Weekly Updates 24/3/25 – 28/3/25 March 24, 2025

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

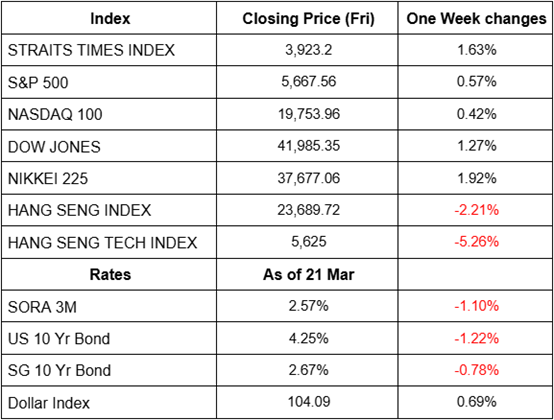

Recap for last week (17 Mar – 21 Mar 2025)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week S&P 500 has gained 0.57% last week, the index started the week lower but due to US Fed’s mixed messaging on Thursday, markets reacted positively and ending the week higher. The People’s Bank of China failed to cut rates, giving the needed stimulus and kick start to justify the recent rally due to expectations of more support for China’s central bank. Cause the Hang Seng Index and Hang Seng Tech Index to end lower by -2.21% and -5.26% respectively.

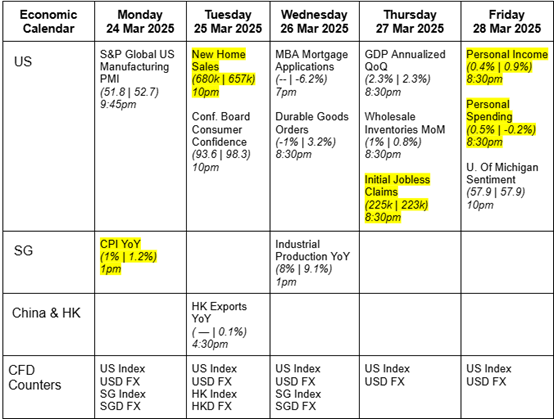

Updates for the week (24 Mar – 28 Mar 2025)

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

In the US, there was a fall in mortgage rates in Feb, which seems to have boosted more buyers to buy new houses thus New Home Sales is anticipated to rise by 680k.Previously there is a buildup of inventories of new homes, thus analyst also expect them to close more deals with potential buyers in upcoming months. Jobless claims are most likely to rise slightly to 225k as preliminary figures from the Department of Labor shows that the application of unemployment benefits has cooled slightly for the week ended 8 March. This figure is set to surge in the future as recently President Donald Trump has signed an executive order to dismantle the Department of Education, which places approximately 50% of the current workers on leave starting on21 March. It is expected that Personal income will only rise by 0.4% due to transfer payments and wage growth whereas Personal spending is forecasted to rise by 0.5%driven by health-care essentials and front-loading before tariffs are imposed. In Singapore, analyst projected that inflation is most likely to decline further to a 1% YoY price inflation on 24 March influenced by the lower import costs and other major goods and services categories, this also shows the fading effects of past GST hikes.

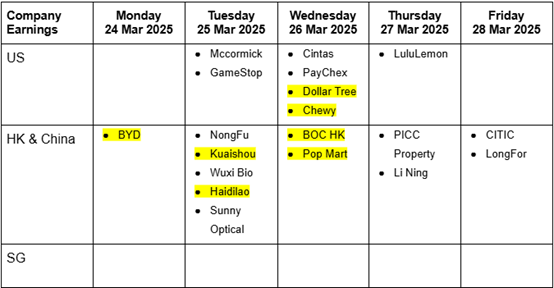

US earnings releases for this week focus on Dollar Tree and Chewy, with Dollar Tree YTD share price dropping -12.71%, analysts and market participants are pricing in lower growth and profit margins. While HK and China earning releases focus around EV giant BYD, Kuaishou Technology, Haidilao, Pop Mart and BOC HK. BYD has been out performing it’s EV peers having a YTD increase of 51.67%. Investors and analysts are eager to see if the earnings and positive sentiment is shown in the fundamentals. Most HK counters has enjoyed a rally YTD, given its recent gains, market participants are focused on the forward guidance and upcoming expectations.

YZJ Shipbldg(YZJ.SG): Potential Long Opportunity by Alex Lee

Key Entry Price Pivot(s)

- $2.23

Recommended Trade

- Long at $2.31

- Stop Loss at $2.20

- Take Profit at $2.90

Alternative Case

- Short at $2.20

- Stop Loss at $2.31

- Take Profit at $1.80

Remarks

- Looking at the daily chart of YZJ Shipbldg SGD, we can see that the price has bounced off from the support level of $2.23

- Currently, price has rejected the support line as well as the 20-moving average with significant volume thereby presenting an opportunity for going long.

- We may see price extending towards the next resistance level at $2.90

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.