Patience Pays Off: Mastering the Wheel Options Strategy September 30, 2025

Introduction

In today’s dynamic economic landscape, investors would miss out on profit-taking windows as a result of heightened volatility. In reality, it may also take a while for investors to see a return on their investment in a safer stock, while faster-paced alternatives like buying short-term options may be too risky.

That’s where the Wheel Strategy comes in — a patient, structured approach that helps you generate consistent income while taking advantage of market movements, without the stress of chasing quick wins.

What is the Wheel Strategy?

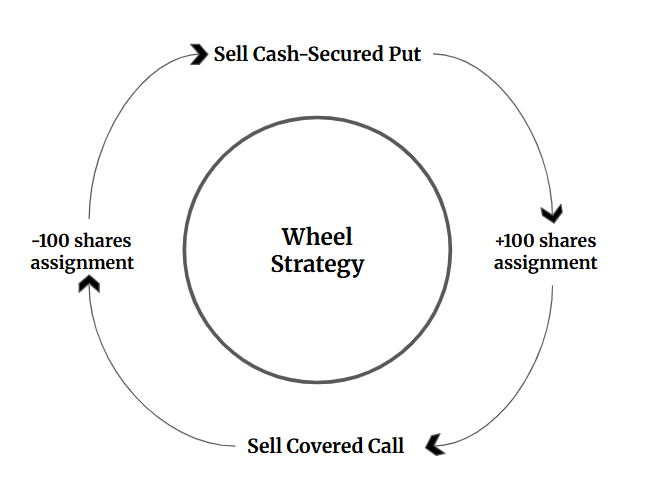

The Wheel Strategy combines two option strategies: the cash-secured put and the covered call, and works in a cycle as follows:

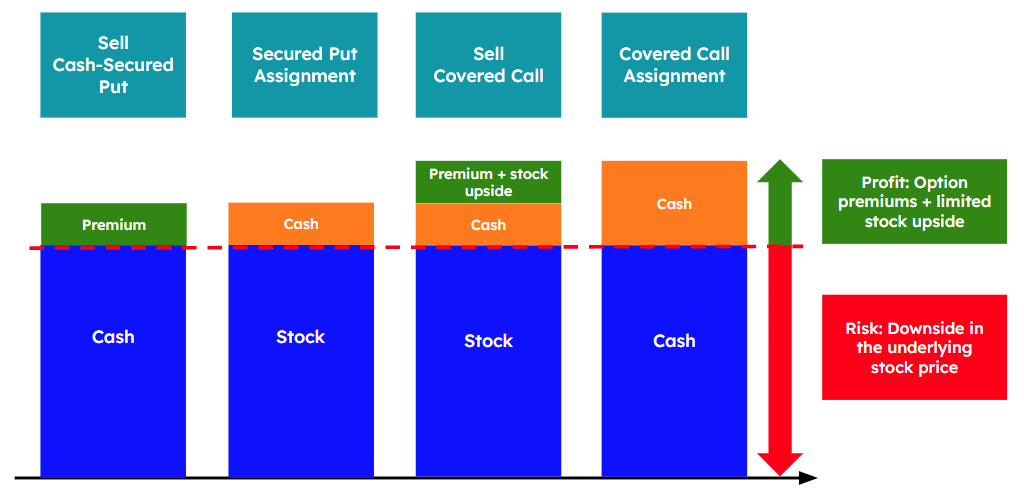

- You sell a cash-secured put to collect a premium while waiting to buy a stock at your chosen price, potentially.

- If the cash-secured put is assigned, you now own the stock at that price. From there, you switch to selling a covered call, earning an additional premium while holding the shares.

- If the shares get called away, you return to step one and repeat the cycle.

This approach is often described as “slow but steady.” Instead of chasing big, risky wins, you’re consistently generating income from option premiums.

As such, it is particularly suited for investors who want a steady cash flow, lower stress compared to large speculative trades, and a disciplined, rules-based strategy that doesn’t require constant monitoring. Think of it as a patient way to let the market work for you over time, while still giving yourself opportunities to accumulate shares or take profits depending on how the stock moves.

If you’d like a deeper understanding of cash-secured puts and covered calls, be sure to check out our earlier market journals, where we break down these strategies in detail.

Why Patience Matters

Each cycle of the wheel takes a certain amount of time to complete. Essentially, you are earning “rent” from your cash or shares. By continuously collecting option premiums, you create a steady income stream while tailoring your strategy to prevailing market conditions. This approach can provide consistent gains over the long run. The strategy works best when applied to stable, highly liquid, and fundamentally strong stocks, where the risks of sudden price shocks are lower and premium collection is more reliable.

Risks to Consider

● Underlying Stock Risk

Downside risk arises from a decline in the underlying stock price. This means the investor bears the same downside exposure as directly holding the stock — in the worst-case scenario, the stock price could fall to zero, resulting in a total loss of the investment.

However, this risk can be mitigated by investing in stable, fundamentally strong companies. Blue-chip stocks, in particular, are less prone to sharp price declines, thereby helping to reduce downside exposure.

● Opportunity Cost

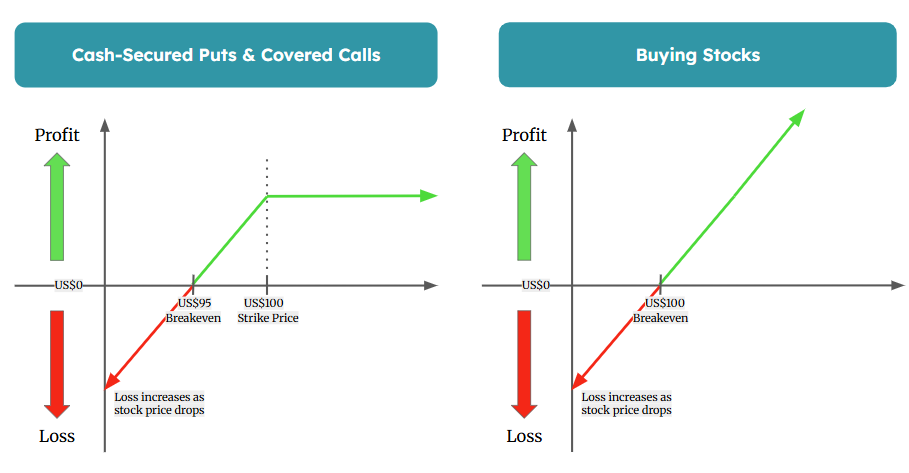

The Wheel Strategy also carries opportunity cost. If the stock rises significantly above the strike price, your profit is capped.

With cash-secured puts and covered calls, the maximum gain is limited to the option premium received and, in the case of covered calls, the stock appreciation up to the strike price. This differs from simply buying and holding the stock, where potential gains are theoretically unlimited if the stock continues to rally. While option strategies provide steady income and some downside cushioning, they do so at the expense of unlimited long-term upside.

Who This Strategy Is For

As the name suggests, the Wheel Strategy requires patience. It often involves eventually owning the underlying stock — either at expiration or earlier if the option buyer exercises their rights.

This strategy is especially suited for investors who are comfortable holding stock long term, since assignment is always a possibility. The Wheel is designed to provide consistent cash flow and can even lower the average cost of entry into a stock.

In times of macroeconomic uncertainty, when market direction can be harder to predict, the Wheel Strategy offers a disciplined approach: it allows investors to stay engaged in the market, collect income, and potentially acquire quality stocks at attractive prices, while managing risk more systematically.

Conclusion

The Wheel Strategy serves as a reminder that patience can pay off in investing. Instead of chasing fast-moving trades or hoping for sudden windfalls, you’re steadily collecting premiums, small hits that add up over time.

It’s not about timing the market perfectly or predicting every move. It’s about having the discipline to follow a structured process, staying comfortable with owning quality stocks, and letting time work in your favour.

Ready to start? Explore our beginner-friendly options platform today, or if you would like to dive deeper into other strategies, check out our detailed guide on Cash-Secured Puts.

For more information on trading the US markets through POEMS, visit our website or contact our Night Desk representatives at 6531 1225 (available from 2 PM onwards). Don’t wait—register your account today and take the first step towards accessing these exciting markets!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile