DBS Group Holdings Ltd – Earnings in line despite lower fee income

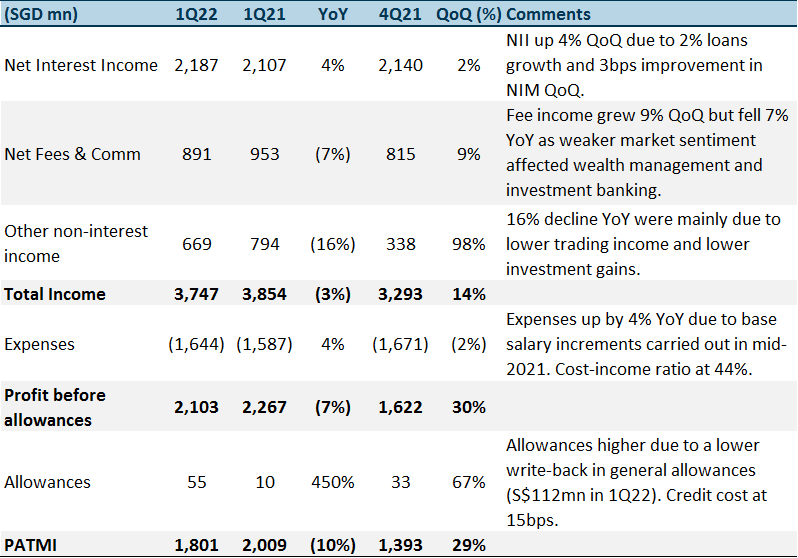

5 May 2022- 1Q22 earnings of S$1.80bn in line with our estimates. 1Q22 PATMI is 24% of our FY22e forecast. 1Q22 DPS stable QoQ at 36 cents.

- NIM fell 3bps YoY to 1.46% but loan growth of 8% YoY cushioned NII. NIM grew 3bps QoQ. Fee income grew 9% QoQ but fell 7% YoY due to weaker market sentiment.

- Maintain ACCUMULATE with unchanged target price of S$41.60. Our FY22e estimates remain unchanged. For FY22e, management guided benign provisions, continued growth in loans and stable NIMs. We believe there is upside to NIM guidance. A 50bps move in interest can raise earnings by 13%.

Results at a glance

Source: Company, PSR

The Positives

+ Asset quality stable, 1Q22 allowances at S$55mn. 1Q22 total allowances were higher YoY and QoQ due to higher SPs of S$167mn for the quarter. Nonetheless, credit costs were maintained at 15bps which is in line with recent quarters when significant repayments were excluded. The GP write-back of S$112mn for 1Q22 was from credit upgrades and transfers to NPA. GP reserves remained prudent at S$3.75bn, which were S$200mn above the MAS requirement and S$1bn above Tier-2 eligibility. NPL ratio was maintained at 1.3%.

+ Loan growth up 8%, deposits up 9% YoY in 1Q22. Loans grew 8% YoY and 2% QoQ to S$416bn. This was mainly due to non-trade corporate loans growth led by drawdowns in Singapore and Hong Kong across a range of industries. Housing and WM loan growth was sustained at the previous quarter’s levels. Management has maintained its FY22e loan growth guidance of mid to single-digit or better. Deposits grew 9% YoY and 4% QoQ to S$520bn, and current and savings accounts (CASA) accounted for 75% of customer deposits.

The Negative

– NII and NIMs remain relatively unchanged. NIM grew 3bps QoQ but declined 3bps YoY to 1.46% as a result of lower market interest rates as customer deposits grew 4% QoQ to S$520bn. NII grew 2% QoQ and 4% YoY to S$2.2bn as higher loan and deposit volumes were moderated by stagnant NIMs. Management has increased its guidance for FY22e NIM to 158 – 160bps.

– Fee income fell 7% YoY. Fee income decline YoY was mainly due to weaker market sentiment affecting wealth management and investment banking. WM fees fell 21% YoY to S$408mn with declines in investment product sales mitigated by higher bancassurance income. Investment banking fees fell by 12% YoY to S$43mn as fixed income activities fell. Nonetheless, fee income grew 9% QoQ mainly due to higher fees from loan-related activities, transaction banking and wealth management as it recovered from a seasonally lower 4Q21.

Outlook

Business momentum strong: Despite economic uncertainties from macroeconomic factors such as slower growth, higher inflation and supply chain disruptions, loans and transaction pipelines are expected to be strong. Management said that stress tests of vulnerable sectors and countries reveal no imminent areas of concern.

GP reserves sufficient: With its capital position and liquidity well above regulatory requirements and high allowance reserves, we believe the bank has sufficient provisions to ride out current economic uncertainties. While the CET-1 ratio fell by 0.4% QoQ due to MAS’ operational risk penalty, the CET-1 ratio of 14% is still at the upper end of DBS’ target operating range. 1Q22 DPS is maintained QoQ at 36 cents, above pre-pandemic 33 cents.

Upside from higher rates: DBS said that a 1 bps rise in interest rates could raise NII by $18mn-20mn (or NII sensitivity of 2% for every 10bps). Assuming hikes of 100bps this year, our FY22e NII can climb S$2bn (or 21%) resulting in an increase in our FY22e PATMI by 26%.

Investment Action

Maintain ACCUMULATE with unchanged target price of S$41.60.

We maintain our ACCUMULATE recommendation with an unchanged GGM target price of S$41.60. We are keeping our FY22e forecast unchanged. Our target price remains based on GGM (1.79x FY22e P/BV, 13.0% ROE estimate) valuation.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)