Riding the A.I. and Semiconductor Wave in 2025 with Taiwan Stocks January 16, 2025

Key Takeaways

Taiwan is at the forefront of the global AI and semiconductor boom, offering investors a strategic opportunity. This growth is driven by advanced semiconductors, rising demand for GPUs, ASICs, and server infrastructure.

Key Taiwanese companies like TSMC, Hon Hai Precision (Foxconn), and Delta Electronics lead in advanced semiconductor manufacturing, AI servers, and power management solutions.

Sector growth highlights include:

- Advanced semiconductors: Supporting AI applications in HPC, IoT, and cloud computing.

- Server technology: Critical for AI-powered data centers and cloud infrastructure.

Introduction

The global investment landscape continues to evolve and new market trends continue to emerge at a rapid pace, driven by technological advancements and shifting economic trends. Among the most prominent sectors in recent years are the AI and semiconductor industries. Taiwan has firmly established itself as a vital contributor to the breakthroughs in these industries on a global scale.

This article will explore Taiwan’s market’s strategic position in the global semiconductor and AI ecosystems. We will also mention the companies that are at the forefront of these industries, and examine their contributions and impact on their respective industries.

Why Invest in AI and Semiconductors?

First, let’s look back in history, to the mid-1990s when the internet was making its breakthrough. Back then, one of the companies leading this charge was Cisco Systems (CSCO.US), and from the start of the year 1994, to 1 April 2000, the company’s stock price rose from a humble US$1.79 to a whopping US$77.31 at its peak. The internet subsequently became a cornerstone of modern life, revolutionising connectivity, cloud computing, and the Internet of Things (IoT).

Today, we stand on the brink of a similar technological revolution: Artificial Intelligence (AI). AI has the potential to replicate the success of the Information Revolution, and with it a huge potential for growth. Advancements in machine-learning, robotics and language processing drives growth at an impressive rate, adding on to this is the ability to be applied into many different industries, such as healthcare, finance, manufacturing and transportation. We are already beginning to see this being adopted into self-driving cars, automated financial trading and more.

AI also has the ability to potentially improve productivity drastically; the automation of repetitive tasks, and simple decision-making skills will likely increase margins and provide higher accessibility and sustainable growth for many companies.

Supporting this AI transformation is the semiconductor industry, which provides the materials and hardware essential for AI development and implementation. The growing demand for semiconductors, driven by AI, creates opportunities to invest not only in AI developers but also in the hardware and infrastructure that powers this progress.

AI is not just a passing trend, many businesses and systems are transforming and adapting new processes that involve AI, thus changing the way they fundamentally operate. It is likely to remain as a key driver of growth and innovation. Let’s move on to some notable stock picks in the Taiwan market, that are involved and contributors in the AI and Semiconductor businesses.

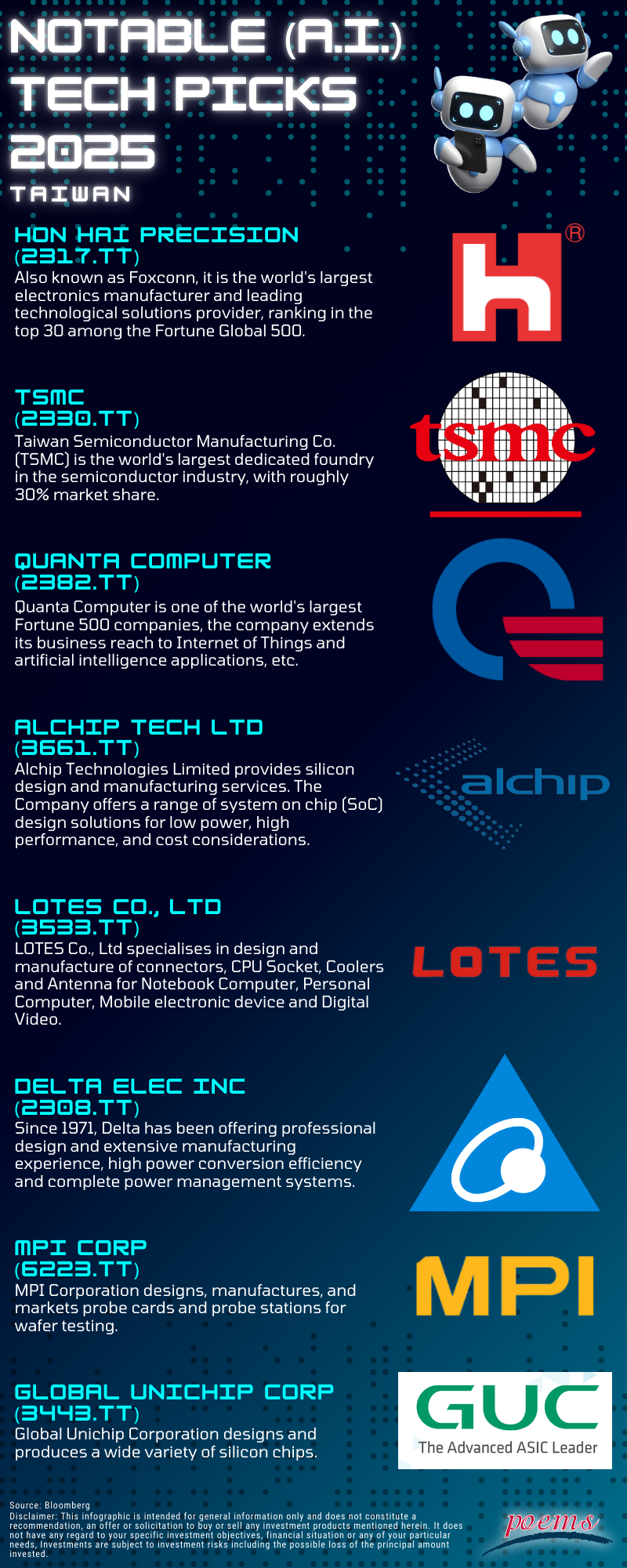

Figure 1: See Company Product/Service Type and Extended Description for more details

Figure 1: See Company Product/Service Type and Extended Description for more details

The 8 Company Products/Service Types and Extended Description

Hon Hai Precision (2317.TT)

AI Server ODM (Original Design Manufacturer)

Hon Hai Precision Industry Co., (2317.TT) commonly known as Foxconn, is the world’s largest electronics manufacturer and a leading technological solutions provider, ranking in the Fortune Global 500’s top 30. Established in 1974, Foxconn produces a wide range of products across four major segments: Smart Consumer Electronics, Cloud and Networking, Computing, and Components and Others. Key offerings include mobile phones, computers, servers, connectors, optical components, and entertainment systems. Recently, the company has expanded into electric vehicles, digital health, and robotics, focusing on next-generation communications, AI, and semiconductors.

Foxconn serves major clients like Apple, Cisco, Dell, and Amazon, with the U.S. contributing approximately 35% of its revenue. Its revenue breakdown by product category includes:

- Smart Consumer Electronics (55%): Smartphones, wearable devices, TVs, game consoles, and audio systems.

- Cloud and Networking (20%+): Equipment like routers, servers, edge computing devices, and data centers.

- Computing (20%): Desktops, laptops, tablets, printers, and related devices.

- Components and Others (5%): Connectors, optical components, semiconductors, automotive equipment, and services like logistics, software development, and industrial integration.

Foxconn’s diversified portfolio and expansion into emerging technologies position it as a pivotal player in the global tech ecosystem.

TSMC (2330.TT)

Advanced Processes, Advanced Packaging

TSMC (2330.TT) is the world’s largest dedicated semiconductor foundry, commanding approximately 30% of the global market share. It specialises in manufacturing semiconductors based on proprietary integrated circuit designs provided by its customers. The company offers a wide range of wafer fabrication processes, including CMOS logic, mixed-signal, radio frequency, embedded memory, and BiCMOS technologies. Additionally, TSMC provides services like design, mask making, advanced packaging (TSMC 3DFabric), silicon stacking technologies, and testing. Its key fabless clients include AMD, Broadcom, NVIDIA, and QUALCOMM, with the US contributing about 65% of TSMC’s revenue.

Primary Segment:

- The foundry segment, responsible for manufacturing, sales, packaging, testing, and design of integrated circuits and semiconductor devices.

Revenue Sources:

- Wafer fabrication accounts for over 85% of revenue.

- The remainder comes from packaging, testing, mask making, design, and royalty income.

- High-Performance Computing (HPC): Nearly 45% of revenue.

- Smartphones: Roughly 40%.

- Internet of Things (IoT): Around 10%.

- Automotive: About 5%.

- Digital Consumer Electronics: Less than 5%.

TSMC’s leadership in advanced semiconductor manufacturing and its significant role in high-demand sectors such as HPC, smartphones, and IoT solidify its position as a cornerstone of the global technology industry.

Quanta Computer (2382.TT)

AI Server ODM (Original Design Manufacturer)

Quanta Computer (2382.TT), established in 1988, is a Fortune 500 company recognized globally as a leader in the R&D, design, and manufacturing of notebook computers. Over time, the company has expanded its operations into cloud computing, enterprise network solutions, mobile communication technology, smart home products, automotive electronics, smart medical care, Internet of Things (IoT), and artificial intelligence (AI) applications. Quanta also operates Quanta Storage, which focuses on data storage products, and RoyalTek, specializing in GPS devices and personal navigation solutions.

The company actively develops products in diverse categories, including mobile and cloud computing, smart IoT and home entertainment, smart medical solutions, 5G telecommunications, smart manufacturing, and metaverse-related VR and AR applications. Despite its diversification, Quanta’s revenue predominantly comes from computer-related products, with other electronic products contributing minimally. About 50% of its revenue is generated from the U.S. market.

Alchip Tech Ltd (3661.TT)

AI ASIC (Application-Specific Integrated Circuit)

Alchip Technologies Limited (3661.TT) provides silicon design and manufacturing services. The Company offers a range of system on chip (SoC) design solutions for low power, high performance, and cost considerations. Alchip produces SoC solutions for products including consumer electronics, optical networking, and medical imaging equipment. Alchip Technologies serves customers worldwide.

Lotes Co., Ltd (3533.TT)

New CPU Platforms, AI Server UQD (Universal Quick Disconnects), GPU Sockets

LOTES Co., Ltd (3533.TT) specialize in design and manufacture of connectors, CPU Socket, Coolers and Antenna for Notebook Computer, Personal Computer, Mobile electronic device and Digital Video.

Delta Electronics Inc. (2308.TT)

AI Server Components

Delta Electronics (2308.TT), established in 1971, is a global leader in power and thermal management solutions, known for its high-power conversion efficiency and comprehensive power management systems. The company developed the world’s first server power supply certified as 80 Plus Titanium and serves diverse sectors, including information, communication, commercial, industrial, medical, energy-saving, and renewable applications. Mainland China accounts for about 30% of its revenue.

Delta operates through three main business segments:

- Power Electronics (60%):

a. Specialises in components, embedded power, fans, thermal management, and automotive electronics.

b. Offers high-efficiency products like switching power supplies, brushless DC fans, and passive components. - Infrastructure (25%):

a. Focuses on industrial and building automation solutions, supporting smart manufacturing and IoT-enabled building systems, such as HVAC, lighting, energy, water supply, and surveillance.

b. Includes ICT infrastructure solutions that enable energy-efficient power management for 5G networks, data centers, and communication networks.

c. Contributes to smart cities through renewable energy, EV charging stations, energy storage, and more. - Automation (15%):

a. Provides diverse automation solutions for industries, enabling smart manufacturing and intelligent systems.

b. Delta also extends its offerings to video wall solutions, projectors, industrial power supplies, medical power supplies, and devices, establishing itself as a world-class supplier of systems and automation solutions.

MPI Corporation (6223.TT)

AI ASIC and CoWoS (Chip-on-Wafer-on-Substrate)

MPI Corporation designs and manufactures probe cards and probe stations for wafer testing, supporting advanced packaging technologies like CoWoS for high-performance computing and AI components.

Global Unichip Corporation (3443.TT)

AI ASIC (Application-Specific Integrated Circuit)

Global Unichip Corporation (3443.TT) designs and produces a wide variety of silicon chips.

Source: Bloomberg, Investor Relations, Sinopac

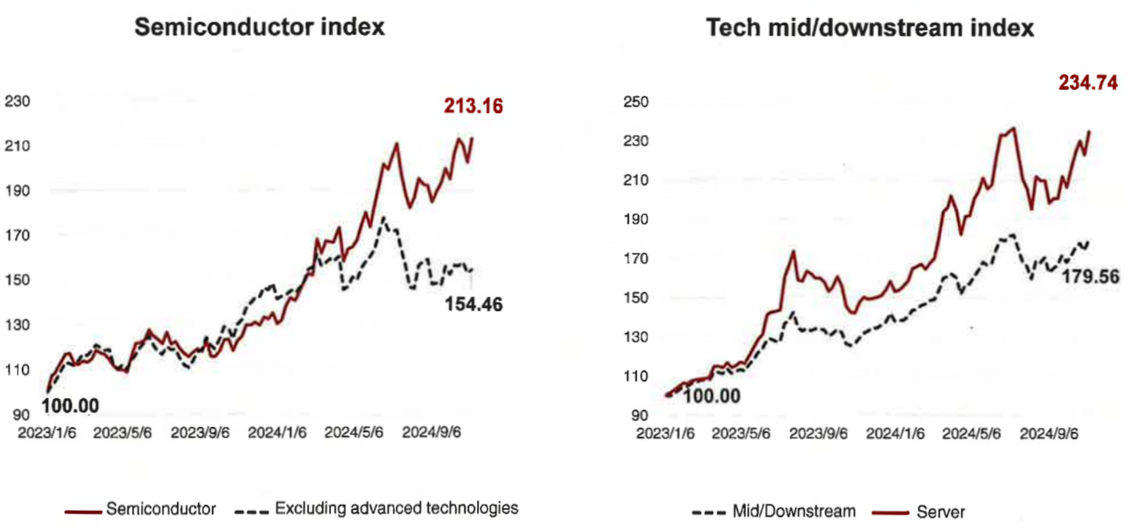

How Are Key Sectors Performing in the AI Revolution?

Source: Cmoney; SinoPac

Source: Cmoney; SinoPac

Taiwan is home to some of the world’s leading semiconductor manufacturers such as TSMC mentioned above, and these companies are at the forefront of producing advanced chips crucial in the development and sustainability of AI, machine learning and other tech applications. AI has ramped up the demand for semiconductors as it relies heavily on sophisticated hardware, including GPUs and ASICs (Application-Specific Integrated Circuits). The graph on the left illustrates the growing gap between two indices, highlighting the performance of companies focused on advanced semiconductor technologies. These companies are likely driving innovations essential to AI, such as advanced processing chips and processors. Future growth is expected to be fuelled by demand for semiconductors used in AI applications, particularly GPUs and cloud infrastructure.

On the right, we can see the outperformance of the Server Index signals the growing importance of server-related technology in supporting AI and its functions. This would include server farms, cloud infrastructure and data centers. While the Tech mid/downstream Index still shows steady growth, it lags behind the Server Index; this would include consumer electronics for example. They might benefit indirectly from AI-driven demand, but are less likely to reap huge rewards as a result of it, as they currently seem to be playing a secondary role by supporting the broader ecosystem, providing materials, components and assembly.

An investment strategy for gaining exposure to the Taiwan market could be to focus on AI and semiconductor sectors and server-related companies to benefit from their sustained growth, and diversify their portfolio into downstream players.

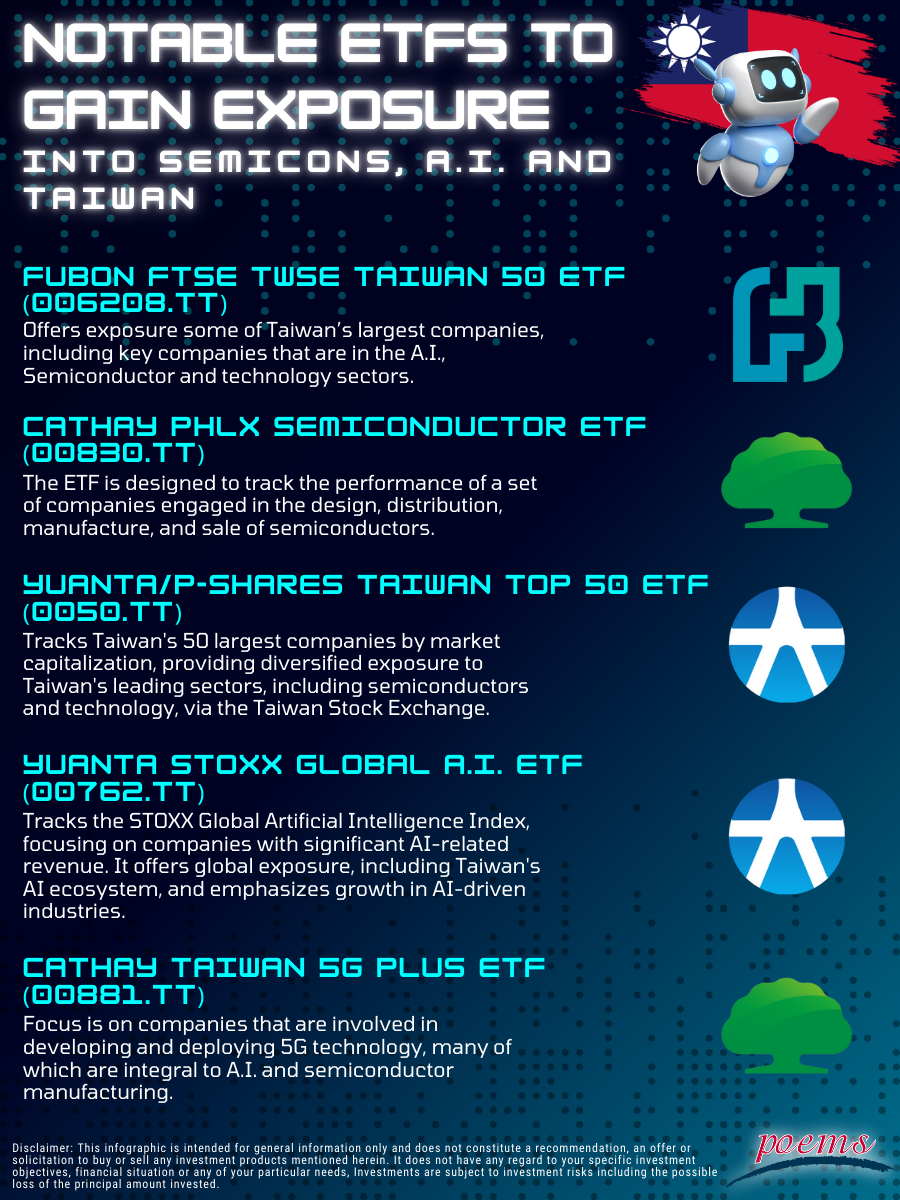

Gaining Exposure (ETFs)

An easy way to gain exposure into these sectors and the Taiwan market in general would be to utilise ETFs, which are readily available on POEMS, here are some noteworthy ETFs for your consideration as well:

Conclusion

The Taiwan market presents a compelling opportunity for investors looking to ride the wave of transformative technological advancements in AI and semiconductors. Taiwan has ensured that they hold a pivotal role in the development and innovation of the AI and semiconductor sectors, as well as in the global supply chain. They have enabled the rapid growth of industries that are transforming and growing the modern economy, and soon it will be as widely adopted as the internet was in the early 2000s. In summary, AI is not a mere trend, it is an innovation that will improve productivity and efficiency, and to support this new technology, advanced semiconductors and advanced infrastructure, hardware and servers are critical. Taiwan’s strategic position as the global hub that provides solutions for all these technological innovations makes it a compelling investment choice, standing not just as a major participant, but a potential leader in this growing space.

If you are already a client of POEMS, you can learn more about trading in the Taiwan market at our market offering page here.

If not, did you know POEMS is one of the only brokers in Singapore to offer trading in Taiwan stocks? Open a POEMS account and start investing today!

Sources: Bloomberg, SinoPac Securities, Cmoney

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile