Weekly Updates 9/12/24 – 13/12/24 December 9, 2024

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

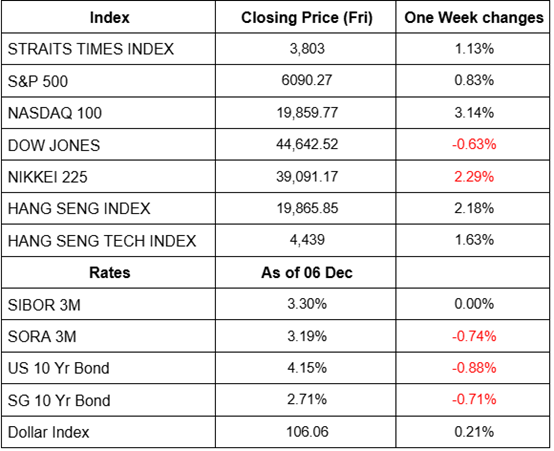

Recap for last week (02 Dec – 06 Dec 2024)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week the Bitcoin stormed above $100K as bets on Trump’s nomination of pro-crypto paul Atkins to run the SEC which cemented the place of cryptocurrencies in the financial markets. The US stock market had a strong weekly gain last week where the S&P 500 rose by 0.83% mainly driven by the increased likelihood of the Fed cutting rates in the later of the month. The tech-heavy Nasdaq saw several tech giants reach new highs with 3.14% gains for the week. US Treasuries also posted positive returns with yields falling by 0.88% on Friday. For the past weeks, data continued to show that the US is experiencing a soft landing with modest slowdown but the economy is still growing at or above the trend.

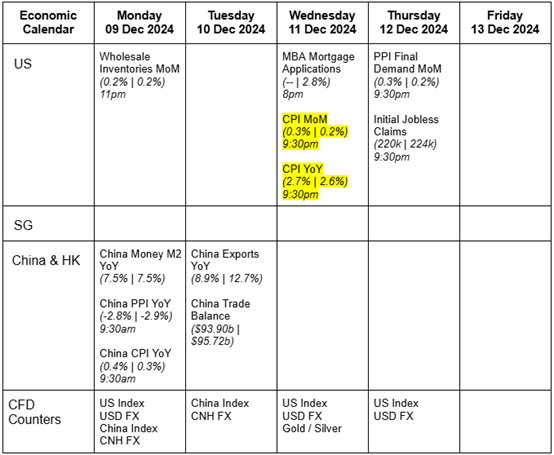

Updates for the week (09 Dec – 13 Dec 2024)

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week ahead all eyes will be on the US CPI where the Nov 2024 CPI report maybe decisive in the Fed’s choice to cut or pause rates at its December Fed meeting.Recent Fedspeak gave us some clues about policymakers being on the fence on Nov’sjob report and CPI due to the recent data have lower downside risks to employment atthe same time the inflation has slowed down. It is expected that there will be anotherhigher core inflation from 0.2% to 0.3% in Nov due to pickup in other core goods andservices (holiday season). This lifts the CPI YoY to 2.7% from 2.6%.

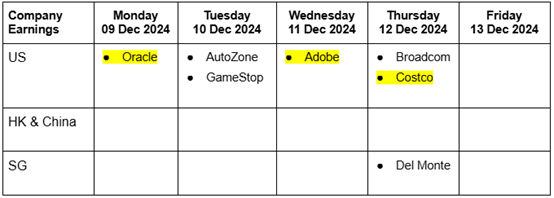

Earnings releases for this week focuses on Oracle, Adobe and Costco from the US.Oracle has been enjoying an impressive 84% YTD gains from its adoption of ArtificialIntelligence and growth in Cloud Services and License Support Revenues byEcosystem. Analysts are expecting a top line revenue increase of 9.1% YoY, showinghigh expectations and strong growth. While Costco has been one of the moresuccessful retailer with 52% YTD returns while other retailer like Target are strugglingin the current economic situation. Market participants are eager to know Costco’sforward guidance and if they can maintain it’s dominant position as one of the leadingretailers.

EUR/USD: Greenback’s Surge by Tan Peng Chien

Key Entry Price Pivot(s)

- 1.06250

Recommended Trade

- Short at 1.05558

- Stop Loss: 1.06250

- Take Profit: 1.04000

Alternative Case

- Long at 1.06250

- Stop Loss: 1.05100

- Take Profit: 1.08000

Remarks

- Price recently moved through and cleared liquidity at the previous market structure level of 1.06000

- The primary outlook is a continuation to the downside, targeting the price range around 1.04000, with a stop-loss strategically placed at the price pivot to manage risk effectively.

- Alternatively, a more cautious approach involves waiting for the price to decisively break above the pivot point. This would shift the strategy to a long position, aiming for the area of liquidity above, with a stop-loss set near 1.05100to maintain a favorable risk-to-reward ratio

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Sam Hei Tung (Assistant Manager, Dealing) | Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities.