The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions November 27, 2025

Recent discussions in Parliament and data from the Financial Industry Disputes Resolution Centre (FiDReC) have shed light on a deeper issue: many Singaporeans struggle to make confident decisions when it comes to choosing financial products — especially more complex ones.

At a glance

- ILP complaints have surged: The Monetary Authority of Singapore (MAS) reported that FIDReC handled 211 investment-linked policy (ILP) complaints in 2024 — a sharp increase from 55 complaints in 2023 1.

- The ILP debate is longstanding: Some say ILPs cost too much and are too complex; others defend their benefits, like tax and estate planning flexibility.

- But the real issue lies elsewhere: many people simply do not have a clear, structured way of evaluating which product suits them.

- A solution exists: The Facilitating Decision-Making (FDM) methodology, first introduced in the Insurance and Financial Practitioners Association of Singapore Journal, offers a practical, client-friendly framework that helps investors and advisers make decisions together in a clearer, more transparent way.

Why ILPs Are Back in the Spotlight

Investment-linked policies (ILPs) have always been debated, but a recent rise in sales, followed by a significant spike in complaints, pushed the topic back into the public spotlight and into Parliament.

The events culminated in a public exchange between two industry voices, financial educator Christopher Tan and adviser Trishita De Mello. Christopher contended that ILPs combine high costs with complex structures, making them unsuitable for most investors. Mello, however, countered that Christopher’s argument unfairly misleads and oversimplifies ILPs.

Both arguments have their own merit. But beneath the debate lies a simpler truth: many investors simply cannot connect what they read in product disclosures with how the product actually works in real life.

Even though ILPs made up only a small portion of all policies sold in 2024, the surge in complaints shows that many Singaporeans still misunderstand what they are buying 2. This is not just a “product problem” — it’s a decision-making problem.

Why Financial Decisions Feel So Hard

Part of the challenge is that today’s suitability checks rely heavily on human judgement. They help rule out clearly unsuitable products, but they do not give people a structured way to compare options.

This means:

- advisers try their best to guide clients using experience and intuition

- clients often struggle to understand trade-offs between one plan and another

- both sides may walk away with different interpretations of the same explanation

For example:

It’s easy to say term insurance is not suitable for funding a child’s university fees. But if a client asks, “Should I pick an endowment plan? An ILP? Or invest separately?”, there’s no standard, easy-to-follow way to examine the differences.

As products get more complex, so do misunderstandings 3.

