One Stock, Many Prices: Understanding US Markets August 26, 2025

Why Isn’t My Order Filled at the Price I See?

Have you ever set a sell limit price, watched the market tick right past it, and thought, “Great, my order should be done by now!”—only to find nothing happened? You check your account again, and mysteriously, your order has expired unfilled.

Puzzled, you checked Yahoo Finance. Sure enough, the day’s high shows a price higher than your limit. So why wasn’t your trade executed?

The answer lies in the hidden details behind US market operations —where your order is routed, which exchange it reaches, and why the price you see on a consolidated tape or a price feed might not be the price available to you at that exact moment.

Unlike SGX or HKEX, which operate a single centralised exchange where all orders are routed and matched, and where market participants receive the same standardised price feed, other markets, such as the US, may have multiple venues with differing order routing and pricing mechanisms.

In this article, I’ll take you behind the scenes of order routing and explain how it works, what really happens when you click “Buy” or “Sell,” and why sometimes your order doesn’t get filled at the order price you place.

Understanding Consolidated Tape and National Best Bid and Offer

- Consolidated Tape

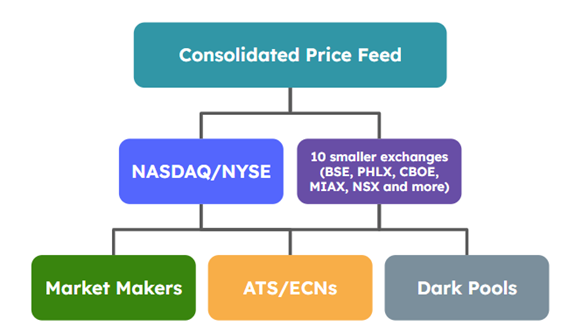

The consolidated tape is a feed that aggregates all quotes and trades from all registered exchanges. Think of it as a highlight reel of transactions happening across different venues. Below is a simple illustration:

- National Best Bid and Offer (NBBO)

From this tape, the National Best Bid and Offer (NBBO) is calculated and disseminated by Securities Information Processors (SIPs). It shows the highest available bid (buy price) and lowest available ask (sell price) across all protected US trading venues at any given moment. Under SEC Regulation National Market System (NMS), brokers must ensure client orders are executed at the NBBO or better.

Under Regulation NMS, the Rule 611 (Order Protection Rule) is designed to prevent “trade-throughs,” where orders are executed at a worse price than what is available elsewhere.

However, there are certain exceptions to this rule, such as:

- Rule 611 exemptions – Certain trades may qualify for an R6 exemption, meaning a trade can occur at a price outside the NBBO in specific situations. (e.g., blocked trades, intermarket sweep order)

- Special order types (e.g., pegged orders, midpoint orders)

- Odd-lot orders (fewer than 100 shares), which historically were not included in NBBO calculations but are now included in the SIP feed, though they may still be treated differently by some systems

How Orders Reach the Market

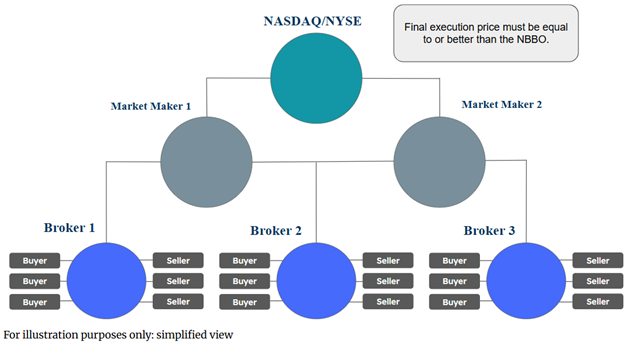

Nowadays, retail orders are never routed directly to exchanges. Instead, they are typically sent to market makers—such as Citadel Securities, Virtu Financial, Goldman Sachs, or J.P. Morgan—which may internalise the trade by filling it at a price equal to or better than the NBBO, or, if necessary, route the order to an exchange for execution if they cannot provide the required liquidity.

This also means that execution prices may vary slightly between different market makers, depending on their available liquidity, order flow, and internal pricing models. Still, US regulations require orders to be executed at a price equal to or better than the NBBO at the time of the trade, and all trades must be reported to their affiliated Trade Reporting Facility (TRF).

Why the Price You See May Differ

- Different Market Data Sources

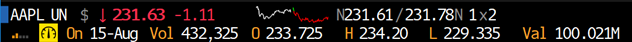

Many brokers and news outlets use alternative market data feeds. For example, POEMS provides the NASDAQ basic price feed, quotes, and trades from NASDAQ-operated venues, not from all exchanges. As a result, prices may vary slightly from those displayed on platforms that utilize the full consolidated tape.

- Execution Venue Mismatch

Your order may be routed to a venue other than NASDAQ, such as NYSE, Cboe, or off-exchange venues like dark pools, that are not reflected in the NASDAQ basic price feed. While the NBBO ensures you still receive the best available price, the quote you’re watching may not match the venue your order reached.

- Insufficient displayed liquidity

Even if NBBO shows a certain price, the number of shares available at that price might be too small to fill your entire order, causing part or all of it to be executed at the next available price.

Take Apple Inc. (AAPL) as an example: its primary listing is on the NASDAQ Global Select Market (NASDAQ GS). This means NASDAQ is considered its “home” exchange for quoting and regulatory purposes.

However, trading in AAPL is not limited to NASDAQ. Orders can be executed on:

- Other national exchanges (e.g., NYSE, Cboe)

- Alternative Trading Systems (ATSs), including dark pools operated by brokers and institutions.

- Market makers (E.g., Citadel, Virtu) can internalise trades or route them to exchanges.

Regardless of where the trade is executed, it will still be reported to the consolidated tape via the SIP. This ensures the trade is reflected in the consolidated feed that forms the basis of the NBBO.

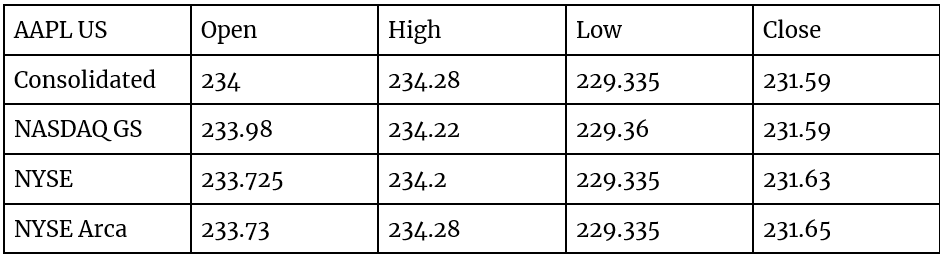

AAPL Consolidated Price Feed

AAPL Consolidated Price Feed

AAPL NASDAQ GS Price Feed

AAPL NASDAQ GS Price Feed

AAPL NYSE Price Feed

AAPL NYSE Price Feed

AAPL NYSE Arca Price Feed

AAPL NYSE Arca Price Feed

Summary Table

Summary Table

As shown above, the reported Open, High, Low, and Close (OHLC) values can differ slightly across exchanges because each market centre executes trades independently.

This does not mean that clients receive the worst executions. Under SEC Regulation NMS and the NBBO rule, orders must always be filled at the best price available across all venues at that moment. In this case, a venue such as NYSE Arca recorded a better price than the prevailing NBBO, which explains why it reported the highest high of the day compared to other exchanges. (Refer to the NBBO example mentioned earlier).

Conclusion

In conclusion, understanding how data such as consolidated tapes and NBBO work can give investors better clarity on how trades are executed and why prices may differ across venues. Most importantly, orders must always be filled at the best price available across all venues based on regulation.

This applies to customers trading via POEMS with us. Your orders are executed at the best available price, then, in compliance with the strict requirements of the NBBO.

We ensure that all executions meet or improve upon the best bid or offer available across all protected market centres—not just the primary exchange. Furthermore, we can provide detailed trade reports to verify that every execution is carried out in the best interest of our investors.

If you want to verify any price differences, you can contact our Phillip Night Desk for a price feed check.

We hope this article has provided you with useful insight into how US exchanges operate. If you’re curious to learn more, explore our previous article how extended hours trading works —including why prices may differ during those sessions—or check out our latest write-up on options trading.

Visit our website or contact our dedicated Night Desk team at globalnight@phillip.com.sg or (+65) 6531 1225.

Start investing smarter with POEMS today—open an account and trade the US markets now!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile