Navigating Leveraged ETFs: Strategies, Risks, and Opportunities November 22, 2024

Table of contents

- History of Leveraged ETFs

- Overview of MAS SIP Requirements

- How Do Leveraged ETFs Work?

- Trading Strategy using Leveraged ETFs

- Advantages and Disadvantages of Leveraged ETFs

- Top Assets & Average Daily Volume of Leveraged ETFs

- POEMS Guide

Inverse ETFs carry many risks and may not be suitable for risk-averse investors.

History of Leveraged ETFs

Leveraged Exchange-Traded Funds (ETFs) have gained significant popularity over the years, with trading volumes experiencing rapid growth. Introduced by ProShares in 2006, these ETFs allow traders and investors to capitalise on short-term market movements and implement inverse strategies1 to amplify potential returns.

Overview of MAS SIP Requirements

Since 2012, the Monetary Authority of Singapore (MAS) has mandated that brokers evaluate investors’ relevant knowledge and experience before allowing them to invest in Specified Investment Products (SIPs)2, to protect retail investors. As such, investors must complete the Customer Account Review (CAR) eligibility form before being allowed to invest in listed SIPs.

How Do Leveraged ETFs Work?

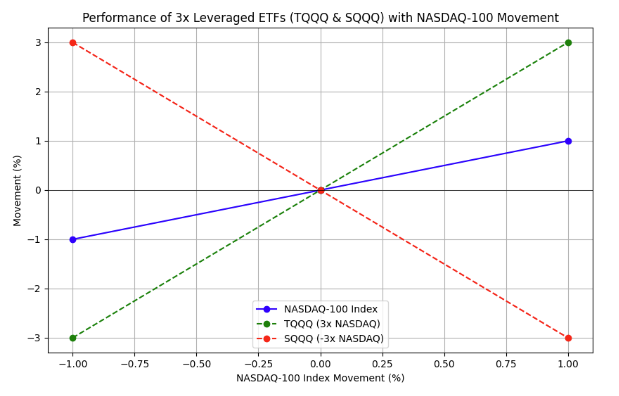

Leveraged ETFs are designed to amplify both returns and risks, typically by two to three times the performance of their underlying index. For example, TQQQ is a 3x leveraged ETF that moves approximately 3% for every 1% movement in the NASDAQ-100 index. Similarly, SQQQ is an inverse leveraged ETF that moves in the opposite direction of the NASDAQ-100 by three times, providing an opportunity to potentially profit from declines in the index.

Chart 1.1: TQQQ/SQQQ vs NASDAQ-100

Chart 1.1: TQQQ/SQQQ vs NASDAQ-100

Trading Strategy Using Leveraged ETFs

The table below outlines the key aspects of Leveraged ETFs, providing a concise overview of their main features and potential applications:

| Feature | Description |

| Short-Term Use | Ideal for day-to-day or short-term trading due to daily rebalancing, not suited for long-term holding. |

| Value Decay | Daily rebalancing can lead to ‘value decay’ over time, especially in volatile or sideways markets. |

| Potential to Amplify Returns | Allows investors to potentially magnify returns on a short-term outlook with less capital. |

| Hedging Tool | Can be used to protect portfolios against market downturns, with a temporary hedge. |

| Risk Management | Use for hedging specific positions or managing market risk in volatile conditions. |

Table 1.1: Leveraged ETFs Features

Advantages & Disadvantages of Leveraged ETFs

The following table summarises the advantages and disadvantages of leveraged shares:

| Aspect | Advantages | Disadvantages |

| Amplification | Potential for significant short-term gain with smaller capital outlay | Potential for significant losses as losses can accumulate quickly in volatile markets |

| Convenience & Accessibility | Traded like regular ETFs, making them more accessible than futures or options | – |

| Decay from Daily Rebalancing | – | Daily rebalancing can lead to “compounding risk”, eroding value over time |

| Market Cycles | Performs optimally in trending markets | Sideways markets can erode value due to the resetting mechanism, reducing returns |

Table 1.2: Leveraged ETFs Advantages & Disadvantages

Investors should be aware that leveraged and inverse ETFs are specifically designed to track daily market movements and are generally not intended for holding periods longer than a few days or weeks. Due to daily rebalancing, these ETFs can experience value decay over time, which can erode returns if held for extended periods.

Top Assets & Average Daily Volume of Leveraged ETFs

As of 9 November 2024, data from ETFdb.com highlights the ETFs with the largest assets and highest average trading volumes available for trading on POEMS3. Leading ETF issuers like ProShares, Direxion, and GraniteShares are among the top providers of leveraged ETFs.

| Symbol | ETF Name | Leverage | Total Assets (US$ Mil) | YTD Return | Avg Daily Volume |

| TQQQ | ProShares UltraPro QQQ | 3x | 25,139.5 | 64.95% | 49,997,796 |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares | 3x | 11,299.9 | 13.37% | 89,975,304 |

| QLD | ProShares Ultra QQQ | 2x | 7,702.31 | 45.84% | 3,071,379 |

| SSO | ProShares Ultra S&P 500 | 3x | 5,554.67 | 50.19% | 2,234,171 |

| SPXL | Direxion Daily S&P 500 Bull 3X Shares | 3x | 5,512.15 | 76.40% | 3,505,306 |

| NVDL | GraniteShares 2x Long NVDA Daily ETF | 2x | 5,493.24 | 457.08% | 21,505,498 |

Table 1.3: Top AUC & Volume Leveraged ETFs

POEMS Guide

Leveraged and inverse ETFs can provide opportunities to amplify returns or hedge against market declines, but they require careful evaluation due to their inherent risks. Be sure to explore our previous ETF market journal, where we delve into strategies for leveraged ETFs. Like any investment, incorporating leveraged ETFs into your portfolio requires thorough research and a clear understanding of your financial goals and risk tolerance.

Access Live US Price Feeds for Free! As a non-professional investor, you can subscribe to our US live price feed for free on POEMS 2.0 or POEMS Mobile 3 App. Each subscription is valid for 12 months. Please note that without a subscription, displayed option prices will have a delay of 15-30 minutes.

Why Trade with POEMS?

Discover the power of leveraged ETFs to amplify returns through strategic market plays. Learn their mechanics, explore trading strategies, and uncover top-performing assets to navigate their unique risks and rewards effectively. With POEMS, you gain access to 26 stock exchanges worldwide, providing endless opportunities to diversify and explore global markets. Whether you aim for regional growth or international investments, our comprehensive platform is here to support your trading needs seamlessly.

Start Your Global Investment Journey Today! Open an account with POEMS and take the first step toward a diversified, globally-focused portfolio!

For more information about trading on POEMS, you can visit our website or reach out to our Night Desk representatives at 6531 1225.

Reference:

- [1] ProShares. (n.d.). Leveraged and inverse strategies, 9 November 2024

- [2] Singapore Exchange (SGX) Academy. (n.d.). Specified Investment Products (SIP), 15 November 2024

- [3] ETF Database. (n.d.). Leveraged equity ETFs, 9 November 2024

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Thng Xiao Xiong

Xiao Xiong is an assistant manager in the Global Markets Team specializing in UK markets. He is a graduate of the Singapore Institute of Technology with a bachelor's in Aircraft System Engineering. He has a strong interest in macroeconomics and options strategies.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?