Weekly Updates 4/11/24 – 8/11/24 November 4, 2024

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (28 Oct – 01 Nov 2024)

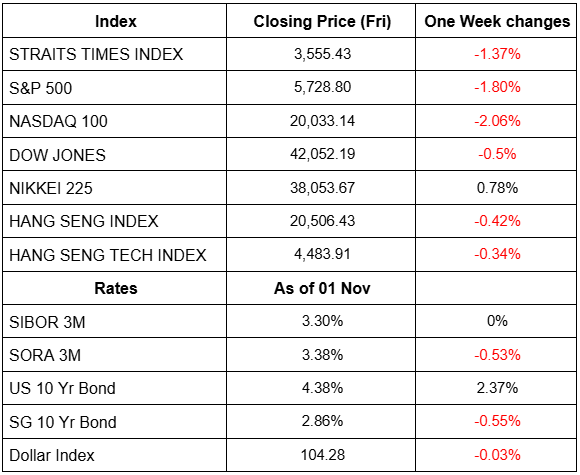

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week the S&P 500 ended the week down by 1.80% while DJI and Nasdaq was also down by 0.5% and 2.06% respectively. Treasury yields hit new 4-months high despite light Oct 2024 jobs growth while the volatility stayed firm approaching Tuesday’s election. According to Charles Schwab, the market are pricing in the 82% chance of consecutive Nov and Dec rate cuts. Recent earnings release have been decent where 75% of the 70% companies of S&P500 have released earnings have beaten analyst EPS estimates while 60% of them exceeded revenue expectations.

Updates for the week (04 Nov – 08 Nov 2024)

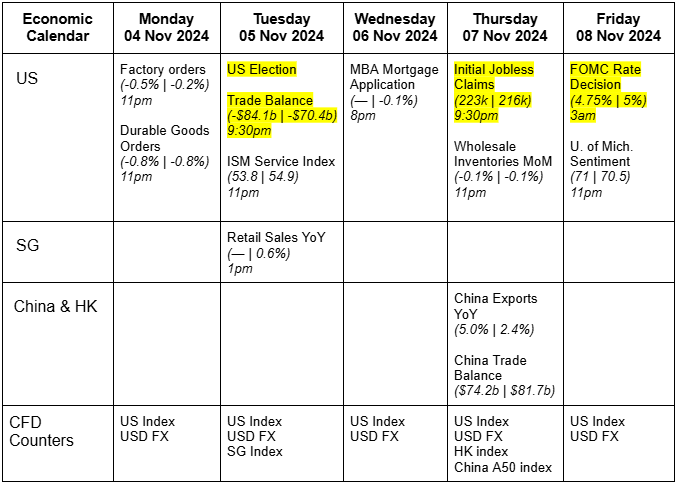

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week ahead, all eyes will be laid on the US election on Tuesday. Recent polls show that President Donald Trump is in a tie with Vice President Kamala Harris where the victory will most likely boil down to a few thousands of votes in different states. According to Bloomberg, it is said that the national debt will still climb regardless US is under either candidate’s tax policy. If Kamala wins, there will be a divided government that will limit government spending and have tax cuts, which US will have a contraction in their fiscal budget in coming 2026, whereas if Trump wins they will make the 2017 Tax Cuts and Jobs Act permanent. On Tuesday, Trade Balance is set to be released, where the trade deficit is most likely to widen to $84.1b in Sep 2024. This increase is reflected by the US retailers being pulled forward towards overseas orders ahead of the anticipated disruptions from the Gulf Coast ports and the Middle east. Initial Jobless claims are expected to rise due to a higher number of unemployed persons in continuing claims. The FOMC Meeting will be held on Friday where consensus are expecting the Fed to cut rates by another 25bp, but this might change due to the presidential election on Tuesday. The uncertainty over the election results could trigger a market turmoil.

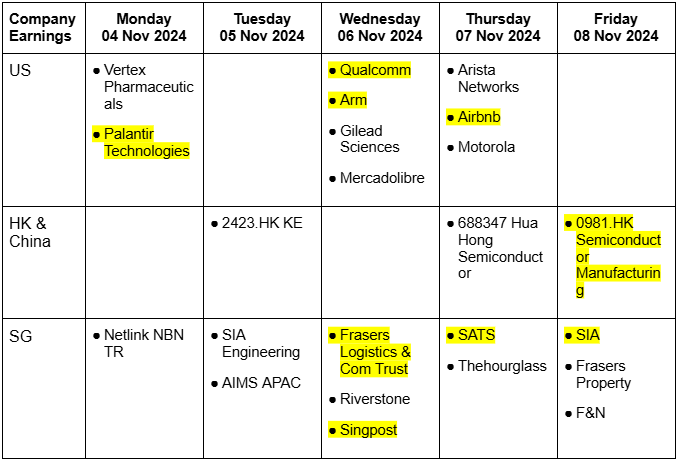

Earnings releases for this week focus on Singapore companies like SIA, SATS, Frasers Logistics & Com Trust and Singpost. And US tech and chip stocks like Palantir, Qualcomm and Arm holdings. Palantir has enjoyed a ~152% gain YTD, the upcoming earnings release will determine if this bull run will continue or will end. Given the recent high volatility, companies that are able to beat estimates and have bullish forward guidance are rewarded with significant price movements while companies that underperform tend to suffer a huge drop.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available. As CFD is traded on margin, there is a risk of losing more than your initial deposit amount and traders need to adopt proper risk assessment and management to determine if CFD is the product for you. If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

Keppel: Potential Short Opportunity by Alex Lee

Key Entry Price Pivot(s)

- $6.51

Recommended Trade

- Short at $6.44

- Stop Loss at $6.60

- Take Profit at $6.10

Alternative Case

- Long at $6.60

- Stop Loss at $6.40

- Take Profit at $6.80

Remarks

- Looking at the daily chart of Keppel, we can see that the price has bounced off from the resistance level of $6.51.

- Currently, price has rejected the resistance line as well as the 20-moving average with significant volume thereby presenting an opportunity for going short.

- We may see price extending towards the next support level at $6.10

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.