BHG Retail Reit - Stock Analyst Research

| Target Price* | - |

| Recommendation | NON-RATED› NON-RATED |

| Market Cap* | 279mn |

| Publication Date | 2 Mar 2022 |

*At the time of publication

BHG Retail REIT – Stable growth with resilient portfolio

- Committed occupancy improved to 97.0% from 93.5% in 2H20 as four portfolio assets saw recovery.

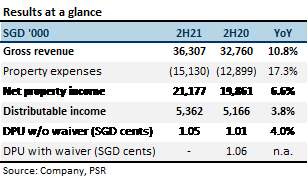

- Gross revenue and net property income increased by 10.8% and 6.6% YoY respectively. 2H21 DPU was up by 4% to 1.05 Scts.

The Positives

+ Committed occupancy recovered to 97.0% from 93.5% in 2H20. Occupancy recovered in four malls: Beijing Wanliu, Chengdu Konggang, Hefei Mengchenglu and Hefei Changjiangxilu. Occupancy remained full at the remaining two malls: Xining Huayuan and Dalian Jinsanjiao.

+ Increase in gross revenue and net property income. The recovery in its gross revenue and property income was underpinned by healthy occupancy. The main contributor to the increase was Beijing Wanliu mall, with gross revenue increasing 19% to S$20mn. No rental rebates were given in 2H21. Rents for new and renewed leases continued to recover.

The Negative

– Higher property operating expenses. Property operating expenses increased 17.3% YoY, due to the gradual resumption of malls’ normal operations and absence of COVID-19 subsidies from the government.

Outlook

China’s GDP grew 8.1% in 2021. Retail sales of consumer goods recovered in tandem, by 12.5% YoY to RMB44.1tn. Urban residents’ disposable income per capita improved 12.6% YoY.

BHG REIT’s portfolio has again proved its resilience, with continued recovery in portfolio occupancy and higher gross revenue, despite the COVID-19 Omicron wave in 2H21. Gearing remained healthy at 34.1%, providing comfortable debt headroom to pursue M&A growth opportunities.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell