Singapore Equities Hit New Highs in Record Nine-Month Rally February 9, 2026

Market Performance Highlights

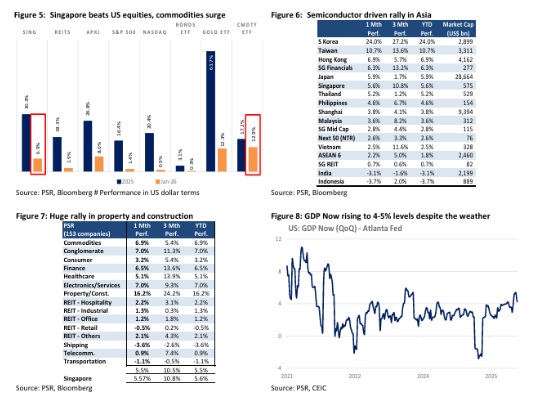

Singapore equities demonstrated exceptional momentum in January 2026, rising 5.6% to cap a remarkable nine consecutive months of gains totalling 28%. This historic performance streak reflects the robust underlying economic conditions and favourable market dynamics driving the city-state’s equity markets to new heights.

Property companies emerged as the primary drivers of this advance, benefiting from attractive valuations and growing optimism surrounding new property launches. The sector’s strength stems from favourable interest rate conditions and a reduced risk of government cooling measures, creating an environment conducive to real estate investment and development.

Economic Foundation and Growth Drivers

Singapore’s economic conditions remain vibrant, with industrial production surging 19% year-over-year in the fourth quarter of 2025. This growth is underpinned by strong electronics demand, with the sector experiencing a 24.5% jump that represents the best performance in 32 quarters since the third quarter of 2017.

A major capital spending cycle is currently underway across multiple sectors. Semiconductor equipment spending is trending upward following TSMC’s guidance indicating significantly higher capital expenditure over the next three years. The company’s 2026 capital expenditure guidance jumped 31% year-over-year to US$54 billion, providing substantial momentum for equipment manufacturers especially Frencken.

The construction sector is positioned for another record year in 2026, driven by massive Terminal 5 contracts and other major infrastructure projects. This construction boom will benefit the entire supply chain, including contractors, building materials suppliers, and related property services such as dormitories and co-living facilities.

Valuation and Market Outlook

Singapore equities currently trade at 16 times forward price-to-earnings ratio, modestly above the 25-year historical average of 15 times. However, with continued earnings momentum and valuation expansion supported by low interest rates and EQDP+ capital flows, Phillip Securities Research believes the market could reach the one standard deviation valuation of 19 times. This scenario implies a target index level of 5,700, representing a potential 15% gain from current levels.

The combination of robust economic fundamentals, favourable monetary conditions, and strong sectoral tailwinds positions Singapore equities for continued outperformance in the current market environment.

Frequently Asked Questions

Q: What drove Singapore equities’ strong performance in January 2026?

A: Singapore equities rose 5.6% in January, led by property companies benefiting from attractive valuations, optimism about new launches, favourable interest rates, and reduced risk of cooling measures.

Q: How significant was the nine-month rally mentioned in the report?

A: The nine consecutive months of gains totalled 28%, representing a record streak that demonstrates exceptional market momentum and investor confidence.

Q: What sectors are expected to benefit from the construction boom?

A: The construction boom will benefit contractors, building materials suppliers, and related property services including dormitories and co-living facilities, all supported by massive Terminal 5 contracts and other major projects.

Q: How does current market valuation compare to historical averages?

A: Singapore equities trade at 16x forward PE compared to the 25-year historical average of 15x, with potential to reach 19x (1SD valuation) implying a target index of 5,700.

Q: What is driving the semiconductor equipment spending cycle?

A: TSMC’s guidance of significantly higher capital expenditure over three years, with 2026 guidance jumping 31% to US$54 billion, is driving increased semiconductor equipment spending and benefiting the entire supply chain.

Q: Which sectors underperformed during the January rally?

A: Shipyards retreated due to soft container rates and litigation concerns, while REITs underperformed with only modest gains compared to other sectors.

Q: What economic indicators support the positive outlook for Singapore?

A: Industrial production surged 19% year-over-year in Q4 2025, loan growth rose 6.1% supported by consumer loans of 7.2%, and new home sales surged 65% in 2025 to 10,951 units.

Q: What is the target price expectation for Singapore equities?

A: Phillip Securities Research believes the market could reach a target index level of 5,700, representing approximately 15% upside potential based on reaching the 1SD valuation of 19x forward PE.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Paul Chew

Paul has more than 25 years of experience as a fund manager and sell-side analyst. He currently covers sectors such as healthcare, electronics, telecommunications, conglomerates, small caps, and strategy.

He graduated from Monash University and has completed both his Chartered Financial Analyst and Australian CPA programme.

OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth

OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth  Tesla Faces Delivery Challenges as EV Tax Credits Are Removed

Tesla Faces Delivery Challenges as EV Tax Credits Are Removed  Reddit Inc.: Transforming Community Engagement into Revenue Growth

Reddit Inc.: Transforming Community Engagement into Revenue Growth  CNMC Goldmine Holdings: Phillip Securities Maintains BUY Rating Amid Production Expansion

CNMC Goldmine Holdings: Phillip Securities Maintains BUY Rating Amid Production Expansion