News & Research

Hear from the Experts

Market Overview

*15mins delayed

| 24 February 2026

Recent Podcasts:

Advanced Micro Devices Inc. – Clear Instinct GPU roadmap, strong CPU demand

Netflix Inc. – Content, ads, and scale drive the next leg of growth

The Walt Disney Company – Streaming Turns Profitable

Trade of The Day

Analyst: Zane Aw

Current Price: S$0.260) – TECHNICAL BUY

Buy price: S$0.260 Stop loss: S$0.230 (-11.53%)

Take profit: S$0.305 (+17.30%)

Trades Initiated in Past Week

UOB’s 4Q25 earnings of S$1,410mn were slightly below our estimates, with FY25 earnings at 98% of our FY25e forecast. NII fell 4% YoY to S$2,346mn as loan growth of 4% YoY cushioned NIM decline of 16bps to 1.84%. Fee income grew 10% YoY from broad based growth. Allowances fell by 50% YoY to S$113mn from lower SPs. Resultantly, total credit costs fell 6bps YoY to 19bps. Final dividend declined 23% YoY to 71cents with FY25 dividends at S$1.81 including the 25cents capital return dividend (FY24: S$2.05 including 25cent capital return dividend), dividend payout ratio was kept at 50%. They provided FY26e guidance for NIM of 1.75-1.80%, low single digit loan growth, high single digit fee income growth and credit costs at around 25-30bps.

Glenn Thum

Research Manager

glennthumjc@phillip.com.sg

Singapore stocks ended higher on Monday (Feb 23) as investors processed the news of US President Donald Trump’s latest global tariffs announced over the weekend. The local benchmark gained 0.5% or 23.73 points to finish at 5,041.33. Meanwhile, the iEdge Singapore Next 50 Index remained almost flat at 1,520.5.

U.S. equities tumbled on Monday as investors grappled with persistent fears around artificial intelligence disruptions to various industries and President Donald Trump’s decision to raise his global tariffs. The Dow Jones Industrial Average dropped 821.91 points, or 1.66%, to close at 48,804.06, while the Nasdaq Composite declined 1.13% and ended at 22,627.27. The S&P 500 shed 1.04% and closed at 6,837.75, putting it into the red once again for 2026.

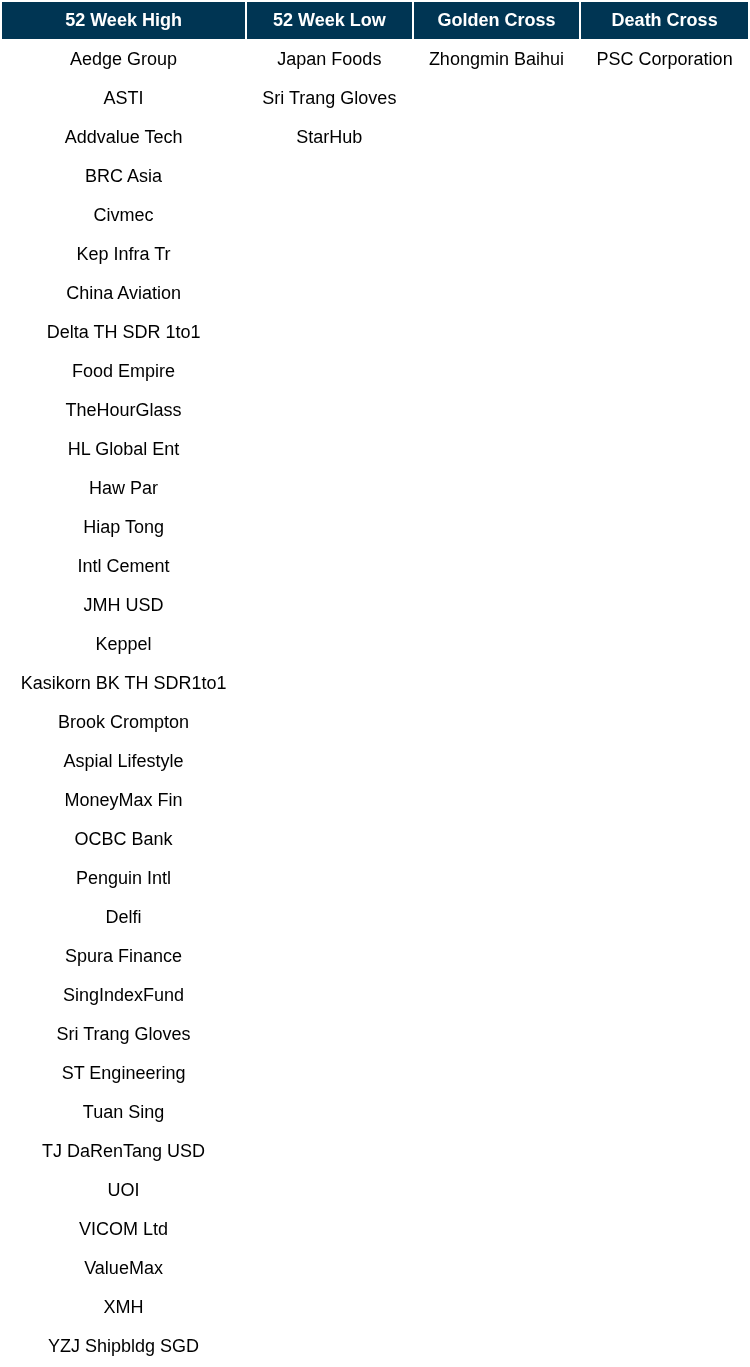

Singapore Technical Highlights

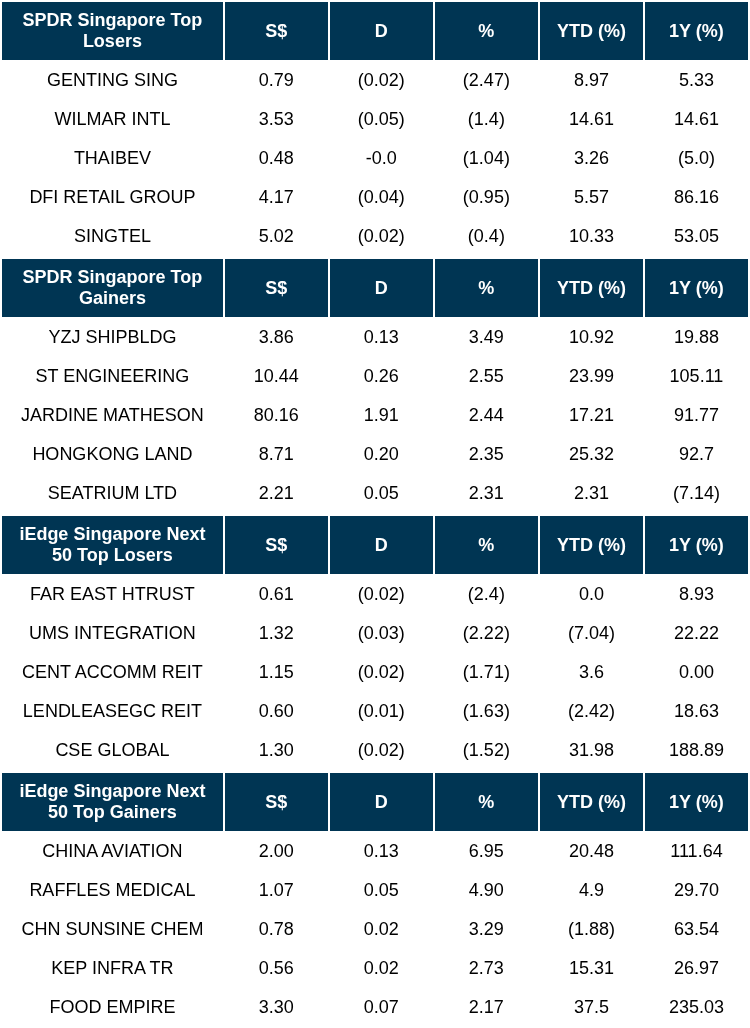

TOP 5 GAINERS & LOSERS

Events Of The Week

SG

Raffles Medical Group posted a 21.7% rise in net profit to S$38.5 million for its second half ended Dec 31, 2025, from S$31.6 million for the previous corresponding period. This was mainly due to improved performance from its hospital services and insurance businesses, as well as fair value gains on investment properties.

Centurion Accommodation Reit posts DPU of S$0.01739 in first results since IPO. Revenue was at S$50.7 million for the period from Sep 24 to Dec 31, 3.4% higher than its S$49 million forecast. This was primarily from higher rental rates in Singapore, as well as better-than-expected occupancy rates in its portfolio.

ValueMax on Monday (Feb 23) posted a 14% increase in net profit to S$54.1 million for the six months ended Dec 31, 2025, from S$47.4 million in the same period a year earlier. This came on the back of a 25.8% rise in revenue to S$284.8 million, from S$226.4 million previously. The increase is mainly due to increases in cost of sales for retail and trading of jewellery and gold and moneylending businesses of S$39.2 million and S$300,000, respectively.

MoneyMax Financial Services reported that its profit for the second half of 2025 nearly doubled to S$42 million, from S$21.6 million the year before, on the back of strong growth in its core business segments. This was achieved amid strong business fundamentals and a record performance for the full year.

CapitaLand Ascott Trust on Monday (Feb 23) announced the acquisition of three freehold rental housing properties in Southern Kanagawa, Greater Tokyo, for 4.6 billion yen (S$38.3 million) from an unrelated third party, Patience Capital Group. The assets have an average occupancy of more than 95% and average lease terms of about two years, providing stable income.

Seatrium expects to achieve over S$50 million in annualised operational cost savings by early 2026 through the divestment of non-core assets. The savings follow a series of transactions involving shipyards, tugboats and equipment across Singapore and Indonesia.

Great Eastern Holdings’s FY2025 profit attributable to shareholders rose by 21% year on year to $1,207.1 million. Net profit in 4Q2025 rose by 70% year on year underpinned by a favourable investment performance and earnings from the existing in-force portfolio.

US

Eli Lilly on Monday launched a new form of its blockbuster obesity drug, Zepbound, that offers a month’s worth of doses in a single pen. The pen could serve as a more convenient option for some patients, as it reduces the number of devices they have to use in a month to take the drug. Prices start at $299 for the lowest dose level on Eli Lilly’s direct-to-consumer site, LillyDirect.

Johnson Matthey cut the price of its catalyst technologies unit sale to Honeywell International by over a quarter. The unit will now sell for 1.325 billion pounds, with the deal deadline extended to July 21. The lower price reflects the unit’s fiscal 2026 performance and a challenging market environment.

PayPal Holdings, the digital payments pioneer, is attracting takeover interest from potential buyers after a stock slide wiped out almost half of its value. The shares jumped as much as 9.7% on the news. The San Jose, California-based company has fielded meetings with banks amid unsolicited interest from suitors.

Paramount Skydance Corp. raised its offer to buy Warner Bros. Discovery Inc., extending the battle for the iconic studio. The new bid improves on the $30-a-share proposal and addresses concerns including greater certainty of Paramount financing. Warner Bros. will consider the new Paramount offer and if deemed superior, Netflix will have four days to respond.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

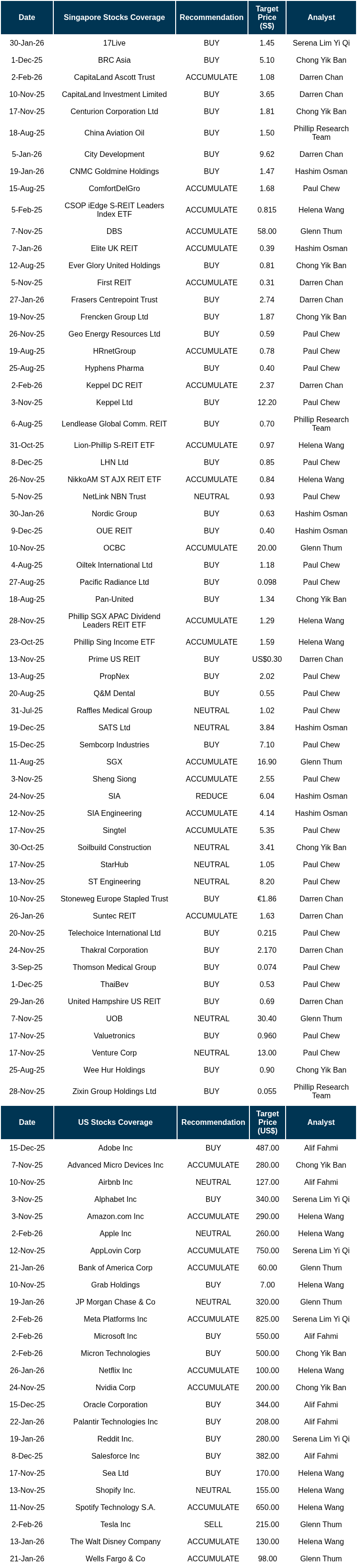

RESEARCH REPORTS

Market Journal articles powered by PhillipGPT

Singapore Budget 2026 Signals Strategic AI Pivot, Equity Boost

DBS Group Holdings Ltd Upgraded to Accumulate Despite Earnings Decline

Elite UK REIT Shows Strong Performance with Successful Lease Regearing

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Stoneweg Europe Stapled Trust (SERT)

Date & Time: 27 February 26 | 12PM-1PM

Register: poems-20260227-138685

Corporate Insights by Attika Group [NEW]

Date & Time: 3 March 26 | 12PM-1PM

Register: poems-20260303-139953

Corporate Insights by LMS Compliance [NEW]

Date & Time: 4 March 26 | 12PM-1PM

Register: poems-20260304-139955

Corporate Insights by OUE REIT

Date & Time: 5 March 26 | 12PM-1PM

Register: poems-20260212-138119

Corporate Insights by Lendlease REIT

Date & Time: 10 March 26 | 12:30PM-1:30PM

Register: poems-20260310-138683

Research Videos

Weekly Market Outlook: ABNB, Reddit, SPOT, Grab, DBS, LREIT, CLI, TMG, Mag7, SG Weekly & More!

Date: 23 Feb 2026Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.