Weekly Updates 18/11/24 – 22/11/24 November 18, 2024

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

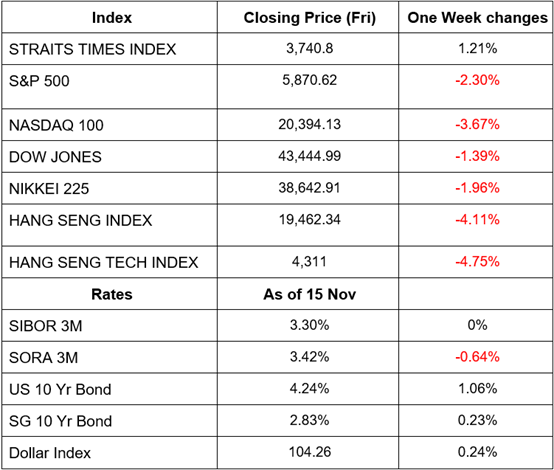

Recap for last week (11 Nov – 15 Nov 2024)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week many stock markets gave back some of the robust post-election gains where the S&P 500 was down by 2.3%, Nasdaq is down by 3.67% while DJI is down by 1.39%. Traders increased bets that the Fed will not change its rates in the Dec 2024 meeting as this view is reinforced by last Friday’s economic data showing Retail Sales rose slightly more than expected in Oct 2024, where most data released on last Wednesday and Thursday shows sticky inflation. CPI data for the month Oct 2024 was in line with expectations where inflation will continue with a downward trend. There is potential for inflation to gradually approach the Fed’s target in the coming months and stabilize between 2-3% range over the long term. The uncertainty around policy regarding tariffs has instilled a sense of caution in the markets even though tariffs may act as a tax on consumers, historical trends indicate that targeted tariffs rarely serve as long-term drivers of inflation.

Updates for the week (18 Nov – 22 Nov 2024)

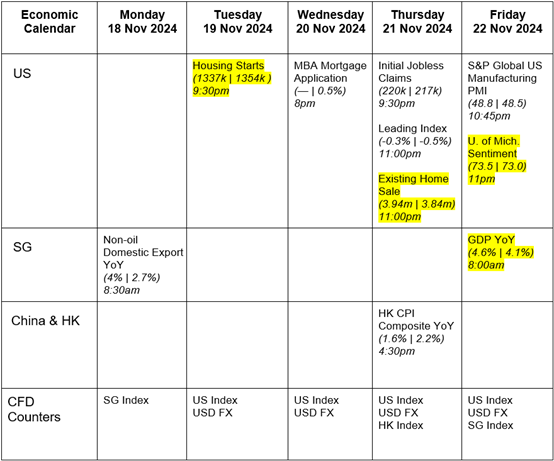

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week ahead mainly focuses on housing data and sentiment data coming out of the US. Housing Starts is expected to drop to 1337k from 1354k, while existing home sales are expected to increase to 3.94m from 3.84m. University of Michigan sentiment data is expected to increase to 73.5 from 73. Singapore GDP YoY is expected to increase to 4.6% from 4.1%, showing strong growth and economy.

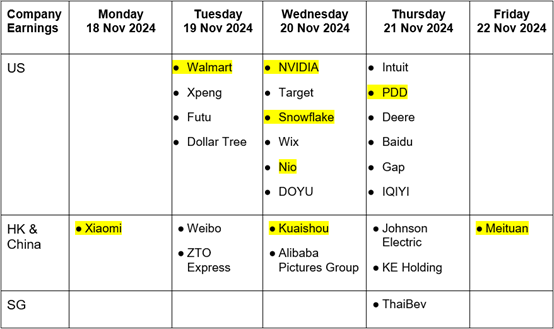

Earnings releases for this week encompasses mostly in the US market. All eyes will be on Nvidia where it is set to report its Q3 earnings on Wednesday as AI fevers continue to power Wall Street. Nvidia share price has rocketed 189% YTD outpacing all of its company’s chip rivals like AMD and Intel. Nvidia is expected to post a $0.74 EPS with a revenue of $33.2 billion according to Bloomberg’s analyst. Investors will be on the lookout for any insights from the CEO Hensen Huang about Nvidia’s next gen Blackwell line of AI chips which are used to run AI applications.

Wall Street will be looking at Walmart as well to see if reports another solid quarter as consumers price pressure persist as latest data showed CPI grew by 2.6% in Oct 2024 which is a slight uptick from 2.4% in Sept 2024. Walmart as the world largest retailer by sales can provide insights into US consumer sentiment.

Another stock that investors will keep a lookout for is Nio where its shares have plunged more than 15% since US election as Chinese EV markets haven’t made any inroads in the US at this point but Donald Trump policies push this possibility even further.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available. As CFD is traded on margin, there is a risk of losing more than your initial deposit amount and traders need to adopt proper risk assessment and management to determine if CFD is the product for you. If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

Hong Kong Tech Index (HTI): Key Support Level by Louis Hee

Key Entry Price Pivot(s)

- 4261

Recommended Trade

- Long above 4261

- Take Profit at 4829

- Stop Loss at 3970

Alternative Case

- Short below level 4261

- Take profit at 3636

- Stop loss at 4680

Remarks

- The daily chart of HTI is showing that it has reached its support level.

- The price rebounded once when it touched the support level.

- Traders can potentially seek to take a long trade when price rebound at support level, or a short trade if price breaks below it.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing) & Jing Khai Gan, Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.

Jing Khai graduated from Monash University with a Bachelor’s degree majoring in Econometrics and Finance. His interest is in exploring the use of technology into trading. He builds algorithms and test trading ideas for trading robots as he believes full automation is the future of finance.