Microsoft Strengthens Position on Azure Growth Despite Supply Constraints February 9, 2026

Company Overview

Microsoft Corporation stands as one of the world’s leading technology companies, operating across multiple segments including cloud services, productivity software, and business applications. The company’s core strength lies in its comprehensive ecosystem of commercial cloud services, particularly Azure, alongside its widely adopted Microsoft 365 productivity suite. This diversified portfolio positions Microsoft as a critical infrastructure provider for businesses globally.

Strong Quarter Driven by Cloud Excellence

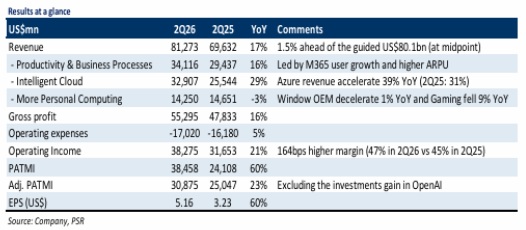

Microsoft Corporation delivered impressive second-quarter fiscal 2026 results that met analyst expectations, with revenue and adjusted profit after tax and minority interests reaching 50% and 51% of full-year forecasts respectively. The technology giant demonstrated robust momentum with 17% year-over-year revenue growth, primarily fueled by exceptional Azure cloud performance that surged 40% compared to the previous year. Adjusted profit after tax and minority interests climbed 23% year-over-year to $30.9 billion, benefiting from enhanced operating leverage across the business.

Forward-Looking Growth Trajectory

Looking ahead to the third quarter of fiscal 2026, Microsoft projects continued strong performance with revenue expected to increase 16% year-over-year to $81.2 billion. Azure remains the primary growth engine, with projected expansion of 37% as the company strategically prioritizes supply allocation amid demand that continues to exceed available capacity. The impressive commercial remaining performance obligations, which soared 110% year-over-year to $625 billion, provide substantial revenue visibility over the next 2.5 years.

Investment Merits and Valuation

The strength of Microsoft’s cloud services performance stands out as a key investment merit. Azure’s 40% acceleration drove Intelligent Cloud segment growth of 29% to $32.9 billion, supported by efficiency improvements across Microsoft’s server infrastructure. The productivity suite maintains robust demand, with the Productivity and Business Processes segment rising 16% to $34.1 billion, representing 42% of group revenue.

Research Recommendation

Phillip Securities Research has upgraded Microsoft to BUY from ACCUMULATE, maintaining a DCF target price of $540. The upgrade reflects recent price performance, with the company currently trading at a blended forward price-earnings ratio of 23.9x, below the negative one standard deviation level of 27.2x, suggesting attractive valuation despite strong fundamentals.

Frequently Asked Questions

Q: What drove Microsoft’s strong second-quarter performance?

A: Microsoft’s 17% year-over-year revenue growth was primarily driven by exceptional Azure cloud performance, which surged 40% compared to the previous year. This strong cloud performance helped adjusted profit after tax and minority interests climb 23% year-over-year to $30.9 billion.

Q: What is Microsoft’s revenue outlook for the next quarter?

A: For the third quarter of fiscal 2026, Microsoft expects revenue to rise 16% year-over-year to $81.2 billion, driven by continued strong growth across commercial businesses, with Azure projected to grow 37%.

Q: How significant are Microsoft’s commercial remaining performance obligations?

A: Commercial remaining performance obligations rose dramatically by 110% year-over-year to $625 billion and are expected to be recognized over the next 2.5 years. This includes major commitments from OpenAI ($250 billion multi-year Azure commitment) and Anthropic ($30 billion).

Q: What is the current research recommendation for Microsoft?

A: Phillip Securities Research upgraded Microsoft to BUY from ACCUMULATE with an unchanged DCF target price of $540, citing recent price performance and attractive valuation.

Q: How is Microsoft’s productivity software performing?

A: The Productivity and Business Processes segment rose 16% to $34.1 billion, representing 42% of group revenue. M365 Commercial Cloud revenue increased 17% year-over-year, supported by higher adoption and revenue per user growth from M365 Copilot and E5.

Q: What challenges is Microsoft facing with Azure?

A: Microsoft continues to face supply constraints in Azure, with management noting that demand still exceeds available capacity. The company is prioritizing supply allocation to manage this challenge while maintaining strong growth momentum.

Q: How does Microsoft’s current valuation compare to historical levels?

A: Microsoft is currently valued at a blended forward price-earnings ratio of 23.9x, which is below the negative one standard deviation level of 27.2x, suggesting the stock is attractively valued relative to historical standards.

Q: What contributed to Azure’s strong performance?

A: Azure’s 40% year-over-year growth was supported by efficiency improvements across Microsoft’s flexible server fleet, which allowed additional computing capacity to be allocated to Azure services, helping meet strong demand across various workloads.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.