Why Every Investor Should Understand Put Selling August 26, 2025

Introduction

Options trading can seem complicated at first, but it offers investors flexible strategies to complement a traditional buy-and-hold portfolio. One popular approach is selling put options, which allows you to collect premium income and potentially buy stocks you like at a discount.

To earn a steady income or acquire shares at a price you’re comfortable with, selling puts is worth understanding.

Understand the Basics: What is a Put Option?

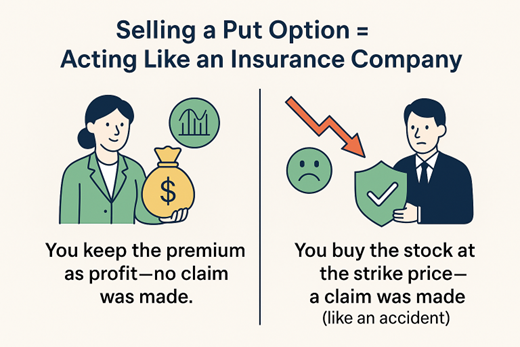

When you sell a put option, you agree to buy a stock at a specific price (known as the strike price) if the buyer decides to exercise the option before it expires. In exchange, you receive a premium (cash) upfront. If the buyer doesn’t exercise the option, you keep this premium as your profit. Typically, one stock option contract represents 100 shares of the underlying stock.

What does it mean to Sell a Put Option?

Selling a put option is like being an insurance company.

The Benefits of Selling Put Options

1) Earn Premium Income

Each time you sell a put, you collect a premium upfront. If the option expires worthless (stock price stays above the strike), you keep this premium as profit.

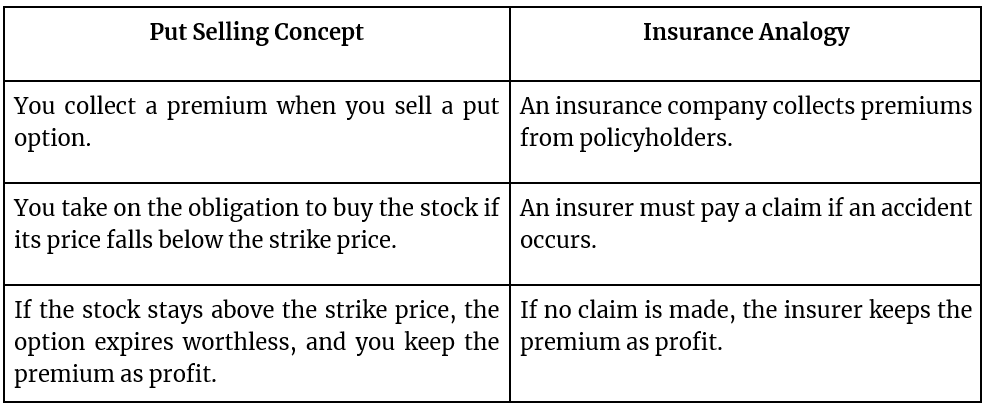

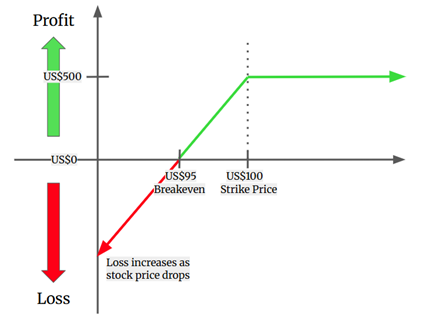

In the example above, selling a put option with a strike price of US$100 and receiving a US$500 premium means that if, at expiry, the underlying share price is above US$100, the option will typically expire worthless, you keep the full US$500 premium.

2) Buy Stocks at a Discount

If the stock price drops below the strike price, you’ll be assigned the shares. However, you’re buying at the strike price minus the premium collected, which effectively lowers your cost basis.

In the example above, buying the shares at the strike price of US$100 and receiving a US$500 premium lowers your breakeven price to US$95 per share. This means you would still earn US$2.50 per share in profit even if the stock falls to US$97.50. (1 contract = 100 shares)

3) Flexibility in Market Conditions

Selling puts works best when you expect the stock to remain flat or rise slightly. Unlike strategies that rely solely on upward price movement, this approach allows you to generate returns in a broader range of scenarios.

Understanding the Risks of Selling Put Options

1) Below your strike price

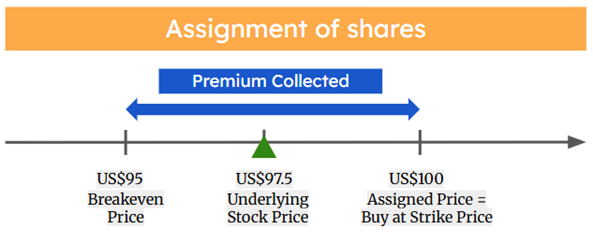

If the stock drops sharply, you may have to purchase it at a higher price than the market is offering, leaving you with an unrealised loss.

In the example above, buying the shares at US$100 and receiving a US$500 premium lowers your breakeven price to US$95 per share. However, if the stock price falls to US$90, you would face an unrealised loss of US$5 per share.

2) Potential for Large Losses

Premiums are limited, but downside risk is not. If the stock keeps falling, losses can accumulate in the same way as directly owning the shares.

How to Mitigate the Risk?

Like any strategy, selling puts comes with its risks, but these can be managed effectively.

1) Sell Puts on Stocks You’re Comfortable Owning

Choose stable and reputable companies that you’re willing to own at a lower price. That way, even if you’re assigned, you’ll own a stock you believe can recover over time.

2) Be Mindful of Market Conditions

Selling puts works best in neutral to slightly bullish markets with some uncertainty. Instead of waiting for prices to fall (and possibly missing opportunities), selling puts allows you to stay engaged in the market and earn premiums despite elevated valuations.

3) Generate Passive Income Strategically

If you believe the stock is stable but prefer not to own it outright, you can continue selling puts to collect premiums. Rolling positions further out in time can also help reduce downside impact.

Example Scenario

You like Company ABC, currently trading at US$100, but would prefer to buy it at US$95.

- You sell a put option with a US$100 strike price and receive a US$500 premium for the contract sold.

- Two outcomes:

- Stock stays above US$100: You keep the US$500 premium and the option expires worthless.

- Stock falls below $100: You’re assigned and must buy 100 shares at $100 each. However, after factoring in the $500 premium ($5 discount per share), your breakeven price is $95 per share, giving you a discount compared to the original price.

Conclusion

Selling put options can be a powerful way to generate income and acquire stocks at attractive prices, provided it is applied with discipline and proper risk management.

For investors keen to explore this strategy straightforwardly, POEMS has launched a strategy-friendly Cash-Secured Put feature designed to help investors better understand and incorporate this strategy into their portfolios.

Ready to start? Explore our beginner-friendly options platform today, or if you would like to dive deeper into other strategies, check out our detailed guide on Cash-Secured Puts.

For more information on trading the US markets through POEMS, visit our website or contact our Night Desk representatives at 6531 1225 (available from 2 PM onwards). Don’t wait— register your account today and take the first step towards accessing these exciting markets!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile