- Home

- SBP Promotion

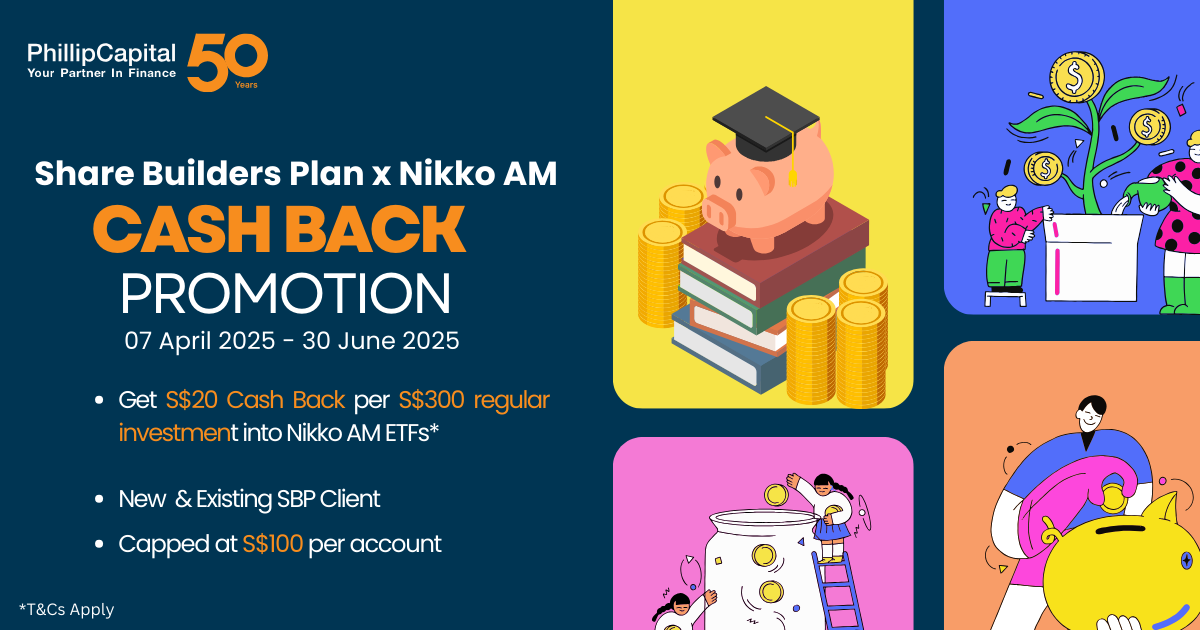

Subscribe to NikkoAM ETFs via the Share Builders Plan and receive Cash Back with *T&Cs.

*Please read the full Terms & Conditions for the promotion below:

Cash Back Details

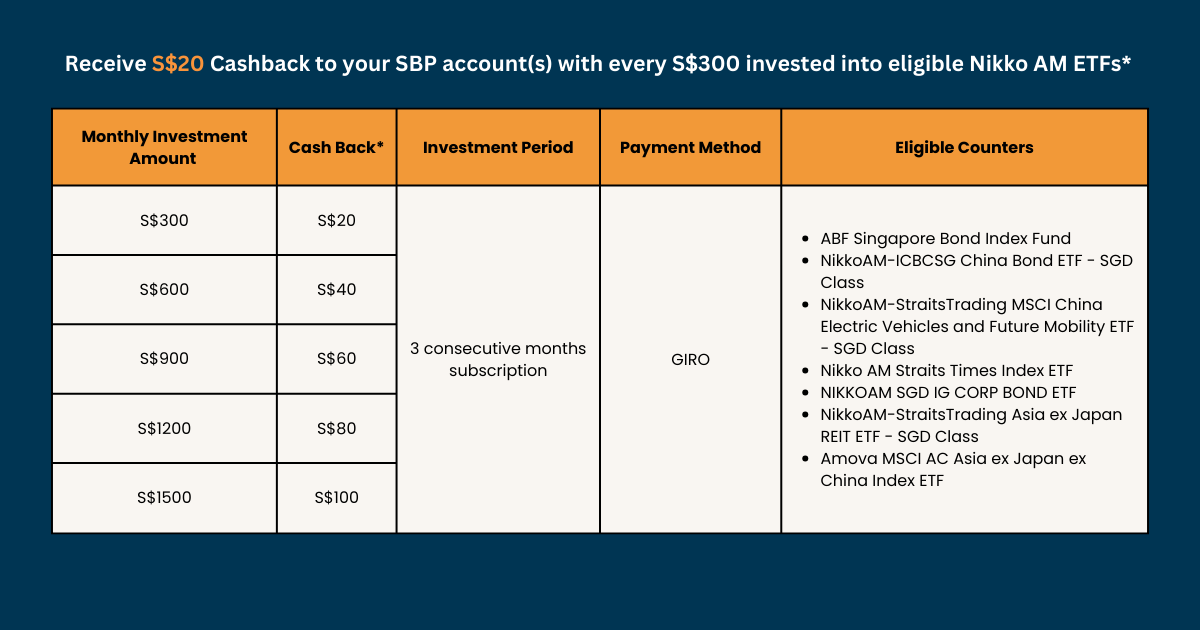

The promotion is limited to the first 200 SBP accounts. Eligible customers will receive S$20 Cash Back (credited to their Share Builders Plan (SBP) Ledger) for every S$300 fresh funds invested into selected NikkoAM ETFs*, with a minimum subscription period of three months with GIRO.

FAQ

The SBP Cash Back Promotion allows participants to receive S$20 Cash Back for every S$300 fresh funds invested per month in any eligible counter for three consecutive months with GIRO.

The maximum Cash Back per SBP account is S$100.

You will receive S$20 cashback after successfully completing the three consecutive months of subscription via GIRO.

Yes

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cash Back |

| April 2025 | ABF SG BOND ETF | S$900 |

3 consecutive months |

S$60 |

| May 2025 | ABF SG BOND ETF | S$900 | ||

| June 2025 | ABF SG BOND ETF | S$900 |

*This example should not be considered as financial advice.

Yes, you are eligible for the cashback because it is granted with every S$300 invested. Please refer to the example below

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cash Back |

| April 2025 | ABF SG BOND ETF | S$100 | 3 consecutive months | S$20 |

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 | |||

| May 2025 | ABF SG BOND ETF | S$100 | ||

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 | |||

| June 2025 | ABF SG BOND ETF | S$100 | ||

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 |

*This example should not be considered as financial advice.

There are seven eligible counters:

- ABF Singapore Bond Index Fund

- NikkoAM-ICBCSG China Bond ETF – SGD Class

- NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF – SGD Class

- Nikko AM Straits Times Index ETF

- NIKKOAM SGD IG CORP BOND ETF

- NikkoAM-Straits Trading Asia ex Japan REIT ETF – SGD Class

- Amova MSCI AC Asia ex Japan ex China Index ETF

To receive the maximum cashback, you must subscribe to any eligible counter with an investment of S$1,500 per month for three consecutive months via GIRO.

You will not be eligible for the promotion. The investment must be continuous for three months via Giro. Any missed or delayed payments will result in disqualification.

| Month | Investment counter | Investment Amount S$ | Cash Back |

| April 2025 | Nikko AM STI ETF | 300 | No S$0 |

| May 2025 | ABF SG BOND ETF | 300 | |

| June 2025 | ABF SG BOND ETF | 300 |

Yes, customers can increase and decrease their investment amount but if you reduce your investment during the three-month GIRO subscription period, you will not qualify for the promotion. (Refer to illustration A below)

The cashback is based on your first month’s investment. For example, if you invest S$300 in the first month, then S$600 in the second and third months, your cashback will still be S$20. (Refer to illustration B below)

illustration A

| Month | Investment counter | Investment Amount S$ | Cash Back |

| April 2025 | ABF SG BOND ETF | 600 |

S$0 |

| May 2025 | ABF SG BOND ETF | 300 | |

| June 2025 | ABF SG BOND ETF | 300 |

illustration B

| Month | Investment counter | Investment Amount S$ | Cash Back |

| April 2025 | ABF SG BOND ETF | 300 |

S$20 |

| May 2025 | ABF SG BOND ETF | 600 | |

| June 2025 | ABF SG BOND ETF | 600 |

customers can increase their investment amount. The cashback is based on your first month’s investment. For example, if you invest S$300 in the first month, then S$600 in the second and third months, your cashback will still be S$20.

| Month | Investment counter | Investment Amount S$ |

| April 2025 | ABF SG BOND ETF | 300 |

| May 2025 | ABF SG BOND ETF | 300 |

| June 2025 | ABF SG BOND ETF | 300 |

The Cash Back will be credited to your SBP account ledge approximately 30 working days from the end of your consecutive 3-month subscription period with GIRO.

No, both SBP and GIRO applications must be completed within the promotion period to qualify.

No, change of investment instructions between any eligible NIKKO AM ETF to another eligible counter will not be considered as fresh funds, and will not qualify for the Cash Back.

How to Participate

To qualify for the Cash Back, simply complete these steps:

- Sign up for the Share Builders Plan (SBP)

How do I sign up for the Share Builders Plan?If you have yet to open a POEMS Account, open one here.

If you are an existing POEMS Account holder, simply follow these instructions:

Online Application Submission

- POEMS Mobile 3 App:

- Log in to your POEMS Account

- Navigate to Trade > RSP > Share Builders Plan > Apply

- POEMS 2.0 App:

- Log in to your POEMS Account

- Go to the Top left menu > Regular Savings Plan > SBP > Apply

- POEMS Website:

- Subscribe via this link

Step 2: Set Up GIRO for Recurring Investments

Option 1: Submit a Physical GIRO Form- Download and print the GIRO form here.

- Submit the original signed GIRO form to any of our conveniently located Phillip Investor Centre OR mail the form to us at:

Attention: SBP

250 North Bridge Road

#06-00 Raffles City Tower

Singapore 179101

OR

Option 2: Apply e-GIRO:

- POEMS Mobile 3 App:

- Log in to your POEMS Account

- Tap on the “Me” tab > eGIRO > Select SBP (Account no.) > Choose Bank > Apply

- POEMS Website:

- Log in to your POEMS Account

- Go to Acc Mgmt > Online Forms > Account Application > eGIRO > Select SBP (Account no.) > ChooseBank > Apply

- POEMS Mobile 3 App:

- Invest a minimum of S$300* per month in any of the eligible ETFs for three consecutive months with GIRO to qualify for the S$20 Cash Back*

Eligibility Criteria- Existing SBP Customers:

- Customers who are already subscribed into any of the NikkoAM eligible counters, will only qualify for the Cash Back when investing an additional S$300 or more in fresh funds* in these counters; for three consecutive months with GIRO.

- Customers who are not yet subscribed into any Nikko AM eligible counters, will qualify for the Cash Back after subscribing to at least S$300 per month in any of the eligible counters; for three consecutive months with GIRO.

*Change of investment instructions between the NikkoAM selected counters will not be considered as fresh funds and thus, not be eligible for the promotion.

Fresh Fund: Refer to the newly deposited investment amount into the SBP account during the promotion period. - New SBP Customers:

- Customers who are new to SBP, will qualify for the Cash Back after subscribing and investing at least S$300 per month into any of the NikkoAM eligible counters; for three consecutive months with GIRO.

- Existing SBP Customers:

SBP Counters Eligible for the promotion:

| S/N | Counter Name | Counter Name on Website |

| 1 | ABF Singapore Bond Index Fund | ABF SG BOND ETF |

| 2 | NikkoAM-ICBCSG China Bond ETF – SGD Class | NAM-ICBCSG CNBS$ |

| 3 | NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF – SGD Class | NAM-STC CHINA EV |

| 4 | Nikko AM Straits Times Index ETF | NIKKO AM STI ETF |

| 5 | NIKKOAM SGD IG CORP BOND ETF | NIKKOAM SGD IGBOND ETF |

| 6 | NikkoAM-StraitsTrading Asia ex Japan REIT ETF – SGD Class | NIKKOAM-STC A_RT |

| 7 | Amova MSCI AC Asia ex Japan ex China Index ETF | Amova Asia exJC S$ |

* Counters not listed above will not be eligible for the promotion

- Eligible Customers must invest a minimum of S$300 fresh funds per month for three consecutive months with GIRO into any of the eligible counters listed in the table above.

- The investment transaction must be made before the 18th of each month (or the next business day if the 18th falls on a non-business day) during the promotion period.

- There is a Cash Back cap of S$100 per account.

- The Cash Back will be processed approximately 30 working days after completion of the consecutive three month subscription period with GIRO.

Example 1:

| Month | Investment counter | Monthly Investment Amount | Investment Period | Cash Back |

| April 2025 | ABF SG BOND ETF | S$300 | Three consecutive months | S$20 |

| May 2025 | ABF SG BOND ETF | S$300 | ||

| June 2025 | ABF SG BOND ETF | S$300 |

*This example should not be considered as financial advice.

Example 2:

| Month | Investment counter | Monthly Investment Amount | Investment Period |

Cash Back |

|

April 2025

|

ABF SG BOND ETF | S$100 | Three consecutive months | S$20 |

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 | |||

| May 2025 | ABF SG BOND ETF | S$100 | ||

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 | |||

| June 2025 | ABF SG BOND ETF | S$100 | ||

| NIKKO AM STI ETF | S$100 | |||

| AMOVA MSCI AC Asia ex Japan ex China Index ETF | S$100 |

* This example should not be considered as financial advice.

- Please refer to examples 1 and 2 on the indicative cash back amount.

| Period of Promotion | T&Cs |

Investment Period |

Cash Back | Eligible Counters | |

|

07 April 2025 – 30 June 2025 |

New to SBP S$300 Subscription into any of the NikkoAM eligible counters; for three consecutive months with GIRO. |

Existing SBP Customers S$300 of fresh funds* into the eligible counters ; for three consecutives Months with GIRO. |

Three consecutive months subscription |

Get S$20 Cash Back for every S$300 monthly subscription into any of the eligible counters during the promotion period. Eligible customer is allowed a maximum Cash Back of S$100 for each SBP account during the promotion period. |

1) ABF SG Bond ETF 2) NAM-ICBCSG CNBS$ 3) NAM-STC CHINA EV 4) NIKKO AM STI ETF 5) NIKKOAM SGD IGBond ETF 6) NIKKOAM-STC A_RT 7) AMOVA MSCI AC Asia ex Japan ex China Index ETF |

* This example should not be considered as financial advice.

*Change of investment instructions between the NikkoAM selected counters will not be considered as fresh funds; and will not be eligible for the promotion.

Fresh Fund: Refer to the newly deposited investment amount into the SBP account during the promotion period.

You’re all set to participate in this Promotion!

Disclaimers:

- This promotion is intended for general information only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in this promotion are not necessarily indicative of future or likely performance of any fund. You should read the prospectus of the respective ETFs (which is available on websites of the issuers) and understand their structure and associated risks before deciding to invest. Any opinion or view herein is made on a general basis and is subject to change without notice. You may wish to obtain advice from a financial adviser before making a commitment to purchase any investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should consider whether the investment product is suitable for you. SBP is a Regular Savings Plan and is not a deposit and not principal protected nor a capital guaranteed plan.

- Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the shares and the income from them may fall as well as rise. Past performance is not necessarily indicative of future performance. Investments in Regular Savings Plan are designed to produce returns over the medium to long term and are not suitable for short-term speculation.

- Any opinion or view herein is made on a general basis and is subject to change without notice.

- You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

- The information is correct as at the date of print and the company reserves the right to revise the charges.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.