Weekly Updates 16/10/23 – 20/10/23 October 16, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (09 Oct 2023 – 13 Oct 2023)

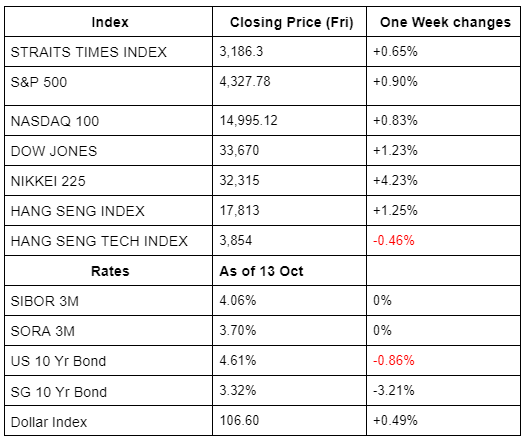

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week’s market movement revolved around oil prices, interest rates and the dollar. Due to the geopolitical shock from the Israel-Gaza war, it triggered the markets to flee towards Treasury bonds. 10 Years US Treasury bond yield rose 8% for the past 1 month to 4.88% and it dropped to 4.66%, investors believe that the yields has reached its peak. This helped to ease some of the pressure built up in equities from rising interest rates and contributed to the equity markets rising modestly last week. Also, the Fed’s tone is changing to be more dovish, instead of hiking interest rates, they turned to how long to hold the policy at restrictive rates.

Updates for the week (16 Oct 2023 – 20 Oct 2023)

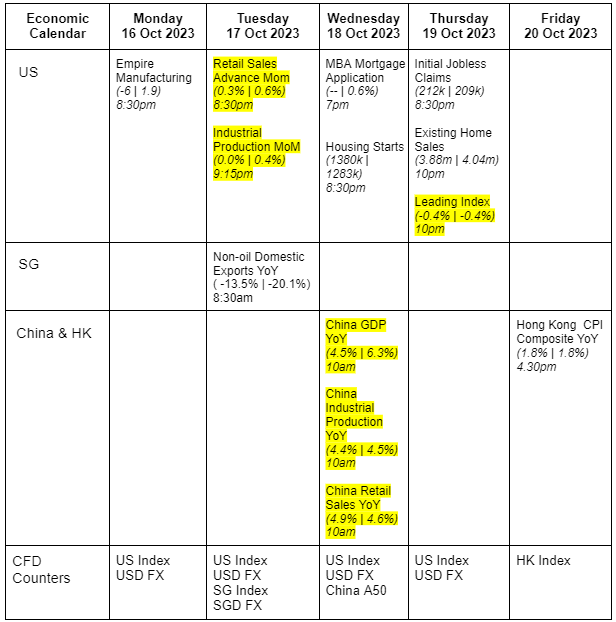

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s macro news mainly focuses on GDP, Industrial Production and Retail Sales data from China. All analyst’s eyes are on the world’s second biggest economy posting GDP data to determine the current economic conditions in China and forward guidance. With both Industrial production and Retail sales in China expected to increase YoY compared to prior year, analysts are expecting a stabilization even though China’s property sector has been hit hard due to the collapse of Evergrande Group.

This week’s corporate earnings are mainly from the US, from retail investor’s favorite Tesla to Netflix and banking and financial sector companies like Goldman, BOA, IB, American Express, Charles Schwab and more. With a wide range of banking and financial companies ranging from Investment banking to brokerage to regional banks and even credit card payment, forward guidance from these earning releases will greatly shape market participant’s forecasts on upcoming quarters. Furthermore, the earning release of Tesla will lead or sink the Electronic Vehicle basket of stocks. Investors exposed to EV counters should pay attention to Tesla’s earning release and adopt adequate risk management if needed.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

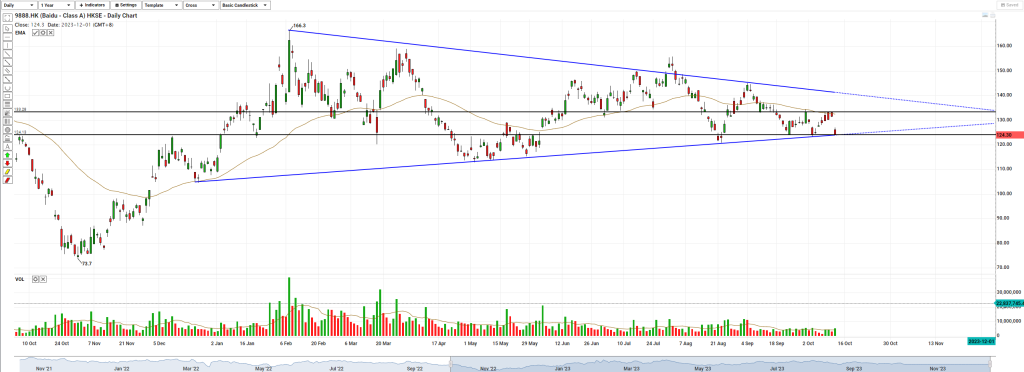

Baidu Inc (HK.9888): Range Play – by Sean Ng

Key Entry Price Pivot(s):

- $124.10

Recommended Trade:

- Long above $124.10

- Take profit 1 at $133.20

- Take profit 2 at $139.00

- Stop loss at $120.00

Alternative Case:

- Short below $120

- Take Profit at $112.80

- Stop loss at $125

Remarks:

- Baidu has been forming a wedge since about December 2022

- It has recently been consolidating in a tighter range between $124.1 and $133.2, with a strong support and resistance respectively on either side

- The bottom of the wedge and the support level of the consolidation have lined up recently

- 50-day exponential moving average has been flattening out, indicating that the consolidation is likely to continue for some time

- This presents a potential long trading opportunity to the other end of the range

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.