What are fixed-income funds? May 15, 2024

In the diverse world of unit trusts, various funds employ distinct investment strategies aligned with investors’ goals and risk profiles. Each strategy offers a unique asset allocation and risk management approach tailored to specific investment objectives. In this article, we’ll cover fixed-income funds.

Fixed income investments, commonly known as bonds, are an asset class that offers regular payments to investors over a fixed interval until a predetermined maturity date. Upon maturity, investors will receive the principal amount that they originally invested. This asset class generally holds a higher claim priority compared to equity investments. When a default event occurs, any available funds that can be recovered from a bankrupt company will have to be paid to bondholders before shareholders.

A fixed-income unit trust consolidates various types of fixed-income securities into a single investment vehicle. Investing in a fixed-income fund presents several benefits, which we will discuss below:

Benefits of investing in fixed-income funds

Diversification: Instead of investing in a single bond, a bond/fixed income unit trust gives investors diversification across multiple types of securities and regions. This means that if one of the many bonds in the unit trust defaults (missing an interest or principal payment), your Net Asset Value will not be as severely impacted as if you held onto a single bond.

Professional Management: Fixed-income fund managers have the experience and knowledge to properly manage and analyse which assets to invest in. Leaning on these managers to find such investment opportunities saves investors time and effort to do their own research. As such, the reputation and track record of the fund manager should be considered when choosing which fund to invest in.

Accessibility: There are some fixed-income tools that normal retail investors do not have easy access to. These could include government treasury bills, fixed income from less accessible markets, or quasi-sovereign bonds. Fixed-income fund managers would have relationships with bond issuers, underwriters, and brokers. These relationships give managers access to unique investment opportunities at better pricing.

Income Generation: Fixed-income securities tend to pay a regular dividend, thus generating a regular stream of income for investors. By investing in a fixed income unit trust, investors could enjoy a monthly income stream compared to investing in a single bond. Most bonds only pay an income twice a year.

Liquidity: Fixed-income unit trusts offer higher liquidity compared to individual bonds, as investors can typically buy or sell fund units on any business day. This flexibility allows investors to respond more promptly to changing financial needs or market conditions.

Here are two features that you might find on the factsheet of a fixed income unit trust:

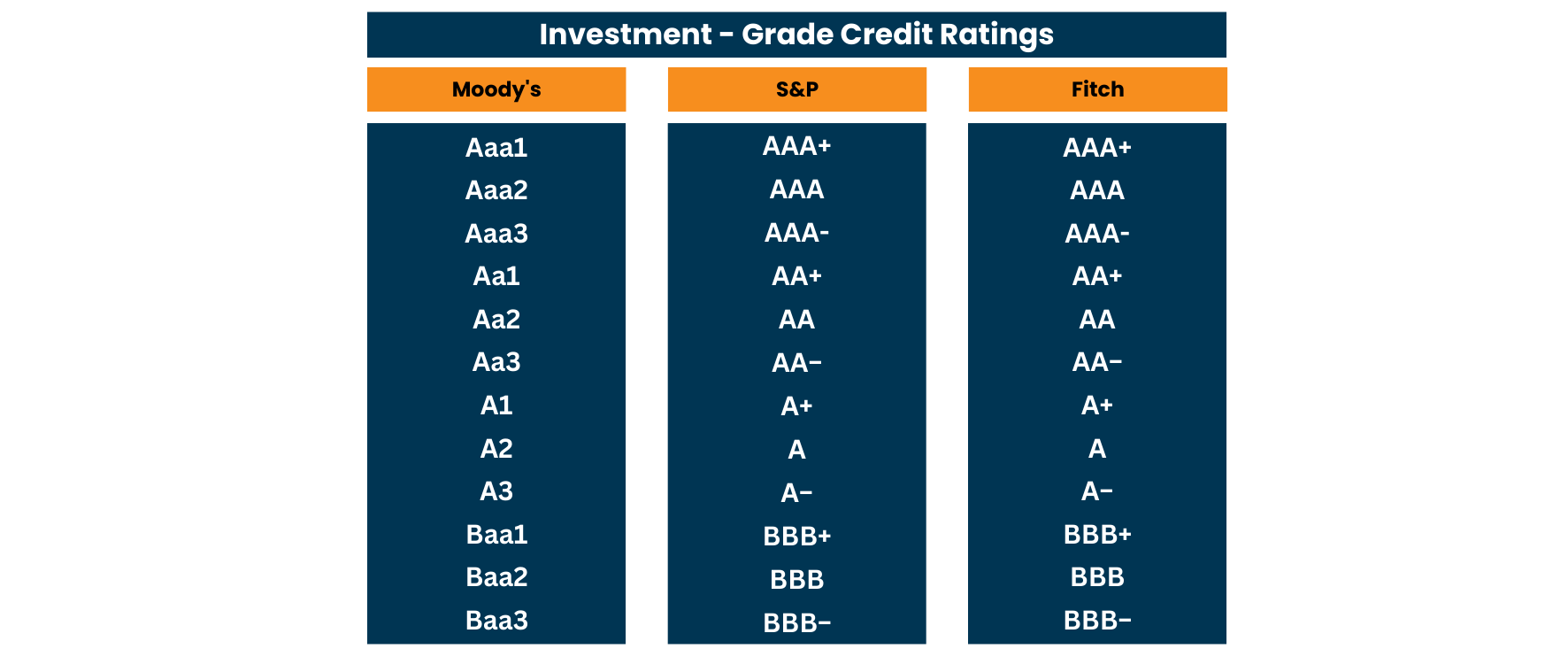

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from ‘AAA’ to ‘BBB-‘ (S&P and Fitch) or ‘Baa3’ (Moody’s) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Risk of investing in fixed income funds

Interest rate risk: Fixed income securities are sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. Fixed income funds holding long-term bonds may be particularly vulnerable to interest rate fluctuations, potentially impacting fund performance and capital.

Credit risk: The risk that the issuer is unable to make timely interest payments and/or return the principal at maturity. Investing in funds that hold lower-rated (usually higher-yield) bonds may offer higher returns, but come with increased risk of default. It is important to do your own research and understand the regions and sectors a unit trust invests in, such as by studying the factsheet.

Conclusion

Fixed-income funds represent a fundamental component of a diversified investment portfolio, offering benefits like regular income, reduced risk, and professional management. While they are not devoid of risks, they play a crucial role in balancing portfolio performance across different market conditions. As with any investment, understanding the nuances of fixed-income funds and how they fit within your overall investment strategy is essential for achieving long-term financial success.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Darius Lee

Darius Lee graduated from the National University of Singapore with a Bachelor’s of Engineering degree. Life took him on a different path and he ended up spending 8 years in the Wealth Management space. He is as obsessed with the technical aspects of investing as well as the psychology that drives investors. In his free time he enjoys reading about topics from Economics to Science Fiction.

Protecting More Than Just Walls: Fire Insurance vs Home Insurance

Protecting More Than Just Walls: Fire Insurance vs Home Insurance  Before the Year Ends: Key Financial Steps for a Confident 2026

Before the Year Ends: Key Financial Steps for a Confident 2026  The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions

The ILP Debate: Why Singaporeans Struggle With Financial Product Decisions  Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting