Weekly Updates 14/7/25 – 18/7/25 July 15, 2025

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (07 Jul – 11 Jul 2025)

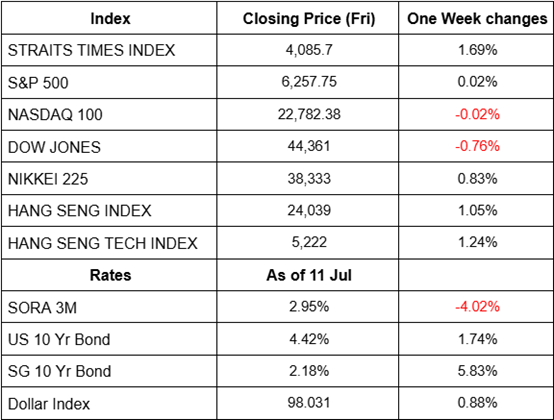

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week the US stock market posted mixed results with the S&P 500 rising by only 0.02% while the Nasdaq slipping 0.02% and the DJI falling by 0.76%. Despite the pullback the US stock market has been hovering near record highs supported by the strength in energy and industrial sectors which helped offset concerns over newly announced tariffs on more than 20 countries. The ‘One Big Beautiful Act’ signed into law on 4th July has extended key tax cuts and introduced new deductions which boosted investor sentiment despite the long-term deficit concerns.

Updates for the week (14 July – 18 July 2025)

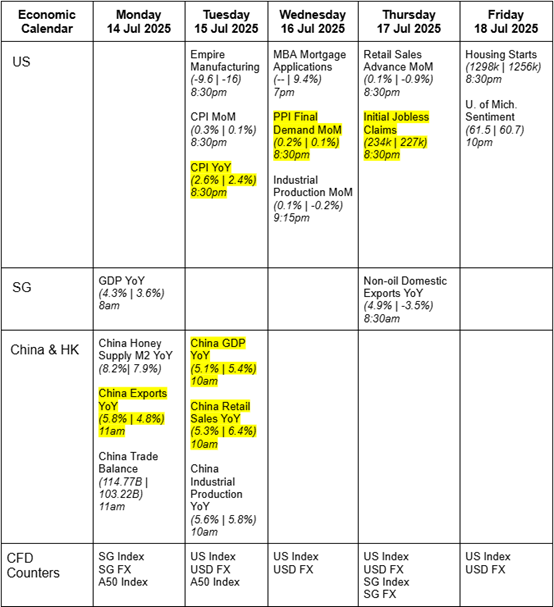

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s upcoming macro-economic news revolves around US CPI data and China Trade data, GDP Retail Sales and Industrial production. Market analysts expect US CPI data to slightly increase from 2.4% to 2.6% for CPI YoY. While China had some upside surprises in China Exports, with analysts expecting 5% increase while results showed an increase of 5.8% in exports. Next item to look out for will be China GDP YoY on Tuesday, which analysts expect an increase of 5.1%.

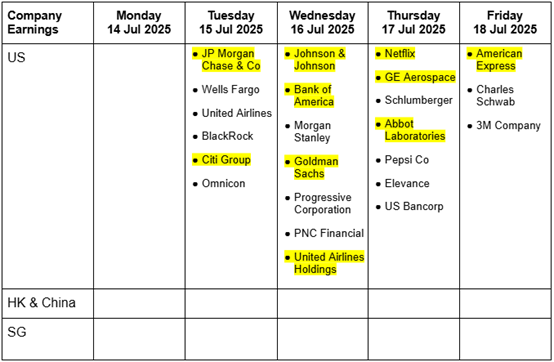

This week, the US earnings season kicked off with major financial institutions including JP Morgan, Citi Group, Goldman Sachs and Bank of American. These institutions will offer investors the insights of its lending margins and trading revenue, it will most likely set the tone for other financial institutions for the season. Healthcare on the other hand like Johnson & Johnson and Abbott Laboratories is revealing trends in pharma and medical devices. United Airlines and GE Aerospace will highlight the trend in travel and industrial momentum. Also, investors will look at Netflix’s results for its streaming growth while American express will reveal consumer spending data. All these reports will shape investor sentiment around banking profitability, consumer resilience and tech demand heading into Q3 2025.

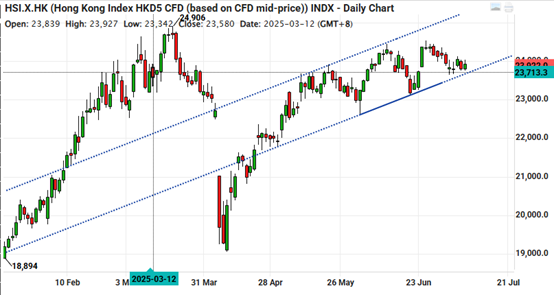

Hong Kong Index (HSI): Uptrend Channel Trade By Jun Kuan Kwong

Key Entry Price Pivot(s)

- 23,700

Recommended Trade

- Long at level 23,700

- Take profit at 24,900

- Stop loss at 23,110

Alternative Case

- Short at level 23,600

- Take profit at 22,600

- Stop loss at 24,100

Remarks

- The daily chart of the Hong Kong Index (HSI) shows that price is moving within an uptrend channel.

- Currently, the price is approaching the channel support.

- Traders may consider a long position if a strong bullish candlestick forms at the channel support, indicating a potential rejection and suggesting a move toward the channel resistance near 24,900.

- Alternatively, if a strong bearish candlestick breaks and closes below the uptrend channel, it signals that the uptrend may be invalidated. In such a case, traders may consider a short position below the bearish bar, targeting lower levels around 22,600.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.