DBS Group Holdings Ltd-Higher fees and allowances write-backs

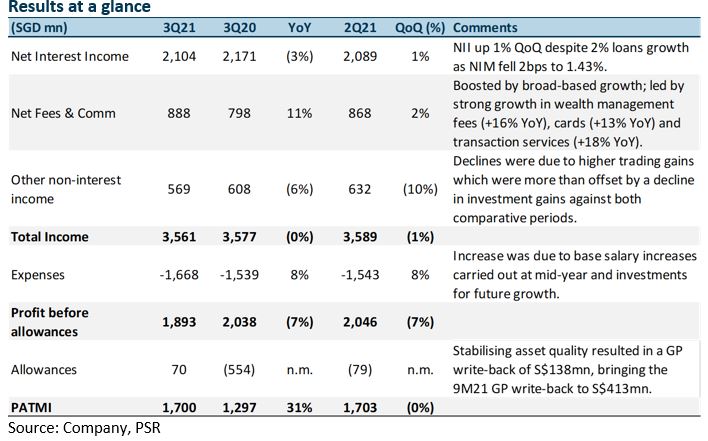

8 Nov 2021- 3Q21 earnings of S$1.7bn exceeded forecast due to reversal in general allowances. 9M21 PATMI is 83% of our FY21e forecast. 3Q21 DPS jumped 83% to 33 cents.

- Asset quality stable, resulting in further GP write-backs of S$138mn. Management lowered full-year allowances to under S$100mn (9M21 allowance at S$19mn).

- Maintain ACCUMULATE with a higher GGM TP of S$35.90, from S$32.00. We raise FY21e earnings by 3.9% as we lower allowances estimates for FY21e. We now assume 1.56x FY21e P/BV in our GGM valuation, up from 1.39x, as we raise our ROE estimates to 11.6%. DBS pays a 4.5% FY21e with earnings upside from higher interest rates.

The Positives

+ Fee income grew 11% YoY. All fees rose by double digits from a year ago. WM fees rose 16% YoY with higher activity across a range of investment products. Transaction fees grew 18% YoY to a new high of S$239mn from increases in cash management and trade finance. Card fees rose 13% YoY as consumer spending continued to recover towards pre-pandemic levels.

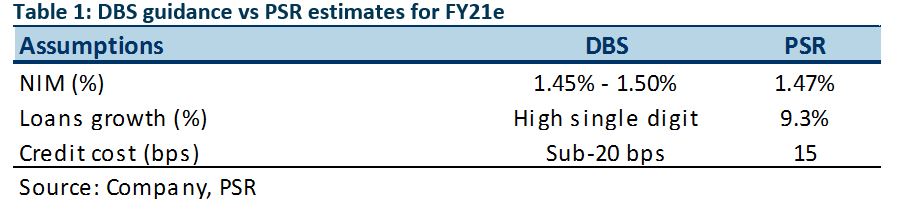

+ Asset quality stable, resulting in further GP write-backs of S$138mn. Repayment by weaker exposures and credit upgrades allowed DBS to write back GPs during the quarter. SPs fell 59% YoY to S$68mn due to a write-back for a non-performing loan. It lowered full-year allowances to under S$100mn (9M21 allowance at S$19mn) with credit cost likely to be under 20bps. We believe full-year allowances will come under this guidance because of the Group’s asset quality. In light of its recent GP write-back, we cut total provisions for FY21e to S$19mn from S$309mn.

+ Loan growth up +9% YoY in 3Q21. Loan growth was led by non-trade corporate loans with growth led by drawdowns in Singapore and Greater China. Housing and WM loan growth was sustained at the previous quarter’s levels. However, these increases were offset by a S$2bn decline in trade loans from higher repayments. Management’s guidance for FY21e loan growth remains unchanged at high-single digit.

The Negative

– NIMs declined 2bps QoQ to 143bps; full-year guidance now at the lower end of range. NIM decline was a result of lower market interest rates as deposits grew 1% QoQ to S$489bn. NII grew 1% QoQ to S$2.1bn as higher loan and deposit volumes were moderated by lower NIMs. Management now expects FY21 NIMs to fall at the lower end of its guided range of 145-150bps.

Outlook

Business momentum strong: Despite economic uncertainties from Singapore’s return to Phase 2 (Heightened Alert), loans and transaction pipelines are expected to be strong. We lower allowance estimates for FY21e. Consequently, our earnings for FY21e rise by 3.9%.

Loans under moratorium: Total loans under moratorium remains low at 0.5% of total loans, with no exposure in the rest of ASEAN, i.e., Malaysia, Indonesia. SME and mortgage loans under moratorium in Singapore are down to around S$100mn with no delinquencies. 80% of ESG loans in Singapore are paying both interest and principal with no pickup in delinquencies. The Group also has no exposure to real estate loans in Mainland China.

GP reserves sufficient: With its capital position and liquidity – CET-1 ratio of 14.5% in 9M21 vs. 13.9% in 9M20 – well above regulatory requirements and high allowance reserves, we believe the bank has sufficient provisions to ride out current economic uncertainties. 3Q21 DPS is 33 cents, back to pre-pandemic levels. We do not rule out special dividends.

Upside from higher rates: DBS mentioned that a 10 bps rise in interest rates could raise PBT by $18m to $20mn (or PBT sensitivity of 0.3% for every 10bps). Assuming two rate hikes of 50bps next year, our FY22e PBT can climb S$1bn (or 14%).

Investment Action

Maintain ACCUMULATE with a higher target price of S$35.90, up from S$32.00

We raise FY21e earnings by 3.9% as we lower allowances estimates for FY21e. We now assume 1.56x FY21e P/BV in our GGM valuation, up from 1.39x, as we raise our ROE estimates to 11.6%.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)