Smart Women, Smarter Money: Take Control of Your Finances with SMART Park March 6, 2025

As more women seek financial independence, understanding how to grow and manage personal finances becomes more important than ever. However, one area where many women feel uncertain is investing, especially when they believe that investing is inherently risky and complicated. In reality, it does not have to be. There are simple, low-risk options, like money market funds, that can help you grow your money steadily and confidently.

Understanding Money Market Funds: A Smart Choice for Your Money

A money market fund is a type of mutual fund that pools money from multiple investors to purchase short-term, low-risk investments, like government or corporate bonds or debt securities. It is designed to offer potentially higher returns than traditional savings accounts while avoiding the volatility of the stock market.

While all investments carry some level of risk, money market funds are generally designed to keep it low risk. They are therefore ideal for individuals who want to grow their savings without stressing over volatility from other investment vehicles.

Low Risk, Real Growth

Smart investing, unlike gambling, allows you to grow your money. Options like SMART Park, a money market fund, ensures you can grow wealth safely and effortlessly as it offers potential returns—higher than keeping monies idle—with no hidden fees.

As of 3 March 2025, SMART Park offers an (7 Day) Annualised Return* of:

- 2.5579% P.A. (Singapore Dollar)

- 3.9261% P.A. (US Dollar)

This is higher than what you’d typically earn in a traditional savings account while keeping your risk low.

*Based on the average rate of annualised returns over the past rolling week. Past performance is not necessarily indicative of future performance.

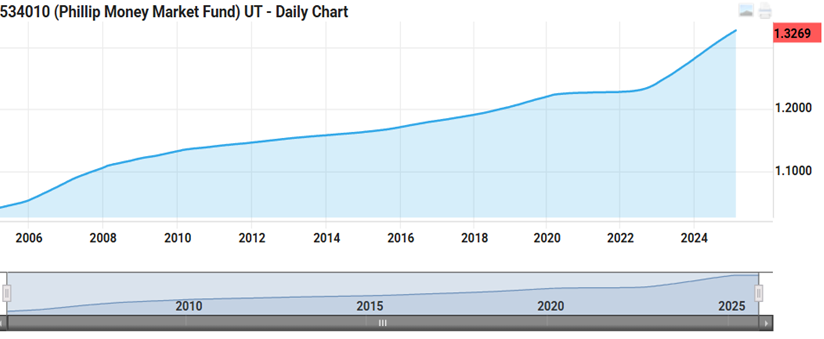

Figure 1. 10 year Returns Table for Phillip MMF

Figure 1. 10 year Returns Table for Phillip MMF

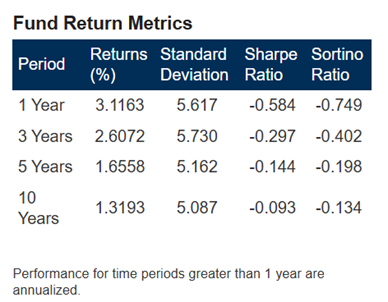

Table 1. Returns Metrics Of Phillip MMF

Table 1. Returns Metrics Of Phillip MMF

Why SMART Park is Perfect for Women

For many women, balancing work, family, and finances can feel like a tightrope walk. With SMART Park, they may enjoy the many benefits of simple investing with peace of mind:

- Steady Returns: Reliable returns without monitoring

- Flexibility: Access cash anytime, penalty-free to manage unexpected costs

- Low Fees: Minimal fees mean more money stays yours

- Convenience: Easy online management

As women pursue financial independence, SMART Park offers a simple, low-risk way to grow wealth—delivering steady returns with flexibility and no hidden fees. This International Women’s Day, check out SMART Park and confidently take charge and “Accelerate action” for your financial future.

Reference:

Contributor:

Steffi Teo

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/steffiteodw

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Steffi Teo

Wealth Manager

Steffi has graduated from National University of Singapore majoring in Economics and has been in the finance industry for over 12 years. With over 3 years in banking and after close to a decade with Phillip Securities, she has served over thousands of clients over the span of her career, ensuring that her clients are optimizing their finances to their needs. As a Certified Financial Planner and a multi licensed holder, she is committed and focused on providing unique solutions for her clients across asset classes, be it for risk management and investments for wealth creation.

Protecting More Than Just Walls: Fire Insurance vs Home Insurance

Protecting More Than Just Walls: Fire Insurance vs Home Insurance  Before the Year Ends: Key Financial Steps for a Confident 2026

Before the Year Ends: Key Financial Steps for a Confident 2026  The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions  Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting