What is an Active ETF? September 26, 2025

An Active ETF is an exchange-traded fund with a portfolio that is actively managed by investment professionals. Unlike passive ETFs that simply mirror a stock index, investment in active ETFs involve ongoing buy and sell decisions aimed at achieving a specific goal — whether that is outperformance, generating income, or capturing exposure to a particular theme.

How Active ETFs differ from Passive ETFs

- Objective: Passive ETFs aim to replicate an index (e.g., S&P 500). Active ETFs aim to outperform a benchmark or achieve a specific outcome (e.g. high income or targeted growth).

- Management: Passive ETFs follow rules automatically while active ETFs rely on human judgement, quant models, or a combination of both.

- Costs: Active ETFs usually charge higher management fees because of the research, trading, and portfolio management involved.

- Transparency & Holdings: Passive ETFs typically disclose holdings frequently and are predictable. Some active ETFs may disclose less often to protect proprietary strategies, although many still provide daily updates.

2. Why Demand for Active ETFs Is Growing

- Access to differentiated strategies

Active ETFs open the door for retail investors to tap into strategies once reserved for mutual funds or large institutions. These can include thematic bets on artificial intelligence, enhanced income strategies, or opportunities in niche and tightly regulated markets. - ETF wrapper benefits

With active ETFs, investors enjoy the best of both worlds: the expertise of an active manager combined with the advantages of the ETF structure. This includes intraday liquidity (they trade like a stock), potential tax efficiencies, and lower minimum investment amounts compared with some mutual funds. - Innovation and regulation

Recent regulatory developments and improvements in ETF infrastructure have empowered asset managers to launch a wider variety of active strategies in ETF form. This growing menu of options caters to investors’ appetite for more tailored outcomes, driving innovation across the industry.

3. Common Active ETF Strategies (with Examples)

Fund managers launch active ETFs using different strategies to appeal to investors with specific goals or preferences. Some of the most common approaches include:

A. Thematic & Growth Active ETFs

Goal: Capture long-term growth by investing in themes such as Artificial Intelligence (AI), robotics, or disruptive technologies.

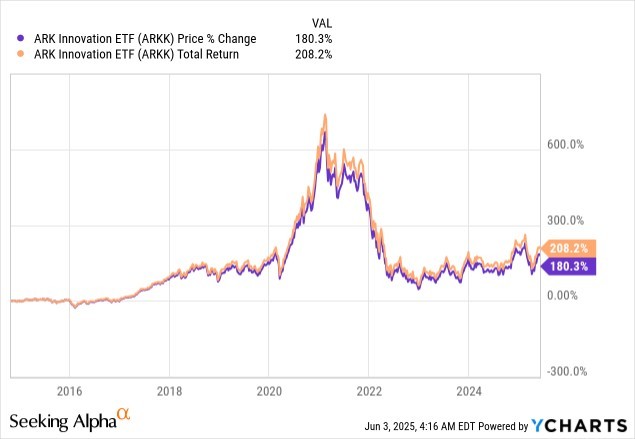

Example (US): ARK Innovation (BATS: ARKK) — actively selects disruptive growth companies

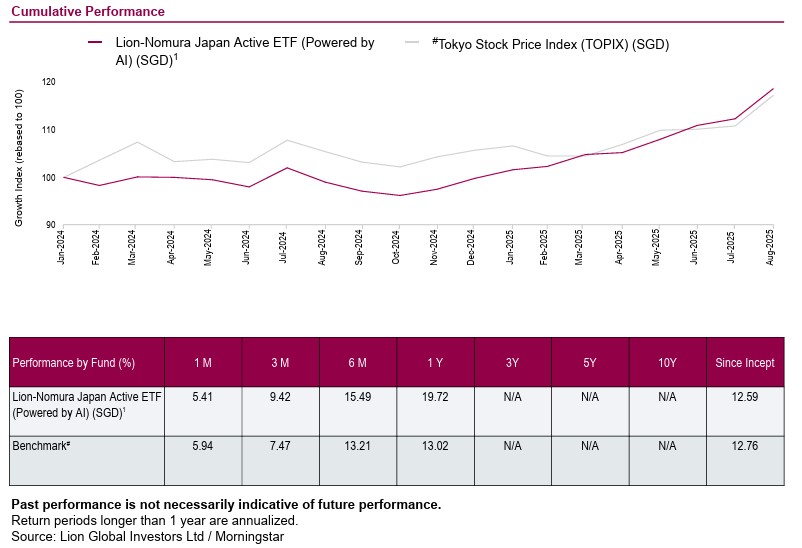

Example (SG): Lion-Nomura Japan Active ETF (SGX: JJJ) — actively selects Japanese stocks with AI-assisted processes

B. Income & Option-Enhanced ETFs

Goal: Deliver steady income by combining dividends with strategies like covered calls or option overlays.

Example (US): JPMorgan Equity Premium Income ETF – (NYSEARCA: JEPI) uses options to enhance yield

C. Sector / Regional Active ETFs

Goal: Leverage managers’ best ideas in a specific region or sector (e.g. Japan, ASEAN, healthcare)

Example (SG): Active Japan ETF JJJ (SGX: JJJ) – An Active ETF where the manager selects 50–100 stocks tailored to current market opportunities

4. Benefits and Risks: What Investors Should Consider

Benefits

- Potential to beat benchmarks: Active managers can exploit inefficiencies, allocate tactically, and lean into high-conviction opportunities

- Customisation: Investors can express specific views — such as AI adoption or Japan’s recovery — through a single ETF

- Operational convenience: Active ETFs trade on exchanges like stocks, offer intraday liquidity, and usually have lower minimums than traditional mutual funds

Risks & Drawbacks

- Manager risk: Returns depend heavily on the manager’s skill and process. Past performance is no guarantee of future success

- Higher fees: Active strategies are generally more expensive, and over time, higher costs can eat into returns

- Transparency tradeoffs: Some active ETFs limit disclosure to protect proprietary models, which can reduce clarity for investors

- Underperformance odds: Statistically, many active funds fail to outperform comparable passive benchmarks over time

5. How Singapore Investors Might Use Active ETFs

Portfolio Roles

- Satellite allocation: Use active ETFs as satellites around a core passive portfolio (e.g., 5–15% tactical exposure to AI or income)

- Access niche markets: Gain exposure to overseas or tightly regulated markets via locally listed active ETFs without complex account setups

- Income overlay: Replace or complement fixed income with option-enhanced active ETFs for higher distributed yield

Tips for ETF selection

- Understand the manager’s process and look for a track record in comparable mandates

- Check fund fees, turnover, and tax considerations

- Limit allocation to active ETFs to a level consistent with your conviction and risk tolerance (e.g., 5–20% of portfolio)

- Review holdings / performance regularly and watch for changes in strategy or personnel

6. Key Takeaways — Active ETFs

- Active ETFs blend professional management with ETF convenience: intraday trading, tax efficiency, and low operational friction.

- They can deliver differentiated outcomes — alpha, income, or niche themes — but they demand confidence in the manager and come with higher costs.

- They are best used as satellite positions, complementing a low-cost passive core.

- Due diligence is essential: read the prospectus, examine the manager’s process, and evaluate costs and track record.

Conclusion

Active ETFs are reshaping the investment landscape by combining the expertise of active management with the convenience of the ETF structure. They provide opportunities for outperformance, targeted exposure, and innovative income strategies, but they also come with higher costs and the risk of underperformance.

For Singapore investors, active ETFs can serve as useful satellite allocations alongside a low-cost passive core, offering access to niche markets, thematic opportunities, or enhanced income. Success, however, hinges on careful manager selection, disciplined allocation, and regular review.

As the ETF market continues to evolve, active ETFs are likely to play a growing role in portfolios — not as replacements for passive funds, but as complementary tools to help investors navigate a more complex investment environment.

Stay tuned for our next feature, where we explore factor-based ETFs and how they fit into a modern portfolio.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Mr Teo Huan Zi

Mr Teo Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a Bachelor’s degree in Business, majoring in Banking and Finance.

He currently serves as a dealing manager with a team of more than 10 equity specialists. Additionally, he frequently conducts seminars and webinars to empower his clients with financial and investment knowledge, including fundamental analysis and technical analysis.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?