Unveiling Opportunity: Exploring the Potential of European Equities February 16, 2026

European markets have long been overshadowed by their U.S. counterparts, particularly the S&P 500, which commands global investor attention. However, this underappreciation masks the unique opportunities that European indices offer. Despite challenges such as geopolitical tensions and slower growth forecasts, European markets present compelling prospects for traders and investors. And importantly, 2025 was a reminder that “U.S. always leads” is not a permanent rule – major European benchmarks like the DAX outperformed the S&P 500 on the year, reinforcing the case for keeping Europe on the radar.

To fully appreciate the potential of European equities, it’s essential to understand how to gain exposure to these markets, explore their key indices, and compare them to their U.S. counterparts like the S&P 500. Along the way, we’ll uncover why these indices deserve a place in your trading arsenal.

Gaining Exposure to European Markets Through Indices

One of the most efficient ways to access European equities broadly is through index trading. Unlike individual stocks, which require extensive research and carry higher idiosyncratic risk, indices offer diversified access to entire sectors or regions. For those interested in European markets, three key indices stand out: Euro Stoxx 50, CAC 40, and the DAX. These indices represent the largest and most liquid companies in their respective regions, making them ideal for traders seeking exposure to European equities.

An Overview of Key European Indices

- Euro Stoxx 50: Often referred to as the “blue-chip” index of Europe, the Euro Stoxx 50 comprises the 50 largest and most liquid companies across the Eurozone. Key constituents include multinational giants like ASML Holding (semiconductors), LVMH (luxury goods), and SAP (software). This index serves as a barometer for the health of the Eurozone economy.

- CAC 40: Representing France’s top-performing companies, the CAC 40 tracks the performance of 40 leading firms listed on Euronext Paris. Notable constituents include LVMH, Airbus, and BNP Paribas. The index is heavily influenced by the French economy, with a strong focus on luxury goods, energy, and financial services.

- DAX: Germany’s flagship index, the DAX, comprises of the 40 largest companies traded on the Frankfurt Stock Exchange. Heavyweights like Volkswagen, SAP, and Bayer dominate this index. As Europe’s largest economy, Germany’s industrial prowess heavily influences the DAX’s movements.

How Do These Indices Compare to the S&P 500?

Performance Year-over-Year (YoY)

Over the past five years, the S&P 500 has often outperformed its European peers – particularly during U.S.-led tech-driven rallies.

However, 2025 was a notable exception: European performance strengthened meaningfully, with Germany’s DAX and the Euro Stoxx 50 outperforming the S&P 500 on a full-year basis.

According to latest data:

- S&P 500: The S&P 500 delivered a calendar-year 2025 total return of 17.88%.1

(For reference, S&P 500 price return in 2025 was 16.39%2 – the difference is dividends.

Over a longer horizon, the S&P 500’s annualized total return over the last 10 years (2016-2025) works out to roughly ~14-15%3 per year (CAGR computed from yearly total returns). - Euro Stoxx 50:The Eurozone’s Euro Stoxx 50 benchmark gained 22.1%4in 2025.

- CAC 40: France’s CAC 40 logged roughly a 10.4%5 gain in 2025, lagging other major European markets amid political turbulence and fiscal-debt concerns.

- DAX:Germany’s benchmark DAX rose 23.0%5 in 2025 – its best year since 2019, supported by policy support themes and a broader rotation into Europe.

Source: tradingview.com

Source: tradingview.com

Volatility Metrics

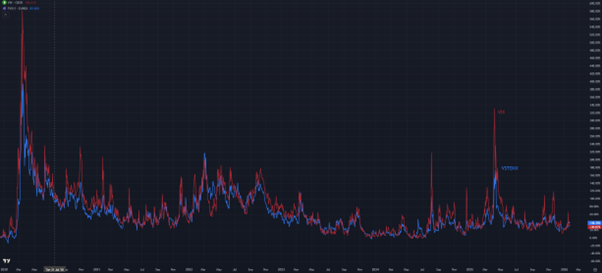

Volatility is often best measured through implied volatility – the market’s priced-in expectation of how much an index may move in the near term. VIX is the benchmark for U.S. equities, derived from S&P 500 option prices. In Europe, the closest equivalent is VSTOXX, which reflects implied volatility on the Euro Stoxx 50, also sourced from the options market.

Over the past five years, the most striking feature is high co-movement: major spikes and cooldowns broadly align, reflecting shared global “risk-on/risk-off” regimes. At the same time, the chart shows that volatility leadership rotates – there are stretches where U.S. implied volatility (VIX) prices higher than Europe, and periods where the gap narrows.

In the chart below, the U.S. volatility series is represented by the VIX, while the European volatility series is represented using FVS1 (Eurex), a tradable VSTOXX futures contract.

Source: tradingview.com

Source: tradingview.com

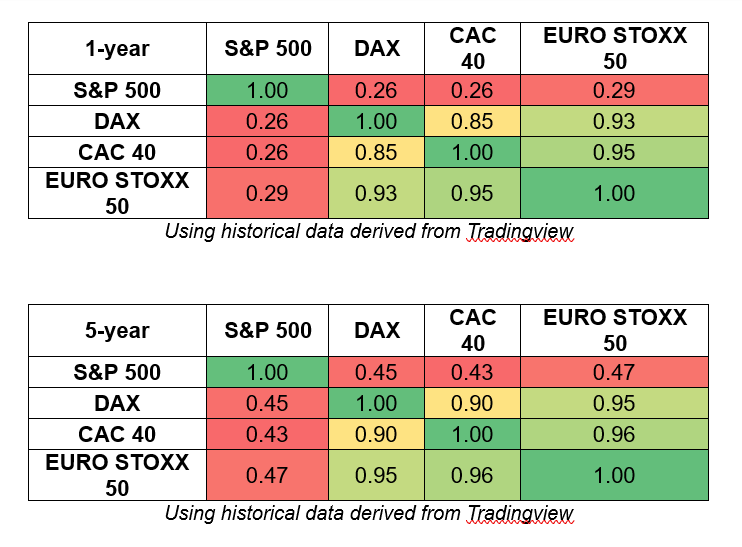

Correlation Analysis

Provided below are the correlations between the S&P 500 and the three European Indices (Euro Stoxx 50, CAC 40, and DAX) over 1-year and 5-year timeframes:

Correlation is a statistical measure that describes how two stock indices move in relation to each other. It ranges from -1 to +1:

- +1: Perfect positive correlation (the two indices move in the same direction 100% of the time)

- 0: No correlation (the movements of the two indices are completely independent)

- -1: Perfect negative correlation (the two indices move in opposite directions 100% of the time)

Leveraging Correlation Matrices for Strategic Trading

Understanding correlation dynamics when trading global indices can unlock powerful strategies for risk management, trade timing, and identifying price divergences. Below are three key strategies traders can apply:

1. Pairs Trading: Profiting from Price Divergences

Pairs trading involves taking simultaneous long and short positions in two correlated assets, betting that their relative price movements will revert to historical norms. The matrix highlights strong correlations between several European indices:

- Euro Stoxx 50 & CAC 40 (1-year: 0.95, 5-year: 0.96)

- Euro Stoxx 50 & DAX (1-year: 0.93, 5-year: 0.95)

In these high-correlation pairs, significant price deviations can present trading opportunities. For example, if the Euro Stoxx 50 rallies while the CAC 40 lags, a trader might short the outperforming index and go long on the underperforming one, expecting the spread to close as correlation reverts prices to the mean.

2. Hedging Strategies: Mitigating Downside Risk

Traders holding long positions in a particular index can hedge against potential downside risk by shorting a correlated index.

The European indices have historically been highly correlated with each other:

- CAC 40 & DAX (1-year: 0.85, 5-year: 0.90)

For instance, if a trader holds a long CAC 40 position but anticipates short-term volatility, shorting the DAX can offset potential losses, albeit imperfectly.

3. Expanding Entry Opportunities: Trading Low-Correlation Pairs

Interestingly, lower correlations can also be advantageous, as they allow traders to capture independent price movements. When two indices have weak correlations, it increases the chance that both long and short trades can succeed independently, rather than offsetting each other:

- S&P 500 & DAX (1-year: 0.26, 5-year: 0.45)

- S&P 500 & Euro Stoxx 50 (1-year: 0.29, 5-year: 0.47)

For example, a trader could go long on the S&P 500 and short the DAX, without the positions cancelling each other out. Success would depend more on each index’s individual price action, creating dual profit potential rather than a zero-sum outcome.

Advantages of Trading European Indices

Trading European indices offers several distinct advantages:

1. Active European Trading Hours

European indices are most active during European trading hours (3:00 PM to 11:30 PM SGT), a period when US markets tend to be less volatile. This creates opportunities for traders to capitalise on price movements and news-driven events during these hours.

2. Leveraging Diverse Correlations for Strategic Flexibility

The varied correlation levels between European indices and the S&P 500 provide traders with multiple strategic opportunities:

- high-correlation pairs (such as Euro Stoxx 50 & CAC 40) enable pairs trading and hedging strategies, helping traders mitigate risks by balancing long and short positions.

- low-correlation pairs (such as S&P 500 & FTSE MIB) allow traders to capture independent price movements, increasing the potential for profiting from both long and short positions simultaneously.

3. Increased Volatility

The higher volatility in European indices, compared to the S&P 500, offers more frequent trading opportunities for those employing short-term strategies. Higher volatility means larger price swings, which can translate into greater profit potential for active traders who time their entries and exits effectively.

Conclusion: Why European Indices Belong in Your Trading Arsenal

Incorporating European indices into your trading strategy could enhance potential returns through increased volatility, opportunities arising from varying market correlations and exposure to distinct economic events happening in the European markets.

Whether you’re capitalising on early-morning price action or executing pairs trades, understanding the intricacies and nuances of these European indices, traders can potentially unlock additional avenues for profit. Don’t let the spotlight on US markets overshadow the untapped potential of European indices.

Trade European Index CFDs on POEMS

Unlock the potential of European equity markets with index CFDs on POEMS. Whether you’re looking to diversify your portfolio, capitalise on market volatility, or hedge against US market movements, European index CFDs offer a dynamic way to trade.

With POEMS, you can gain exposure to key European indices like the Euro Stoxx 50, CAC 40 and DAX through our European index CFDs—all with competitive trading conditions and a seamless trading experience.

Start trading European Index CFDs on POEMS today and explore new market opportunities.

For enquiries, please email us at cfd@phillip.com.sg.

References:

- [1] https://ycharts.com/indicators/sp_500_total_return_annual

- [2] https://www.slickcharts.com/sp500/returns

- [3] https://www.macrotrends.net/2526/sp-500-historical-annual-returns

- [4] https://stoxx.com/stoxx-dax-etfs-get-record-inflows-as-sentiment-on-european-equities-improves/

- [5] https://www.reuters.com/markets/europe/european-shares-set-best-year-since-2021-2025-12-31/

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Promotion Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Lester Chua

Dealer

Lester graduated from Singapore Institute of Management (University of London) with a bachelor’s degree in Account & Finance (FCH). He possesses over 9 years of trading and investing experience with in-depth knowledge of stocks and various investment products. In his free time, he researches on value investing and trading concepts.

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?  Salesforce: A Steady Tech Leader in Volatile Times

Salesforce: A Steady Tech Leader in Volatile Times