Mooncakes: The Hidden Environmental Cost of Gifting October 21, 2025

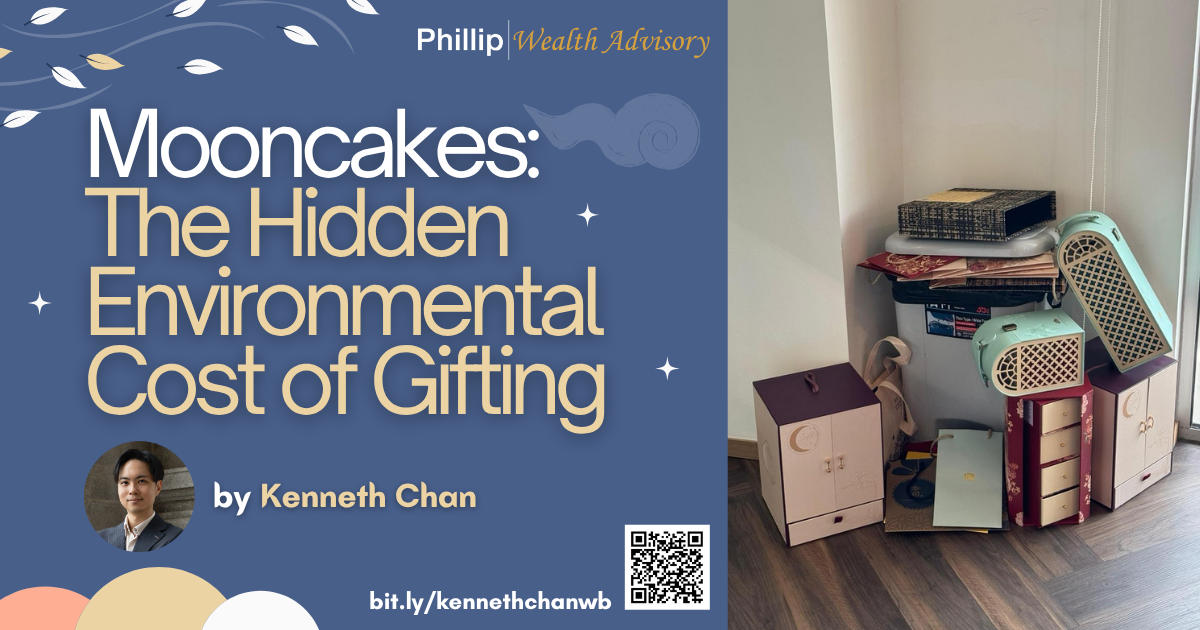

Every year during the Mid-Autumn Festival, many homes across Asia are filled with colourful mooncake boxes. Some are lavishly designed, embossed with gold foil, and often heavier than the pastries they protect. Crafted to impress and symbolise prosperity, they serve as tokens of appreciation in both corporate and personal exchanges. Yet after the celebration ends, many of these boxes end up discarded, barely used and seldom recycled. This seemingly harmless tradition reflects a broader tension between aesthetic excess and sustainable responsibility. For investors, the discarded mooncake box offers profound Environmental, Social, and Governance (ESG) lessons that extend far beyond the packaging industry.

The first lesson lies in the environmental cost of aesthetic indulgence. A typical premium mooncake box is made from layered materials, including coated paper, plastic inserts, metallic embellishments, and magnetic clasps, making it nearly impossible to recycle efficiently. According to Bloomberg, the popularity of mooncakes and their elaborate packaging is driving China’s rising demand for plastics, with polyethylene output nearly doubling since 2018 and packaging equipment production increasing by 32.2% this year. [1] Similar patterns are observed in Singapore, where elaborate packaging has become a competitive differentiator among brands.

From an ESG investment standpoint, this issue is best viewed through the lens of resource efficiency and the circular economy. Excessive packaging contributes to higher waste generation and increased Scope 3 emissions, highlighting the importance of responsible consumption and production as outlined in UN Sustainable Development Goal 12. For investors, this underscores the need to assess companies based on measurable sustainability outcomes—such as energy efficiency ratios, waste reduction targets, carbon disclosure scores, and supply chain transparency—rather than appearances alone.

The second ESG dimension is the social factor. It emerges when we consider why companies continue producing such elaborate packaging. The answer lies in consumer psychology and societal norms. Many consumers perceive luxury packaging as a proxy for quality or sincerity. In the corporate gifting culture of Asia, presentation often outweighs practicality. This social expectation drives firms to overproduce, even when executives acknowledge the waste involved.

