Stepping into 2025 and Reflecting on 2024 January 21, 2025

Introduction

Throughout 2024, key indices across major markets—such as the S&P 500, Dow Jones Industrial Average, FTSE 100, Nikkei 225, and MSCI Emerging Markets Index—demonstrated varying performances influenced by macroeconomic developments, geopolitical tensions, and technological advancements. Notable events, including central bank policies, elections, inflation trends, and corporate earnings reports, have driven volatility and shaped investor sentiment.

As we step into the many potentials of 2025, let us also take a look back on how some of the major equities markets had fared last year, before moving into the various market outlooks for 2025.

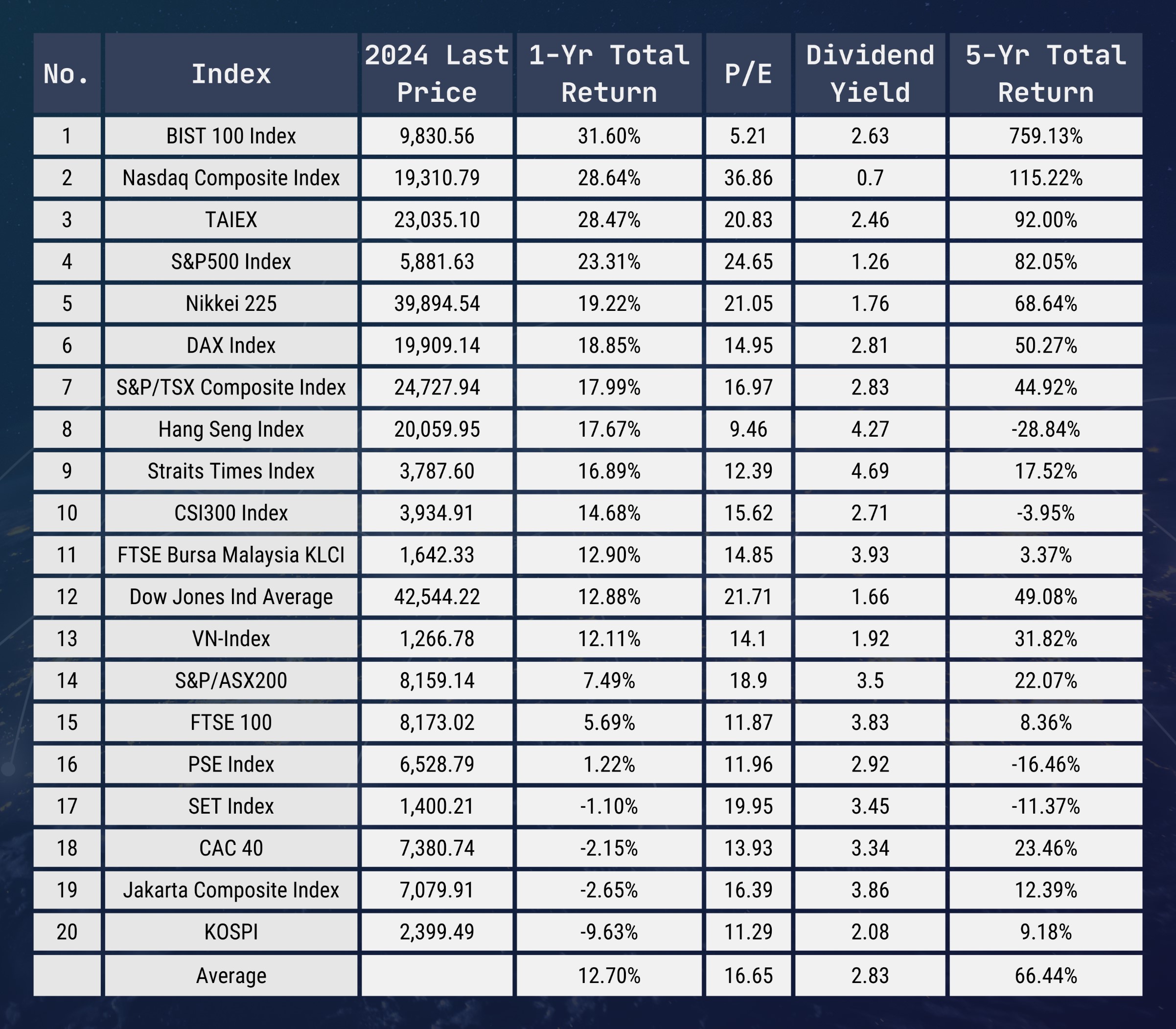

Table of Global Stock Market Indices that are tradable with POEMS

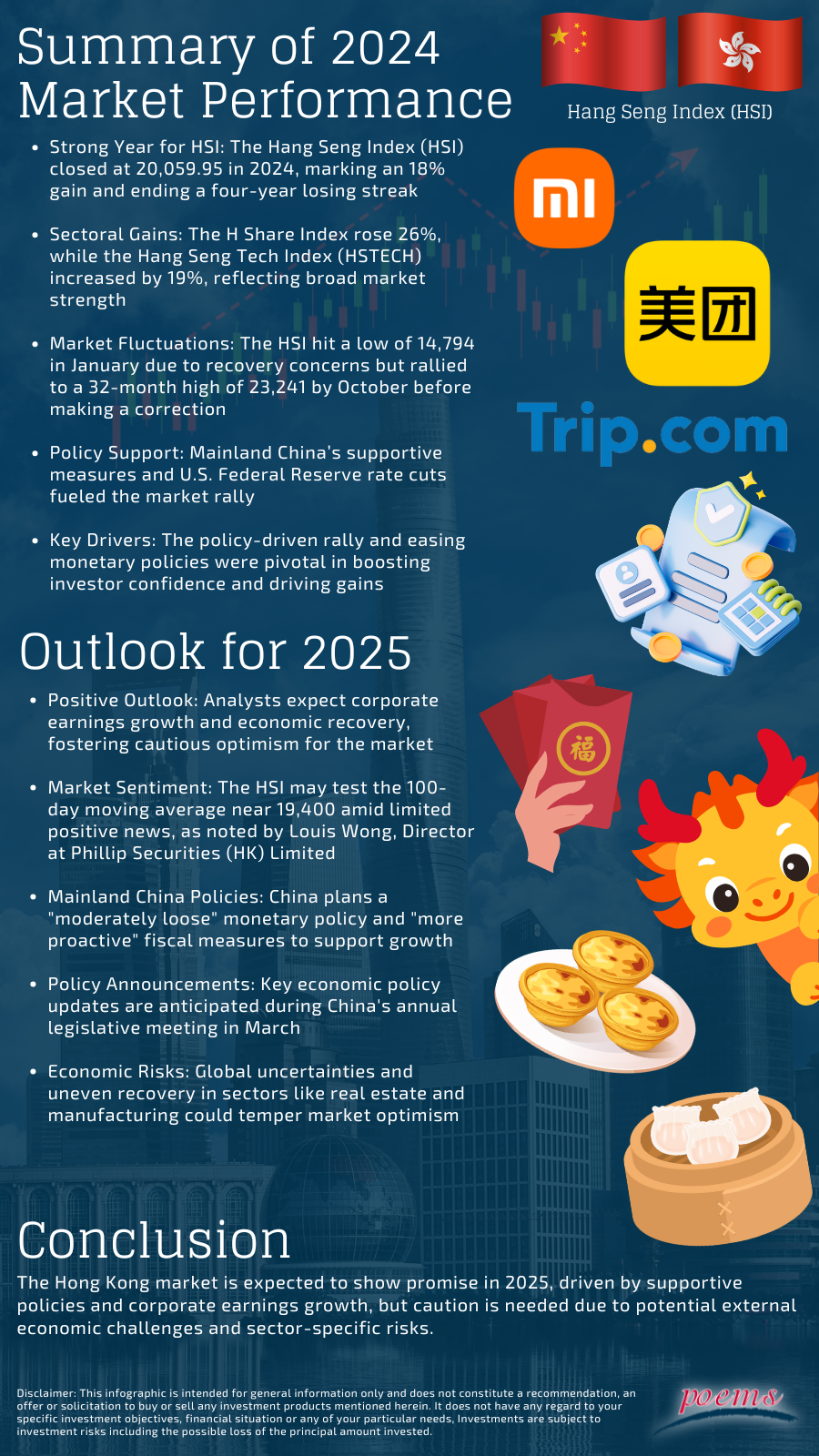

Hong Kong and China Markets (8th and 10th place)

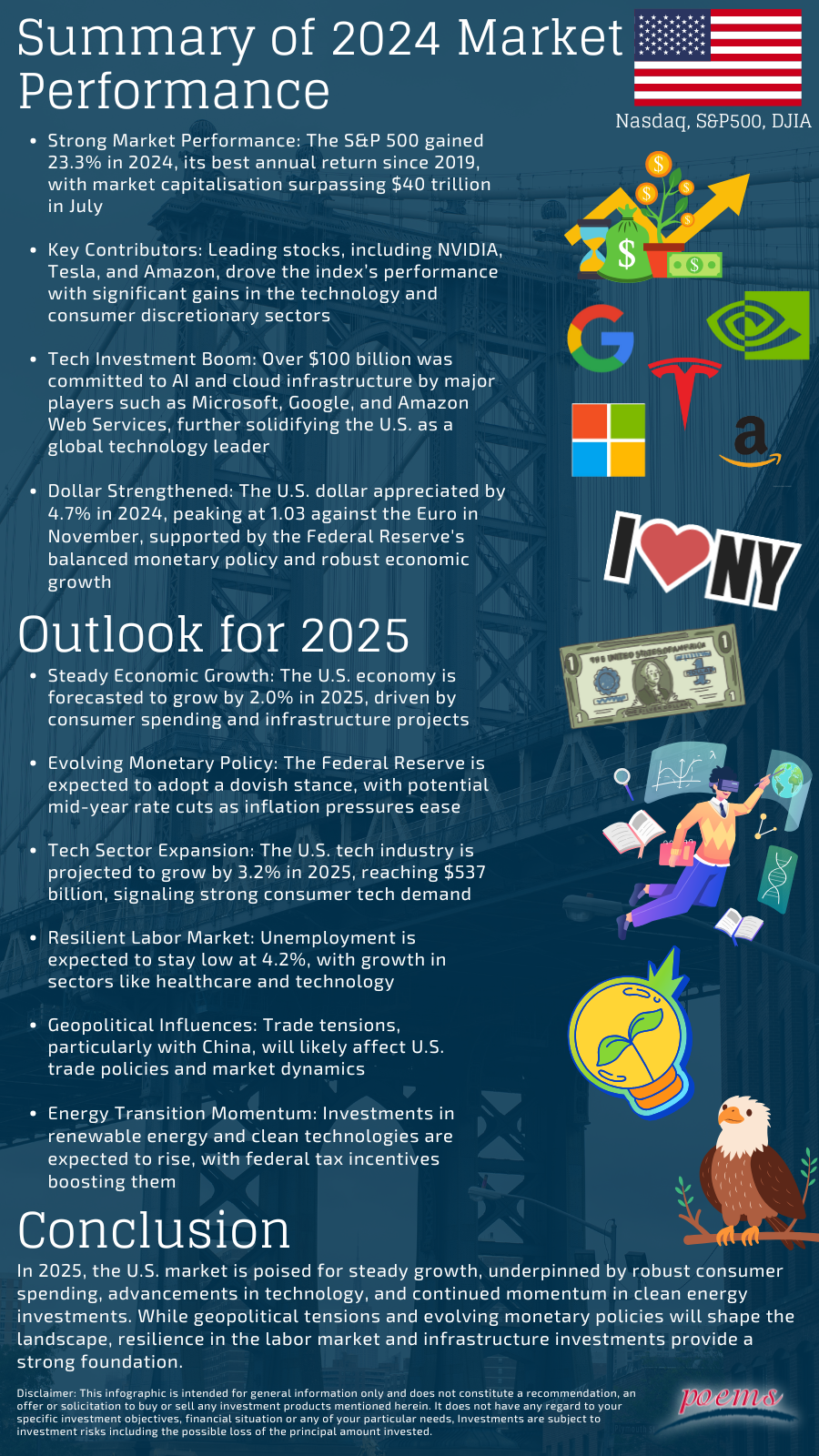

U.S. Markets (2nd, 4th, and 12th place)

Japan Market (5th place)

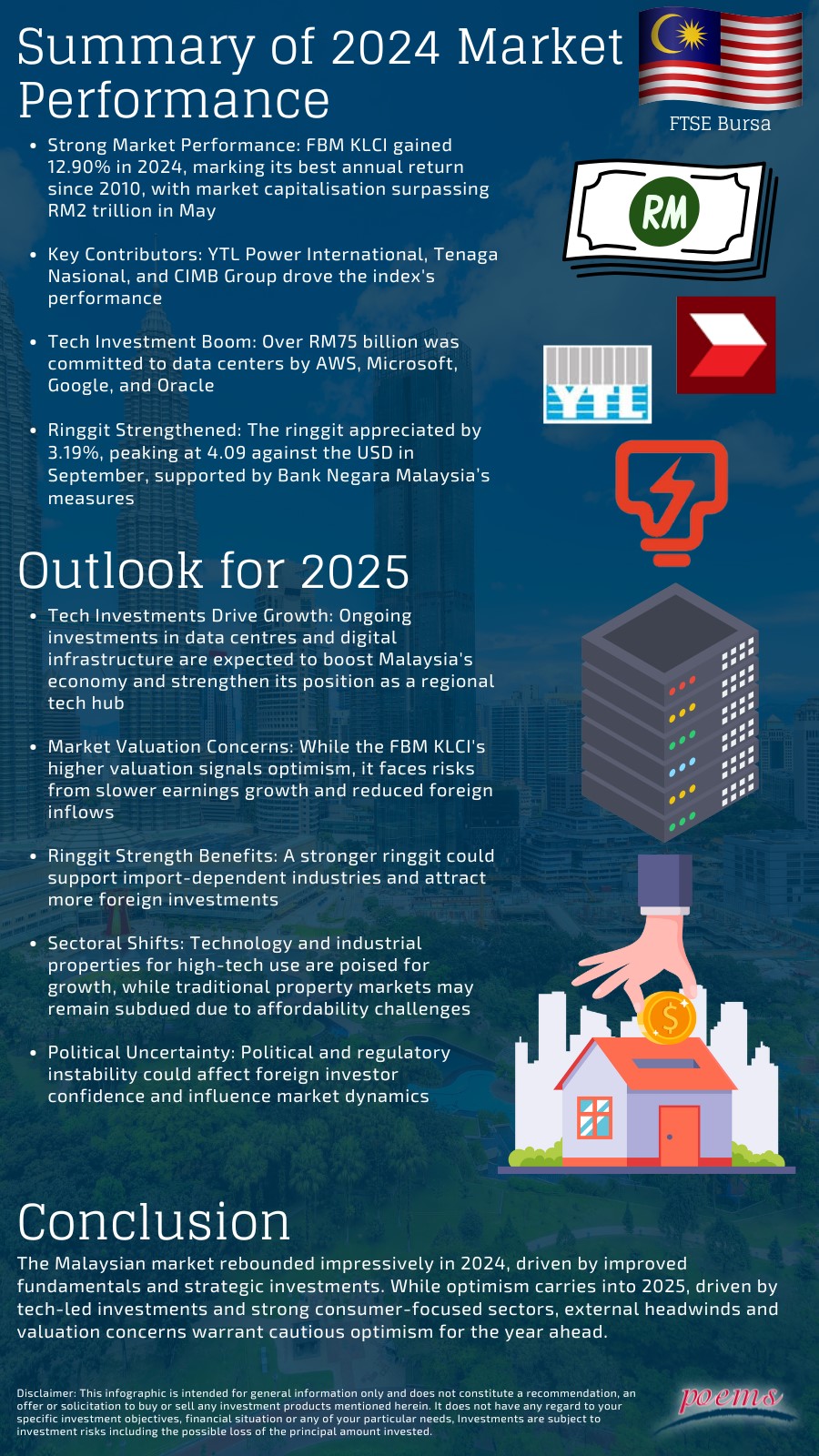

Malaysia Market (11th place)

Australia Market (14th place)

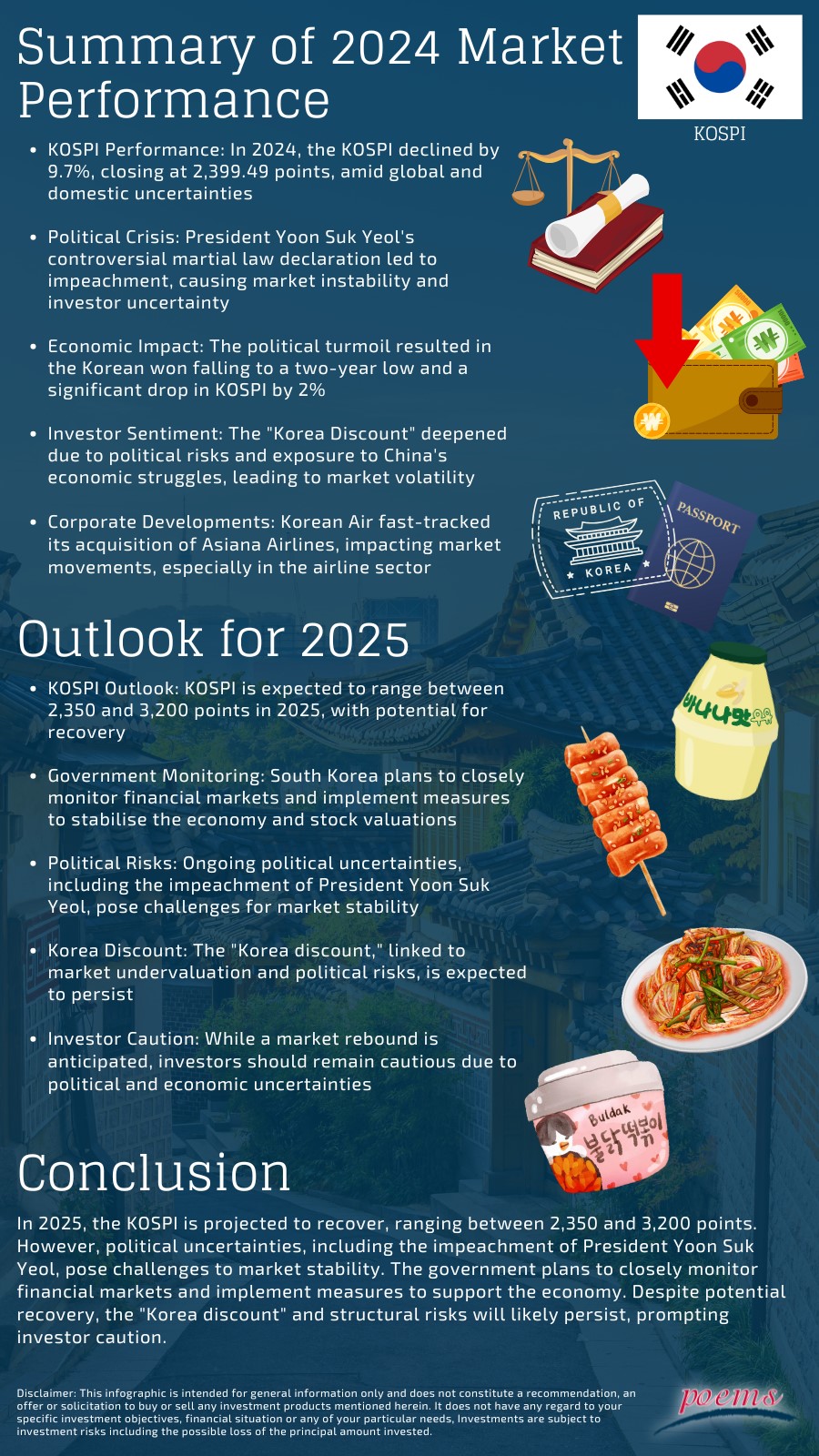

Korea Market (Last place)

Conclusion

In 2025, markets are poised for growth, driven by advancements in technology, green energy, and increased investments in artificial intelligence and sustainable industries. The Asia-Pacific region, particularly China, may see a rebound as fiscal policies support domestic consumption and economic stabilisation.

However, risks persist, including the potential for inflation to remain high, aggressive monetary tightening by central banks, and geopolitical tensions, notably in U.S.-China relations and European conflicts. Earnings volatility in discretionary sectors also warrants caution as global economies adapt to post-pandemic realities.

Investors should focus on diversification, balancing exposure between developed and emerging markets, and consider thematic investments in technology and renewable energy. Staying vigilant about central bank policies and geopolitical developments will be key to navigating volatility while capitalising on emerging opportunities.

Start trading on POEMS! Open a free account here!

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile