Leveraged and Inverse ETFs 101 September 12, 2022

Key Takeaways

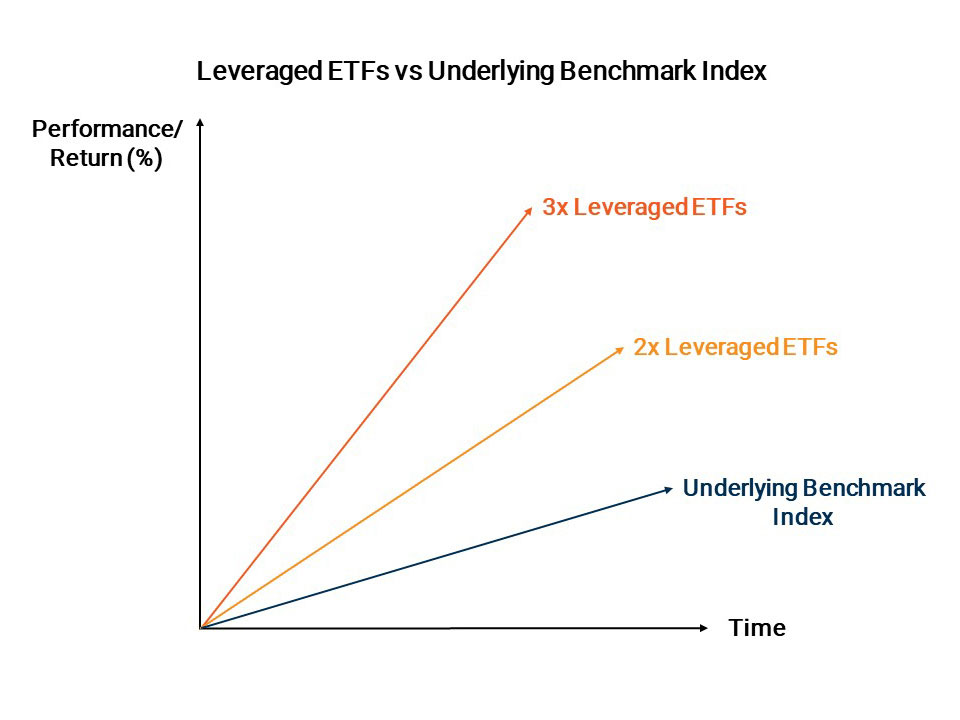

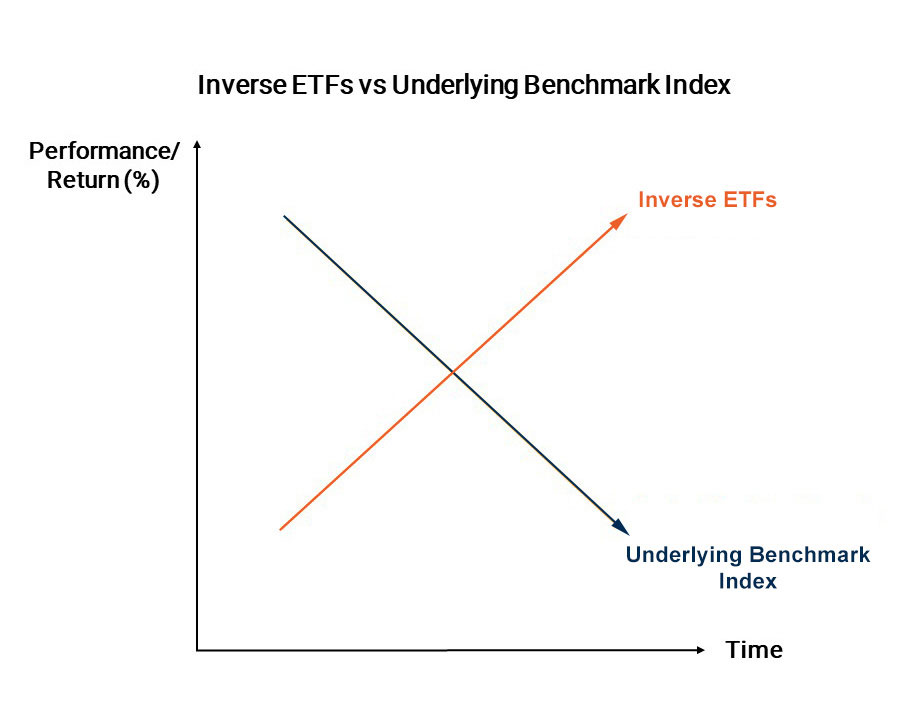

- Leveraged ETFs are ETFs that multiply returns of their underlying indices, whereas inverse ETFs provide returns in the opposite direction of their underlying indices.

- L&I ETFs are structured in such a way that they are meant for active trading rather than buy-and-hold purposes. Holding these ETFs for a longer-term period will expose investors to further risk, as their performance will deviate from their investment objectives.

- L&I ETFs are like double-edged swords. They can provide an additional option for investors to gain exposure to market themes and opportunities but incorrect usage may result in losses for investors.

What is an ETF?

Exchange-Traded Funds (ETFs) are open-ended investment funds listed and traded on stock exchanges. An ETF is a basket of securities that aims to track, replicate or correspond to the performance of an underlying index or assets.

A single ETF can give an investor exposure to multiple equities, an entire market sector, or even securities from one particular country. An ETF covers a broad range of stocks through just one instrument, providing investors with flexibility and diversification of portfolios. They trade on exchanges with full price transparency, just like stocks.

However, there are special classes of ETFs available in the market that allow investors to leverage or short their investment directly without the need to deposit a margin or borrow stocks respectively.

These unique types of ETFs are called Leveraged and Inverse ETFs (L&I ETFs). They do not have implied volatility or higher risk as compared to most other derivative financial products.

How are L&I ETFs different?

While ETFs are core traditional financial products, L&I ETFs operate similar to derivative financial products. Unlike traditional financial products, derivative financial products are complex and highly volatile. Derivatives are often used by traders to express their daily market view or as a hedging tool for their portfolios. Thus, they are used only for active trading.

| Traditional Financial Products | Derivatives Financial Products |

| Long-term and/or short-term | Take advantage of market trends tactically |

| Buy-and-hold and/or active trading | Daily monitoring is required |

| Suitable for passive and/or active investment | Liquidity is critical for daily trading |

| Generally less volatile | Adjust portfolio’s market exposure, risk and return profile |

Investors should always prioritise building up their core investment portfolio first with traditional financial products. Having taken care of that priority, investors can then construct their non-core investment portfolio by using derivatives financial products and L&I ETFs for their personal investment needs.

Should I invest in L&I ETFs?

L&I ETFs are designed for short-term trading needs and are not intended for buy-and-hold purposes. They are very volatile and are appropriate for sophisticated tactical traders who have market views that they want to express. It is of utmost importance that investors monitor and manage their trades daily if they intend to use L&I ETFs as part of their trading strategy.

| Suitable for investors who | Not suitable for investors who |

| Are risk takers and can accept losses on their investment | Are conservative and want their initial investment capital to be protected |

| Understand the unique nature and performance characteristics of the ETFs | Are unfamiliar with the unique nature and performance characteristics of the ETF |

| Active traders who are constantly monitoring the market so that they are able to give timely respond to changing market conditions | Passive investors who do not monitor their portfolio daily |

Now that we know what roles leveraged and inverse ETFs play in your portfolio, let’s take a deeper dive into what exactly these two products do.

What is a leveraged ETF?

Leveraged ETFs are ETFs that participate in a more than proportional manner in the performance of their indices. For example, a 1% increase in the performance of an index can result in an approximate 2% or 3% increase in returns for a 2x or 3x leveraged ETF respectively. On the other hand, a downturn in an index’s performance will result in an amplified decline in the returns of the leveraged ETFs.

They are suitable for investors who have a high conviction in a particular market sector and intend to earn a higher return through leveraged ETFs.

What is an inverse ETF?

Inverse ETFs track the movement of their indices’ performances in the opposite direction. They are designed to have a negative relationship with their benchmark indices. Hence, inverse ETFs are suitable for investors who have a bearish view of a market sector and intend to profit from such a scenario.

There are also Inverse-Leveraged ETFs available for investors who intend to earn a higher return in a bearish market.

How do leveraged and inverse ETFs work?

L&I ETFs use swaps agreements, futures and forward contracts to replicate on a daily basis two or three times the direct or inverse return of their benchmark indices. Before we go further into L&I ETFs, we must acknowledge that they are not designed for investors to buy-and-hold for the long term. They are meant for active trading purposes.

For example, over a one-day period, there may be an inverse relationship between the inverse ETF and the index, but over more extended periods, the relationship may not be applicable.

Investors should also not expect an exact percentage performance return on their L&I ETFs in relation to the performance of the respective indices. A 2x leveraged ETF will not give an exact 2% increase in return should the index performance increase by 1%.

The need to rebalance daily, coupled with the compounding effect will lead to deviation from investment objectives over time but the day-to-day performance of the ETFs should adhere to the investment objectives of the ETFs.

What are the compounding effects of L&I ETFs?

There are various reasons for the deviation from investment objectives. The daily fluctuation of the index will have a more significant influence on the performance of L&I ETFs than they will have on a normal index-tracking ETF. One of the main reasons for this is because of the compounding effect on the performance of the L&I ETFs.

For example, I invested $100 into a 2x leveraged ETF for 2 days. On the first day, the underlying index went up by 10%. So, my 2x leveraged ETF will increase by 20%.

20% X $100 (Investment Amount) = $20 (Gain)

The ETF will produce a 20% return and provide a gain of $20. The new asset value is $100 (Investment Amount) + $20 (Gain) = $120.

If on the second day, the index goes up by 10%, the 2x leveraged ETF will increase by 20% again.

20% X $120 (New Net Asset Value) = $24 (Gain)

So, my ETF will produce a 20% return and provide a gain of $24 on day 2. The compounding effect of the 2x leveraged ETF will return $44 ($20 + $24 = $44) instead of $21. (A normal index tracking ETF will have a value of $121 on Day 2 and a net gain of $21).

But if on the second day, the index goes down by 10%, the 2x leveraged ETF will decrease by 20%.

-20% X $120 (New Net Asset Value) = -$24 (Loss)

The ETF will see a loss of 20% and I will suffer a loss of $24 on day 2. Due to the compounding effect of the 2x leveraged ETF, I suffer a net loss of $4 ($20 – $24 = -$4) even though the market is flat after two days.

A normal index tracking ETF will have a value of $99 on Day 2 and a net loss of $1.

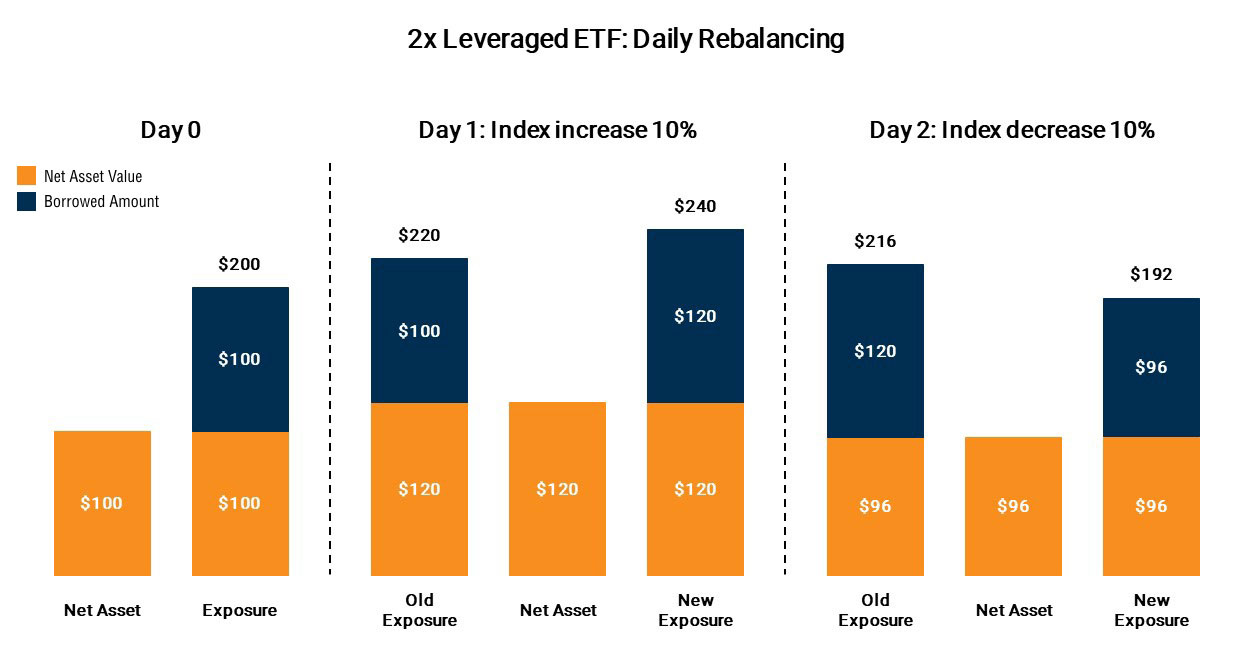

Daily Rebalancing

The L&I ETF will also undergo daily rebalancing to adjust its exposure to the benchmark index. Example:

Day 0:

An Investor bought $100 worth of 2x leveraged ETF. The fund manager will borrow another $100 (via swaps, forwards, futures etc.) to bring investor overall exposure to $200 in order to deliver the 200% return for the next trading day.

Day 1: Index increase by 10%

$200 X 10% = $20

$200 + $20 = $220 (New Exposure)

The exposure will increase to $220 when index increased by 10%.

$220 (New Exposure) – $100 (Borrowed Amount) = $120 (Investor’s Net Asset)

The Investor will be entitled to $120 of the $220 because $100 is borrowed. Hence, the investor will enjoy a 20% return even though the index only increases by 10%.

The investor can exit his trading position with $120, or he can continue to hold his existing position. If he holds his position, the fund manager will have to borrow another $20 to bring the overall exposure to $240 in order to deliver the 200% return for the next trading day.

Day 2: Index decrease by 10%

$240 X -10% = -$24

$240 – $24 = $216 (New Exposure)

The exposure will decrease to $216 when index decreased by 10%.

$216 (New Exposure) – $120 (Borrowed Amount) = $96 (Investor’s Net Asset)

The Investor will only be entitled to $96 of the $216 because $120 is borrowed.

The investor can exit his trading position with $96 or he can continue to hold his existing position. If he holds his position, the fund manager will have to reduce the exposure by $24 to bring the new exposure to $192 in order to deliver the 200% return to the investor for the next trading day.

How can I utilize inverse and leveraged ETFs?

1. Outright Trade

An investor with high conviction about a particular market sector or theme can buy into leveraged ETFs that track the respective market index. Leveraged ETFs can earn a higher return than their traditional index-tracking ETFs counterparts.

Investors who are bearish about a market sector can buy into inverse ETFs instead of borrowing securities to short sell. Thus, they will not be susceptible to force buy-in and the relevant costs that will be incurred during the short-selling process.

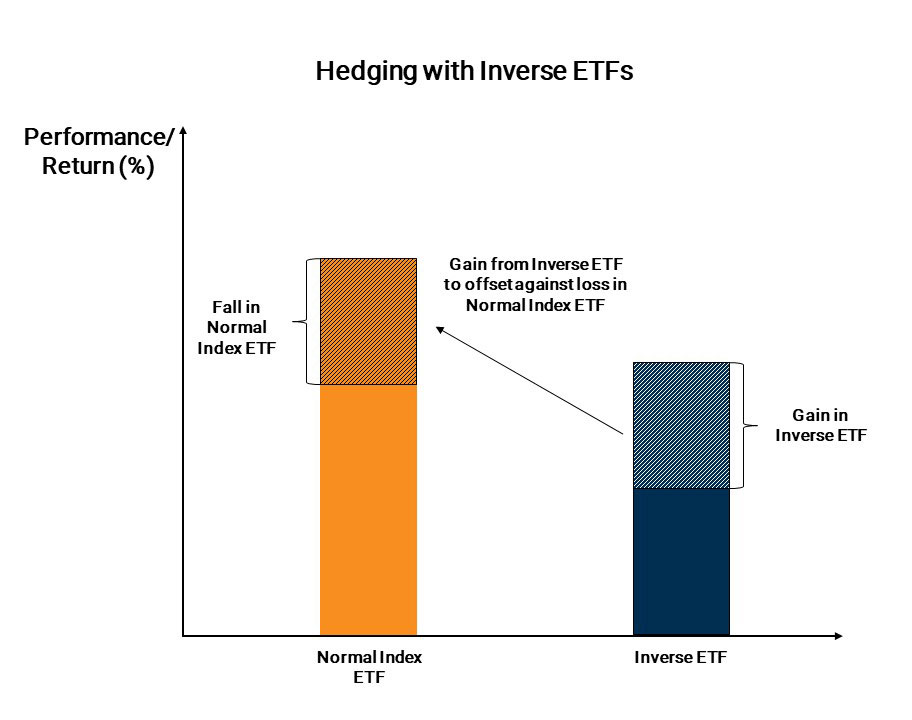

2. Hedging

Inverse ETFs can be used as hedging tools to protect against losses in an investor’s portfolio holdings. In the event of a market downturn, the gain from the Inverse ETF is used to offset against the loss in the main portfolio holding. Investors must take note that such a hedging method may not result in a 100% hedge because of tracking errors and other reasons.

It may also not be cost-efficient to sell the main portfolio holdings during periods of downturn, so the availability of inverse ETF allows investors to tide over these periods in the short term.

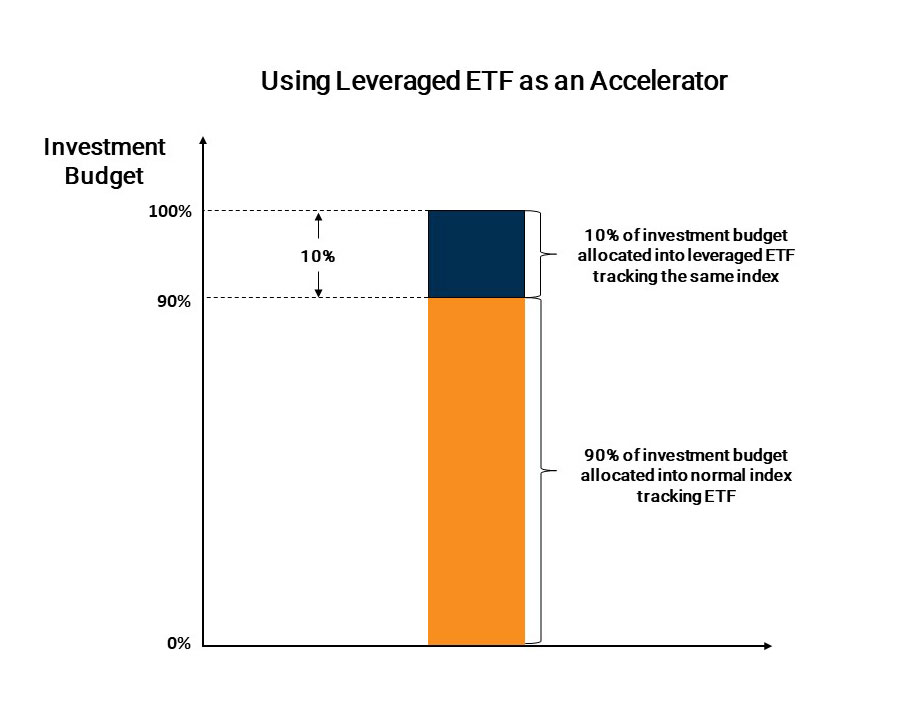

3. Accelerator

Investors who have a long position in a particular index and wish to accelerate the returns for their portfolio holdings can use leveraged ETFs. This is a more capital efficient method as compared to buying more of the same financial assets for the portfolio.

Which indices have L&I ETFs?

S&P 500

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| ProShares Ultra S&P 500 | AMEX | SSO | Leveraged | 2x |

| ProShares UltraPro S&P 500 (3x) ETF | AMEX | UPRO | Leveraged | 3x |

| Direxion Daily S&P 500 Bull 2x Shares | AMEX | SPUU | Leveraged | 2x |

| Direxion Large Cap Bull 3x Shares ETF | AMEX | SPXL | Leveraged | 3x |

| ProShares Short S&P 500 | AMEX | SH | Inverse | -1x |

| UltraShort (-2x) S &P 500 | AMEX | SDS | Inverse | -2x |

| UltraPro Short S&P500 | AMEX | SPXU | Inverse | -3x |

| Direxion Daily S&P 500 Bear 1x Shares | AMEX | SPDN | Inverse | -1x |

| Direxion Daily S&P 500 Bear 3x Shares | AMEX | SPXS | Inverse | -3x |

Dow Jones Industrial Average

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| ProShares Ultra Dow 30 | AMEX | DDM | Leveraged | 2x |

| ProShares UltraPro Dow 30 | AMEX | UDOW | Leveraged | 3x |

| ProShares Short Dow 30 | AMEX | DOG | Inverse | -1x |

| ProShares UltraShort Dow 30 | AMEX | DXD | Inverse | -2x |

| ProShares UltraPro Short Dow 30 | AMEX | SDOW | Inverse | -3x |

NASDAQ 100

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| ProShares Ultra QQQ | AMEX | QLD | Leveraged | 2x |

| China AMC Direxion NASDAQ 100 Daily 2x Leveraged ETF | HKEx | 7261 | Leveraged | 2x |

| ProShares UltraPro QQQ | NASDAQ | TQQQ | Leveraged | 3x |

| ProShares Short QQQ | AMEX | PSQ | Inverse | -1x |

| China AMC Direxion NASDAQ 100 Daily -1x Inverse ETF | HKEx | 7331 | Inverse | -1x |

| ProShares UltraShort QQQ | AMEX | QID | Inverse | -2x |

| China AMC Direxion NASDAQ 100 Daily -2x Inverse ETF | HKEx | 7522 | Inverse | -2x |

| ProShares UltraPro Short QQQ | NASDAQ | SQQQ | Inverse | -3x |

FTSE China A50

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| ProShares Ultra FTSE China 50 | AMEX | XPP | Leveraged | 2x |

| Direxion Daily FTSE China Bull 3x Shares | AMEX | YINN | Leveraged | 3x |

| ProShares Short FTSE China 50 | AMEX | YXI | Inverse | -1x |

| ProShares UltraShort FTSE China 50 | AMEX | FXP | Inverse | -2x |

| Direxion Daily FTSE China Bear 3x Shares | AMEX | YANG | Inverse | -3x |

CSI 300 Index

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| Direxion Daily CSI 300 China A Share Bull 2x Shares | AMEX | CHAU | Leveraged | 2x |

| Direxion Daily CSI 300 China A Share Bear 1x Shares | AMEX | CHAD | Inverse | -1x |

Hang Seng Index

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| CSOP HSI Daily 2x | HKEx | 7200 | Leveraged | 2x |

| Global X HSI Daily 2x | HKEx | 7231 | Leveraged | 2x |

| CSOP HSI Daily -1x | HKEx | 7300 | Inverse | -1x |

| CSOP HSI Daily -1x | HKEx | 7300 | Inverse | -1x |

| Global X HSI Daily – 1xChinaAMC Direxion HSI Daily -1x | HKEx | 7321 | Inverse | -1x |

| Global X HSI Daily – 1x | HKEx | 7336 | Inverse | -1x |

Nikkei 225

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| Daiwa ETF Japan Nikkei 225 Leveraged Index | TSE | 1365 | Leveraged | 2x |

| Listed Index Fund Nikkei Leveraged Index | TSE | 1358 | Leveraged | 2x |

| NEXT FUNDS Nikkei 225 Leveraged Index ETF | TSE | 1570 | Leveraged | 2x |

| Daiwa ETF Japan Nikkei 225 Inverse Index | TSE | 1456 | Inverse | -1x |

| Daiwa ETF Japan Nikkei 225 Double Inverse Index | TSE | 1366 | Inverse | -2x |

| NEXT FUNDS Nikkei 225 Inverse Index ETF | TSE | 1571 | Inverse | -1x |

| NEXT FUNDS Nikkei 225 Double Inverse Index ETF | TSE | 1357 | Inverse | -2x |

TOPIX

| ETF Name | Exchange | Ticker Code | Leveraged/Inverse | Leveraged Amount |

| Daiwa ETF Japan TOPIX Leveraged Index | TSE | 1367 | Leveraged | 2x |

| TOPIX Bull 2x ETF | TSE | 1568 | Leveraged | 2x |

| Daiwa ETF Japan TOPIX Inverse Index | TSE | 1457 | Inverse | -1x |

| Daiwa ETF Japan TOPIX Double Inverse Index | TSE | 1368 | Inverse | -2x |

| TOPIX Bear -1x ETF | TSE | 1569 | Inverse | -1x |

| TOPIX Bear -2x ETF | TSE | 1356 | Inverse | -2x |

Information accurate as at July 2022.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?