Weekly Updates 25/12/23 –29/12/23 December 26, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

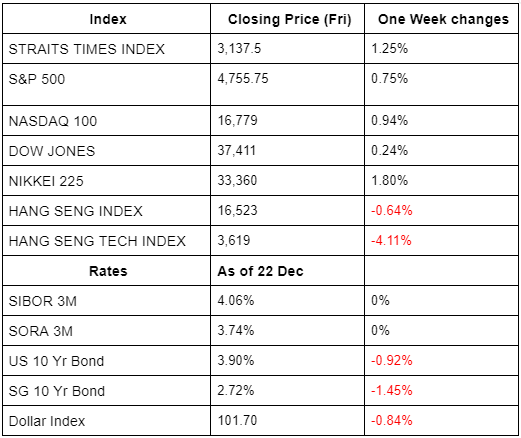

Recap for last week (18 Dec 2023 – 22 Dec 2023)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week’s market movement revolving around US Personal consumption expenditures index has drifted below Fed’s 2% goal. Market participants now look ahead to a likely 3 times of reduction in interest rates for 2024, this can be as early as March 2024 due to the current pain for consumers who are experiencing surging credit card debts and rising auto loan delinquencies. On the investment side, US 10 year bond yields are falling making those investments less lucrative. Most index are having a Santa rally in response to the Fed’s rate-cut news except for HSI and HSTI. This is because Chinese regulators proposed new restrictions for the online video-game industry which wiped off nearly $80 billion in market value for the 2 biggest gaming companies (Tencent and NetEase). Its impact was immediate which caused the Chinese authorities to review the newly drafted online gaming rules. Yesterday, Beijing approves more games to soften its stance on the gaming industry but this did little to help in restoring investors’ confidence.

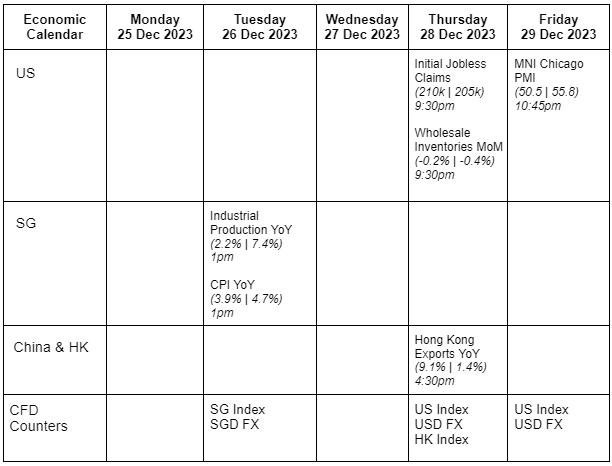

Updates for the week (25 Dec 2023 – 29 Dec 2023)

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s macro news mainly focuses on CPI data coming out of Singapore as US inflation data is under control earlier than expected, market participants are looking at other country’s inflation numbers to determine if other central banks can consider rate hikes in early 2024. The US traders and investors will be looking at initial jobless claims as an early indicator of the strength of the US labor markets.

Traders should position their portfolio before the macro news release to not be negatively affected and have good risk management.

This week’s corporate earnings are quiet since its the last week for the Year 2023. Stay tuned for 2024 earnings.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

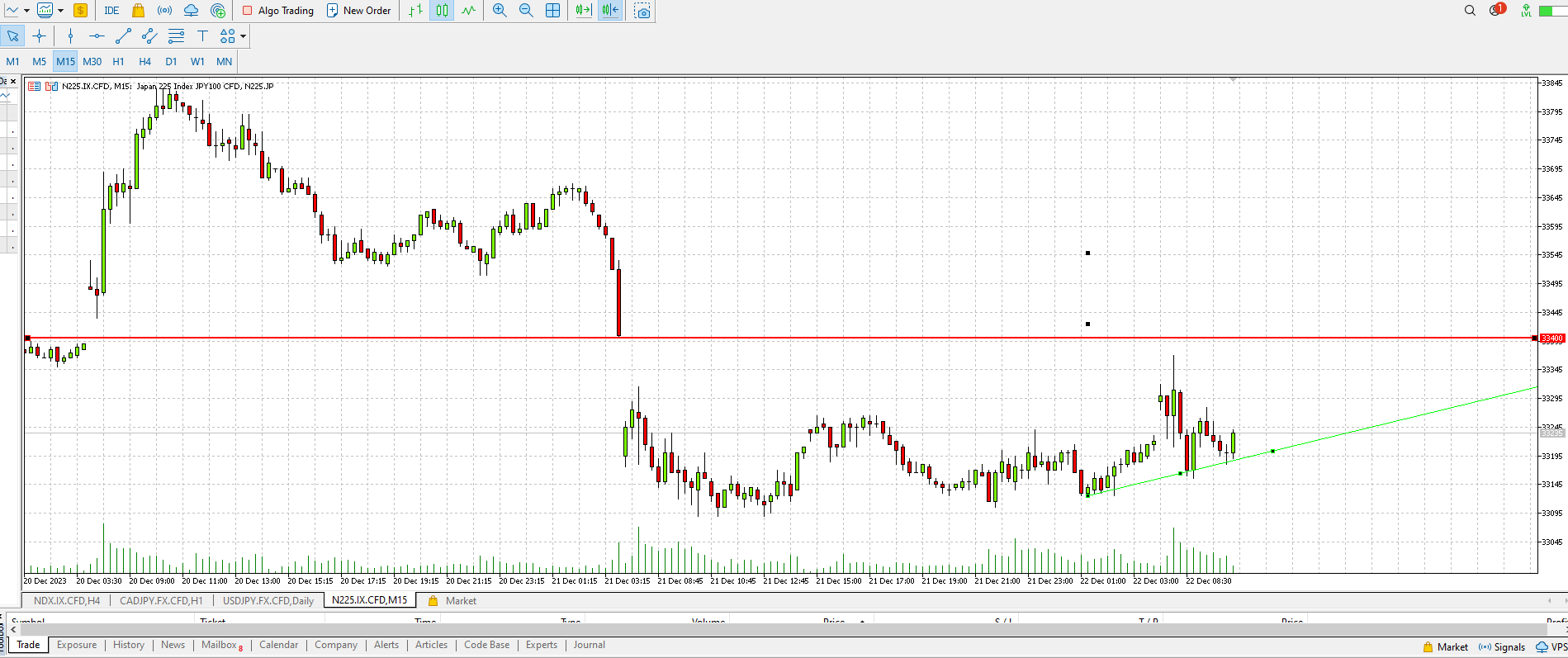

Nikkei 225 Trade Opportunity – by Annabelle Esther Tang Yee Hua

Key Entry Price Pivot(s)

- 33,200

Recommended Trade

- Long at 33,200

- Stop Loss at 33,150

- Take Profit at 33,400

Remarks

- Looking at the 15 minutes chart of Nikkei 225, we can see that the gap has yet to close. As a result, we recommend traders to take profit at 33400 which is the price at which the gap closes, and stop loss either anywhere along the green resistance line shown or at 33150.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.