Salesforce: A Steady Tech Leader in Volatile Times June 11, 2025

US markets experienced a downturn from mid-February to mid-March — a textbook correction of more than 10% from recent highs. April’s news of sweeping US tariffs exacerbated market sentiment. This was followed by a rebound in May, highlighting the underlying market volatility.

So, what can investors do in times of such uncertainty? Is it an opportune time to buy? And if so, what kind of business makes for a resilient investment?

In this article, we’ll delve into Salesforce, who they are, how they generate revenue, and how one might approach investing in the company moving forward.

In today’s intensely competitive business environment, data is king. Organisations that effectively leverage data can create outstanding customer experiences, build loyalty, and fuel growth. This creates a positive feedback loop, a virtuous cycle where high-quality data enhances customer insight, improves service delivery, and generates even more valuable data in return. However, when mismanaged, this cycle can become destructive. Poor data practices can lead to dissatisfied customers, diminished trust, and ultimately, declining revenues.

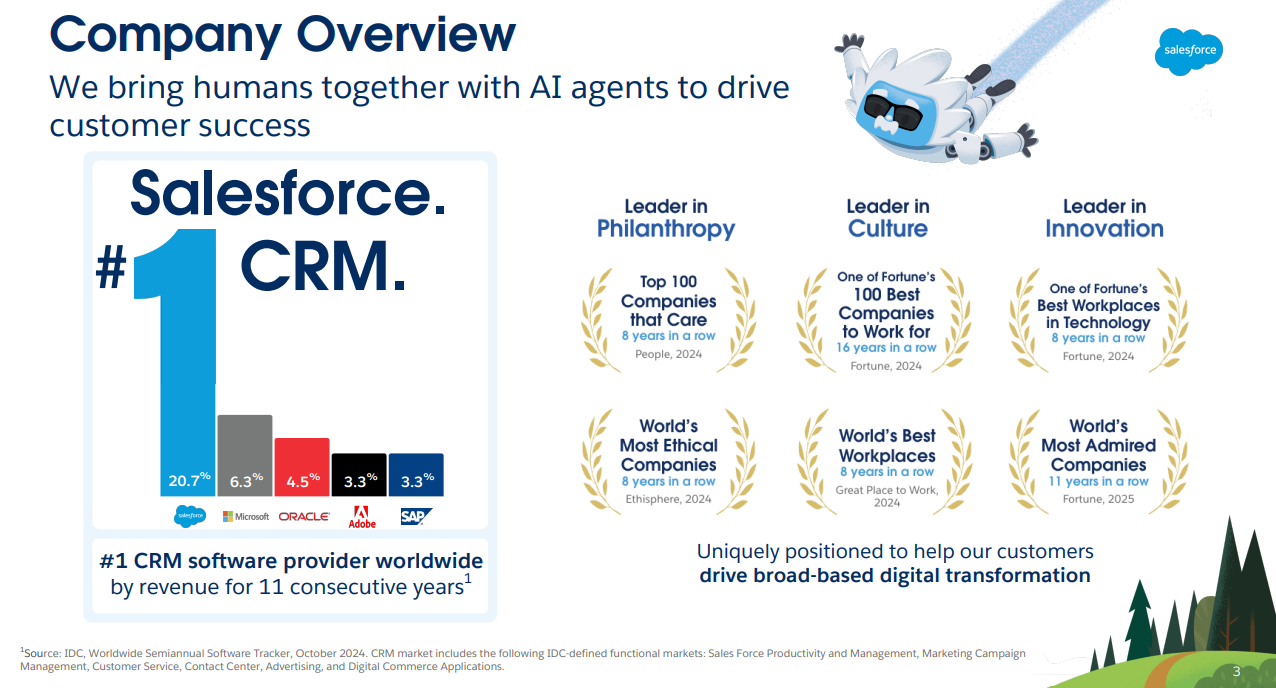

At the core of this data-driven transformation is Salesforce, the world’s leading provider of Customer Relationship Management (CRM) software. Salesforce equips businesses to gather, analyse, and utilise customer data, enabling them to deliver tailored experiences on a large scale.

Founded in 1999 by Marc Benioff and Parker Harris, Salesforce is headquartered in San Francisco, California. Listed on the NYSE under the ticker CRM, the company specialises in developing cloud-based enterprise software solutions focused on customer relationship management. Salesforce’s suite of products includes sales force automation, customer service and support, marketing automation, digital commerce, community engagement, collaboration tools, industry-specific solutions, and its proprietary Salesforce platform. It also offers a range of consulting, training, support, and advisory services to help clients maximise the value of their technology stack.

The Big Picture

According to Dogma Group, the customer relationship management (CRM) industry is expected to grow 13% from 2023 to 2032. Industry’s revenue is forecasted to exceed US$90 billion by 2025.

Source: Gartner

Source: Gartner

Salesforce ranks as the number one leader in both vision and execution, according to Gartner (above) and IDC (below). In times of uncertainty, it pays to be invested in market leaders and resilient businesses.

Source: Salesforce Investor Relations

Source: Salesforce Investor Relations

How Salesforce Generates Revenue

Salesforce operates on a subscription-based revenue model, which provides predictable and recurring income. Here’s a breakdown of its revenue streams:

- Subscription and Support (makes up approximately 95% of revenue): Salesforce charges customers a recurring fee for access to its cloud-based CRM platform

- Professional Services (the remaining approximately 5% of revenue): Salesforce offers consulting, implementation, and training services to help businesses optimize their use of the platform

Marc Benioff, Chair and CEO, Salesforce, notes:

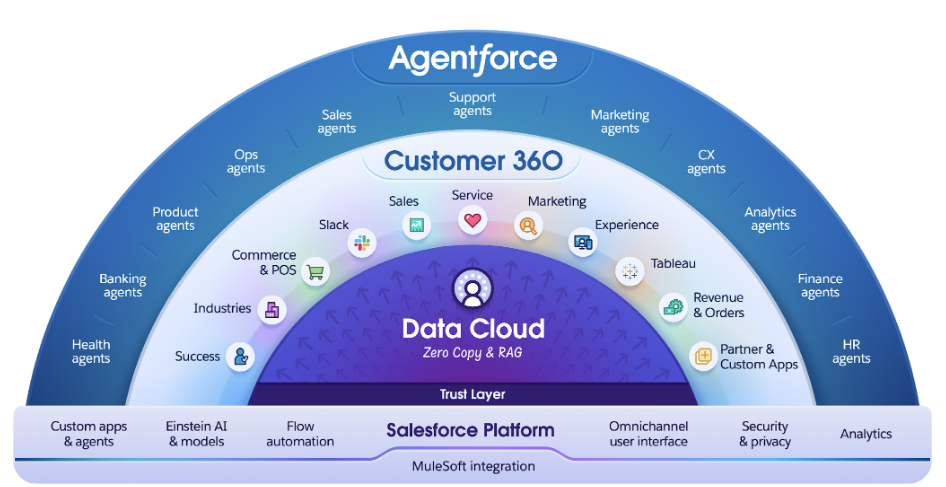

“No company is better positioned than Salesforce to lead customers through the digital labor revolution. With our deeply unified platform, seamlessly integrating our Customer 360 Apps, Data Cloud and Agentforce , we’re already delivering unprecedented levels of productivity, efficiency and cost savings for thousands of companies.”

He added on further by saying:

“Our formula now really for our customers is this idea that we have these incredible Customer 360 apps. We have this incredible Data Cloud, and this incredible agentic platform. These are the 3 layers. But that it is a deeply unified platform, it’s a deeply unified platform, it’s just one piece of code, that’s what makes it so unique in this market.”

The infographic below provides a summary of how Salesforce conducts its business, highlighting its core processes, product offerings, and platform integration.

Source: Salesforce Blog

Source: Salesforce Blog

Profitability Insights

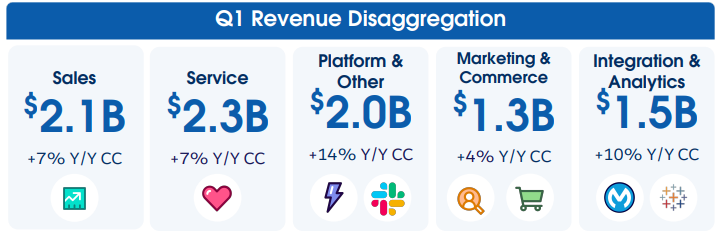

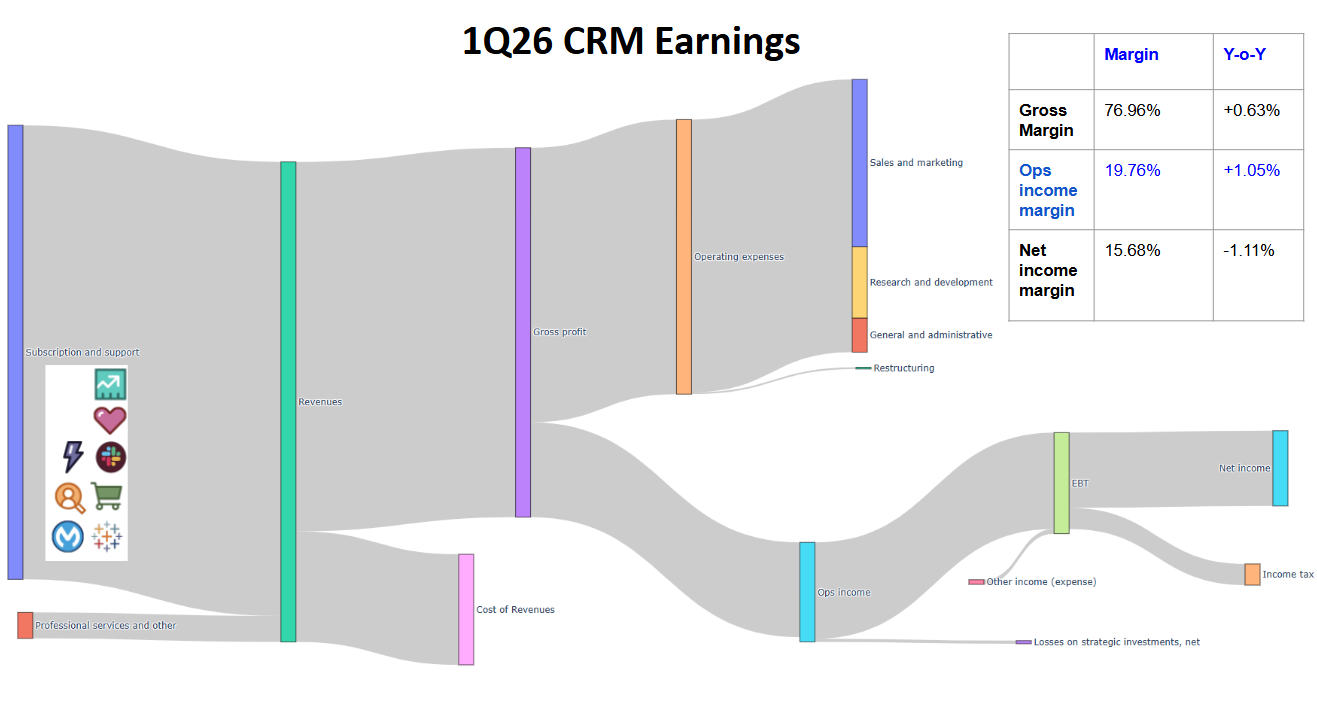

Source: Salesforce 1QFY26 Presentation

Source: Salesforce 1QFY26 Presentation

Above are the various subscription and support services that contribute to Salesforce’s 95% revenue.

Each component has recorded year-on-year growth in Q1 FY26.

Source: Salesforce 1QFY26 Presentation

Source: Salesforce 1QFY26 Presentation

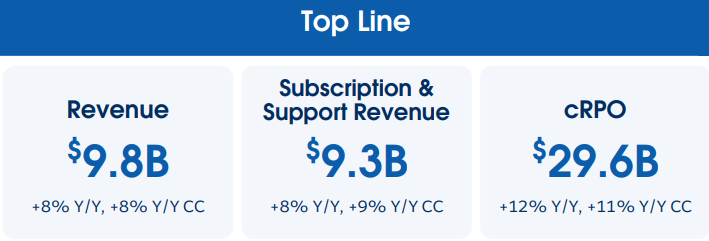

Top Line Overview

- Total Revenue: US$9.8B (+8% Y/Y)

- Subscription & Support Revenue: US$9.3B (+8% Y/Y)

- Current Remaining Performance Obligation (cRPO): US$29.6B (+12% Y/Y)

As of Q1 FY26, Salesforce’s current remaining performance obligation (cRPO) stands at US$29.6 billion. This figure represents the amount of revenue Salesforce expects to recognise over the next 12 months, based on contracts already in place.

For comparison, in Q1 FY25, cRPO was US$26.4 billion — an increase of 12% year-on-year, highlighting continued customer demand and contract growth.

Source: Salesforce Q1FY26 filing

Source: Salesforce Q1FY26 filing

This is the latest earnings flow chart for Salesforce. Gross margin improved by 0.63%, operating margin increased by 1.05%, while net income margin declined by 1.11%. These indicators suggest that Salesforce is not only increasing its revenue but also managing costs effectively—demonstrating strong economies of scale.

Performance Review

Below is the guidance provided in the previous quarter and how Salesforce performed relative to its own expectations:

- Revenue: US$9.71 to US$9.76 billion

- cRPO: US$29.0 billion

- GAAP Earnings per Share (EPS): US$1.49 – US$1.51

→ Actual: US$9.8 billion (beat by US$0.09 billion)

→ Actual: US$29.6 billion (beat by US$0.6 billion)

→ Actual: US$1.59 (beat by US$0.08)

This demonstrates that Salesforce’s forecasting has been relatively accurate and that it outperformed expectations for Q1 FY26.

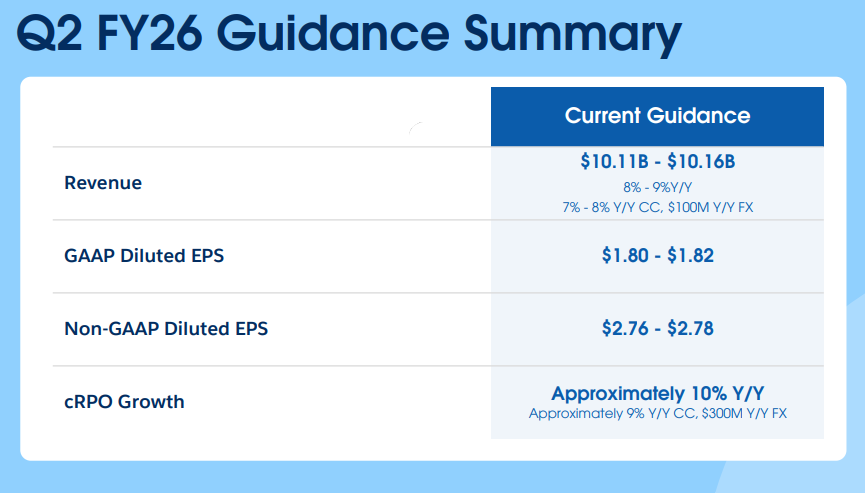

Next Quarter Outlook

At every earnings call, Salesforce presents guidance for the next quarter—in this case, Q2 FY26.

Note: If you’re unfamiliar with fiscal years, it’s worth noting that many companies use financial years that differ from the calendar year.

Source: Salesforce 1QFY26 Presentation

Source: Salesforce 1QFY26 Presentation

Above is the guidance given by Salesforce in their latest earnings call. Despite ongoing macroeconomic uncertainty, Salesforce remains confident in its ability to achieve growth in the next quarter.

Valuation – What Is A Reasonable Price

So, what is considered a reasonable price?

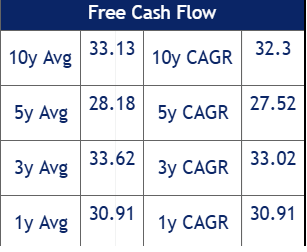

According to the financial data from TradingView, Salesforce has grown its free cash flow by 27.52% over the past five years.

Source: www.tradingview.com

Source: www.tradingview.com

Assuming a continued free cash flow growth rate of 25%, the intrinsic value is estimated at US$337.

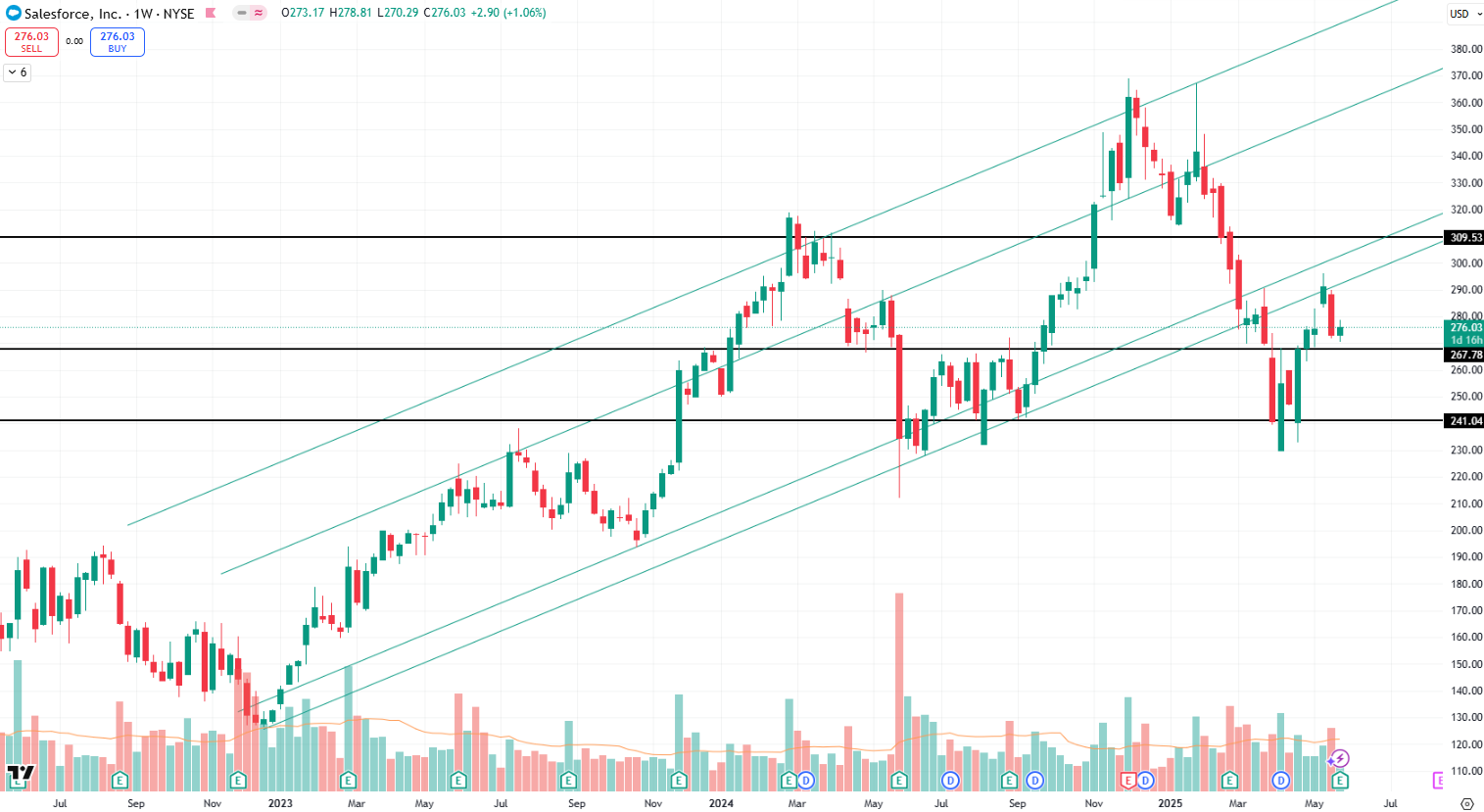

From a technical perspective, Salesforce’s share price is in a multi-year uptrend. There was a pullback to the lower portion of the uptrend channel, followed by a break below, largely attributed to the tariff-related news. Markets, being close to efficient, saw participants take advantage of the dip to accumulate shares in what they consider a fundamentally strong company.

Currently, price is finding some support at US$270 level. Short-term traders may take advantage of this price movement using leverage products such as CFDs. Long-term investors, on the other hand, may have already entered during the earlier dip caused by trade tensions, recognising it as a temporary discount on a quality business.

Conclusion

A 10% correction in the S&P 500 is a relatively rare occurrence and often presents an attractive opportunity to invest in solid companies at more favourable valuations.

In times of uncertainty, it is prudent to focus on businesses with a proven track record.

Salesforce remains a cornerstone of the CRM industry, empowering organisations to harness the power of data and deliver exceptional customer experiences. Its subscription-based model, focus on innovation, and strong ecosystem position it well for sustained growth.

By understanding Salesforce’s business fundamentals, industry relevance, and valuation metrics, we gain insight into why it continues to lead the way in the tech sector. Whether the data-driven cycle becomes virtuous or vicious will depend on how businesses like Salesforce evolve and innovate in a rapidly shifting world.

How to get started with POEMS

POEMS’ award-winning suite of trading platforms offers investors and traders more than40,000 financial products across global exchanges.

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg.

References:

- [1] https://dogmagroup.co.uk/top-crm-trends-2025/

- [2] https://www.gartner.com/doc/reprints?id=1-2JP9M0NN&ct=241212&st=sb

- [3] https://www.salesforce.com/blog/what-does-salesforce-do/

- [4] https://s205.q4cdn.com/626266368/files/doc_financials/2026/q1/CRM-Q1-FY26-Quarterly-Investor-Deck.pdf

- [5] https://www.tradingview.com/

- [6] https://https://www.cnbc.com/2020/10/16/salesforce-ceo-marc-benioff-developed-this-mindset-to-lead-in-crisis.html

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Zheng Wei Seow

Dealer

Contract for Differences

Zheng Wei graduated from RMIT university with a Bachelor's Degree in Economics and Finance. His interest is in FX and trading with strategies using a more hands-on approach as his trading style. There is always room for retail traders who love to grow on their own.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?