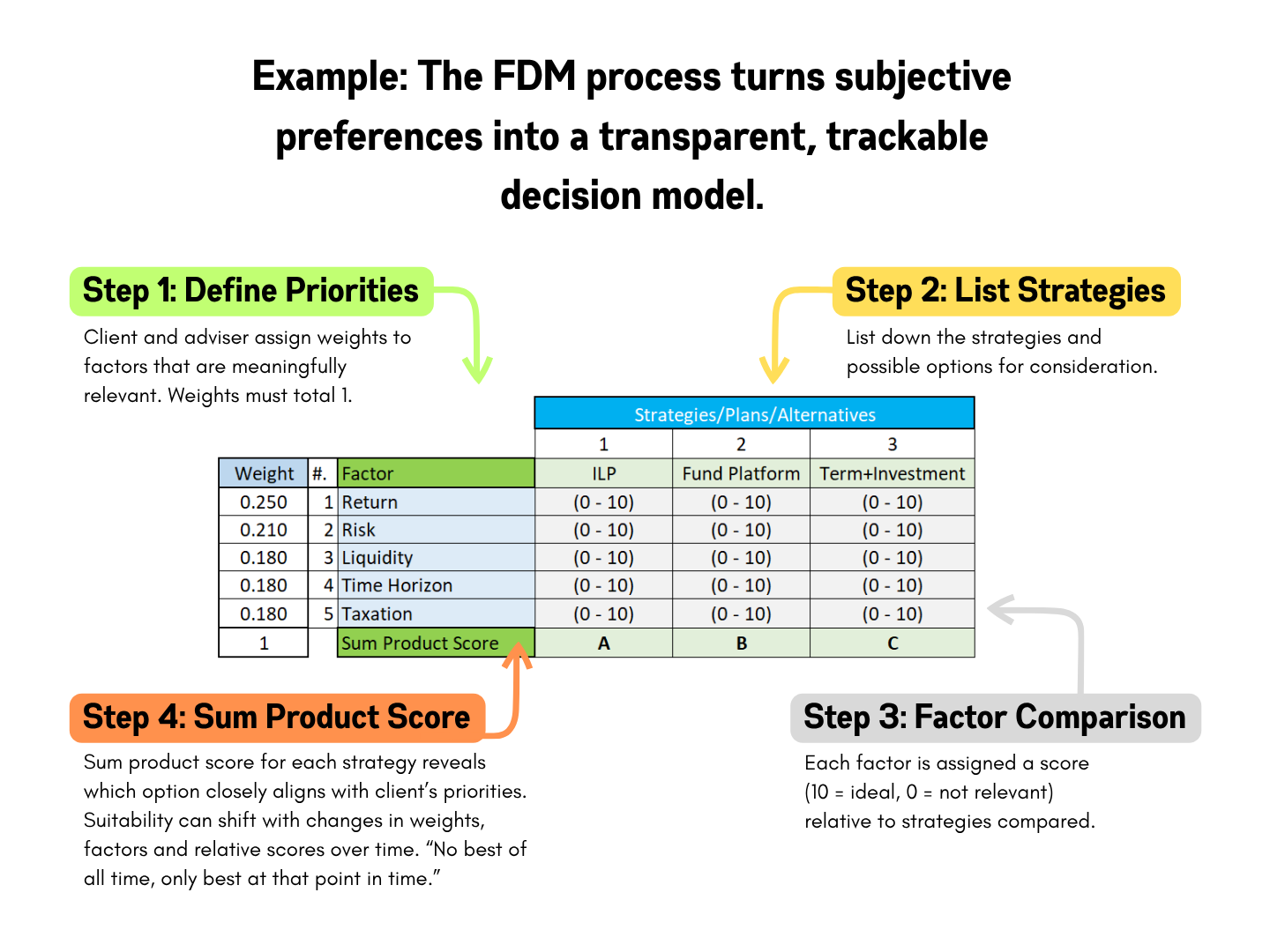

A Framework for Clarity: FDM

This is where the Facilitating Decision-Making (FDM) methodology comes in. FDM provides the structure that many clients and advisers have been missing.

FDM takes what good advisers already do in their heads — comparing factors, weighing trade-offs, and explaining choices — and turns it into a transparent process that clients can clearly follow.

The methodology involves:

- identifying meaningful and relevant factors such as potential returns, risk, liquidity, tax implications, legal considerations and client specific requirement such as ESG or Shariah compliance

- assigning weights to each factor, forcing both client and financial adviser to prioritise trade-offs

- scoring potential strategies such as ILPs, term-plus-investment combinations, or pure fund platforms — on the identified factors on a scale of 0 to 10, with financial advisers providing a rationale for each score

While the ratings may be inherently subjective, each one can be accompanied by a brief explanation from the financial adviser outlining the rationale. The sum product scores are then tallied to see how closely each option aligns with what the client actually values.

This transparent and reviewable framework fosters trust between both parties, invites challenges or clarification, and provides clients with meaningful co-ownership of the process.

What Financial Planning Often Misses

FDM also acknowledges that the best strategy can change over time. Market shifts and evolving client priorities mean that product suitability is contextual, hence there is no ‘best plan of all time’; only the ‘best at that point in time’.

With a structured process like FDM, clients are not tied to a one-time decision. Instead, planning becomes an ongoing partnership where decisions can be reviewed and updated using the same transparent framework.

A Call for Clearer Conversations

The recent scrutiny around ILPs is not just about ILPs themselves. It reflects a deeper industry challenge: helping clients understand how recommendations are made.

A structured approach like FDM can elevate industry clarity by ensuring recommendations can be explained, reviewed, and improved over time.

It empowers both advisers and clients to look beyond product features and focus on what truly matters — clarity, confidence, and informed decision-making.

The Takeaway: The Best Plan Is the One You Understand

Financial planning does not need to feel intimidating.

When both adviser and client follow a clear framework, decisions become easier, clearer, and more aligned with real-life goals.

Products may change. Markets may change. Life will certainly change.

But with a structured approach to decision-making, you can always find the “best plan for you — at this point in time”.

Contributor:

Isaac Fang, CFA

Portfolio Manager (Dual Licence)

Phillip Securities Pte Ltd (A member of PhillipCapital)

http://bit.ly/TTPisaac

References:

- [1] https://www.mas.gov.sg/news/parliamentary-replies/2025/written-reply-to-parliamentary-question-on-investment-linked-policies

- [2] https://www.fidrec.com.sg/_entity/annotation/7aae5aed-95a7-ef11-b8e9-6045bd22652a

- [3] https://www.straitstimes.com/business/concerns-raised-over-investment-linked-plans-as-demand-for-them-goes-up-in-singapore

- [4] https://www.businesstimes.com.sg/opinion-features/investment-linked-insurance-products-complexity-label-long-time-coming

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Isaac Fang, CFA

Portfolio Manager (Dual License)

Phillip Securities Pte Ltd (A member of PhillipCapital)

Isaac has been in the financial services industry since 2001. Over the years, he has acquired CFP, ChFC and CFA certifications. Passionate about financial literacy for the masses, he has conducted courses at People’s Association Community Clubs and delivered presentations at SGX events. He has also trained practitioners in the CFP programme and contributed articles to IFPAS’ Tuesday Times.

In recognition of his work, he was awarded Top TR Securities Wrap for 2016 and 2017; Top TR IOP Phillip SING Inc ETF in 2018; and Top Performer Self-Trading Futures in 2019. He was also a finalist in FPAS’ Financial Planning Awards 2020.

Isaac adds value to his clients by adopting a design-driven innovation approach in his financial advisory services.

Protecting More Than Just Walls: Fire Insurance vs Home Insurance

Protecting More Than Just Walls: Fire Insurance vs Home Insurance  Before the Year Ends: Key Financial Steps for a Confident 2026

Before the Year Ends: Key Financial Steps for a Confident 2026  Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting  Why Idle Cash Attracts Scammers & How to Beat Them

Why Idle Cash Attracts Scammers & How to Beat Them