Weekly Updates 18/12/23 – 22/12/23 December 18, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (11 Dec 2023 – 15 Dec 2023)

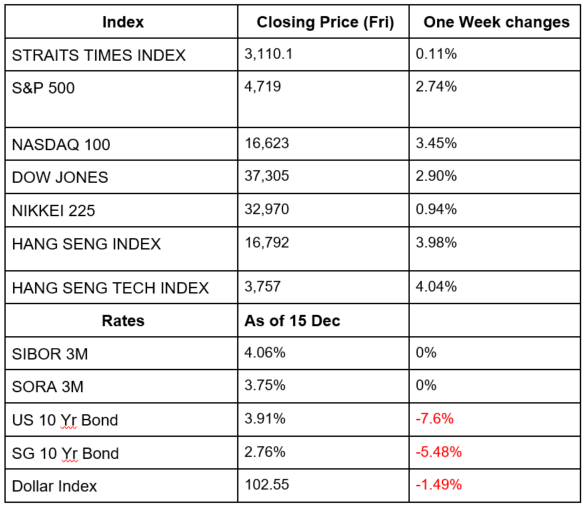

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week’s market movement revolved around the Fed keeping rates unchanged but hinting at three potential interest rate cuts next year. This pivot has boosted the stock and bond markets. The Dow Jones hit an all-time high, and the other indexes are in the green. On the other side, China announced a record injection of cash on last Friday, the central bank is hoping to bolster the economy against the pressure of a falling housing market which was twice as much as analyst expected.

Updates for the week (18 Dec 2023 – 22 Dec 2023)

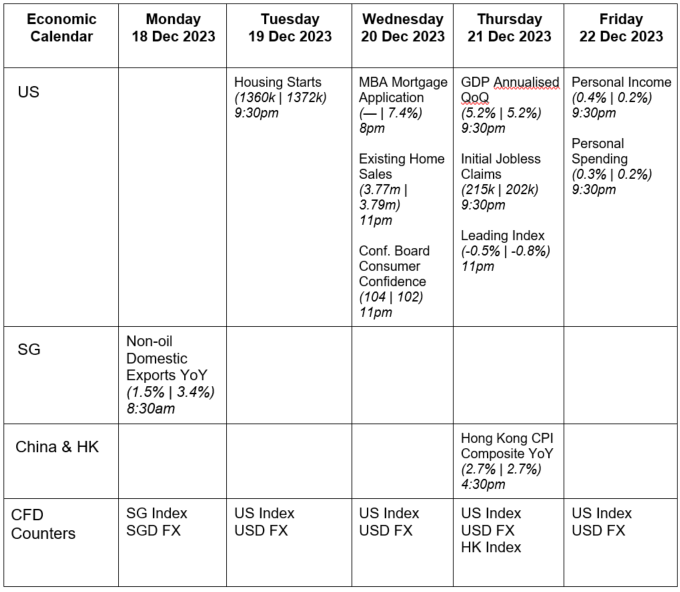

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s macro news mainly focuses on US GDP data, US housing market data and some leading indicators for US consumers. Market participants and analysts are looking at the GDP data and the individual components to determine if the Fed is able to achieve a soft landing and narrowly avoid a recession. Furthermore analysts are interested in the strength of the US consumer be it Personal Income and Personal Spending, which is both expected to increase compared to prior. A potential source of volatility if there are any positive or negative surprises.

Traders should position their portfolio before the macro news release to not be negatively affected and have good risk management.

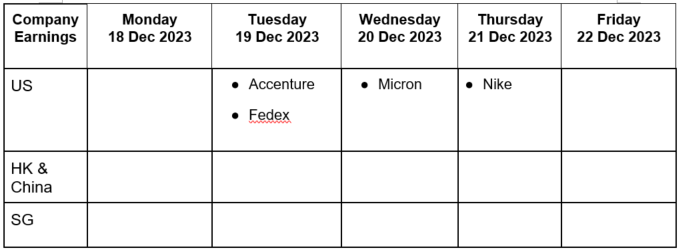

This week’s corporate earnings focuses on Micron as many analyst has hiked its price-target as they are looking at the recovery of memory-chip market in 2024. This allow market participants to have a forward guidance of how the semi-conductor sector might do in 2024. Other earning releases includes Accenture, Fedex and Nike in the US where investors will pay attention to these consumer staples and take it as a indicator to see how is the economy doing before 2024 starts.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

USD/JPY Rejected From Multi-year High With Strong Downward Momentum – by Jeraldine Tan

Key Entry Price Pivot(s)

- 140.95

Recommended Trade

- Short at 140.95

- Stop Loss at 146.95 (600 pips)

- Take Profit at 128.95 (1200 pips)

Alternative Case

- Long at 143.00

- Stop Loss at 140.50 (250 pips)

- Take Profit at 145.50 (250 pips)

Remarks

- USD/JPY tested high of 151.95 but was properly rejected forming a double top

- USD/JPY proceeded to trade lower and broke the neck line of the double top pattern. Momentum accelerated and price traded below 10/20/50 EMAs. Zooming out to a weekly chart, downward momentum is still strong.

- Given this, there is a potential with-trend trade to the downside for traders who are bearish. Trade is structured on an hourly timeframe, to be triggered on a break down below recent low of 140.95, and stop above recent high for a wide 600pip stop. Position size should be adjusted accordingly.

- Market may transition into a trading range which has its low at about 127.50 hence take profit target is 1200pips below entry at 128.95 for a 1:2 risk:reward trade.

- Alternative case is presented above for traders who remain bullish on USD/JPY to structure a recovery trade – possible entry if price is able to break above the most recent high of last candle which indicates loss of momentum, with stop below the most recent low (250pips) and take profit target right below the recent high (250pips) for a 1:1 risk:reward trade

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.