Weekly Updates 17/3/25 – 21/3/25 March 17, 2025

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (10 Mar – 14 Mar 2025)

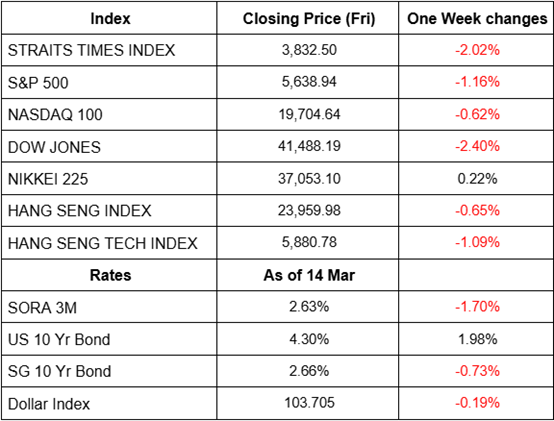

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week’s market movements revolve around the volatile trading sessions of the major US indices like the S&P500, Dow Jones and Nasdaq 100. With Tesla share price plunging ~15% at the start of the week only to slowly crawl back ending the week at -1%. Hostility towards President Donald Trump and his tariffs are at an all time high with Canada and Mexico threatening to retaliate. With ever changing tariff direction from the US, sending global markets in to an era of uncertainty and pushing US allies to seek leadership among themselves.

Updates for the week (17 Mar – 21 Mar 2025)

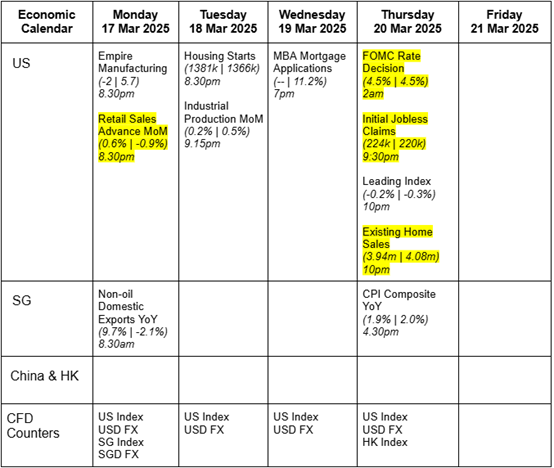

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week ahead mainly focuses on the US FOMC rate decision. It is widely expected that the rates will be held steadily this time round at 4.5%. Retail sales are expected tore bound at 0.6% after January’s harsh weather in the US. Consumers are focused on purchasing general merchandise goods whereas spending on alcohol or luxury goods has decreased. The initial jobless claim is set to rise slightly due to layoffs of Federal workers while in the future it is set to be much higher as many of them are in their probation period. Looking at Existing Home Sales, it will most likely decline further in Feb as mortgage rates are still high for a lot of home buyers which puts them off from buying.

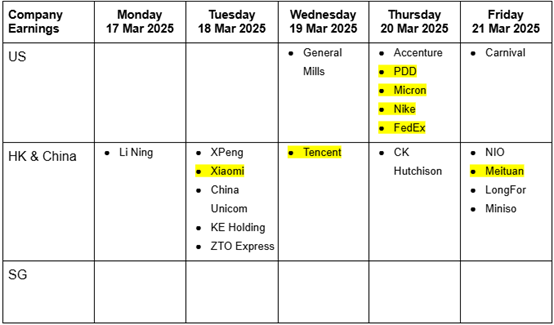

The major earnings releases for this week focus on Micron, Nike and FedEx from the US, along with mega heavy weights from China like Tencent, Xiaomi, Meituan and PDD. Nike has been struggling for the past year with disappointing sales and profit margins, with a 1 Year stock price drop of -27.43%. Analysts and market participants are eager to see the new CEO’s plans to pivot Nike back to their strengths and stop the bleeding of market share.

XiaoMi is the biggest gainer among China mega caps with a 1 Year stock price gain of 260.44%, market participants are eager to see how the company executes and if the new valuation is warranted. Expectations are high and there is still room for both upside and downside surprises.

EUR/USD: Price Rebalancing by Tan Peng Chien

Key Entry Price Pivot(s)

- 1.09402

Recommended Trade

- Short at 1.08507

- Stop Loss: 1.09402

- Take Profit: 1.06304

Alternative Case

- Long at 1.09402

- Stop Loss: 1.08407

- Take Profit: 1.11145

Remarks

- As prices adjust following the EUR/USD rally two weeks ago, we may see some weakness as the market rebalances inefficiencies after accumulating liquidity from the upward move.

- A possible trade setup is to short the pair at 1.08507, just below last Friday’s open, with a stop loss at the pivot point of 1.09402 and a target at the imbalance low of 1.06304.

- Alternatively, if the price surpasses the pivot point at 1.09402, we could adopt along position from there, setting a stop loss at 1.08407 and aiming for previous highs around 1.11145.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.