Malaysia in Focus: 3 Potential Drivers That Global Investors Are Watching July 28, 2025

In mid-2025, global markets are once again caught in the crosshairs of geopolitical risk. The US has announced sweeping new tariffs targeting key Asian sectors, particularly semiconductors and electronics, as part of its strategic pivot to protect domestic industries and counter China’s global tech dominance. While this move is aimed at China, ASEAN economies like Malaysia are feeling the ripple effects, given their embedded roles within critical global supply chains.

Malaysia now finds itself at a crossroads. After a post-COVID economic recovery and a year of relative stability, external shocks ranging from trade policy to commodity price fluctuations are testing its economic resilience. Yet beneath the noise lies an evolving structural story, rising foreign investment, a transition towards digital and green industries, and proactive policy support quietly reshaping the country’s economic foundation.

So, how should investors position themselves in Malaysia’s stock market? Let’s break it down into 3 key points.

1. Navigating Tariff Risks with Policy Support

The US tariff wave set to take effect in Aug 2025 has injected new uncertainty into Malaysia’s trade outlook. Although Malaysia isn’t the direct target, its exposure to global semiconductor and electronics supply chains, particularly in Penang and Johor, puts export reliant companies at risk. In response, Malaysia is actively pursuing negotiations with the US to secure preferential tariff outcomes.

There are already signs of a slowdown, Malaysia’s GDP growth moderated to 4.4% in Q1 2025 and 4.5% in Q2 2025, reflecting softer export demand. In a bid to cushion the economy, Bank Negara Malaysia (BNM) adopted a more dovish stance of reducing the Overnight Policy Rate (OPR) to 2.75% in July recently. The rate cut was made to support the Malaysian economy amidst global economic uncertainties and a weaker growth outlook. BNM also lowered the Statutory Reserve Requirement (SRR) by 100 basis points in May, injecting RM19 billion into the banking system to support liquidity.

2. Domestic Resilience & Rising FDI Inflows

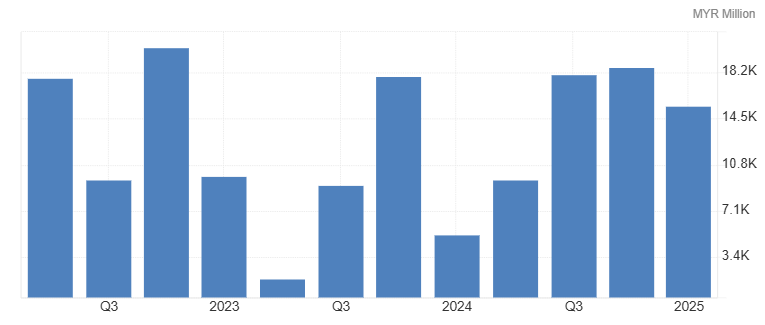

Malaysia’s underlying economic fundamentals remain resilient. Private consumption continues to hold up, supported by a relatively stable labour market and easing inflation. A key pillar of support lies in foreign direct investment (FDI). Despite a decrease in FDI to MYR 15.57 billion in Q12025 from MYR 18.68 billion in Q42024, the value of secured investment says otherwise.

Malaysia Foreign Direct Investment

Department of Statistics, Malaysia – Trading Economics

Department of Statistics, Malaysia – Trading Economics

In Q12025, Malaysia secured RM89.8 billion (US$ 21 billion) in new investments, up 3.7% year-on-year. The largest contributors were Singapore, the US, and China, with a strong focus on services, manufacturing, and green technologies.

This isn’t a one-off event; it reflects a broader shift in global supply chains. As companies adopt “China-plus-one” strategies to diversify production, Malaysia’s political stability, solid infrastructure, and bilingual workforce are making it an increasingly attractive destination.

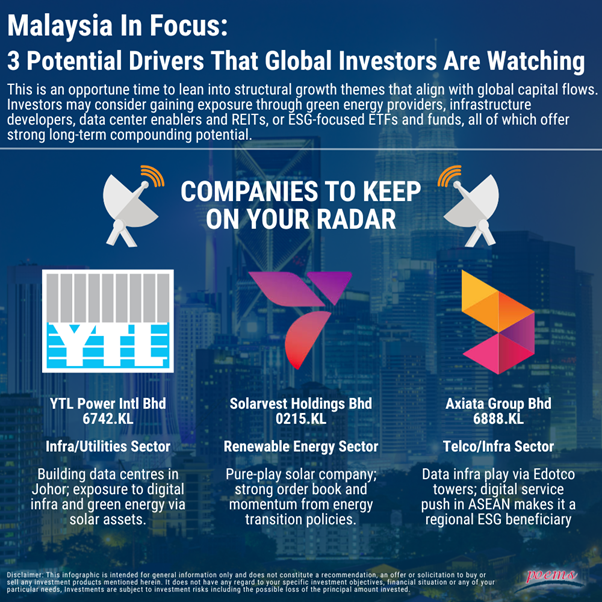

3. Structural Shifts: Green Economy & Digital Infrastructure

Beyond the cyclical narrative, Malaysia’s long-term growth story is evolving rapidly. The government’s industrial master plan and climate commitments are driving investments into renewable energy, digital infrastructure, and ESG compliance.

Notable initiatives include:

- The Malaysia Green Technology Master Plan, which aims for 40% renewable energy capacity by 2035

- The National Energy Transition Roadmap, with targeted investments in solar, hydrogen, and energy efficiency

- Development of “Semiconductor Valley” under the Malaysia Vision Valley 2.0 project, supported by state and private capital

Meanwhile, tech giants and data centre operators are flocking to Johor, turning it into a regional digital hub. Companies like YTL Power International, TM (Telekom Malaysia), and various listed REITs are poised to benefit from infrastructure demand and urban transformation.

Want to learn more about these counters? Login with your POEMS account to use our Stock Screener

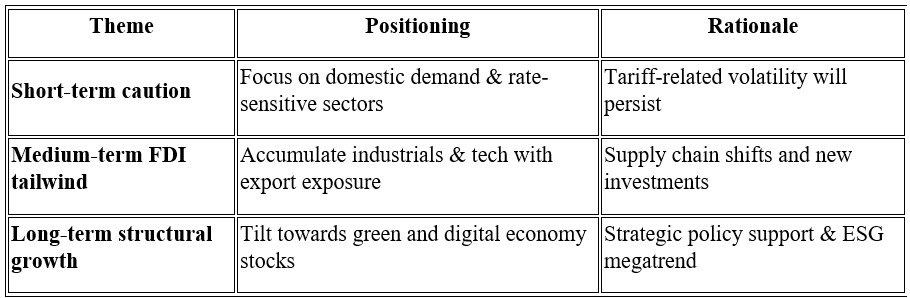

Final Thoughts: Tactical Patience, Strategic Positioning

Malaysia’s stock market is often seen as a “middle ground” in Asia; less volatile than emerging peers, but more measured than fast-growing tech-heavy markets like Korea or India. In today’s climate, this middle ground could be a sweet spot.

Here’s a simplified strategic playbook:

While global headlines may be dominated by trade wars and macro uncertainty, Malaysia stands out as a market quietly recalibrating for long-term relevance. With a stable policy backdrop, increasing FDI, and a clear pivot toward future-proof industries like green energy and digital infrastructure, the country offers more than just defensive shelter, it offers upside potential.

For investors seeking value with structural catalysts, Malaysia is no longer just a cyclical rebound story. It’s a transition story from export-reliant to innovation-led, from policy reactive to policy proactive.

Now is the time to accumulate selectively, before the market prices in the next growth chapter. POEMS offers Malaysia Market trading from as low as 0.08%.

Start trading on POEMS!Open a free account here!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Appendix:

- [1] https://theedgemalaysia.com/node/756299

- [2] https://www.reuters.com/markets/asia/malaysia-records-approved-investments-21-billion-q1-2025-06-11/

- [3] https://www.reuters.com/markets/commodities/malaysia-pm-says-10-bln-committed-national-grid-upgrade-2025-06-16/

- [4] https://en.vietnamplus.vn/malaysia-attracts-nearly-21-billion-usd-investment-in-q1-post320864.vnp

- [5] https://www.ainvest.com/news/malaysia-tech-driven-manufacturing-surge-21-billion-fdi-catalyst-growth-2506/

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile