Singapore Telecommunications Expands Data Centre Portfolio with Strategic GDC Acquisition February 13, 2026

Major Transaction Details

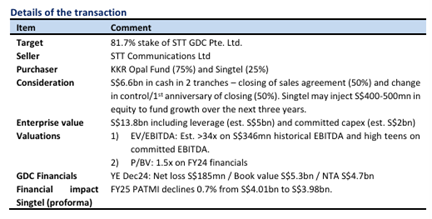

Singapore Telecommunications Ltd (Singtel) has announced a significant expansion of its data centre operations through a strategic partnership with KKR. The two companies will jointly acquire the remaining 81.7% stake in ST Telemedia Global Data Centres (GDC) for S$6.6 billion in cash. Under this arrangement, Singtel will hold a 25% stake while KKR will control 75% of GDC. The transaction is expected to complete in the second half of 2026 and requires no shareholder approval, with Singtel funding its portion through debt and internal cash resources.

Company and Asset Overview

Singapore Telecommunications is a leading telecommunications company that continues to diversify its portfolio beyond traditional telecom services. GDC represents a substantial data centre platform operating 50 facilities across 12 countries with a combined power capacity of 673MW. As of December 2024, GDC maintained a book value of S$5.3 billion, though the company reported a net loss of S$185 million for the year. Despite the loss, GDC generated an estimated EBITDA of S$346 million, indicating operational cash flow generation capabilities.

Investment Merits and Growth Potential

The acquisition is positioned as a growth catalyst for Singtel following the completion of its ST28 strategic plan. The Asia-Pacific data centre market remains structurally underpenetrated, offering substantial long-term expansion opportunities. GDC’s development pipeline includes projects that could potentially triple its existing capacity, providing a clear runway for growth. The expanded footprint across multiple countries provides customers with enhanced geopolitical resilience and reduced redundancy risks.

Additionally, there exists potential for value enhancement through selective listing of Asian assets. The scaling up of Singtel’s data centre operations creates a more robust platform with a pipeline of 1.7GW, which doubles the combined capacity of Singtel’s existing Nxera and GDC operations totaling 819MW.

Financial Impact and Recommendation

The proforma financial impact on Singtel’s net earnings is minimal at less than 1%. While GDC’s current loss-making status means no immediate earnings contribution, the long-term prospects for earnings and cash flow growth from additional data centres remain promising.

Phillip Securities Research maintains an ACCUMULATE recommendation on Singapore Telecommunications, with an unchanged target price of S$5.35. The acquisition is viewed as a strategically positive move that positions the Group for sustained growth beyond its ST28 roadmap.

Key Takeaways

Q: What is the total value of the GDC acquisition and how is ownership structured?

A: Singtel and KKR will jointly acquire the remaining 81.7% stake in GDC for S$6.6 billion in cash. Upon completion, KKR will hold a 75% stake, while Singtel will own the remaining 25%.

Q: When is the transaction expected to complete?

A: The transaction is expected to be completed in the second half of 2026, and does not require shareholder approval.

Q: What is GDC’s current operational scale?

A: GDC operates 50 data centres across 12 countries with a total power capacity of 673MW and a book value of S$5.3 billion as of December 2024.

Q: How did GDC perform financially in 2024?

A: GDC reported a net loss of S$185 million for the year ended December 2024, though it generated an estimated EBITDA of S$346 million.

Q: What growth potential does this acquisition offer?

A: GDC has a development pipeline that could potentially triple its existing capacity. Post-acquisition, the combined pipeline of Singtel’s Nxera and GDC operations totals approximately 1.7GW, more than doubling current installed capacity.

Q: What are the main benefits of this acquisition?

A: The acquisition significantly scales up Singtel’s data centre footprint across multiple countries, offers customers greater geopolitical resilience, reduces redundancy, and positions the company in the underpenetrated Asia-Pacific data centre market.

Q: What is Phillip Securities Research’s recommendation on Singtel?

A: Phillip Securities Research maintains an ACCUMULATE recommendation with an unchanged target price of S$5.35.

Q: What are the potential drawbacks of this deal?

A: Key risks include the lack of immediate earnings contribution due to GDC’s current loss-making position, as well as relatively elevated valuations compared with listed US data centre peers, which trade at approximately 22x EV/EBITDA.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Paul Chew

Paul has more than 25 years of experience as a fund manager and sell-side analyst. He currently covers sectors such as healthcare, electronics, telecommunications, conglomerates, small caps, and strategy.

He graduated from Monash University and has completed both his Chartered Financial Analyst and Australian CPA programme.