For investors, this highlights how social sentiment shapes corporate ESG behaviour. Companies respond to consumer values, and when those values shift, capital flows follow. In particular, evolving preferences toward sustainable alternatives highlight potential transition risks for companies that are gradually adapting their packaging and product offerings. Businesses that align with this growing demand for sustainability are better positioned to maintain market share and support long-term profitability. For example, in recent years, sustainable packaging companies such as DS Smith (UK) and Huhtamäki (Finland) have outperformed traditional peers, benefiting from global consumer preference for biodegradable materials. [2] The discarded mooncake boxes, therefore, are not just environmental waste but also a social signal. It is evidence of a misalignment between consumer behaviour and sustainability awareness. As younger generations grow increasingly sustainability-conscious, demand for minimalist, eco-friendly products will expand. Firms that fail to adapt may face reputational and financial risks.

The governance aspect of ESG relates to how companies balance short-term marketing appeal with long-term sustainability goals. Approving costly, non-recyclable packaging might signal weak sustainability oversight or poor board alignment with ESG principles. When companies prioritise optics over impact, it suggests governance complacency. For investors, governance quality is therefore a key indicator of whether ESG initiatives are genuine or merely performative.

As global regulators, from the EU’s Corporate Sustainability Reporting Directive (CSRD) to Singapore’s mandatory climate disclosures, tighten standards, weak governance will translate directly into financial penalties and reputational damage. The mooncake box thus symbolises ESG immaturity: decisions made without integrating environmental and social responsibility into corporate frameworks.

The broader takeaway for investors is discernment. This involves distinguishing intrinsic value from cosmetic appeal. Just as consumers are drawn to the shimmering box rather than the mooncake’s quality, investors can be seduced by ESG branding that lacks operational depth. According to MSCI’s 2024 ESG Trends report, over 60% of global funds labelled sustainable had no measurable decarbonization strategy. [3] Sustainable investing must be data-driven, focusing on tangible performance indicators such as emissions intensity, renewable energy use, and board diversity.

Ultimately, the discarded mooncake box is symbolic of humanity’s sustainability paradox, illustrating our instinct to value appearance over essence. Yet, in a hopeful turn of events, several confectionery and packaging firms are now adopting biodegradable materials, reusable tins, or digital gifting models that reduce waste entirely. Brands like Maxim’s and Mei-Xin have begun introducing recyclable paper packaging, while newer entrants market minimalist boxes that position environmental care as part of their brand identity. These shifts demonstrate how sustainability, when aligned with brand equity, can yield both financial and reputational dividends.

Investors should recognise that ESG investing is not philanthropy. It is, in fact, risk-adjusted capitalism. Companies that anticipate and mitigate environmental and social risks consistently outperform those that react too late. The mooncake box, then, becomes both a cautionary symbol and a call to action: to demand substance over spectacle, long-term stewardship over short-term appeal, and responsibility over reputation.

As the glitter fades and the boxes pile up, the true investors are those who see lessons in the waste by understanding that sustainability begins not in grand gestures but in small, deliberate choices. Keen to explore how sustainable investing can make a lasting impact?

Learn more at phillipfunds.com/sustainable-investing.

Contributor:

Kenneth Chan

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/kennethchanwb

Appendix:

- [1] https://www.bloomberg.com/opinion/articles/2025-10-08/luxury-mooncakes-won-t-go-away-nor-will-plastic-waste

- [2] https://time.com/collection/worlds-most-sustainable-companies-2024/

- [3] Sustainability and Climate Trends to Watch

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Kenneth Chan

Wealth Manager

Phillip Securities Pte Ltd

Kenneth is a highly data-driven wealth manager renowned for his exceptional ability to identify opportunities and deliver strategic insights. By employing a meticulous and analytical approach, he consistently provides guidance that drives measurable success for his clients.

Dedicated to staying ahead of industry trends and advancements, Kenneth continuously updates his knowledge and refines his skill set to remain at the forefront of financial advisory. His expertise in leveraging data enables him to uncover hidden opportunities, optimise decision-making processes, and craft strategies that are both informed and impactful.

Kenneth’s passion for continuous learning and adaptability ensures he remains responsive to evolving market conditions, empowering his clients with solutions that are both innovative and effective.

Protecting More Than Just Walls: Fire Insurance vs Home Insurance

Protecting More Than Just Walls: Fire Insurance vs Home Insurance  Before the Year Ends: Key Financial Steps for a Confident 2026

Before the Year Ends: Key Financial Steps for a Confident 2026  The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions  Why Idle Cash Attracts Scammers & How to Beat Them

Why Idle Cash Attracts Scammers & How to Beat Them