Weekly Updates 19/5/25 – 23/5/25 May 19, 2025

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

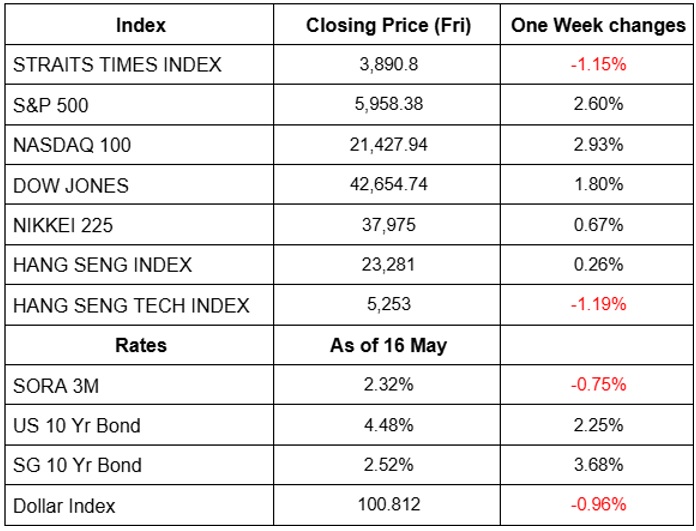

Recap for last week (12 May – 16 May 2025)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week major US indices rose where S&P 500 rose by 2.6% while Nasdaq 100 increased by 2.93% even though some reports show that there is a sudden fall in consumer sentiment. Investors remained optimistic as signs of improved US-China trade relations helped lift the market sentiment. One thing to note is that small caps stocks — Russell 2000 closed out its sixth consecutive week of gains, a milestone that has not been seen since December 2023 when slowing inflation and lower Treasuring yield fueled optimism about potential Fed rate cuts. Mainly last week’s rally was driven by the US-China trade negotiation as both countries agreed to slash tariffs on each other’s imports for 90 days while working to a more border trade deal.

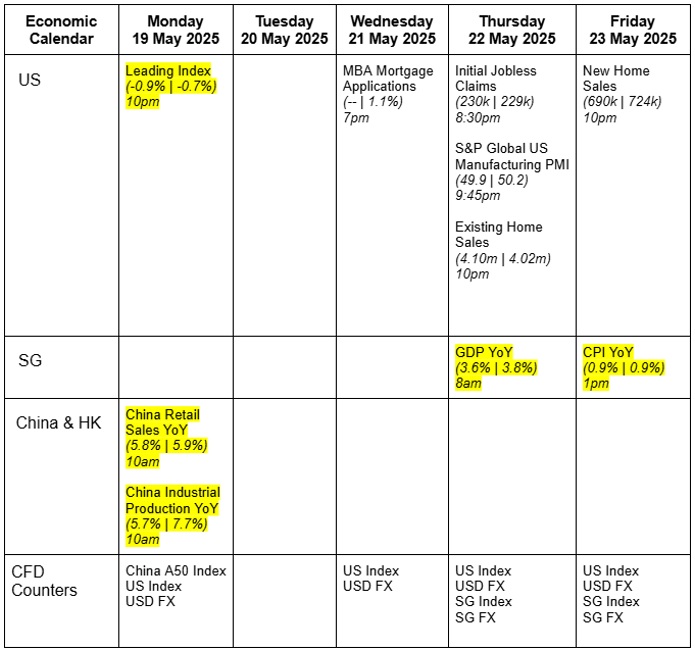

Updates for the week (19 May – 23 May 2025)

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s upcoming macroeconomic releases mainly focuses on China Retail Sales, China Industrial Production YoY, US Leading index and SG GDP & CPI. With the effects of the trade war slowly creeping in to economic data and analyst’s expectations. With US Leading Index expected at -0.9%, lower than prior of -0.7%. China Retail Sales YoY expected to remain flattish at 5.8% vs 5.9% prior, while China industrial Production YoY expected to drop to 5.7% from 7.7% prior. Market participants are eager to find out how the effects of the trade war going to be felt in global markets with President Donald Trump’s unclear tariff directions.

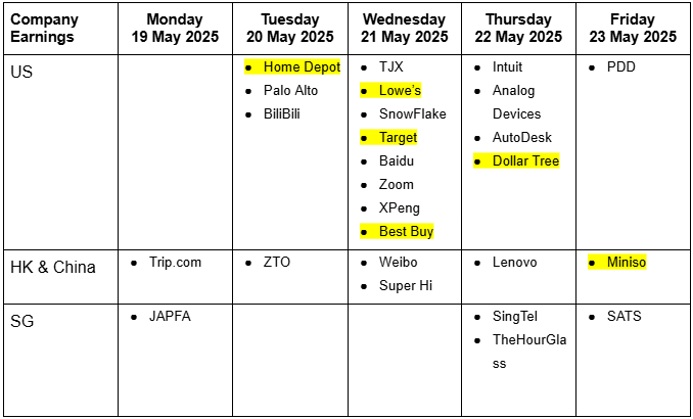

US earnings releases for this week focus on customer staples retail companies like Home Depot, Best Buy, Target, Lowe’s and Dollar Tree. With President Donald Trump announcing sweeping tariffs across almost all trading partners of the US, market participants and analysts are eager to see how local US retailers that rely on cross border imports will be able to absorb the shock and how they will approach the increase in supply cost price across the board.

As for SG earnings releases for this week, investors are eager to find out more on the earnings results for SATS and it’s forward guidance, with SATS’s share price YTD down -17.86%, investors are eager to see how the management plans to.

Alibaba(9988.HK) Bullish Trading Opportunity by Donny Lew

Key Entry Price Pivot(s)

- HK$112

Recommended Trade

- Long at level HK$112

- Take Profit at HK$130

- Stop Loss at HK$95

Alternative Case

- Short below HK$95

- Take Profit at HK$77

- Stop loss at HK$100

Remarks

- Looking at the daily chart of Alibaba, we can see that the price has been in an uptrend with Exponential moving average of 50, 100 and 200 sloping up.

- Currently, we are waiting for the price to pull back at the support level at around HK$112. We can potentially look for a long trade at this level in a lower timeframe with confluence such as a bullish bar at the support level with significant volume.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.