Meta Platforms Q4 Performance Strong, Outlook Optimistic Despite Losses February 9, 2026

Company Overview

Meta Platforms Inc. operates as a leading social media and technology company, managing a family of applications including Facebook, Instagram, WhatsApp, and Threads. The company generates revenue primarily through digital advertising across its platforms while investing heavily in virtual and augmented reality technologies through its Reality Labs division.

Exceptional Q4 Results Exceed Expectations

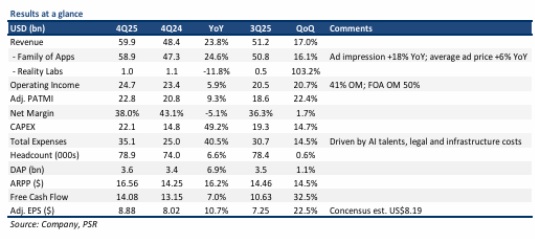

Meta delivered impressive fourth quarter 2025 results that surpassed analyst expectations, with revenue climbing 24% year-over-year to US$59.9 billion. Adjusted profit after tax and minority interest increased 9% annually to US$22.7 billion, driven by robust advertising revenue growth. Full-year 2025 revenue and profit metrics reached 100% and 110% of forecasts respectively, though earnings were impacted by Reality Labs losses totalling US$19 billion.

Strong Monetisation Across Video Platforms

Video content and Threads demonstrated compelling monetisation and engagement opportunities during the quarter. Instagram Reels watch time surged 30% year-over-year in the United States, while Facebook video watch time grew by double digits. These improvements reflect enhanced recommendation quality and product enhancements across feed and video surfaces.

AI-Driven Advertising Performance

Meta’s advertising segment delivered exceptional performance with ad revenue reaching US$58.1 billion, up 24% year-over-year. The growth was supported by higher user engagement and strong advertiser demand, enhanced by improved ad efficiency through AI integration. Continued model optimisation lifted organic feed and video views by 7%, generating the largest quarterly revenue impact from Facebook product launches in two years.

WhatsApp Business Growth

The Family of Apps “other” revenue segment grew 54% year-over-year to US$8.1 billion, supported by WhatsApp paid messaging and Meta verified subscriptions. Business messaging maintained strong momentum, with click-to-message ads in the US rising more than 50% year-over-year. Paid messaging reached an annual run-rate exceeding US$2 billion in Q4 2025.

Investment Recommendation and Outlook

Phillip Securities Research maintains an ACCUMULATE rating while raising the DCF target price to US$825 from the previous US$770. The firm upgraded FY26 revenue and profit forecasts by 7% and 8% respectively, reflecting expected continued benefits from integrating large language models with Meta’s recommendation systems to enhance ad efficiency and pricing.

Frequently Asked Questions

Q: What were Meta’s key financial results for Q4 2025?

A: Meta reported revenue of US$59.9 billion (up 24% YoY) and adjusted profit of US$22.7 billion (up 9% YoY), with full-year results meeting 100% of revenue forecasts and 110% of profit forecasts.

Q: How did video content perform across Meta’s platforms?

A: Instagram Reels watch time increased 30% year-over-year in the US, while Facebook video watch time grew double digits, supported by improved recommendation quality and product enhancements.

Q: What is Phillip Securities Research’s recommendation for Meta stock?

A: The firm maintains an ACCUMULATE rating and raised the target price to US$825 from US$770, with upgraded FY26 forecasts reflecting expected AI benefits.

Q: How did Reality Labs perform in Q4 2025?

A: Reality Labs remained unprofitable with operating losses widening 21% year-over-year to US$6 billion, though revenue declined 12% due to high comparison base from Quest 3S launch.

Q: What drove Meta’s advertising revenue growth?

A: Ad revenue of US$58.1 billion (up 24% YoY) was driven by higher user engagement, strong advertiser demand, and improved ad efficiency through AI integration and model optimisation.

Q: How is WhatsApp’s business messaging performing?

A: WhatsApp business messaging showed strong momentum with click-to-message ads in the US rising over 50% year-over-year, and paid messaging reaching an annual run-rate exceeding US$2 billion.

Q: What are Meta’s capital expenditure plans for FY26?

A: Meta has guided CAPEX to $115-135 billion for FY26 to support core advertising business and Meta Superintelligent Lab expansion, potentially implying 87% year-over-year growth at the high end.

Q: What is the outlook for Reality Labs losses?

A: Meta expects Reality Labs operating losses to have peaked, with FY26 losses broadly in line with FY25 levels (US$19.2 billion) before gradually narrowing thereafter.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Serena Lim Yi Qi

Serena is a Research Analyst covering the U.S. Technology sector at PSR. Prior to joining the firm, she worked as an Equity Dealer and held various roles across the insurance and banking industries. Serena holds a Bachelor's degree in Economics and a Postgraduate Diploma in Applied Finance from the University of Adelaide.