Stock Market Today

| 27 February 2026

Recent Podcasts:

Advanced Micro Devices Inc. – Clear Instinct GPU roadmap, strong CPU demand

Netflix Inc. – Content, ads, and scale drive the next leg of growth

The Walt Disney Company – Streaming Turns Profitable

Trades Initiated in Past Week

Singapore stocks closed lower on Thursday (Feb 26), weighed down by declines in the banking counters. The local benchmark fell 0.9 per cent, or 43.35 points, to 4,964.38. The iEdge Singapore Next 50 Index slipped 0.6 per cent, or 8.8 points, to 1,517.79.

The S&P 500 pulled back on Thursday as the latest results from tech titan Nvidia and software giant Salesforce weren’t enough to boost the broader market. The broad market index fell 0.54% to end at 6,908.86, while the Nasdaq Composite declined 1.18% and closed at 22,878.38. The Dow Jones Industrial Average added 17.05 points, or 0.03%, to settle at 49,499.20.

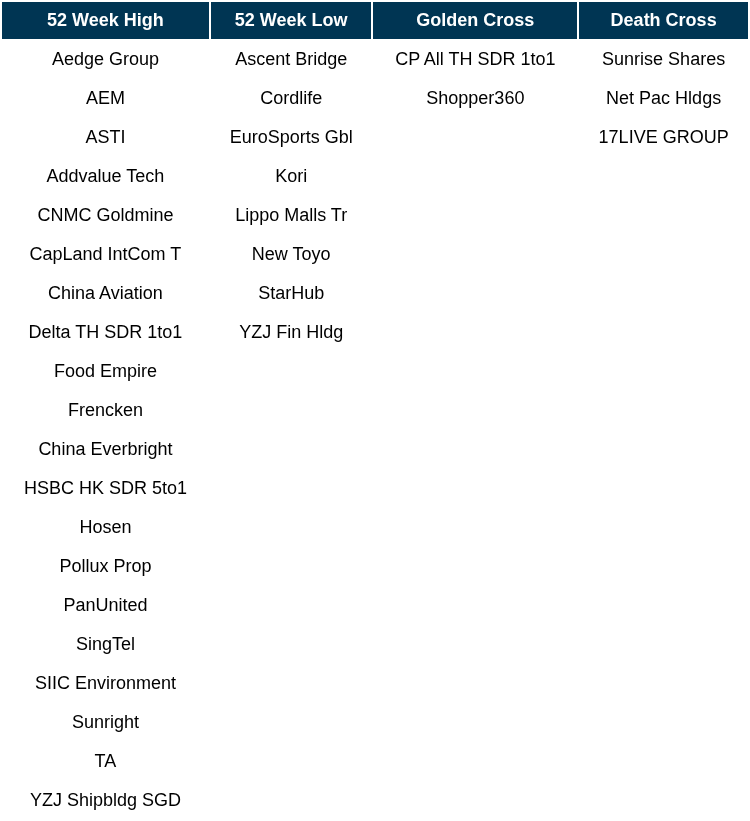

Singapore Technical Highlights

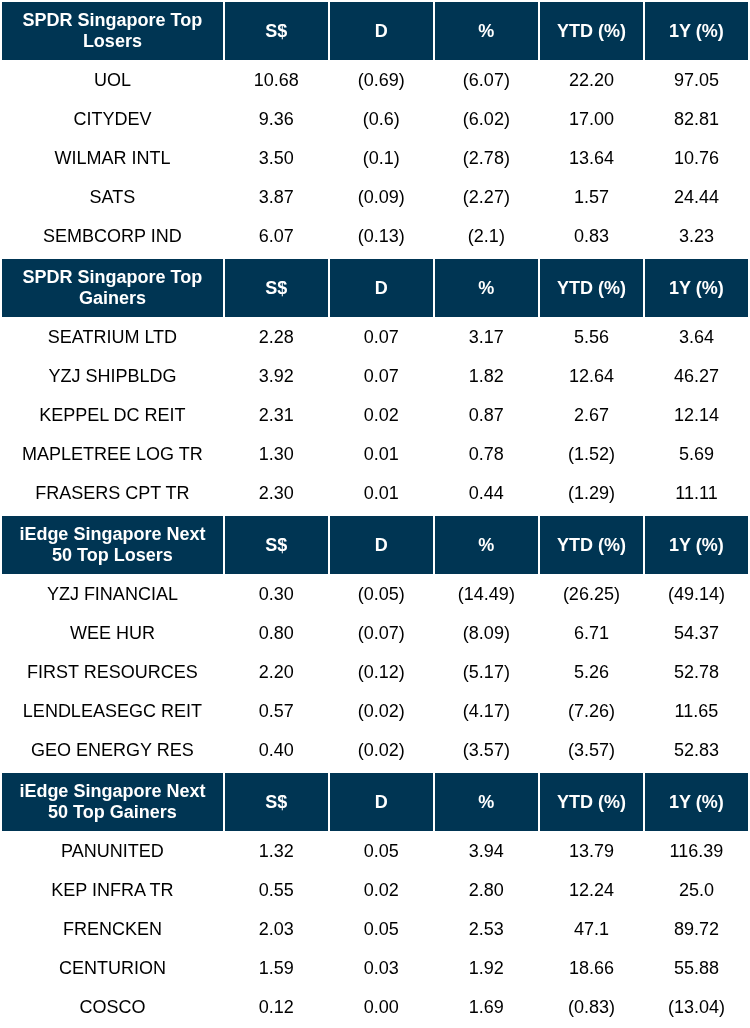

TOP 5 GAINERS & LOSERS

Events Of The Week

SG

Offshore and marine group Seatrium posted a 48.3 per cent rise in net profit to S$179.3 million for the second half of the year ended Dec 31, 2025. For the full year, its net profit doubled to S$323.6 million, from S$156.8 million in FY2024. This was on the back of stronger margins, revenue growth in the oil and gas and offshore wind segments, as well as lower net finance costs.

Sasseur Real Estate Investment Trust on Thursday (Feb 26) reported a distribution per unit (DPU) of S$0.03083 for the second half of FY2025, up 5.3 per cent year on year from S$0.02929. The Reit’s DPU performance was supported by resilient rental income under its entrusted management agreement (EMA) model.

Acrophyte Hospitality Trust’s distribution per stapled security (DPS) for the second half of FY2025 was down 50.7 per cent at US$0.00418 from US$0.00848 in H2 FY2024. The top-line decline came on the back of a reduction in portfolio size due to the disposal of non-core assets and disruptions from brand-mandated renovations at seven of its higher-performing hotels.

China Aviation Oil posted a net profit of US$60.5 million for its second half of 2025, up 68.3 per cent from US$36 million in the year-ago period. The group said on Thursday (Feb 26) that the improvements were due to an increase in gross profit and share of results from its associates, but were partially offset by the increase in expenses and income tax expenses.

Venture Corporation posted a 6.1 per cent fall in H2 FY2025 earnings to S$114 million from S$121.4 million the year prior. This was mainly driven by lower demand in the lifestyle consumer technology sector for product replacement due to improved product reliability.

CSE Global on Thursday (Feb 26) posted an 87.1 per cent surge in net profit to S$21.2 million for the second half ended Dec 31, 2025, from S$11.3 million for the previous corresponding period. The bottom-line growth was driven mainly by a 22.1 per cent jump in revenue to S$528 million from S$432.3 million a year earlier and was fuelled by growth in the group’s electrification and communications business segments in the Americas.

Property player UOL on Thursday (Feb 26) posted a 21 per cent rise in net profit to S$276.2 million for the six months ended Dec 31, 2025, from S$227.8 million for the corresponding period a year earlier. The group has delivered sharp execution on all fronts, with strong recurring income from its residential segment; very high positive reversion for its commercial assets, especially in Singapore; and a stronger hospitality portfolio.

Agribusiness Wilmar International on Thursday (Feb 26) posted a 38.3 per cent rise in net profit to US$815.9 million for its second half ended Dec 31, 2025, up from US$590.2 million for the same period a year prior. The group attributed the gains mainly to strong performance in its feed and industrial products segment.

Golden Agri-Resources on Thursday (Feb 26) recorded an 8.5 per cent drop in net profit to US$239.9 million for its second half ended Dec 31, 2025, from US$262.1 million in the previous corresponding period. Profitability was affected mainly by the absence of non-recurring gains on the disposal of joint ventures recorded in 2024, and higher income-tax expenses.

CNMC Goldmine on Thursday (Feb 26) posted a 384.1 per cent leap in net profit to US$26.2 million for the second half of its 2025 financial year, from US$5.4 million in the same period the year before. The mining company, which operates in the Malaysian state of Kelantan, cited the breakneck gold rally and increased production in metals across its mining portfolio as the reasons for its gains.

Mainboard-listed Soilbuild Construction on Thursday (Feb 26) posted an 84.1 per cent rise in net profit to S$35.3 million for its second half ended Dec 31, 2025, from S$19.2 million for the previous corresponding period. Soilbuild Construction attributed the earnings surge mainly to sustained revenue growth in its construction operations, as well as in its precast and prefabrication operations.

UltraGreen.ai on Thursday (Feb 26) posted a 36 per cent increase in net profit to US$75.6 million for the 2025 financial year, from US$56 million the year before. The fluorescence-guided surgery and digital health platform said the growth was driven mainly by increases in the amount of indocyanine green (ICG) sold in the Americas and the average price per ICG vial.

Centurion Corporation on Thursday (Feb 26) posted a 82 per cent drop in net profit to S$40.9 million for its second half ended Dec 31, 2025, from S$226.6 million in the previous corresponding period. The decrease came mainly from a lower fair-value gain of S$22.9 million recorded on investment properties in 2025, compared to the exceptional fair-value gain of S$219.1 million in 2024.

Samudera Shipping posted a 30.2 per cent drop in net profit to US$34.9 million for H2 FY2025, from US$50 million in the year before. The board proposed a special dividend of S$0.044 a share, and a final dividend of S$0.0215 a share, subject to shareholders’ approval at the annual general meeting in April.

Aztech Global on Thursday (Feb 26) posted a 1 per cent rise in net profit to S$24.1 million for its second half ended Dec 31, 2025, from S$23.9 million for the previous corresponding period. However, the group’s full-year net profit was down 43 per cent at S$40.2 million. Aztech Global attributed the lower performance for FY2025 primarily to increased competition and softer demand for IoT (Internet of Things) devices and data-communication products.

City Developments Ltd recorded a more than four times increase in earnings for its second half ended Dec 31, as its net profit rose 374.3 per cent to S$538.5 million, from S$113.5 million in the previous corresponding period. The improvements came as all its business segments reported increases for H2 2025.

PropNex posted a net profit of S$28.1 million for its second half ended Dec 31, up 28.3 per cent from S$21.9 million in the year-ago period. The company said that the improvements were mainly due to the increase in commission income from project marketing services of S$81.3 million

US

eBay will lay off about 6.5% of its global workforce, or roughly 800 employees, to cut costs and restructure the business. The job cuts followed eBay’s agreement last week to buy secondhand fashion platform Depop from Etsy for about $1.2 billion.

Shake Shack reported higher fourth-quarter profit and revenue, with adjusted earnings of 37 cents a share. The company’s sales growth and operational improvements helped maintain margins despite macroeconomic headwinds. Shake Shack forecast low single-digit same-store sales growth for fiscal 2026 and is offering deals to attract customers.

BlueScope Steel said a revised US$11 billion takeover offer from Steel Dynamics and SGH isn’t sufficient, but is open to further talks. BlueScope cited insufficient value and onerous conditions as reasons for not recommending the proposal to shareholders. The offer structure involves SGH acquiring BlueScope’s assets and selling North American businesses to Steel Dynamics.

Papa John’s International said it is closing hundreds of domestic stores, slashing menu items and cutting corporate jobs as it seeks to turnaround its business. The fourth-largest pizza chain by U.S. sales plans to close 300 stores by the end of 2027. Most of the locations, which are owned by franchisees, will close this year.

Walmart has agreed to pay $100 million to settle Federal Trade Commission claims that the retailer misled delivery drivers about the pay and tips they could earn. The FTC alleged Walmart caused drivers with its delivery service Spark to lose tens of millions of dollars worth of earnings by showing them inflated figures for what they could expect to earn from pre-tips selected by customers at checkout, base pay and special incentive earnings opportunities.

Netflix declined to raise its bid for Warner Bros. Discovery’s assets to match a revised bid by Paramount Skydance. On Thursday, the WBD board said it valued Paramount’s $31-per-share offer to be superior to an existing deal with Netflix. Paramount agreed to pay the $2.8 billion breakup fee that WBD would owe Netflix if that deal didn’t go through.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

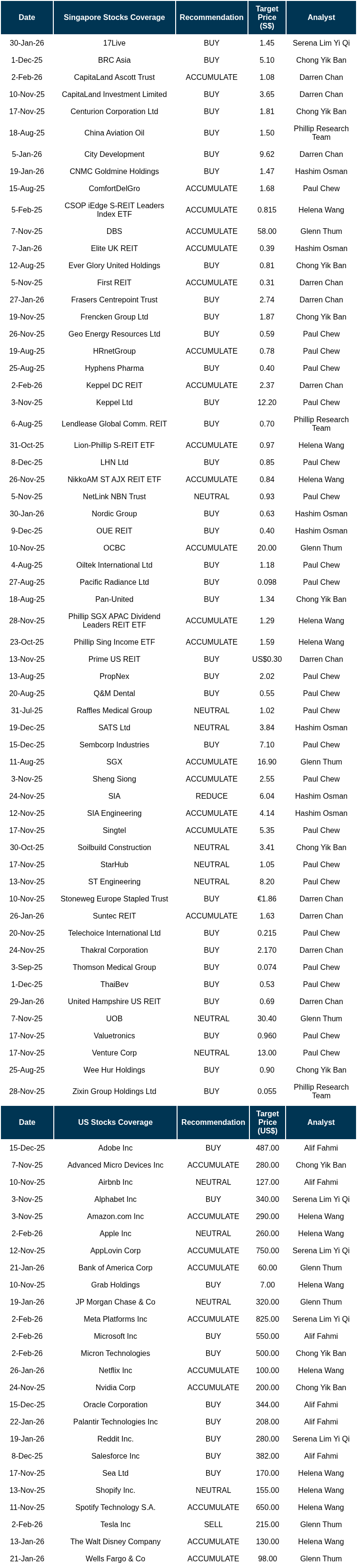

RESEARCH REPORTS

HRnetGroup Limited – Overseas levers of growth

Recommendation: ACCUMULATE; TP S$0.82; Last close: S$0.74; Analyst Paul Chew

- FY25 revenue met expectations but adj. PATMI was below our FY25e forecast at 100%/92%. Government grants and interest income were lower than modelled. Full-year dividends rose 5% to 4.2 cents with a payout ratio of 78%. Adjusted PATMI declined 20% YoY due to the timing of government grants.

- Revenue grew 3% in 2H25, supported by 26% and 12% rise in North Asia and SE Asia, respectively. Singapore was the weakest, with a 3% contraction in revenue due to sluggish hiring activity. Taiwan was the bright spot in semiconductor, technology and F&B roles.

- We lower our FY26e adj. PATMI forecast by 3% to S$48mn due to lower government grant assumptions. Our target price is raised to S$0.82 (prev. S$0.78) as we rollover valuations to FY26e. Our ACCUMULATE recommendation is maintained. Activity in Singapore remains soft with candidates less mobile and competition more intense, especially in the middle market. Countries such as Taiwan and Malaysia are the core growth geographies. HRnet is building on its senior executive search roles through its regional network of 18 cities, consistent experience and preferred pricing structure. The company is paying an attractive dividend yield of 5.7%, backed by a cash pile and securities worth S$337mn (47% of market cap). Excluding cash and interest income, the underlying business is valued at 10x PE FY25.

Oversea-Chinese Banking Corp Ltd – Wealth momentum anchors earnings resilience

Recommendation: ACCUMULATE; TP S$22.3; Last close: S$21.3; Analyst Glenn Thum

- 4Q25 earnings of S$1.75bn were slightly below our estimates, with FY25 earnings at 98% of our FY25e forecast. Final dividend up by 2% YoY to 42 cents, with FY25 total dividends at S$0.99 (FY24: S$1.01), inclusive of a special dividend of 16 cents.

- NII dipped 6% YoY as loan growth of 7% was offset by NIM declining 29bps YoY to 1.86%. Total non-interest income surged 37% YoY from a 16% rise in fee income and a recovery in trading and insurance income. Allowances dipped and expenses were stable. OCBC has provided FY26e guidance for a slight to moderate decline in NII, mid-single-digit loan growth, CIR in the low to mid 40s, and credit costs of 20-25bps. OCBC has also committed to completing the S$2.5bn capital return plan by FY26e of which S$780mn of share buyback is outstanding.

- Maintain ACCUMULATE with a higher target price of S$21.50 (prev. S$20.00) as we roll over our valuations to FY26e. We lower our FY26e earnings estimate by ~4% due to lower NII. We assume a 1.56x FY26e P/BV and a 12.6% ROE estimate in our GGM valuation. We expect FY26e earnings to increase by 4% YoY, supported by loan growth and fee income. OCBC did not provide any guidance on the continuation of its capital return plan, but did mention the possibility of a special dividend if the S$780mn of share buyback is not completed. We believe OCBC can exceed the 50% dividend payout ratio and continue the special dividend (an additional 10% dividend payout ratio) for at least 2 more years (until FY28), in order to reach its target CET1 of 14% (4Q25 fully phased-in CET1: 15.1%). We like OCBC for its robust wealth management execution and healthy asset quality which mitigate margin pressures, securing both resilient earnings growth and highly visible capital returns.

Pan-United Corporation Ltd – Project offtake drives 35% YoY growth in 2H25 PATMI

Recommendation: BUY; TP S$1.73; Last close: S$1.32; Analyst Yik Ban Chong (Ben)

- 2H25 revenue was within our expectations, while 2H25 PATMI exceeded our expectations. FY25 revenue/PATMI were at 103%/112% of our FY25e forecasts. 2H25 PATMI spiked 35% YoY to S$30.1mn, the highest increase since 2H23. This was driven by an estimated 12% YoY higher ready-mixed concrete (RMC) volume delivered due to higher project offtake, and higher efficiency achieved from its proprietary technology system AiR Digital. An example is the use of AiR Digital system to reduce truck queuing duration and thus operational costs.

- The Building and Construction Authority (BCA) projected 2026e RMC demand to be 15-16mn cubic metres, 7% higher YoY and 30% higher than the 20-year historical average of 11.9mn cubic metres annually. Demand in 2026e is expected to be driven by Changi Airport T5 superstructure, MBS Integrated Resort (IR) expansion, New Tengah General & Community Hospital, HDB BTO, and MRT LTA line extension.

- We maintain BUY with a higher DCF-derived TP of S$1.73 (prev. S$1.34). Our WACC/growth rate assumptions are unchanged at 7.7%/1.5%. We raised our TP to reflect a 3%/22% higher FY26e revenue/PATMI forecast. Industry RMC prices rose 4% YoY in 4Q25 to an average S$125/cubic metre, the highest since 2008. We believe Pan-United can benefit from expanded margins given higher ASPs from favourable construction demand and from its in-house technology platform. Pan-United trades at an attractive FY26e dividend yield of 4.2%.

Stoneweg Europe Stapled Trust– Inorganic growth to drive earnings

Recommendation: BUY; TP S$1.89; Last close: S$1.67; Analyst Darren Chan

- 2H25/FY25 DPU of 6.84/13.39 €cents was in line with our estimates, representing 51%/100% of our FY25e forecast. It was 3.1%/5.1% lower YoY due to higher finance costs. FY25 NPI was 2.5% higher, due to higher income from completed redevelopments, growth in the logistics/light industrial sector, and lower doubtful debt expense, partially offset by asset divestments.

- Portfolio occupancy dipped slightly to 92.6% (3Q25: 93.5%). FY25 leasing was robust at c.300k sqm, achieving +9.8% rent reversion, more than double the +4.3% five-year average. Portfolio valuations rose 1% HoH, the fourth consecutive half-year increase.

- Maintain BUY with a higher DDM-derived TP of €1.89 (prev. €1.86) as we roll forward our forecasts. FY26e DPU is lowered by 2% on the loss of income from divested assets. SERT’s portfolio remains c.7% under-rented, leaving room for further positive rent reversions. The REIT is evaluating a pipeline of over €70mn in near-term acquisitions to offset the impact of divestments, while its 6.72% stake in the AiOnX data centre development platform provides long-term NAV upside potential. SERT continues to offer an attractive 8% dividend yield, supported by 96 properties (93% freehold), and trades at a compelling 0.82x P/NAV.

United Overseas Bank Limited – Earnings recover as provisions stabilise

Recommendation: NEUTRAL; TP S$37; Last close: S$36.76; Analyst Glenn Thum

- 4Q25 earnings of S$1,410mn were slightly below our estimates from lower-than-expected NII and other non-interest income. FY25 PATMI was 98% of our FY25e forecast. Final dividend declined 23% YoY to 71cents with FY25 dividends at S$1.81, including the 25cents capital return dividend (FY24: S$2.05, including 25cents capital return dividend). The dividend payout ratio was kept at 50%.

- NII fell 4% YoY from NIM compression of 16bps, while fee income rose 10% YoY. Allowances fell 50% from lower SPs and credit costs normalised to 19bps (4Q24: 25bps). UOB has maintained its FY26e guidance of NIM at 1.75-1.80%, low-single-digit loan growth, and credit costs at around 25-30bps but lowered fee income growth to high single (from high single to double-digit). We expect FY26e earnings to increase by ~18%, mainly driven by a recovery in fee income and a decline in allowances.

- Maintain NEUTRAL with a higher target price of S$37.00 (prev. S$36.70) as we roll over our valuations to FY26e. We lower FY26e earnings by ~5% from the lower fee income estimate. We assume a 1.26x FY26e P/BV and an ROE estimate of 10.9% in our GGM valuation. We expect UOB’s FY26e earnings to increase by ~17% YoY, driven by fee income growth and lower provisions. NIM compression will ease in FY26e as funding costs continue to improve from deposit rate cuts. Fee income will be the most significant driver from the successful integration of Citi portfolios, which will accelerate UOB’s expansion into ASEAN. UOB reaffirmed its capital return plan and will complete the remaining 68% of its S$2bn share buyback programme, or S$1.4bn.

Market Journal articles powered by PhillipGPT

Singapore Budget 2026 Signals Strategic AI Pivot, Equity Boost

DBS Group Holdings Ltd Upgraded to Accumulate Despite Earnings Decline

Elite UK REIT Shows Strong Performance with Successful Lease Regearing

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Stoneweg Europe Stapled Trust (SERT)

Date & Time: 27 February 26 | 12PM-1PM

Register: poems-20260227-138685

Corporate Insights by Attika Group [NEW]

Date & Time: 3 March 26 | 12PM-1PM

Register: poems-20260303-139953

Corporate Insights by LMS Compliance [NEW]

Date & Time: 4 March 26 | 12PM-1PM

Register: poems-20260304-139955

Corporate Insights by OUE REIT

Date & Time: 5 March 26 | 12PM-1PM

Register: poems-20260212-138119

Corporate Insights by Lendlease REIT

Date & Time: 10 March 26 | 12:30PM-1:30PM

Register: poems-20260310-138683

Corporate Insights by Ever Glory [NEW]

Date & Time: 13 March 26 | 12PM-1PM

Register: poems-20260313-140475

Research Videos

Weekly Market Outlook: ABNB, Reddit, SPOT, Grab, DBS, LREIT, CLI, TMG, Mag7, SG Weekly & More!

Date: 23 Feb 2026Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials