However, the sector remains highly sensitive to global supply chain dynamics and US-China trade relations. If demand for AI and high-performance computing continues to surge, semiconductor stocks may benefit.

- Financials & Banking: With the BOJ’s policy shift, Japanese banks stand to benefit from a higher interest rate environment. Wider lending margins could improve profitability, but increased borrowing costs might weigh on corporate and consumer spending. Investors should watch for bank earnings reports in Q2 to gauge the impact of rate hikes.

- Automotive & Industrials: Nissan’s (7201.JP) decision to call off merger talks with Honda (7267.JP) underscores shifting strategies in Japan’s auto sector. The industry’s focus will likely remain on EV production and supply chain resilience. Further government policies supporting EV adoption could drive renewed interest in auto stocks.

- Trading Houses & Investment: Warren Buffett’s increased stake in Japan’s top five trading houses in Q1 fuelled strong rallies in Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. In Q2, continued foreign investment and corporate restructuring efforts could support the market. However, geopolitical uncertainties and fluctuations in commodity prices remain risks.

ETFs to Watch for Japan Exposure

With Japan’s market heating up, ETFs offer a convenient way to gain exposure before valuations rise further. Here are some ETFs to explore:

- Technology & Semiconductors: Next Funds Nikkei Semiconductor ETF (200A.JP)

- Japan Growth and Economy: iShares Core TOPIX ETF (1475.JP) and Next Funds Nikkei 225 ETF (1321.JP)

- Banking Sector: Next Funds TOPIX BANKS ETF (1615.JP)

Notable News on Listed Japanese Equities

Nissan and Honda considered $60 Billion Merger to Strengthen Global Position

Makoto Uchida (Left), CEO of Nissan, and Toshihiro Mibe, CEO and Representative Director of Honda Motor

Makoto Uchida (Left), CEO of Nissan, and Toshihiro Mibe, CEO and Representative Director of Honda Motor

In December 2024, Japanese automakers Nissan Motor (7201.JP) and Honda Motor (7267.JP) explored the possibility of a US$60 billion merger to enhance their competitiveness in the rapidly evolving automotive sector. Unfortunately, Nissan officially ended merger discussions with Honda indicating a change in its strategic direction and potentially impacting Japan’s automotive industry landscape. Had the deal materialised, the combined entity would have become the world’s fourth-largest automaker by vehicle sales, trailing only Toyota (7203.JP), Volkswagen (VOW), and Hyundai (005380.KS).

The proposed merger aimed to help both companies navigate the increasing challenges posed by fast-growing Chinese electric vehicle manufacturers. Analysts highlighted the importance of such alliances, as companies like BYD (002594.SZ) and other Chinese EV brands continue to capture market share with advanced, software-driven models.

Additionally, looming US tariffs on vehicles imported from Mexico, a key production hub, added further pressure for strategic partnerships in the Japanese automotive industry.

SoftBank’s 6.5 Billion Acquisition

SoftBank Group (9984.JP) deepened its commitment to the semiconductor space by acquiring Ampere Computing, a US chip start-up founded by a former Intel executive. This deal follows a string of strategic investments, including funding for OpenAI, the Stargate project for AI data centres, and a joint venture with OpenAI called Cristal, aimed at delivering AI services to Japanese corporations. Japan is rapidly cementing its status as a semiconductor powerhouse. As institutional capital flows into AI and chip stocks, retail investors waiting on the sidelines may miss out on further gains.

Buffett’s Investment in Japanese Trading Houses

Warren Buffett’s Berkshire Hathaway has increased its holdings in five leading Japanese trading firms—Itochu (8001.JP), Marubeni (8002.JP), Mitsubishi (8058.JP), Mitsui (8031.JP), and Sumitomo (8053.JP) —raising its stake by over 1 percentage point in each, bringing its ownership to between 8.5% and 9.8%. The announcement triggered a rally in stock prices, with all five companies seeing gains of at least 4%, while Itochu and Marubeni climbed 4.12% and 4.55%, respectively.

Buffett’s investment approach includes hedging currency risk by selling Japanese debt while benefiting from the difference between dividend payouts from these holdings and the bond coupon payments he needs to cover. By the end of 2024, Berkshire’s Japanese investments had a market value of US$23.5 billion against an aggregate acquisition cost of US$13.8 billion. Buffett has expressed confidence in the companies’ management teams, investor relations, and capital allocation strategies.

Global investors are quietly increasing exposure to Japan’s corporate giants. Warren Buffett’s latest move signals confidence in Japan’s resilience—will you seize the same opportunity before valuations move even higher?

Conclusion

Q2 2025 presents a nuanced outlook for Japan’s markets. While higher interest rates may weigh on equities, resilient sectors like semiconductors, financials, and trading houses offer selective opportunities. Investors should stay alert to BOJ policy shifts, macroeconomic indicators, and trade-related developments.

Japan appears to be entering a new growth phase. The risk now may not just lie in market exposure—but in missing out on the gains that lie ahead. With the right timing and sector focus, investors could benefit from the next chapter in Japan’s economic resurgence.

We also had a webinar with Nomura Asset Management’s Senior Economist Mr. Atsushi Matsumoto, check out the replay here to learn more!

We also had a webinar with Nomura Asset Management’s Senior Economist Mr. Atsushi Matsumoto check out the replay here to learn more!

Start trading on POEMS! Open a free account here!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Appendix

- [1] https://www.cnbc.com/2025/01/24/japan-core-inflation-climbs-to-a-16-month-high-boosting-case-for-rate-hikes.html

- [2] https://www.cnbc.com/2025/01/24/bank-of-japan-hikes-policy-rates-by-25-basis-points-to-highest-since-2008.html

- [3] https://www.cnbc.com/2025/03/19/bank-of-japan-holds-rates-steady-in-march.html

- [4] https://www.cnbc.com/2025/03/19/softbank-to-acquire-chip-designer-ampere-in-6point5-billion-deal.html

- [5] https://www.cnbc.com/2025/03/18/itochu-marubeni-mitsubishi-mitsui-sumitomo-shares-rally-buffett-berkshire-hikes-stake.html

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile